Ripple (XRP) And The $3.40 Resistance: A Technical Analysis

Table of Contents

1. Historical Price Action and the Significance of $3.40

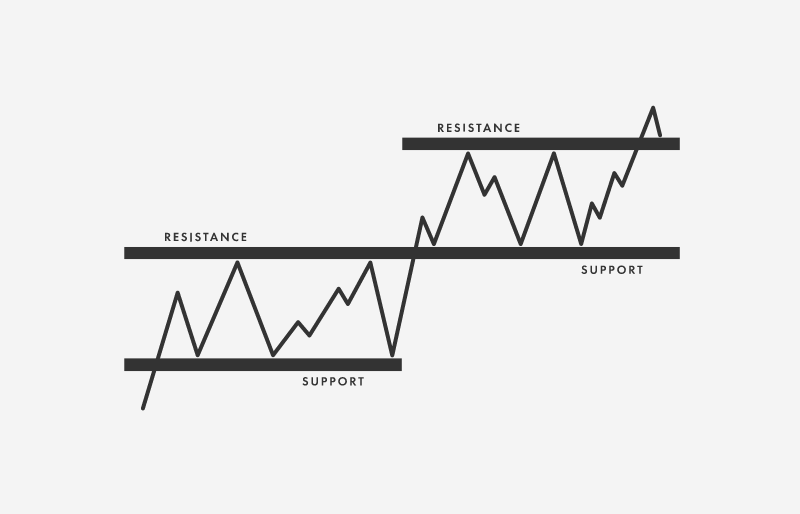

Analyzing XRP's price history reveals a consistent struggle to break through the $3.40 resistance level. This price point has acted as a significant hurdle on multiple occasions. Let's examine some key moments:

- Previous Attempts: Several attempts to breach the $3.40 mark have resulted in price rejections, leading to temporary pullbacks. These failures have solidified the psychological importance of this level for many traders.

- Correlation with News Events: Significant price movements around $3.40 have often coincided with major news events affecting Ripple, including legal updates regarding the SEC lawsuit and announcements related to Ripple's technology partnerships. These events significantly impact market sentiment and XRP's price.

- Chart Patterns: Reviewing the Ripple price chart (see below) illustrates the consistent rejection at the $3.40 level, highlighting its importance as a resistance point. Identifying chart patterns, such as head and shoulders or double tops, near this level can provide additional insights into potential future price movements.

[Insert a chart here showing historical XRP price data clearly illustrating the $3.40 resistance level. Label key highs and lows around this level.]

2. Technical Indicators Suggesting a Potential Breakout (or Failure)

Technical indicators provide valuable insights into the potential for a breakout or failure at the $3.40 resistance. Let's examine several key indicators:

- RSI (Relative Strength Index): The RSI measures the magnitude of recent price changes to evaluate overbought or oversold conditions. An RSI above 70 generally suggests an overbought market, while below 30 suggests an oversold market. Analyzing the XRP RSI near the $3.40 level will help determine whether a breakout is likely or if a correction is imminent.

- MACD (Moving Average Convergence Divergence): The MACD helps identify momentum changes by comparing two moving averages. A bullish crossover (MACD line crossing above the signal line) often signals a potential price increase, while a bearish crossover suggests the opposite. The MACD's behavior near the $3.40 resistance level is crucial for predicting price movement.

- Moving Averages (e.g., 50-day MA, 200-day MA): Moving averages smooth out price fluctuations, providing insights into long-term trends. The relationship between XRP's price and these moving averages near the $3.40 resistance could indicate support or resistance levels.

[Insert charts here showing the RSI, MACD, and moving averages for XRP, clearly highlighting their values near the $3.40 resistance level.]

3. Trading Volume and Market Sentiment Analysis

Trading volume and market sentiment play a significant role in determining whether XRP can break through the $3.40 resistance.

- High Volume Breakouts: A significant increase in trading volume accompanied by a price move above $3.40 would suggest strong conviction behind the breakout, potentially leading to further price appreciation. Conversely, low volume breakouts might indicate a weak move, susceptible to a reversal.

