Should You Buy Palantir Stock Before May 5th? A Pre-Earnings Analysis

Table of Contents

Palantir's Recent Performance & Growth Projections

Analyzing Palantir's recent financial reports is crucial for assessing its potential before the May 5th earnings announcement. Key metrics like revenue growth, operating margin, and customer acquisition paint a picture of the company's health and future prospects.

-

Review Q4 2022 and full-year 2022 results: Examining the Q4 2022 and full-year 2022 reports reveals Palantir's performance against expectations. Analyzing revenue figures, profitability, and any surprises helps gauge momentum heading into 2023. A strong finish to 2022 could signal positive trends for Q1 2023 and beyond, impacting the Palantir stock price.

-

Discuss the company's guidance for Q1 2023 and full-year 2023: Palantir's management provides guidance for the upcoming quarters. Comparing this guidance to previous performance and analyst estimates is key. Upward revisions in guidance could boost investor confidence and the Palantir stock price. Conversely, downward revisions can signal potential challenges.

-

Analyze growth in key sectors (government, commercial): Palantir operates in both government and commercial sectors. Understanding the growth trajectory in each sector is vital. Strong growth in the commercial sector could signal diversification and reduced reliance on government contracts, a crucial factor in assessing Palantir stock.

-

Examine the impact of government contracts on revenue: A significant portion of Palantir's revenue stems from government contracts. Analyzing the size and duration of these contracts, and the potential for future wins, is crucial to understanding Palantir's revenue stability and future Palantir growth.

-

Assess the success of new product launches and their contribution to growth: New product launches and their market adoption are key indicators of innovation and future revenue streams. Analyzing the success of these initiatives provides valuable insights into Palantir's long-term prospects. Keywords: Palantir revenue, Palantir growth, Palantir financials, Palantir Q1 2023, Palantir government contracts

Market Sentiment and Analyst Predictions

Gauging market sentiment towards Palantir is essential. Analyst ratings and price targets provide valuable insights into the overall outlook for the stock.

-

Summarize recent analyst reports and their buy/sell/hold recommendations: A consensus view from leading analysts helps understand the prevailing market sentiment. A high percentage of "buy" recommendations suggests positive expectations for the Palantir stock price.

-

Discuss any recent news impacting investor sentiment (e.g., partnerships, regulatory changes): News such as major partnerships, new product announcements, or regulatory changes can significantly influence investor sentiment and the Palantir stock price. Positive news generally boosts investor confidence.

-

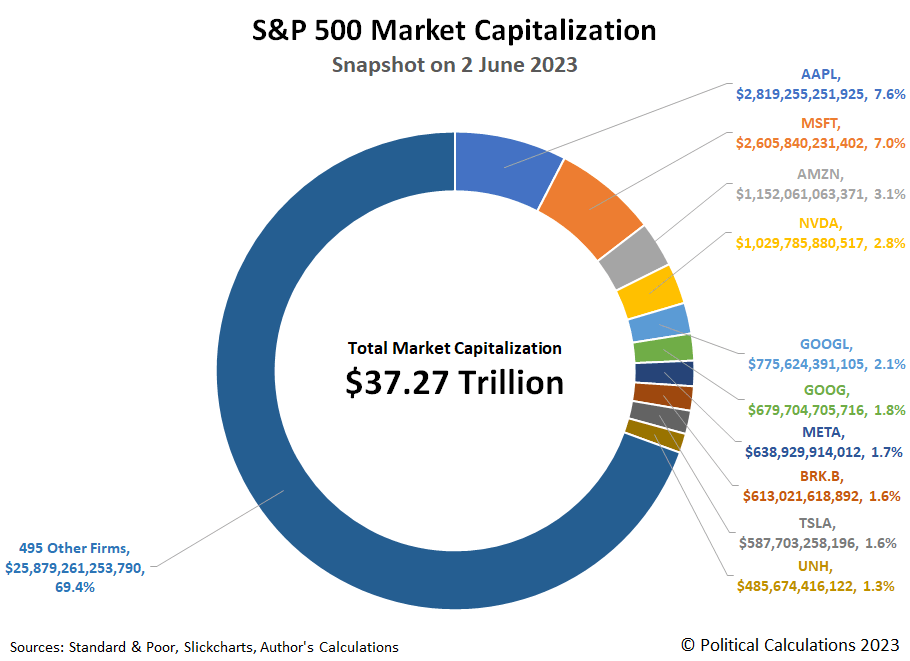

Analyze the impact of broader market conditions on Palantir's stock price: The overall market environment plays a role. During periods of market uncertainty, even fundamentally strong companies like Palantir can experience price fluctuations.

