Saudi PIF Bans PwC From Advisory Roles For A Year

Table of Contents

The Saudi PIF's Decision and its Implications

The Saudi Public Investment Fund's decision to ban PwC from advisory roles for a full year represents a major setback for the global accounting and consulting giant. This ban, impacting all advisory services, specifically excludes audit services at this time, potentially costing PwC millions in lost revenue from projects associated with the PIF. The ramifications extend beyond immediate financial losses; it casts a shadow over PwC's reputation and its ability to secure future contracts within Saudi Arabia, a crucial market for international firms. The impact on PIF's ongoing projects remains to be seen, potentially leading to delays and requiring a restructuring of advisory teams for several key initiatives.

- Duration of the ban: One year.

- Scope of the ban: Advisory roles only, excluding audit services for now.

- Potential financial impact on PwC: Significant loss of revenue from PIF-related projects.

- Potential impact on PIF's ongoing projects: Potential delays and the need for reshuffling advisory teams.

Reasons Behind the Ban: Understanding the Allegations

While the exact reasons behind the PIF's decision haven't been publicly disclosed in full detail, allegations of potential regulatory violations and conflicts of interest are reportedly at the heart of the matter. The Saudi PIF is understood to have conducted a thorough internal investigation, the results of which led to the ban. The focus seems to center on whether PwC adequately adhered to ethical and regulatory guidelines in its dealings with the PIF. The possibility of a breach of confidentiality or failure to disclose relevant information is also under investigation. Further information is expected to emerge as investigations progress.

- Specific allegations: Potential conflict of interest, breach of confidentiality, and/or failure to meet regulatory standards.

- Ongoing investigations: An internal investigation by the PIF is underway, and further details are expected to emerge.

- Other firms involved: While PwC is currently the only firm affected by this ban, the incident could lead to increased scrutiny of other financial advisory firms operating in Saudi Arabia.

PwC's Response and Future Actions

PwC has issued a statement acknowledging the Saudi PIF's decision and expressing its commitment to cooperating fully with the ongoing investigation. While not explicitly admitting any wrongdoing, the firm stated that it is taking the matter seriously. Internal reviews and investigations are being conducted to assess PwC’s adherence to its internal policies and procedures related to its work with the PIF. The firm will likely focus on damage control, emphasizing its commitment to ethical practices and attempting to regain the trust of the Saudi PIF and other clients.

- PwC's official statement: Acknowledgment of the ban and a pledge for full cooperation with the investigation.

- Internal investigations: PwC is conducting internal reviews to determine its compliance and implement corrective measures.

- Strategies to mitigate damage: Damage control efforts will likely focus on demonstrating a commitment to ethical practices and regulatory compliance.

Broader Implications for the Saudi Arabian Business Landscape

The Saudi PIF's ban on PwC has broader implications for the Saudi Arabian business environment and its investment climate. It highlights the kingdom's commitment to enhancing corporate governance and maintaining high standards of regulatory compliance. This action could increase scrutiny of other international firms operating in Saudi Arabia and lead to a more robust regulatory framework in the financial sector. It might also impact investor confidence in the short term, although the long-term effects remain to be seen. This decision underlines the increasingly stringent regulatory landscape within the kingdom.

- Impact on investor confidence: Potential short-term impact, though the long-term effect remains uncertain.

- Increased scrutiny of other firms: Other financial advisory firms operating in Saudi Arabia may face increased scrutiny.

- Changes in regulatory oversight: The incident might catalyze further improvements and stricter oversight in Saudi Arabia's financial sector.

Conclusion

The Saudi PIF's decision to ban PwC from advisory roles for a year is a landmark event with significant consequences. The allegations of regulatory violations, PwC's response, and the broader implications for the Saudi Arabian business landscape underscore the importance of ethical conduct and robust regulatory frameworks in the financial sector. The long-term impact on investor confidence and the future of PwC's operations in Saudi Arabia remains to be seen. Stay updated on the evolving situation surrounding the Saudi PIF and PwC. Follow our site for further updates on the impact of the Saudi PIF ban on PwC and other key developments in the Saudi Arabian business landscape. For in-depth analysis on Saudi PIF and its investment strategies, continue reading our articles.

