Ryan Reynolds' MNTN: IPO Launch Expected As Early As Next Week

Table of Contents

MNTN's Business Model and Growth Trajectory

MNTN's business model centers around a direct-to-consumer (DTC) approach, bypassing traditional retail channels to sell its premium fitness products directly to consumers online. This strategy allows for greater control over branding, pricing, and customer relationships. The company's key revenue stream is the sale of its fitness supplements and equipment, but future revenue streams may also include partnerships and subscriptions for fitness plans or training programs. MNTN's target market is health-conscious consumers seeking high-quality, convenient fitness solutions.

Analyzing MNTN's recent growth is challenging due to the pre-IPO nature of the company, however, anecdotal evidence suggests strong performance. Key metrics like revenue, customer acquisition cost (CAC), and customer lifetime value (CLTV) are expected to be highlighted in the IPO prospectus. Several factors have contributed to MNTN's impressive trajectory:

- Strong brand recognition: Ryan Reynolds' involvement has undoubtedly played a crucial role in building brand awareness and trust.

- Effective marketing and social media strategies: MNTN has leveraged creative and engaging marketing campaigns, particularly on social media platforms, to reach its target audience.

- Innovative product offerings: The company's products are designed to be high-quality and cater to a specific market need, fostering customer loyalty.

- Expanding market reach: MNTN is actively working on expanding its geographic reach and product lines, which fuels future growth potential.

The IPO Details and Expected Valuation

While the exact details surrounding the MNTN IPO are still emerging, several key aspects have been speculated. The number of shares to be offered, the expected price range per share, and the lead underwriters will be crucial factors determining the overall success of the offering. The anticipated market valuation of MNTN is subject to significant speculation at this stage, with estimates varying widely depending on the projected growth trajectory and market conditions. Investors will be keenly observing the initial pricing and market reaction upon the stock's debut. Key IPO information to watch for includes:

- Date of IPO: Currently expected as early as next week.

- Number of shares offered: This figure will be revealed in the IPO prospectus.

- Expected price per share: The price range will likely be announced closer to the IPO date.

- Lead underwriters: The investment banks managing the offering will significantly influence the process.

Potential Risks and Investment Considerations

Investing in any IPO carries inherent risks, and the MNTN IPO is no exception. While the company has shown promising growth, several factors warrant consideration before making an investment decision.

- Competition from established players: The fitness industry is fiercely competitive, with established players like Peloton and Nike dominating the market. MNTN will need to differentiate itself effectively to maintain its competitive edge.

- Dependence on celebrity endorsement: While Ryan Reynolds' involvement is a strength, over-reliance on celebrity endorsement could prove to be a vulnerability if his appeal diminishes.

- Market fluctuations and economic uncertainty: Broader market conditions, including economic downturns, could negatively impact investor sentiment and the valuation of MNTN.

- Potential challenges in scaling operations: As MNTN grows, it will need to manage increased operational complexities efficiently.

Alternative Investments in the Fitness Sector

For diversification, investors may consider exploring other publicly traded companies in the fitness sector. Companies like Peloton Interactive (PTON) and Nautilus (NLS) offer alternative investment avenues within the same industry. Researching these companies and comparing their performance, business models, and growth prospects can provide valuable context for evaluating the MNTN IPO.

Should You Invest in Ryan Reynolds' MNTN IPO?

The MNTN IPO presents both exciting opportunities and considerable risks. While the company's innovative business model, strong brand recognition, and promising growth trajectory are positives, investors must carefully weigh the potential challenges and competitive pressures. The anticipated launch is generating considerable buzz, but remember that any investment decision should be based on thorough due diligence. Consider factors like market volatility and the company's ability to scale successfully. Before considering investing in the Ryan Reynolds' MNTN IPO, learn more about the MNTN IPO, research MNTN stock, and ensure that it aligns with your individual risk tolerance and investment goals. Remember to consult with a financial advisor before making any investment decisions related to the MNTN IPO or similar direct-to-consumer fitness brands.

