Sharp Decline In Amsterdam Stock Market: A Year's Low

Table of Contents

Underlying Factors Contributing to the Amsterdam Stock Market Dip

Several interconnected factors have contributed to this recent downturn in the Amsterdam stock market. Understanding these complexities is crucial for navigating the current economic climate.

Global Economic Uncertainty

The global economic landscape has been turbulent in recent months. High inflation rates in many countries, coupled with aggressive interest rate hikes by central banks to combat inflation, have created a climate of uncertainty. This uncertainty directly impacts investor confidence and risk appetite, leading to sell-offs in various global markets, including Amsterdam.

- The war in Ukraine: The ongoing conflict has disrupted global supply chains, driven up energy prices, and fueled inflationary pressures worldwide.

- Rising energy prices: Soaring energy costs are impacting businesses and consumers across the globe, dampening economic growth and reducing consumer spending.

- Supply chain disruptions: Persistent supply chain bottlenecks continue to constrain production and increase costs for businesses, impacting profitability and investor sentiment.

These global headwinds have significantly impacted the Amsterdam stock market, contributing to the recent sharp decline. Data from the AEX (Amsterdam Exchange Index) shows a considerable drop compared to the previous year. (Insert relevant graph or chart showing AEX performance here).

Performance of Key Dutch Sectors

The decline hasn't affected all sectors equally. Some sectors within the Amsterdam stock market have been disproportionately impacted, revealing vulnerabilities within the Dutch economy.

- Technology: The technology sector, often sensitive to interest rate hikes and economic slowdowns, has experienced a notable decline in valuations. (Insert data points on specific technology companies listed on the AEX).

- Finance: The financial sector, while relatively resilient, has also felt the pressure from global uncertainty and increased risk aversion among investors.

- Energy: While energy companies might initially benefit from high prices, the broader economic slowdown and concerns about future demand have impacted their stock performance. (Insert data on specific energy companies and their performance).

A comprehensive analysis of the performance of these key sectors is essential to understand the overall decline in the Amsterdam stock market.

Investor Sentiment and Market Volatility

Investor sentiment plays a critical role in shaping market movements. Negative news, economic uncertainty, and geopolitical risks can quickly erode investor confidence, leading to sell-offs and increased market volatility.

- Decreased investor confidence: Concerns about inflation, recession, and geopolitical instability have led to a decline in investor confidence, prompting many to liquidate their holdings.

- Increased market volatility: The sharp fluctuations in the AEX index reflect the heightened market volatility, making it challenging for investors to predict future market trends.

- Shift in investment strategies: Many investors have shifted towards safer assets, such as government bonds, reducing their exposure to riskier equities.

Understanding the interplay between investor sentiment and market volatility is vital for grasping the dynamics of the sharp decline in Amsterdam stock market.

Impact of the Decline on the Dutch Economy

The sharp downturn in the Amsterdam stock market has significant implications for the Dutch economy, affecting businesses and consumers alike.

Consequences for Dutch Businesses

The decline has directly impacted Dutch businesses, particularly those listed on the AEX. Reduced investor confidence translates to lower valuations and difficulties in accessing capital for expansion or investment.

- Reduced investment: Companies may postpone or cancel expansion plans due to reduced investor funding.

- Potential job losses: Some companies might resort to cost-cutting measures, including potential job losses, to maintain profitability.

- Examples: (mention specific companies affected, citing examples of reduced profits, hiring freezes, or restructuring).

The overall effect on Dutch businesses could be substantial, impacting economic growth and employment.

Ripple Effects on Consumers

The decline's impact extends beyond businesses, affecting consumer confidence and spending.

- Reduced consumer spending: Uncertainty in the market can lead to reduced consumer spending, dampening economic activity.

- Potential price increases: Market instability can lead to increased prices for goods and services, further reducing consumer purchasing power.

- Government interventions: The Dutch government may introduce economic stimulus packages or support measures to mitigate the impact on consumers.

The cascading effects of the market decline on consumer behavior can have a profound impact on the overall health of the Dutch economy.

Potential Recovery Strategies and Future Outlook for the Amsterdam Stock Market

While the situation is challenging, several strategies could contribute to a recovery of the Amsterdam stock market.

Government Intervention and Policy Changes

Government intervention can play a vital role in stimulating economic growth and restoring investor confidence.

- Fiscal stimulus: Government spending on infrastructure projects or tax cuts could boost economic activity.

- Monetary policy adjustments: Central bank policies may be adjusted to support economic growth without exacerbating inflation.

- Regulatory reforms: Streamlining regulations and promoting a business-friendly environment could attract investments.

Past government interventions in similar economic downturns can inform current policy decisions.

