Should You Buy Palantir Stock In 2024? A 40% Growth Projection Analysis

Table of Contents

Palantir's Financial Performance and Growth Trajectory

Palantir Technologies, a prominent player in the big data analytics market, provides software platforms to government and commercial clients for data integration, analysis, and operational decision-making. Understanding its financial health is crucial for any Palantir investment.

Revenue Growth and Profitability

Palantir's recent financial reports reveal a mixed picture. While revenue has shown consistent year-over-year growth, profitability remains a key area of focus.

- 2023 Q2: [Insert actual Q2 2023 figures for revenue growth and profitability metrics here. Source the information correctly]. This shows a [positive/negative] trend compared to the previous year.

- Government Contracts: A significant portion of Palantir's revenue stems from government contracts, particularly in defense and intelligence. The stability and predictability of these contracts are vital to its financial performance.

- Commercial Partnerships: Palantir is actively expanding its commercial partnerships, aiming to diversify its revenue streams and reduce reliance on government contracts. The success of this strategy is crucial for long-term growth.

Analyzing the 40% Growth Projection

The 40% growth projection for Palantir stock in 2024 requires careful scrutiny. Where did this figure originate?

- Source of Projection: [Identify the source of the 40% projection – e.g., specific analyst reports, company guidance, etc. and cite the source correctly].

- Reliability and Limitations: The reliability of this projection depends heavily on various factors, including the successful execution of Palantir's strategic initiatives, the overall economic climate, and the competitive landscape. Unforeseen circumstances could significantly impact the accuracy of this prediction.

- Contributing Factors: Factors that could contribute to this growth include new product launches, expanding commercial partnerships, and increased government spending. However, increased competition, economic downturns, or regulatory changes could hinder this growth significantly.

Market Trends and Competitive Landscape

The big data analytics market is rapidly expanding, presenting both opportunities and challenges for Palantir.

The Big Data Analytics Market

The global big data analytics market is experiencing significant growth, fueled by increasing data volumes, advancements in artificial intelligence, and the rising need for data-driven decision-making across various industries.

- Market Size and Growth: [Insert market research data and statistics on the big data analytics market size and growth projections. Cite your source properly].

- Market Segmentation: Palantir operates in several key segments, including government, healthcare, finance, and energy. Understanding its market share within each segment is vital.

Competitive Analysis

Palantir faces stiff competition from established players and emerging startups in the big data analytics space. Key competitors include Databricks, Snowflake, and others.

- Competitive Advantages: Palantir's competitive advantages lie in its sophisticated platform, strong government relationships, and a focus on complex data integration.

- Competitive Disadvantages: Its relatively high pricing and the complexity of its platform can be barriers to entry for some clients.

Risks and Challenges Associated with Investing in Palantir Stock

Investing in Palantir stock involves significant risks. Understanding these risks is critical before committing capital.

