Should You Buy Palantir Stock Before May 5th? A Prudent Investor's Guide

Table of Contents

Palantir Technologies (PLTR) is a data analytics company providing powerful software solutions to government and commercial clients worldwide. Its business model revolves around delivering cutting-edge big data analytics platforms, empowering organizations to make data-driven decisions. This article aims to provide you with the information necessary to decide whether adding Palantir stock to your portfolio before May 5th aligns with your investment strategy. Remember, investing always involves risk, and thorough research is crucial before committing your capital.

H2: Palantir's Recent Performance and Future Projections

H3: Q1 2024 Earnings and Revenue Growth

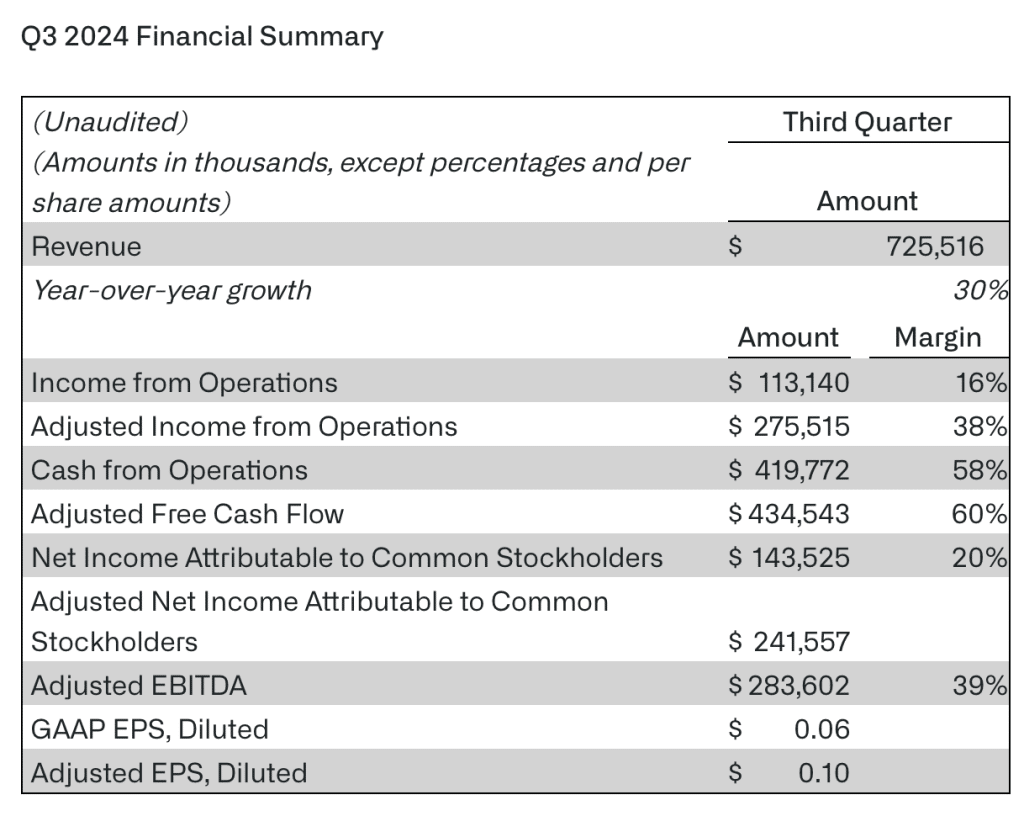

Palantir's Q1 2024 earnings report will be a key factor influencing investor sentiment. Analyzing the reported numbers against analyst expectations will be crucial. Key metrics to watch include:

- Earnings Per Share (EPS): A significant beat or miss on EPS expectations will strongly impact the PLTR stock price.

- Revenue Growth: Consistent and accelerating revenue growth is a positive indicator for long-term investor confidence. Year-over-year (YOY) and quarter-over-quarter (QoQ) growth rates should be closely examined.

- Guidance: Management's guidance for future quarters provides valuable insight into their expectations and the company's projected trajectory. A positive outlook can boost investor sentiment.

- Operating Margin: Improving operating margins demonstrate increasing efficiency and profitability.

Comparing these metrics to analyst expectations will provide a clearer picture of Palantir's performance. Any surprises, either positive or negative, will likely have a significant impact on the PLTR stock price in the short term. Monitoring news and analyst reports surrounding the earnings release is highly recommended.

H3: Long-Term Growth Potential and Market Opportunities

Palantir's long-term vision extends beyond its current client base. The company is actively pursuing growth opportunities in several key areas:

- Artificial Intelligence (AI) Integration: Palantir is strategically positioning itself to capitalize on the burgeoning AI market, leveraging its data analytics expertise to develop AI-powered solutions. This represents a significant growth opportunity.

- Expansion into New Government Contracts: Government contracts remain a core component of Palantir's revenue. Securing new contracts, especially in areas like national security and defense, will be critical for sustained growth.

- Commercial Market Penetration: Growing its presence in the commercial sector is key to diversifying revenue streams and reducing reliance on government contracts. Success in this area will be a vital indicator of long-term sustainability.

Palantir faces competition from established players in the data analytics market. Understanding its competitive advantages, such as its strong security features and focus on complex data problems, is crucial for assessing its long-term potential.

H3: Analyst Ratings and Price Targets

Before making any investment decisions, consult multiple financial news sources and research reports to understand the overall sentiment among financial analysts. Key aspects to consider include:

- Buy/Sell/Hold Recommendations: The consensus among analysts provides a broad overview of market sentiment towards PLTR stock.

- Price Targets: The range of price targets set by different analysts gives an indication of the potential upside or downside for the stock. Note that these are just predictions, not guarantees.

