Ripple (XRP) Analysis: Potential For $3.40 Price Increase

Table of Contents

Technical Analysis of XRP Price

Analyzing XRP's price movements using technical indicators is crucial for assessing its potential. Let's examine chart patterns and trading volume to understand the current market dynamics.

Chart Patterns and Indicators

Current XRP charts show a mixed picture. While the Relative Strength Index (RSI) might suggest periods of overbought or oversold conditions, the Moving Average Convergence Divergence (MACD) could indicate potential bullish or bearish momentum depending on the timeframe. Support and resistance levels are also dynamic, constantly shifting based on market forces. Identifying key support levels near the current price and projecting potential resistance levels around the $3.40 mark are key to this analysis.

- Example: A breakout above a significant resistance level, coupled with increasing RSI and a bullish MACD crossover, could signal a potential price surge. Conversely, a failure to break through resistance and a bearish MACD crossover could suggest a continued downtrend.

- Source: TradingView, CoinMarketCap, and other reputable charting platforms provide the data necessary for technical analysis. However, remember that technical analysis is not an exact science and should be considered alongside other factors.

Volume and Momentum

Analyzing trading volume alongside price movements is essential to confirm the strength of any price trends. High volume during price increases indicates strong buying pressure, suggesting a sustainable uptrend. Conversely, low volume during price increases might signal a weak rally that could easily reverse. Comparing current volume with past price surges helps gauge whether the current momentum is sufficient to drive XRP to $3.40.

- Example: A significant increase in trading volume accompanying a price surge towards $3.40 would suggest strong market interest and increase the likelihood of reaching the target. Conversely, low volume accompanying price increases would raise concerns about the sustainability of the upward trend.

- Data Points: We would need to compare current daily and weekly trading volumes to historical data to verify these observations.

Fundamental Analysis of Ripple

Understanding Ripple's technology, adoption rate, and the legal challenges it faces is crucial for a comprehensive XRP price prediction.

Ripple's Technology and Adoption

XRP's speed, low transaction fees, and utility in cross-border payments are key strengths. Partnerships with financial institutions and integrations into payment systems are boosting XRP's adoption. The more widespread XRP's adoption becomes, the higher the potential demand, and thus, price.

- Examples: Partnerships with major banks and payment processors significantly increase XRP's utility and could contribute to price appreciation. Successful integrations into existing payment infrastructure further enhance its adoption rate.

- Impact: Increased adoption leads to greater demand, potentially driving up XRP's price.

SEC Lawsuit and its Impact

The ongoing SEC lawsuit against Ripple is a significant factor affecting XRP's price. A positive outcome could lead to a surge in price as investor confidence increases. However, an unfavorable outcome could result in a significant price drop.

- Possible Outcomes: A favorable ruling could boost investor confidence, while an unfavorable ruling could trigger widespread selling. The uncertainty surrounding the outcome adds significant volatility to XRP’s price.

- Investor Sentiment: The lawsuit's progress heavily influences investor sentiment, directly impacting the price.

Regulatory Landscape and Global Adoption

The regulatory environment for cryptocurrencies is evolving rapidly. Positive regulatory developments, such as clear guidelines and licensing frameworks, could increase investor confidence and drive adoption. Conversely, negative regulatory actions could dampen market enthusiasm.

- Examples: Favorable regulatory announcements in key jurisdictions could boost confidence and attract institutional investment, while negative regulatory pronouncements could deter investors.

- Influence on Price: The regulatory landscape plays a pivotal role in shaping investor sentiment and ultimately influencing XRP's price.

Market Sentiment and Investor Behavior

Understanding market sentiment and investor behavior is vital in predicting XRP's price trajectory.

Social Media and News Sentiment

Social media sentiment and news coverage can significantly impact XRP's price. Positive news and widespread social media support can fuel buying pressure, while negative news and criticism can trigger selling.

- Examples: Positive news about partnerships or technological advancements often boosts XRP's price. Conversely, negative news, such as regulatory crackdowns or security breaches, usually leads to price drops.

- Impact: Social media sentiment and news coverage reflect overall market sentiment and can influence investment decisions, ultimately impacting XRP's price.

Whale Activity and Institutional Investment

The actions of large investors (whales) and institutional adoption can dramatically influence XRP's price. Large buy orders can push the price upwards, while significant sell-offs can trigger sharp declines.

- Examples: Large purchases by institutional investors signal confidence and can significantly impact the price. Conversely, large sell-offs by whales can trigger panic selling and price drops.

- Influence: Whale activity and institutional investment are powerful factors shaping XRP's price movement.

Conclusion

Reaching the $3.40 price target for XRP requires a confluence of positive factors, including a favorable resolution to the SEC lawsuit, increased adoption by financial institutions, positive regulatory developments, and sustained bullish market sentiment. While the technical analysis shows potential, the fundamental and market sentiment factors introduce significant uncertainty. Our analysis suggests that while the potential for XRP to reach $3.40 exists, numerous significant hurdles remain.

While the potential for XRP to reach $3.40 exists, careful consideration and thorough due diligence are crucial before making any investment decisions in Ripple (XRP). Always conduct your own research and understand the inherent risks involved in cryptocurrency investments before committing any capital.