Featured Posts

-

Aaron Judges 2026 Wbc Hopes A Door Cracks Open

May 11, 2025

Aaron Judges 2026 Wbc Hopes A Door Cracks Open

May 11, 2025 -

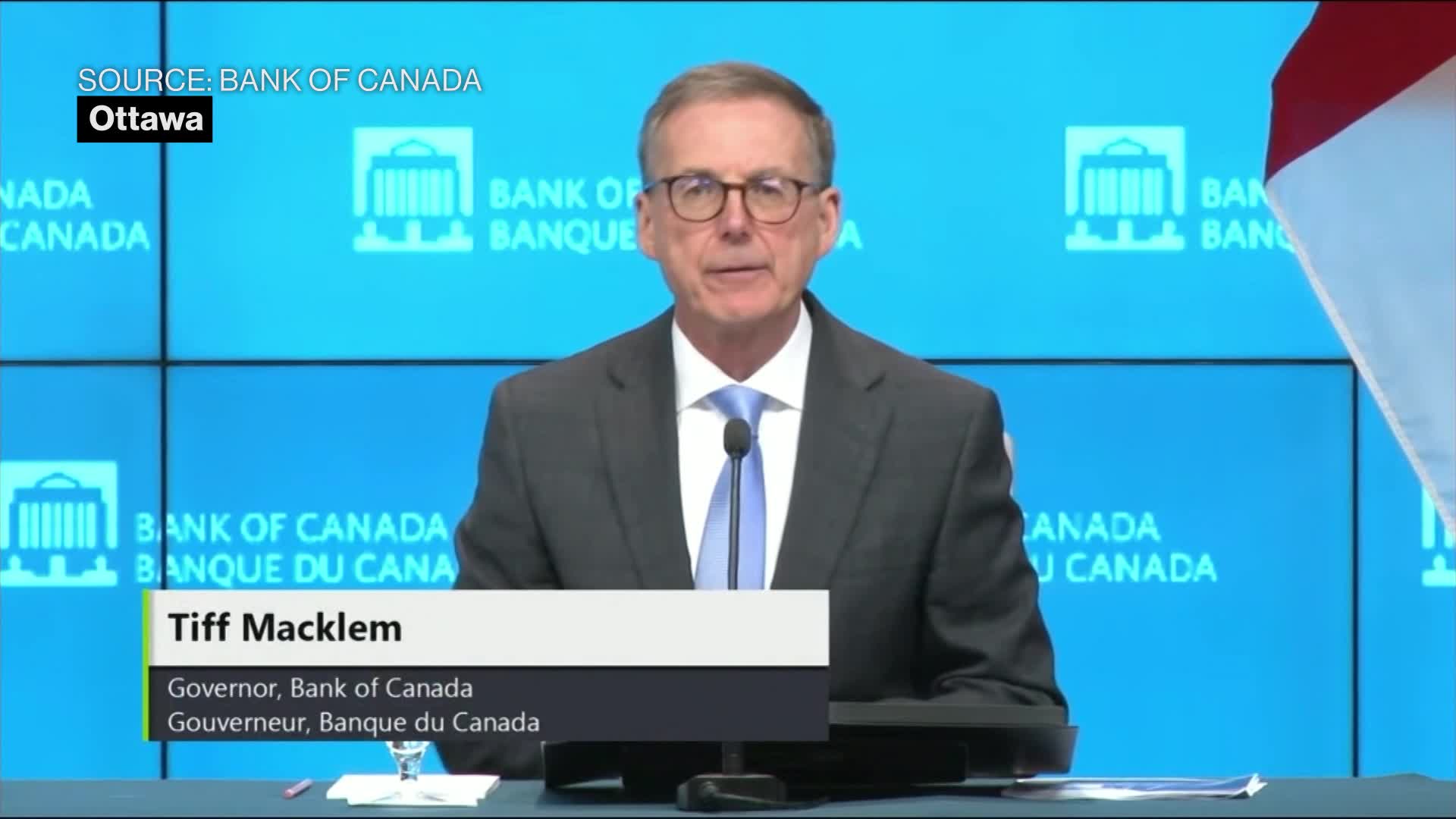

Bank Of Canada Rate Cuts Predicted Amidst Tariff Driven Job Losses

May 11, 2025

Bank Of Canada Rate Cuts Predicted Amidst Tariff Driven Job Losses

May 11, 2025 -

Late Game Heroics Tennessee Beats Lsu To Tie Series

May 11, 2025

Late Game Heroics Tennessee Beats Lsu To Tie Series

May 11, 2025 -

Putins Victory Day Parade Assessing Russias Military Capabilities

May 11, 2025

Putins Victory Day Parade Assessing Russias Military Capabilities

May 11, 2025 -

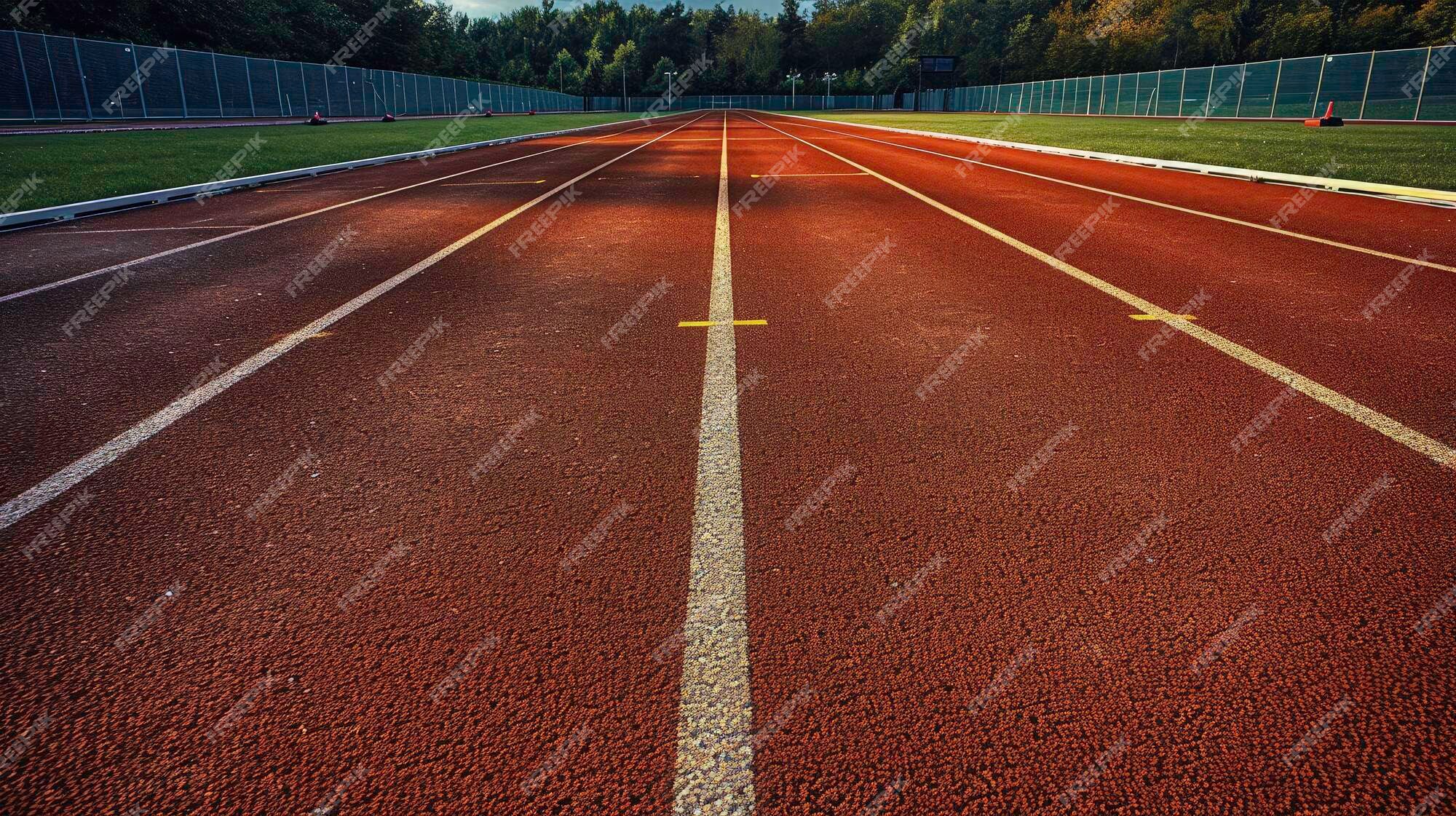

New Track Surface Ready For Championship Events At Stadium

May 11, 2025

New Track Surface Ready For Championship Events At Stadium

May 11, 2025

Latest Posts

-

The Jurickson Profar Ped Suspension Reactions And Fallout

May 11, 2025

The Jurickson Profar Ped Suspension Reactions And Fallout

May 11, 2025 -

Crazy Rich Asians Series Lim And Chu Return For Max

May 11, 2025

Crazy Rich Asians Series Lim And Chu Return For Max

May 11, 2025 -

Understanding Jurickson Profars 80 Game Suspension A Deeper Look

May 11, 2025

Understanding Jurickson Profars 80 Game Suspension A Deeper Look

May 11, 2025 -

Jurickson Profars 80 Game Ped Suspension Career Implications

May 11, 2025

Jurickson Profars 80 Game Ped Suspension Career Implications

May 11, 2025 -

How To Watch The Grand Slam Track Kingston Live Stream

May 11, 2025

How To Watch The Grand Slam Track Kingston Live Stream

May 11, 2025