Rosenberg Critiques Bank Of Canada's Cautious Approach

Table of Contents

Rosenberg's Core Arguments Against the Bank of Canada's Policy

Rosenberg's central argument revolves around his belief that the Bank of Canada is significantly underestimating the threat of inflation and is reacting too slowly to rising prices. This hesitancy, he argues, risks a more severe economic correction down the line. His main points of contention include:

-

Argument 1: Inflationary Pressures are Being Underestimated: Rosenberg likely points to persistent inflation in specific sectors, such as housing and energy, as evidence that the Bank of Canada's inflation targets are overly optimistic. He might also cite stubborn wage growth as a key indicator of embedded inflationary pressures that the Bank is ignoring. The continued rise in prices of essential goods even with rising interest rates strengthens this argument.

-

Argument 2: The Bank of Canada is Reacting Too Slowly: Rosenberg contends that the Bank of Canada's gradual approach to interest rate increases is allowing inflation to become entrenched. He argues that this delayed action will necessitate more drastic measures in the future, potentially leading to a sharper economic downturn and higher unemployment. A more proactive approach, he suggests, would mitigate these risks.

-

Argument 3: The Current Approach Risks a Deeper Recession: By moving too slowly, Rosenberg believes the Bank of Canada is risking a deeper and more prolonged recession. He argues that allowing inflation to persist will ultimately necessitate more aggressive interest rate hikes later, leading to a more painful adjustment for businesses and consumers alike. This could also impact investment and consumer confidence significantly.

Analyzing the Bank of Canada's Stance

The Bank of Canada justifies its cautious approach by citing several factors:

-

Counter-argument 1: Protecting Employment and Economic Growth: The Bank emphasizes the potential negative impact of aggressive rate hikes on employment and economic growth. Raising interest rates too quickly could trigger job losses and a contraction in economic activity, undermining the overall health of the Canadian economy.

-

Counter-argument 2: Addressing Supply Chain Disruptions: The Bank acknowledges the significant role of supply chain disruptions in driving inflation. They argue that focusing solely on interest rate hikes without addressing these underlying supply-side issues could prove counterproductive and exacerbate economic problems.

-

Counter-argument 3: Data-Driven Decision Making: The Bank of Canada consistently emphasizes its data-driven approach to monetary policy. They highlight various economic indicators, such as inflation expectations and wage growth, to support their decision-making process. These indicators, they argue, do not support a drastic shift in monetary policy.

Economic Indicators and Data Supporting Both Sides

Understanding the Rosenberg Bank of Canada debate requires examining key economic indicators:

-

Data Point 1: Current Inflation Rate and Trajectory: While inflation has shown signs of easing in some areas, it remains above the Bank of Canada's target range. Rosenberg would likely argue this necessitates faster action, while the Bank might highlight the gradual decline as evidence of the effectiveness of their current strategy.

-

Data Point 2: Unemployment Rate and its Relation to Interest Rate Changes: The unemployment rate is a crucial factor in the Bank's decision-making. A rise in unemployment following interest rate hikes would reinforce the Bank's cautious approach, while Rosenberg might argue that this risk is outweighed by the dangers of unchecked inflation.

-

Data Point 3: GDP Growth and its Correlation with Monetary Policy: GDP growth provides another crucial metric. A slowdown in GDP growth could support the Bank’s cautious approach, but Rosenberg would likely point to the potential for long-term economic damage if inflation isn’t addressed proactively. (Charts and graphs visualizing these data points would be included here).

Potential Consequences and Future Outlook

The long-term implications of both approaches are significant:

-

Scenario 1: Consequences of the Bank of Canada's Current Strategy: Continued slow action could allow inflation to become entrenched, leading to higher interest rates later and a potentially more severe recession.

-

Scenario 2: Consequences of a More Aggressive Approach (as suggested by Rosenberg): A more aggressive approach might trigger a quicker recession but could potentially tame inflation more quickly, preventing long-term damage.

-

Future Outlook: The future outlook remains uncertain. Experts offer varied predictions, with some echoing Rosenberg's concerns about the Bank's caution and others supporting the Bank's measured approach. The evolution of inflation, unemployment, and GDP growth will be crucial in determining the ultimate success of either strategy.