Featured Posts

-

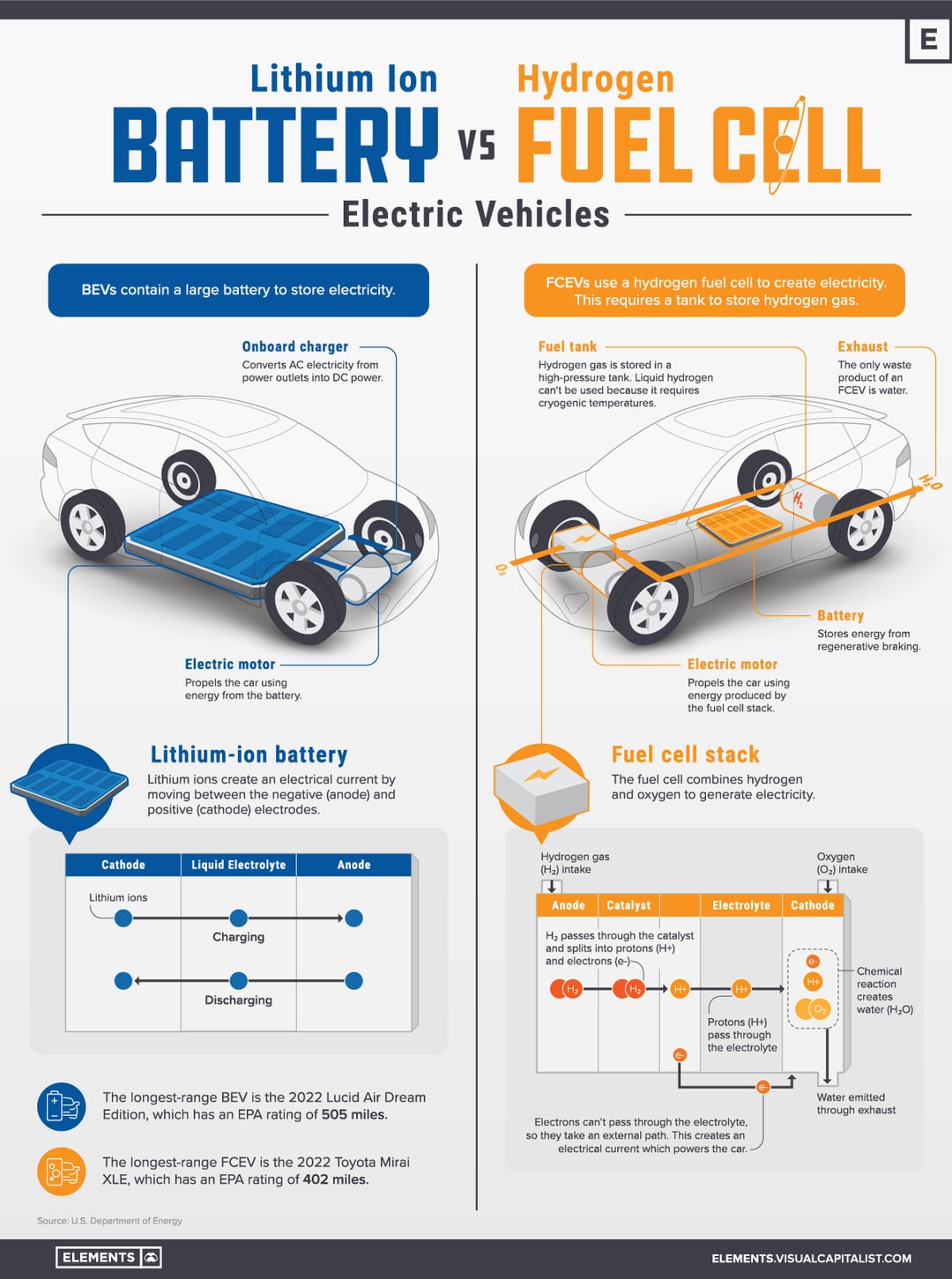

Hydrogen Vs Battery Buses A European Transit Reality Check

May 07, 2025

Hydrogen Vs Battery Buses A European Transit Reality Check

May 07, 2025 -

Who Wants To Be A Millionaire Viewer Anger Over Simple Question Misstep

May 07, 2025

Who Wants To Be A Millionaire Viewer Anger Over Simple Question Misstep

May 07, 2025 -

Willy Adames Walk Off Hero In Giants Home Opener

May 07, 2025

Willy Adames Walk Off Hero In Giants Home Opener

May 07, 2025 -

2025 Nhl Draft Lottery What Utah Hockey Fans Need To Know

May 07, 2025

2025 Nhl Draft Lottery What Utah Hockey Fans Need To Know

May 07, 2025 -

Rihannas Latest Look Bundled Up For Dinner In Santa Monica

May 07, 2025

Rihannas Latest Look Bundled Up For Dinner In Santa Monica

May 07, 2025

Latest Posts

-

Understanding The 400 Xrp Price Increase Is It A Short Term Or Long Term Trend

May 08, 2025

Understanding The 400 Xrp Price Increase Is It A Short Term Or Long Term Trend

May 08, 2025 -

Xrps 400 Growth A Prudent Investors Guide To Buying Or Selling

May 08, 2025

Xrps 400 Growth A Prudent Investors Guide To Buying Or Selling

May 08, 2025 -

Analyzing The Factors Affecting Xrps Price Potential To 5 In 2025

May 08, 2025

Analyzing The Factors Affecting Xrps Price Potential To 5 In 2025

May 08, 2025 -

Is Xrps 400 Rise Sustainable A Comprehensive Market Overview

May 08, 2025

Is Xrps 400 Rise Sustainable A Comprehensive Market Overview

May 08, 2025 -

The Likelihood Of Xrp Reaching 5 By 2025

May 08, 2025

The Likelihood Of Xrp Reaching 5 By 2025

May 08, 2025