Valuation and Stock Price Volatility

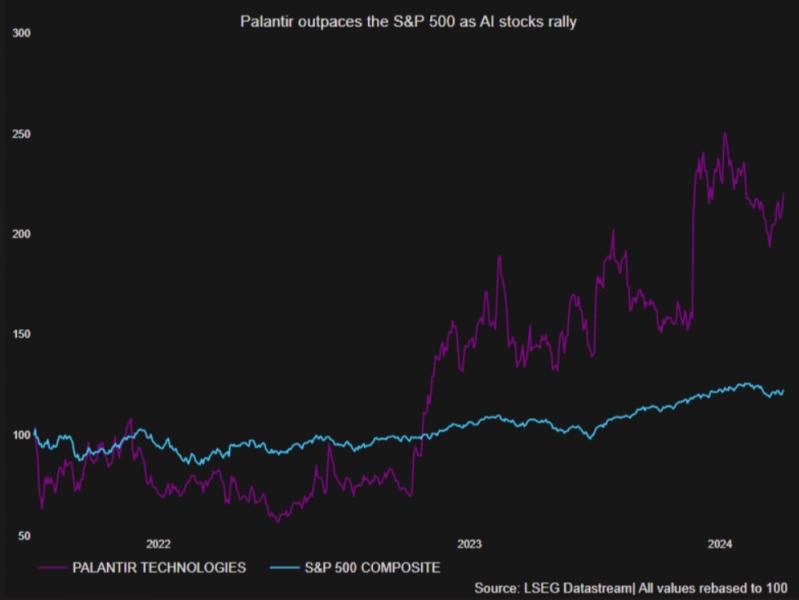

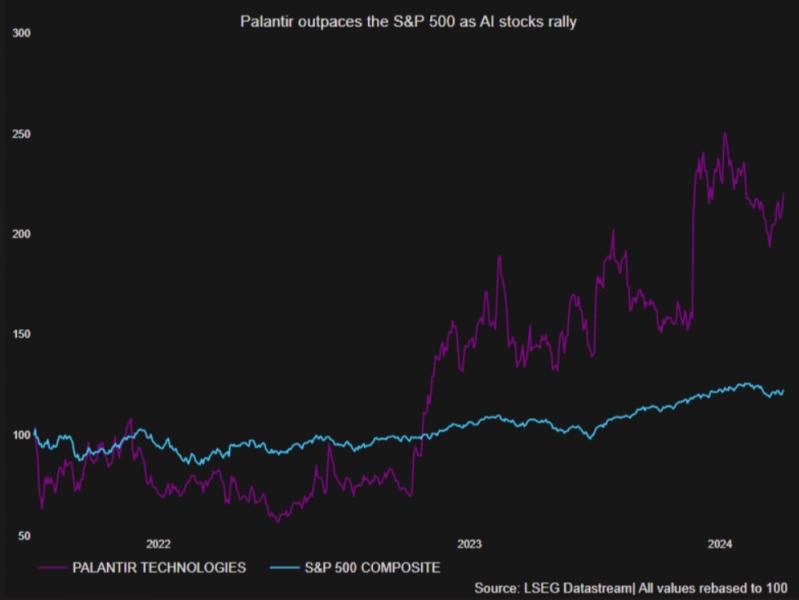

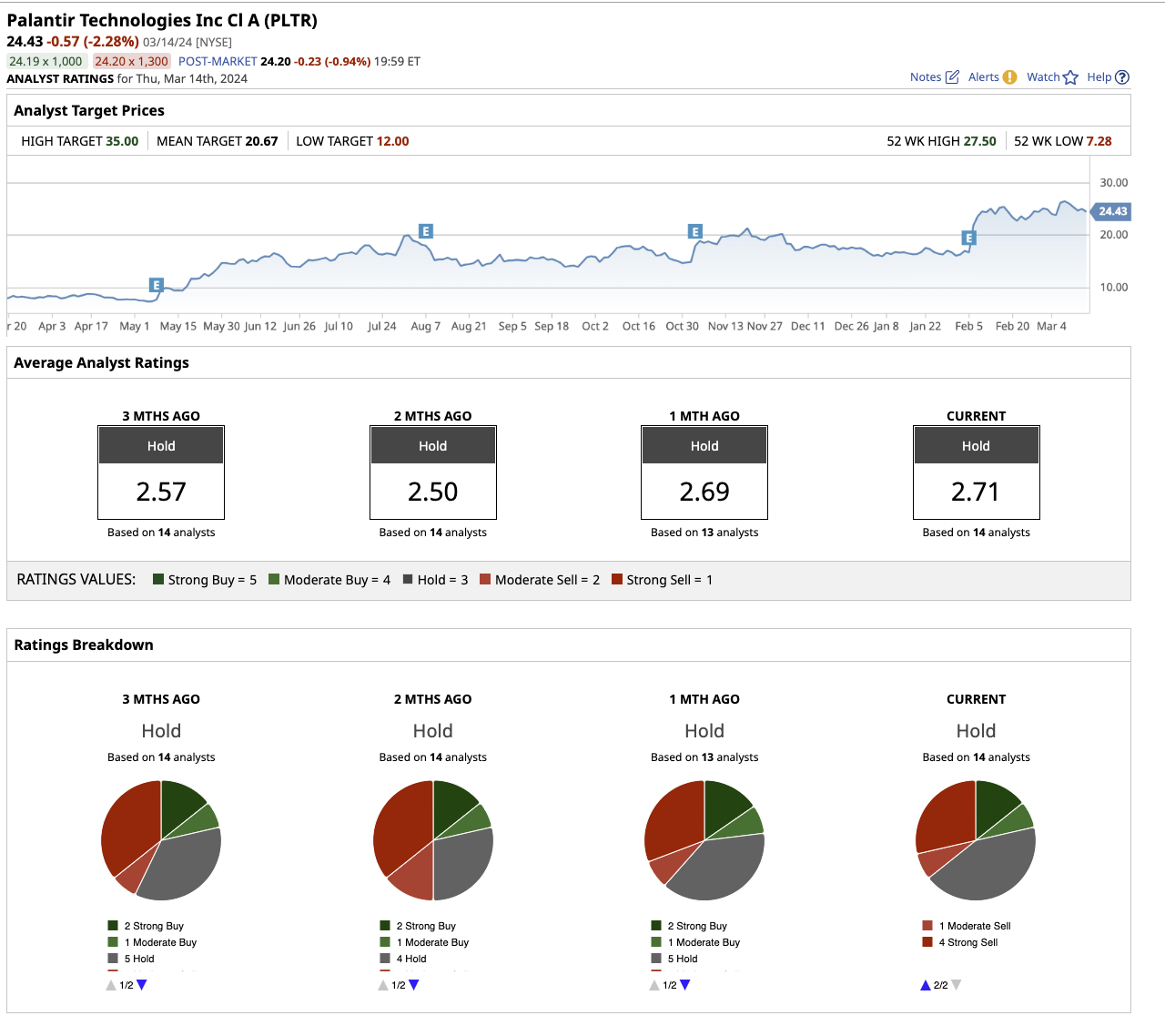

Palantir's stock price has historically been highly volatile.

- Current Valuation: [Discuss Palantir's current valuation metrics, such as P/E ratio and market capitalization].

- Volatility Risk: Investing in a high-growth, volatile stock like Palantir requires a high risk tolerance and a long-term investment horizon.

Geopolitical and Regulatory Risks

Geopolitical events and regulatory changes can significantly impact Palantir's business.

- Government Spending: Fluctuations in government spending, particularly in defense, can affect Palantir's revenue streams.

- Data Privacy and Cybersecurity: Stringent data privacy regulations and cybersecurity threats pose significant risks to Palantir's operations.

Investment Considerations and Potential Returns

Weighing the potential rewards against the associated risks is crucial.

Assessing the Risk-Reward Ratio

The 40% growth projection is alluring, but the risks are substantial.

- Risk Tolerance: Your individual risk tolerance should strongly influence your investment decisions. Are you comfortable with the potential for significant losses?

- Investment Horizon: A longer-term investment horizon is generally recommended for high-growth, volatile stocks like Palantir.

Diversification and Portfolio Allocation

Never put all your eggs in one basket.

- Diversification Strategy: Palantir stock should be only one component of a well-diversified investment portfolio.

- Responsible Investing: Thorough research and due diligence are essential before investing in any stock, particularly one as volatile as Palantir.

Conclusion: Should You Buy Palantir Stock in 2024?