Expert Predictions and Market Analysis

Financial analysts and experts offer diverse perspectives on the potential for market recovery.

- Short-term outlook: Many analysts predict a period of continued volatility in the short term. (Include quotes from financial experts).

- Long-term outlook: The long-term outlook remains uncertain, depending on the evolution of global economic conditions and government policies. (Include quotes from financial experts).

A balanced assessment of expert opinions is crucial for making informed investment decisions.

Conclusion: Navigating the Sharp Decline in the Amsterdam Stock Market

The sharp decline in Amsterdam stock market performance is a complex issue stemming from a combination of global economic uncertainty, sector-specific challenges, and shifts in investor sentiment. The impact extends to Dutch businesses and consumers, necessitating careful consideration of potential recovery strategies. Government intervention, combined with a cautious assessment of expert predictions, will be crucial in determining the future trajectory of the Amsterdam stock market. Staying updated on the latest developments in Amsterdam stock market trends and Amsterdam stock market performance is crucial for navigating future investments. Stay informed by regularly checking reputable financial news sources.

Featured Posts

-

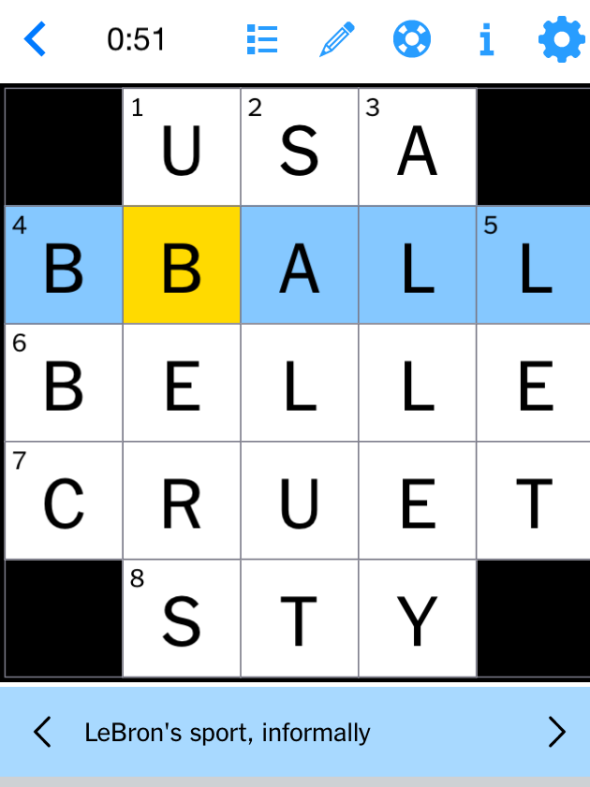

March 13 2025 Nyt Mini Crossword Clues Answers And Solutions

May 24, 2025

March 13 2025 Nyt Mini Crossword Clues Answers And Solutions

May 24, 2025 -

How To Obtain Bbc Radio 1 Big Weekend 2025 Tickets At Sefton Park

May 24, 2025

How To Obtain Bbc Radio 1 Big Weekend 2025 Tickets At Sefton Park

May 24, 2025 -

Eurovision 2025 Conchita Wurst And Jj To Perform At Eurovision Village

May 24, 2025

Eurovision 2025 Conchita Wurst And Jj To Perform At Eurovision Village

May 24, 2025 -

Investing In Amundi Msci World Ex Us Ucits Etf Acc Nav Analysis

May 24, 2025

Investing In Amundi Msci World Ex Us Ucits Etf Acc Nav Analysis

May 24, 2025 -

Leeds Uniteds Interest In Kyle Walker Peters Intensifies

May 24, 2025

Leeds Uniteds Interest In Kyle Walker Peters Intensifies

May 24, 2025

Latest Posts

-

Sean Penn Weighs In On Dylan Farrows Accusations Against Woody Allen

May 24, 2025

Sean Penn Weighs In On Dylan Farrows Accusations Against Woody Allen

May 24, 2025 -

Controversy Surrounding Woody Allen Sean Penns Perspective

May 24, 2025

Controversy Surrounding Woody Allen Sean Penns Perspective

May 24, 2025 -

The Sean Penn Woody Allen Dylan Farrow Controversy

May 24, 2025

The Sean Penn Woody Allen Dylan Farrow Controversy

May 24, 2025 -

Woody Allen Sexual Assault Allegations Sean Penns Doubts

May 24, 2025

Woody Allen Sexual Assault Allegations Sean Penns Doubts

May 24, 2025 -

Sean Penns Response To Dylan Farrows Allegations Against Woody Allen

May 24, 2025

Sean Penns Response To Dylan Farrows Allegations Against Woody Allen

May 24, 2025