- Market Sentiment: Analyzing news articles, social media sentiment, and overall crypto market trends can give us insights into overall investor confidence in XRP. Positive sentiment can fuel a breakout, while negative sentiment could lead to a rejection at the resistance level. Analyzing XRP trading volume and sentiment is critical in determining the likelihood of a successful breakout above $3.40.

4. Potential Scenarios and Price Predictions (with Disclaimer)

Based on the technical analysis, several potential scenarios emerge:

- Scenario 1: Breakout above $3.40: A decisive break above $3.40, confirmed by high volume, could initiate a significant price increase, potentially targeting higher price levels based on chart patterns and Fibonacci retracements.

- Scenario 2: Rejection at $3.40: If the price is consistently rejected at $3.40, a pullback to lower support levels is likely. The extent of the pullback will depend on various factors, including the strength of support levels and overall market sentiment.

- Scenario 3: Consolidation before a Move: The price may consolidate around the $3.40 resistance level before making a decisive move. This consolidation phase could provide traders with opportunities to enter or exit positions strategically.

Price Predictions (Disclaimer: This is not financial advice. Cryptocurrency investments are highly volatile and risky.) Potential price targets depend on various factors and should not be considered guaranteed.

Risk Management: Implementing proper risk management techniques, such as setting stop-loss orders and diversifying your portfolio, is crucial when trading XRP or any other cryptocurrency.

Conclusion: Navigating the XRP $3.40 Resistance – Key Takeaways and Next Steps

The $3.40 level represents a significant resistance point for XRP. The potential for a breakout or rejection at this level depends on a confluence of factors, including historical price action, technical indicators, trading volume, and market sentiment. While a bullish breakout is possible, a rejection remains a real possibility. Conduct thorough research and understand the inherent risks before making any investment decisions. Remember that this analysis is for informational purposes only and should not be considered financial advice. Continue your own research on Ripple (XRP) and the $3.40 resistance, paying close attention to price action, volume, and market sentiment. Learn more about technical analysis applied to XRP trading to make informed decisions.

[Include links to relevant resources such as trading platforms, charting websites, and reputable cryptocurrency news sources.]

Featured Posts

-

Py Ays Ayl Trafy Krachy Ke Bed Lahwr Myn Jshn

May 08, 2025

Py Ays Ayl Trafy Krachy Ke Bed Lahwr Myn Jshn

May 08, 2025 -

Saving Private Ryans Unscripted Scenes Impact And Legacy

May 08, 2025

Saving Private Ryans Unscripted Scenes Impact And Legacy

May 08, 2025 -

Bitcoin Rally Starting Analysts Chart Highlights Key Zones May 6 2024

May 08, 2025

Bitcoin Rally Starting Analysts Chart Highlights Key Zones May 6 2024

May 08, 2025 -

Pnjab Pwlys 29 Afsran Ke Tqrr W Tbadle Ka Nwtyfkyshn

May 08, 2025

Pnjab Pwlys 29 Afsran Ke Tqrr W Tbadle Ka Nwtyfkyshn

May 08, 2025 -

Micro Strategy Vs Bitcoin In 2025 Which Is The Better Investment

May 08, 2025

Micro Strategy Vs Bitcoin In 2025 Which Is The Better Investment

May 08, 2025

Latest Posts

-

Universal Credit Claiming Past Payments You May Be Entitled To

May 08, 2025

Universal Credit Claiming Past Payments You May Be Entitled To

May 08, 2025 -

Jayson Tatum On Steph Curry An Honest All Star Game Reflection

May 08, 2025

Jayson Tatum On Steph Curry An Honest All Star Game Reflection

May 08, 2025 -

Dwp Universal Credit Refunds How To Claim Historical Payments

May 08, 2025

Dwp Universal Credit Refunds How To Claim Historical Payments

May 08, 2025 -

Could You Be Owed Money From Universal Credit

May 08, 2025

Could You Be Owed Money From Universal Credit

May 08, 2025 -

Jayson Tatum Faces Renewed Criticism From Colin Cowherd

May 08, 2025

Jayson Tatum Faces Renewed Criticism From Colin Cowherd

May 08, 2025