Palantir's financial performance, while showing revenue growth, presents a mixed picture regarding profitability. The 40% growth projection for Palantir stock in 2024 is ambitious and hinges on several factors, including successful market penetration, navigating stiff competition, and avoiding the impact of geopolitical and regulatory risks. While the big data analytics market offers significant opportunities, the inherent volatility of Palantir stock and the challenges it faces need careful consideration. Therefore, a thorough analysis of your risk tolerance and investment goals is paramount before investing in Palantir stock. While a 40% growth projection for Palantir stock in 2024 is ambitious, further investigation into Palantir’s financials and market position is crucial before making any investment decisions. Thoroughly research Palantir investment opportunities and consider consulting with a financial advisor.

Featured Posts

-

Young Thugs New Album Uy Scuti When Is It Coming Out

May 10, 2025

Young Thugs New Album Uy Scuti When Is It Coming Out

May 10, 2025 -

Palantir Stock Analyzing The Viability Of A 40 Increase In 2025

May 10, 2025

Palantir Stock Analyzing The Viability Of A 40 Increase In 2025

May 10, 2025 -

Uk Immigration Policy New Visa Crackdown Targets Nigerians And Other High Risk Groups

May 10, 2025

Uk Immigration Policy New Visa Crackdown Targets Nigerians And Other High Risk Groups

May 10, 2025 -

Perus Emergency Mining Ban Assessing The 200 Million Gold Production Loss

May 10, 2025

Perus Emergency Mining Ban Assessing The 200 Million Gold Production Loss

May 10, 2025 -

Analyzing Elon Musks Net Worth The Role Of Us Economic And Political Factors

May 10, 2025

Analyzing Elon Musks Net Worth The Role Of Us Economic And Political Factors

May 10, 2025