- Reasoning Behind Ratings: Understanding the rationale behind each analyst's rating is vital for a comprehensive analysis. Factors considered may include financial performance, market outlook, and competitive landscape.

H2: Factors to Consider Before Investing in Palantir Stock Before May 5th

H3: Risk Assessment

Investing in Palantir stock carries inherent risks:

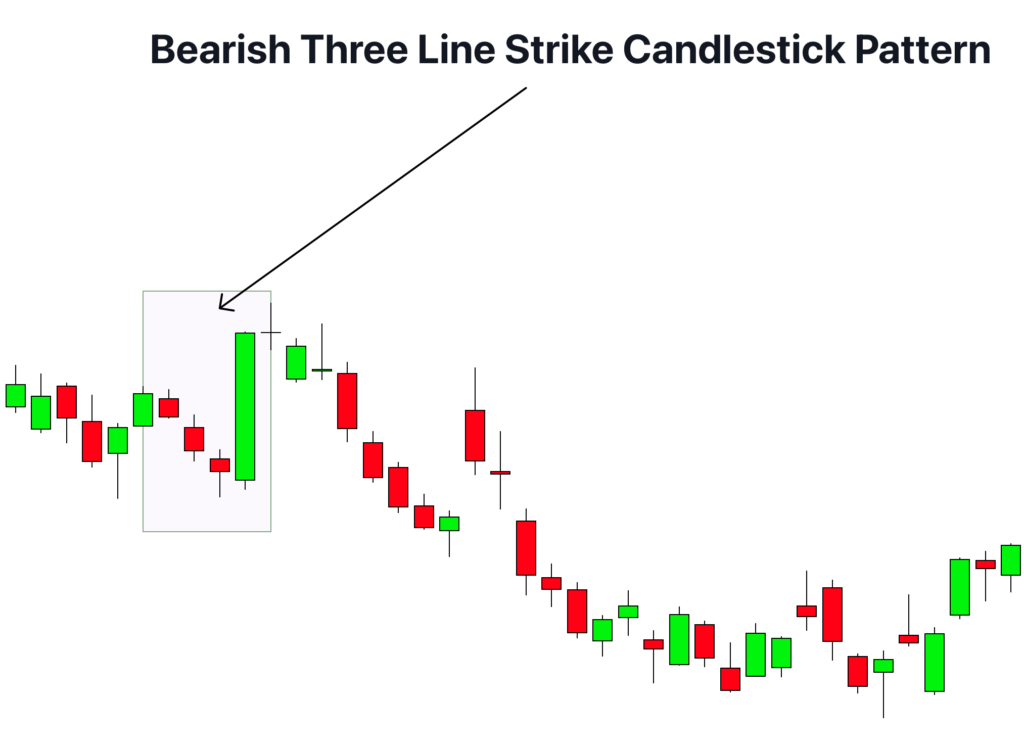

- Stock Market Volatility: The overall stock market can experience significant volatility, impacting even fundamentally sound companies like Palantir.

- Dependence on Government Contracts: A substantial portion of Palantir's revenue comes from government contracts. Changes in government policies or budget cuts could negatively affect the company's financial performance.

- Competition: Palantir faces intense competition in the data analytics market from well-established and emerging players.

Understanding these risks is crucial for managing your investment. Don't invest more than you can afford to lose.

H3: Your Investment Goals and Risk Tolerance

Before investing in any stock, including Palantir, ask yourself:

- What are my investment goals (short-term, long-term)?

- What is my risk tolerance (conservative, moderate, aggressive)?

- How does this investment align with my overall portfolio diversification strategy?

Aligning your investment decisions with your individual financial goals and risk tolerance is paramount for successful investing.

H3: Diversification and Portfolio Allocation

Diversification is a cornerstone of a robust investment strategy. Investing in a single stock, even one with significant potential like Palantir, can be risky. Consider how Palantir fits into your broader investment portfolio. A well-diversified portfolio reduces overall risk by spreading investments across different asset classes and sectors.

H2: Alternative Investment Options

Before focusing solely on Palantir, explore alternative investment options within the technology sector or related fields. Consider companies with similar growth potential but potentially lower risk profiles. This research provides valuable context for evaluating the attractiveness of Palantir stock. Examples of such alternatives might include other data analytics firms or cloud computing companies.

3. Conclusion

Deciding whether to buy Palantir stock before May 5th requires a careful evaluation of its recent performance, future growth potential, inherent risks, and your personal investment goals. Analyze Q1 2024 earnings, long-term market opportunities, analyst ratings, and your risk tolerance before making any investment decisions. Remember that past performance is not indicative of future results.

Conduct thorough due diligence, consult with a qualified financial advisor, and only invest what you can afford to lose. Approaching the decision to buy Palantir stock with a prudent and informed perspective is crucial for maximizing your chances of success. Remember, thorough research is key before buying Palantir stock, or any stock for that matter.

Featured Posts

-

Oilers Vs Kings Nhl Playoffs Game 1 Prediction Picks And Betting Odds

May 10, 2025

Oilers Vs Kings Nhl Playoffs Game 1 Prediction Picks And Betting Odds

May 10, 2025 -

Casey Means A Deep Dive Into Trumps Surgeon General Pick

May 10, 2025

Casey Means A Deep Dive Into Trumps Surgeon General Pick

May 10, 2025 -

Review Of Wynne And Joanna All At Sea

May 10, 2025

Review Of Wynne And Joanna All At Sea

May 10, 2025 -

Pakistan Stock Exchange Portal Down Volatility And Tensions Impact Trading

May 10, 2025

Pakistan Stock Exchange Portal Down Volatility And Tensions Impact Trading

May 10, 2025 -

Elizabeth Line Strike Action Service Updates For February And March

May 10, 2025

Elizabeth Line Strike Action Service Updates For February And March

May 10, 2025