Ripple's Future: Analyzing XRP's Potential For Million-Dollar Returns

Table of Contents

Ripple's Technology and its Global Adoption

Ripple's success hinges on its innovative technology and its growing global adoption. Let's examine the key components:

RippleNet and its Impact on Cross-Border Payments

RippleNet is a real-time gross settlement system (RTGS), currency exchange, and remittance network. It aims to revolutionize cross-border payments by providing a faster, cheaper, and more transparent alternative to traditional systems like SWIFT. Numerous banks and financial institutions are already utilizing RippleNet, including major players like Santander, SBI Holdings, and MoneyGram.

- Key Features and Benefits of RippleNet:

- Significantly reduced transaction times (seconds versus days).

- Lower transaction costs compared to SWIFT.

- Enhanced transparency and traceability of transactions.

- Improved security and reliability.

- Scalability to handle large transaction volumes.

RippleNet offers a compelling alternative to SWIFT by addressing its inefficiencies and high costs. This makes it a strong contender in the global payments landscape.

XRP's Role in RippleNet and its Utility

XRP acts as a bridge currency within the RippleNet ecosystem, facilitating faster and cheaper transactions between different currencies. It enables near-instantaneous conversions, reducing the time and expense associated with traditional intermediary banks.

- Mechanics of XRP Usage within RippleNet:

- Banks and financial institutions use XRP to settle transactions in a cost-effective manner.

- XRP's speed and efficiency make it ideal for cross-border payments.

- The use of XRP minimizes reliance on correspondent banks and their associated fees.

Beyond its current role, XRP holds potential for future applications: decentralized finance (DeFi), micropayments, and potentially even as a store of value. The widespread adoption of RippleNet could significantly increase demand for XRP, driving its price upward.

Regulatory Landscape and its Influence on XRP's Price

The regulatory landscape plays a crucial role in shaping XRP's trajectory. The ongoing legal battles and evolving global regulatory frameworks significantly influence its price and future prospects.

The Ongoing SEC Lawsuit and its Potential Outcomes

The SEC lawsuit against Ripple remains a major overhang on XRP's price. The outcome of this case could dramatically affect XRP's future, with potential scenarios ranging from a complete victory for Ripple to a significant regulatory setback.

- Key Arguments in the Lawsuit: The SEC alleges XRP is an unregistered security, while Ripple contends it is a utility token.

- Potential Outcomes and Their Impact: A positive outcome could send XRP's price soaring, while an adverse ruling could result in a significant price drop. A settlement could lead to a mixed market reaction.

Global Regulatory Trends and Their Impact on Cryptocurrency

The regulatory environment for cryptocurrencies is rapidly evolving globally. Different jurisdictions are adopting varying approaches, ranging from outright bans to more permissive frameworks.

- Key Regulatory Developments: The EU's MiCA regulations, and country-specific regulations in Japan, Singapore, and the US, are examples of the evolving landscape.

- Impact on XRP: Clear regulatory guidelines could boost investor confidence, while ambiguous or restrictive regulations could stifle growth.

Market Sentiment and Future Price Predictions (with Cautions)

Analyzing Current Market Trends and Investor Sentiment

Analyzing XRP's price history, trading volume, and market capitalization provides valuable insights into current market sentiment. Factors such as broader cryptocurrency market trends, investor confidence, and news events significantly influence XRP's price.

- XRP Price Data: Tracking XRP's price against the US dollar and other major cryptocurrencies is critical for understanding its volatility.

- Market Capitalization and Trading Volume: These metrics indicate the overall size and liquidity of the XRP market.

Potential Catalysts for Exponential Growth

Several factors could trigger exponential growth in XRP's price:

- Increased Adoption of RippleNet: Widespread adoption by banks and financial institutions could significantly increase demand for XRP.

- Positive Regulatory News: A favorable outcome in the SEC lawsuit or positive regulatory developments globally could drive substantial price appreciation.

- Technological Advancements: Improvements in Ripple's technology, such as enhanced scalability or new applications, could also lead to increased demand.

Risk Assessment: The Importance of Diversification and Realistic Expectations

Investing in cryptocurrencies like XRP carries substantial risk. The market is highly volatile, and prices can fluctuate dramatically in short periods.

- Risk Diversification: It's crucial to diversify your investment portfolio and not put all your eggs in one basket.

- Realistic Expectations: Avoid unrealistic expectations of overnight riches. Cryptocurrency investments require patience and an understanding of the inherent risks.

Conclusion: Investing in Ripple's Future – Is XRP Worth the Risk for Million-Dollar Returns?

XRP's potential for substantial price appreciation is tied to several factors: the success of RippleNet, positive regulatory outcomes, and increased market adoption. While the potential for million-dollar returns exists, it's essential to acknowledge the significant risks involved. The SEC lawsuit, market volatility, and the ever-evolving regulatory landscape present considerable challenges.