Featured Posts

-

Planning For A Happy Day February 20 2025

Apr 29, 2025

Planning For A Happy Day February 20 2025

Apr 29, 2025 -

Porsche 911 Za 1 33 Mln Zl Najpopularniejszy Model W Polsce

Apr 29, 2025

Porsche 911 Za 1 33 Mln Zl Najpopularniejszy Model W Polsce

Apr 29, 2025 -

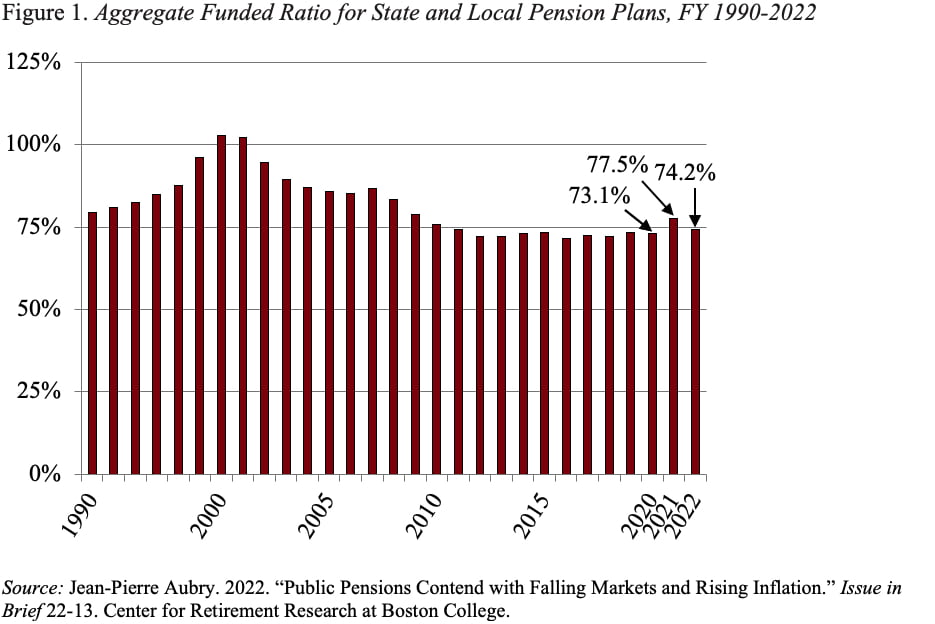

The Growing Financial Strain Of Public Sector Pensions On Taxpayers

Apr 29, 2025

The Growing Financial Strain Of Public Sector Pensions On Taxpayers

Apr 29, 2025 -

Kynning A Nyja Rafdrifn Porsche Macan

Apr 29, 2025

Kynning A Nyja Rafdrifn Porsche Macan

Apr 29, 2025 -

David Rosenberg Was The Bank Of Canada Too Timid

Apr 29, 2025

David Rosenberg Was The Bank Of Canada Too Timid

Apr 29, 2025

Latest Posts

-

Ru Pauls Drag Race Live Celebrates 1000 Shows With Global Livestream

Apr 30, 2025

Ru Pauls Drag Race Live Celebrates 1000 Shows With Global Livestream

Apr 30, 2025 -

Ru Pauls Drag Race Season 17 Episode 8 Wicked Preview And Spoilers

Apr 30, 2025

Ru Pauls Drag Race Season 17 Episode 8 Wicked Preview And Spoilers

Apr 30, 2025 -

Ru Pauls Drag Race Season 17 Episode 8 Wicked Preview And Predictions

Apr 30, 2025

Ru Pauls Drag Race Season 17 Episode 8 Wicked Preview And Predictions

Apr 30, 2025 -

Ru Pauls Drag Race Season 17 Episode 8 Preview A Wicked Good Time

Apr 30, 2025

Ru Pauls Drag Race Season 17 Episode 8 Preview A Wicked Good Time

Apr 30, 2025 -

Things Get Fishy A Guide To Ru Pauls Drag Race Season 17 Episode 6

Apr 30, 2025

Things Get Fishy A Guide To Ru Pauls Drag Race Season 17 Episode 6

Apr 30, 2025