-

Consider the impact of competitor activity on Palantir's market position: Analyzing the competitive landscape, including the activities of competitors, is crucial. Increased competition could put pressure on Palantir's market share and profitability, impacting the Palantir stock price. Keywords: Palantir analyst ratings, Palantir market sentiment, Palantir price target, Palantir competitors

Key Risks and Potential Downsides

Investing in Palantir stock involves inherent risks. Understanding these risks is crucial for informed decision-making.

-

Discuss the impact of potential economic slowdowns: Economic downturns can negatively impact technology spending, particularly in the commercial sector, potentially affecting Palantir's revenue and profitability.

-

Analyze the dependence on government contracts and the associated risks: Heavy reliance on government contracts can expose Palantir to budget cuts, changes in government priorities, or delays in contract awards.

-

Evaluate the company's competitive landscape and the potential for increased competition: The data analytics market is competitive. Increased competition could put pressure on Palantir's pricing and market share.

-

Assess the company’s ability to maintain profitability and cash flow: Analyzing Palantir's profitability and cash flow generation capabilities is crucial for assessing its long-term sustainability. Keywords: Palantir risk, Palantir downside, Palantir competition, Palantir profitability

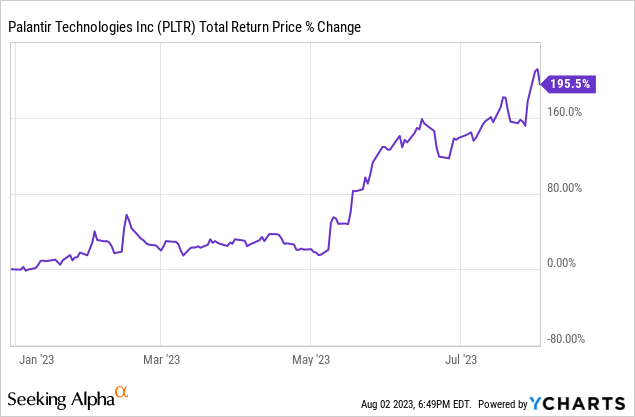

Technical Analysis of Palantir Stock

Technical analysis provides insights into potential price movements based on chart patterns and trading volume. (Note: This section would ideally include charts and graphs).

-

Analyze recent price action and trading volume: Examining recent price movements and trading volume can reveal trends and potential support and resistance levels.

-

Identify key support and resistance levels: Support levels represent prices where buying pressure is expected, while resistance levels represent price ceilings.

-

Discuss potential trading strategies (e.g., buy on the dip, wait for earnings): Based on technical analysis, different trading strategies can be considered, such as buying on dips or waiting for post-earnings price movements.

-

Include disclaimers regarding the limitations of technical analysis: Technical analysis is not foolproof and should be considered alongside fundamental analysis. Keywords: Palantir stock chart, Palantir technical analysis, Palantir support resistance, Palantir trading strategy

Conclusion: Should you buy Palantir stock before May 5th?

The decision to buy Palantir stock before its May 5th earnings announcement is complex. While Palantir's growth potential in the government and commercial sectors is promising, investors must carefully weigh this against the considerable downside risks associated with its reliance on government contracts and the competitive landscape. Thorough due diligence, including an assessment of your risk tolerance, and potentially consulting a financial advisor, is strongly recommended before making any investment decisions in Palantir stock or any other investment. Remember to always conduct thorough research before buying Palantir stock. Keywords: Palantir stock buy, Palantir investment decision, Palantir stock risks, Palantir due diligence

Featured Posts

-

Nhl Playoffs Oilers Vs Kings Prediction Best Bets For Tonights Game

May 10, 2025

Nhl Playoffs Oilers Vs Kings Prediction Best Bets For Tonights Game

May 10, 2025 -

Palantirs Potential Can It Achieve A Trillion Dollar Market Cap By The End Of The Decade

May 10, 2025

Palantirs Potential Can It Achieve A Trillion Dollar Market Cap By The End Of The Decade

May 10, 2025 -

Ocasio Cortez Calls Out Pro Trump Fox News Commentary

May 10, 2025

Ocasio Cortez Calls Out Pro Trump Fox News Commentary

May 10, 2025 -

Travailler A Dijon Restaurants Et Rooftop Dauphine

May 10, 2025

Travailler A Dijon Restaurants Et Rooftop Dauphine

May 10, 2025 -

Analyzing West Hams 25 Million Financial Deficit

May 10, 2025

Analyzing West Hams 25 Million Financial Deficit

May 10, 2025