Investing In Amundi MSCI World Ex-US UCITS ETF Acc: NAV Analysis

Table of Contents

Understanding the Amundi MSCI World ex-US UCITS ETF Acc

What is the ETF and its investment objective?

The Amundi MSCI World ex-US UCITS ETF Acc is a passively managed Exchange-Traded Fund designed to track the performance of the MSCI World ex-US Index. This index represents a broad range of large and mid-cap equities from developed markets worldwide, excluding the United States. Its UCITS (Undertakings for Collective Investment in Transferable Securities) compliant structure makes it accessible and attractive to investors across Europe, adhering to stringent regulatory standards. The ETF's primary objective is to provide investors with exposure to a diversified portfolio of international equities, offering potential for growth and diversification benefits beyond a solely US-focused portfolio.

Analyzing the ETF's Holdings and Sector Allocation

The Amundi MSCI World ex-US UCITS ETF Acc boasts significant geographic diversification. Its holdings span a wide array of developed markets, including:

- Europe: Significant exposure to major European economies like Germany, France, the UK, and Switzerland.

- Japan: A substantial allocation to Japanese equities, representing a key component of the Asian market.

- Other Developed Markets: Exposure to Australia, Canada, and other developed nations, further enhancing diversification.

This geographic spread is complemented by a diversified sector allocation. The ETF typically invests across various sectors, including:

- Technology: Exposure to leading global technology companies outside the US.

- Financials: Investment in major international banks and financial institutions.

- Healthcare: Allocation to pharmaceutical and healthcare companies.

- Consumer Staples & Discretionary: Exposure to companies in essential goods and discretionary spending sectors.

This broad diversification aims to mitigate risk by reducing reliance on any single country or industry. However, it's crucial to remember that international investing inherently involves currency risk and potential political instability in certain regions.

Understanding Expense Ratios and Fees

Transparency in fees is crucial. The Amundi MSCI World ex-US UCITS ETF Acc has a competitive expense ratio (check the latest figure on the provider's website). This should be compared to similar ETFs tracking similar indices. Lower expense ratios translate to higher returns over the long term, so it's essential to carefully consider these costs when making your investment decision. Remember that even small differences in expense ratios can significantly impact your overall returns over many years.

Deep Dive into NAV Analysis: Interpreting the Data

What is Net Asset Value (NAV) and why is it important?

The Net Asset Value (NAV) represents the net asset value per share of the ETF. It's calculated daily by subtracting liabilities from the total market value of all the assets held by the ETF, and then dividing by the number of outstanding shares. Daily NAV fluctuations directly reflect the market performance of the underlying assets in the MSCI World ex-US Index. Monitoring NAV is crucial for assessing the ETF's performance and making informed investment decisions.

Analyzing NAV Trends and Performance

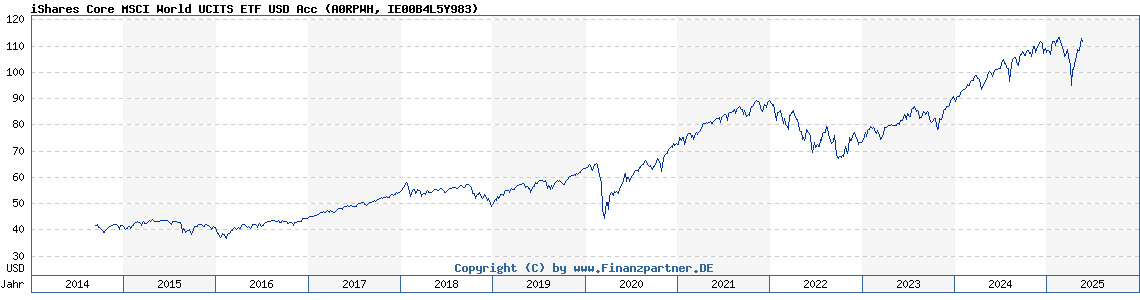

(Insert a clear, visually appealing chart or graph showing historical NAV data for the Amundi MSCI World ex-US UCITS ETF Acc. The graph should show data over different time periods (e.g., 1 year, 5 years, 10 years, if available).)