Conclusion

This analysis of Rosenberg's critique of the Bank of Canada’s approach highlights a key debate within Canadian monetary policy. Rosenberg's concerns about underestimated inflation and slow reaction times are countered by the Bank of Canada's emphasis on protecting employment and economic growth, citing supply chain issues and data-driven decision making. The key economic indicators—inflation, unemployment, and GDP growth—remain crucial factors shaping this ongoing discussion. This Rosenberg Bank of Canada debate underscores the complexities of managing the Canadian economy. Stay informed on the latest developments and the evolving Rosenberg Bank of Canada discussion by regularly checking back for updates on this important issue. Understanding these differing perspectives is vital for navigating the complexities of the Canadian economy.

Featured Posts

-

Are Minnesotas Film Tax Credits Competitive Enough

Apr 29, 2025

Are Minnesotas Film Tax Credits Competitive Enough

Apr 29, 2025 -

Anchor Brewing Company Shuts Down A Legacy Concludes After 127 Years

Apr 29, 2025

Anchor Brewing Company Shuts Down A Legacy Concludes After 127 Years

Apr 29, 2025 -

Blue Origin Rocket Launch Cancelled Subsystem Issue Reported

Apr 29, 2025

Blue Origin Rocket Launch Cancelled Subsystem Issue Reported

Apr 29, 2025 -

Hungary Rejects Us Urging To Curb Chinese Economic Relations

Apr 29, 2025

Hungary Rejects Us Urging To Curb Chinese Economic Relations

Apr 29, 2025 -

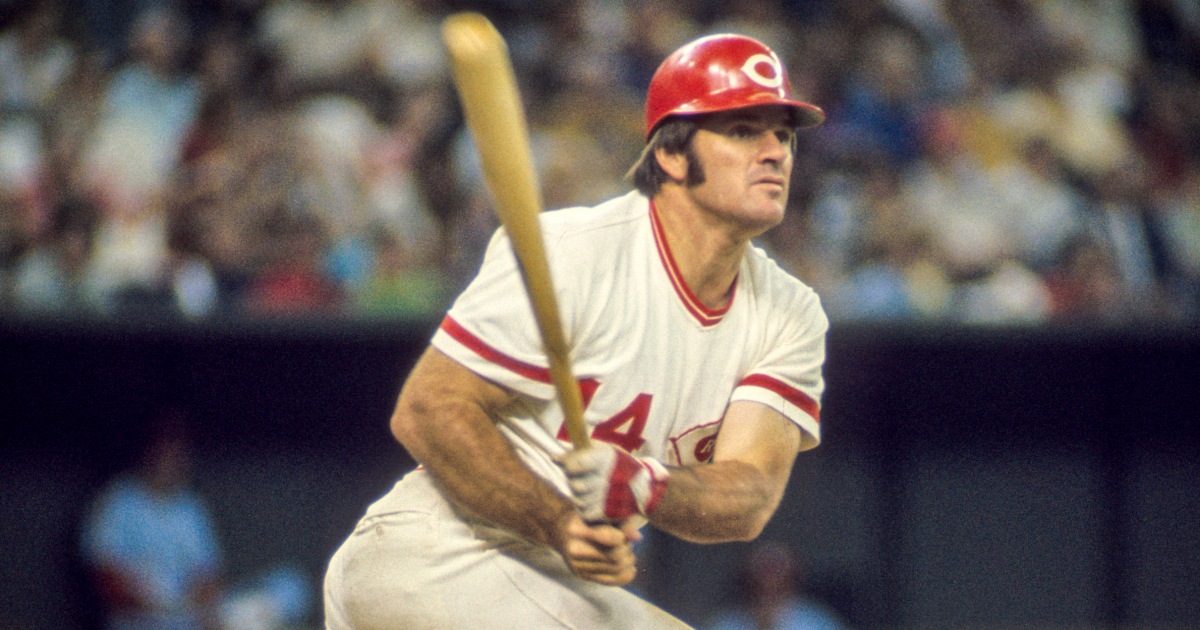

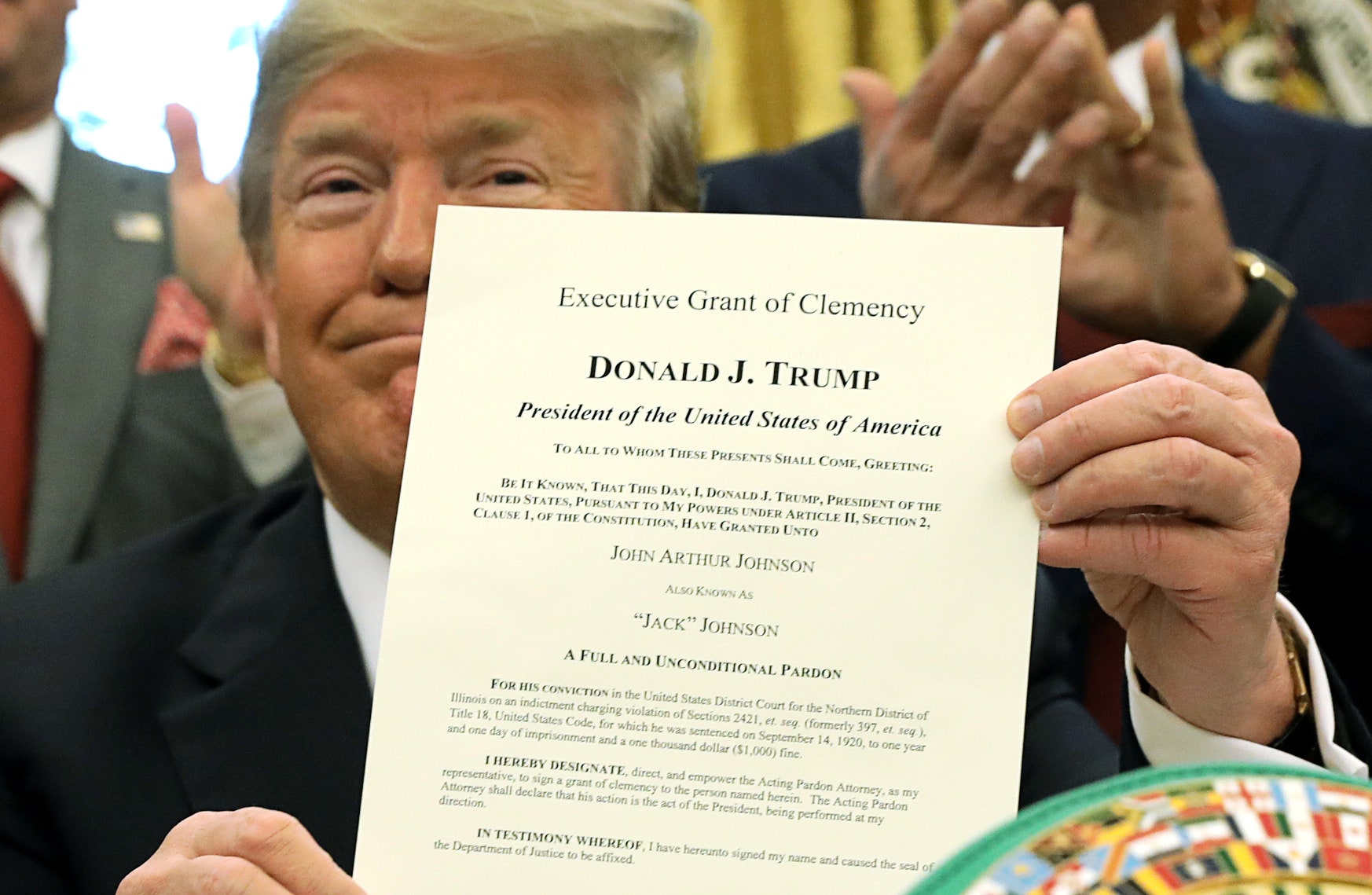

Trumps Potential Pardon For Pete Rose A Look At The Mlb Betting Ban

Apr 29, 2025

Trumps Potential Pardon For Pete Rose A Look At The Mlb Betting Ban

Apr 29, 2025

Latest Posts

-

Older Viewers And You Tube A Growing Trend

Apr 29, 2025

Older Viewers And You Tube A Growing Trend

Apr 29, 2025 -

Why Older Adults Are Choosing You Tube For Entertainment

Apr 29, 2025

Why Older Adults Are Choosing You Tube For Entertainment

Apr 29, 2025 -

You Tubes Growing Popularity Among Older Viewers

Apr 29, 2025

You Tubes Growing Popularity Among Older Viewers

Apr 29, 2025 -

Full Pardon For Rose Trumps Decision And Its Fallout

Apr 29, 2025

Full Pardon For Rose Trumps Decision And Its Fallout

Apr 29, 2025 -

Rose Pardon Will Trump Grant Executive Clemency

Apr 29, 2025

Rose Pardon Will Trump Grant Executive Clemency

Apr 29, 2025