Before investing in XRP or any cryptocurrency, conduct thorough research, understand the risks, and consult with a qualified financial advisor. Explore XRP's potential, assess the risks of XRP investment, and learn more about Ripple's technology. Only then can you make an informed decision about whether XRP aligns with your investment strategy and risk tolerance. Remember, responsible investing is key to navigating the exciting, yet unpredictable world of cryptocurrency.

Featured Posts

-

Saturday Lotto Results April 12 2025 Draw

May 02, 2025

Saturday Lotto Results April 12 2025 Draw

May 02, 2025 -

11 Point Masterclass Duponts Key Role In Frances Victory Against Italy

May 02, 2025

11 Point Masterclass Duponts Key Role In Frances Victory Against Italy

May 02, 2025 -

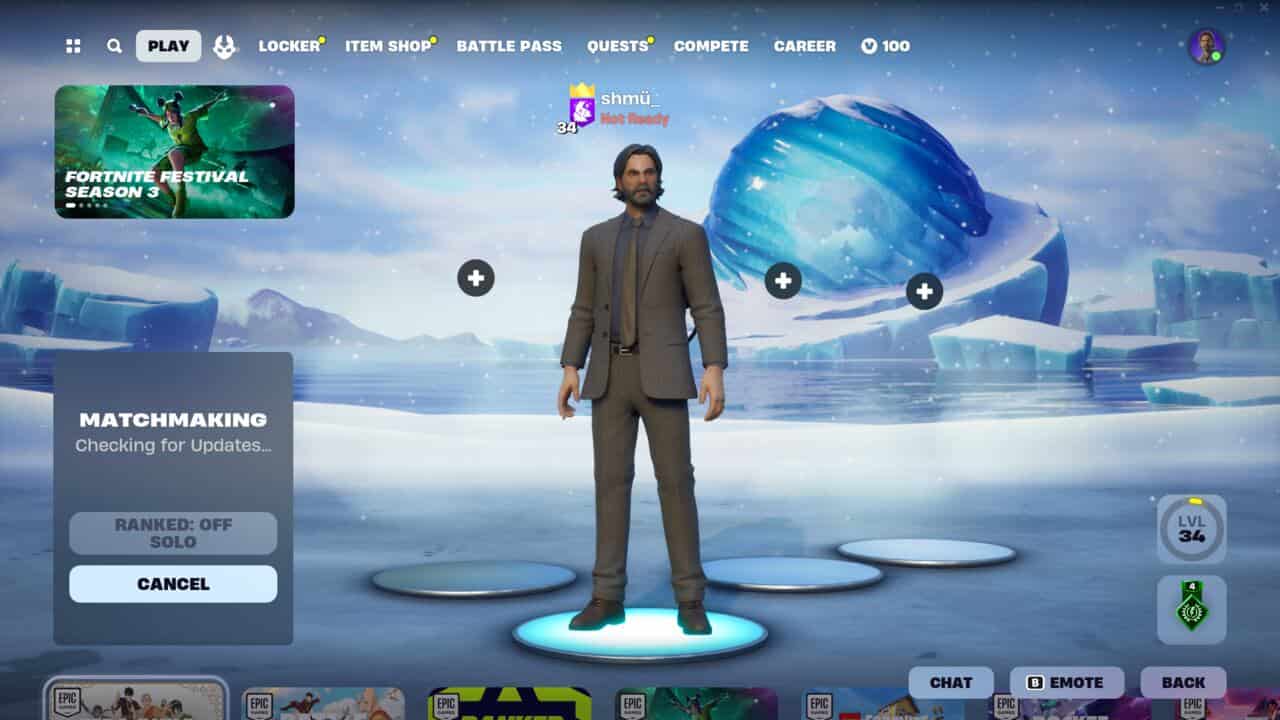

Fortnite Matchmaking Error 1 A Comprehensive Guide

May 02, 2025

Fortnite Matchmaking Error 1 A Comprehensive Guide

May 02, 2025 -

Ripple Vs Sec Settlement Imminent Xrps Future As A Commodity

May 02, 2025

Ripple Vs Sec Settlement Imminent Xrps Future As A Commodity

May 02, 2025 -

Beijings Trade War Strategy Obfuscating The True Economic Costs

May 02, 2025

Beijings Trade War Strategy Obfuscating The True Economic Costs

May 02, 2025

Latest Posts

-

Lee Anderson Celebrates Councillors Move To Reform

May 03, 2025

Lee Anderson Celebrates Councillors Move To Reform

May 03, 2025 -

Councillors Defection To Reform A Major Blow For Labour

May 03, 2025

Councillors Defection To Reform A Major Blow For Labour

May 03, 2025 -

Reform Party Gains Momentum Councillor Switches From Labour

May 03, 2025

Reform Party Gains Momentum Councillor Switches From Labour

May 03, 2025 -

Labour Councillor Defects To Reform A Seismic Shift In Politics

May 03, 2025

Labour Councillor Defects To Reform A Seismic Shift In Politics

May 03, 2025 -

Lee Anderson Welcomes Councillor Defection To Reform Party

May 03, 2025

Lee Anderson Welcomes Councillor Defection To Reform Party

May 03, 2025