Analyzing this chart, we can observe periods of both upward and downward NAV trends. Upward trends generally reflect positive market performance and growth in the underlying assets. Downward trends usually indicate market corrections or periods of economic uncertainty. Understanding these fluctuations requires considering broader economic factors, geopolitical events, and industry-specific news impacting the ETF’s holdings.

Comparing NAV to Share Price

Ideally, the ETF's share price should closely track its NAV. However, minor deviations can occur due to market supply and demand. Significant discrepancies might present arbitrage opportunities for sophisticated traders. By comparing the NAV and share price, investors can gain insights into market sentiment and potential buying or selling opportunities.

Amundi MSCI World ex-US UCITS ETF Acc: Risk and Return Considerations

Risk Assessment

Investing in international equities carries inherent risks:

- Currency Risk: Fluctuations in exchange rates between your base currency and the currencies of the underlying assets can impact returns.

- Political Risk: Political instability or changes in government policies in the countries where the ETF invests can affect performance.

- Market Risk: The overall market performance can significantly influence the ETF's value.

Diversification, as offered by this ETF, helps mitigate these risks, but it doesn't eliminate them entirely. The ETF's historical volatility (which should be researched and included here) provides an indication of its price fluctuations.

Return Expectations

(Include historical return data, clearly stating the time period and emphasizing long-term performance. Avoid making specific future return predictions, instead discuss potential returns based on market projections and economic forecasts in general terms.)

While past performance isn't indicative of future results, analyzing historical data offers valuable context. Long-term investors should expect a return that generally reflects the growth potential of the developed global markets, adjusted for the ETF's expense ratio and inherent risks.

Conclusion

This NAV analysis of the Amundi MSCI World ex-US UCITS ETF Acc highlights the importance of understanding its holdings, expense ratio, risk profile, and the significance of monitoring NAV for informed investment decisions. While the ETF offers diversification benefits and exposure to global growth opportunities, it's crucial to conduct thorough research and consider your individual risk tolerance before investing. Remember that this analysis is for informational purposes only and is not financial advice. Start your journey towards global diversification with a comprehensive analysis of the Amundi MSCI World ex-US UCITS ETF Acc NAV and consult with a financial advisor before making any investment decisions.

Featured Posts

-

80 Millio Forintert Extrazott Porsche 911 Reszletes Bemutatas

May 24, 2025

80 Millio Forintert Extrazott Porsche 911 Reszletes Bemutatas

May 24, 2025 -

Sejarah Porsche 356 Eksplorasi Pabrik Zuffenhausen Jerman

May 24, 2025

Sejarah Porsche 356 Eksplorasi Pabrik Zuffenhausen Jerman

May 24, 2025 -

Amundi Msci All Country World Ucits Etf Usd Acc Understanding Net Asset Value Nav

May 24, 2025

Amundi Msci All Country World Ucits Etf Usd Acc Understanding Net Asset Value Nav

May 24, 2025 -

Tracking The Net Asset Value Nav Of The Amundi Msci World Catholic Principles Ucits Etf Acc

May 24, 2025

Tracking The Net Asset Value Nav Of The Amundi Msci World Catholic Principles Ucits Etf Acc

May 24, 2025 -

Joy Crookes Unveils New Music The Single Carmen

May 24, 2025

Joy Crookes Unveils New Music The Single Carmen

May 24, 2025

Latest Posts

-

Did Le Pens Sunday Rally Boost The National Rally A Look At The Numbers

May 24, 2025

Did Le Pens Sunday Rally Boost The National Rally A Look At The Numbers

May 24, 2025 -

Frances National Rally Assessing The Impact Of Le Pens Sunday Rally

May 24, 2025

Frances National Rally Assessing The Impact Of Le Pens Sunday Rally

May 24, 2025 -

Cac 40 End Of Week Decline Yet Stable Performance For The Week March 7 2025

May 24, 2025

Cac 40 End Of Week Decline Yet Stable Performance For The Week March 7 2025

May 24, 2025 -

Analysis National Rallys Sunday Demonstration For Le Pen

May 24, 2025

Analysis National Rallys Sunday Demonstration For Le Pen

May 24, 2025 -

Le Pens Support Rally Did The National Rally Show Its Strength On Sunday

May 24, 2025

Le Pens Support Rally Did The National Rally Show Its Strength On Sunday

May 24, 2025