Should You Buy Palantir Stock Now?

Table of Contents

Palantir's Business Model and Revenue Streams

Palantir's success hinges on its unique approach to data analytics, serving both government and commercial clients. Let's examine the key components of its revenue generation:

Palantir Government Contracts

A significant portion of Palantir's revenue stems from lucrative government contracts, both domestically and internationally. The company plays a crucial role in national security and intelligence, providing cutting-edge data analytics solutions to various government agencies.

- Examples of government clients: CIA, US Army, various international defense departments. (Specific details are often confidential for security reasons).

- Contract size and renewal rates: Contracts can range from millions to hundreds of millions of dollars, with renewal rates generally high due to the specialized nature of Palantir's services and the long-term value proposition for clients. Analyzing these rates is crucial for assessing the sustainability of Palantir government contracts.

- Keyword integration: Palantir government contracts, Palantir national security, Palantir defense contracts.

Palantir Commercial Partnerships

Palantir is aggressively expanding its presence in the commercial sector, targeting various industries seeking to leverage advanced data analytics for improved efficiency and decision-making.

- Examples of commercial partnerships: Large financial institutions, healthcare providers, and manufacturing companies. Specific examples are often disclosed in Palantir's financial reports and press releases.

- Revenue growth in this sector and future potential: The commercial sector presents significant growth potential, and Palantir's revenue from this segment is consistently increasing. Further market penetration and innovative product development could significantly boost this revenue stream.

- Keyword integration: Palantir commercial clients, Palantir commercial partnerships, Palantir revenue growth, Palantir commercial market.

Palantir Foundry Platform

Palantir Foundry, its flagship data analytics platform, is the engine driving the company's growth. It offers a comprehensive suite of tools enabling clients to integrate, analyze, and visualize vast datasets, leading to improved operational efficiency and strategic decision-making.

- Key features of Foundry: Data integration, data visualization, predictive modeling, and collaborative workflows.

- Competitive advantages: Palantir's platform distinguishes itself through its scalability, security features, and user-friendly interface. This competitive advantage is crucial for Palantir's continued success.

- Market adoption rate: The rate of Foundry adoption is an important metric to monitor, indicating market acceptance and future growth potential.

- Keyword integration: Palantir Foundry, Palantir data analytics, Palantir platform, Palantir software.

Financial Performance and Growth Projections

Understanding Palantir's financial performance is critical in evaluating its investment potential. Analyzing historical trends and future forecasts is essential for a comprehensive assessment.

Recent Financial Results

Investors should scrutinize Palantir's recent quarterly and annual reports. Key metrics to consider include:

- Key financial metrics (revenue, EPS, net income): Regularly review these key financial indicators to gauge the company's overall financial health.

- Comparisons to previous periods: Tracking these metrics over time helps assess growth trends and identify any potential concerns.

- Analyst ratings: Keep abreast of analyst ratings and forecasts to gain perspective from financial professionals.

- Keyword integration: Palantir financial reports, Palantir earnings, Palantir revenue growth, Palantir financial statements.

Future Growth Potential

Palantir's future prospects are tied to the growing demand for advanced data analytics, technological advancements in AI and machine learning, and its ability to secure new contracts and partnerships.

- Market projections for data analytics: The market for data analytics is expected to experience robust growth in the coming years, offering significant opportunities for Palantir.

- Palantir's strategic initiatives: Palantir’s investment in R&D and strategic acquisitions can fuel its future growth.

- Potential risks to growth: Increased competition and economic downturns represent potential threats to Palantir's growth trajectory.

- Keyword integration: Palantir growth projections, Palantir future, Palantir market opportunity, Palantir AI, Palantir machine learning.

Risks and Considerations

While Palantir presents significant opportunities, potential risks must be carefully considered.

Competition

Palantir faces competition from established players and emerging startups in the data analytics space.

- Major competitors (e.g., Databricks, Snowflake): Analyzing these competitors and their market share is crucial for understanding Palantir's competitive position.

- Competitive advantages and disadvantages for Palantir: Identifying Palantir's unique strengths and weaknesses compared to its competitors is essential for assessing its long-term viability.

- Keyword integration: Palantir competitors, Palantir competitive advantage, Palantir market share.

Dependence on Government Contracts

Palantir's significant reliance on government contracts exposes it to specific risks.

- Potential for reduced government spending: Changes in government priorities or budget cuts could negatively impact Palantir's revenue.

- Geopolitical risks: International conflicts or political instability can disrupt contracts and operations.

- Contract renewal uncertainties: The success of Palantir hinges on its ability to secure contract renewals.

- Keyword integration: Palantir government contract risk, Palantir political risk, Palantir contract renewal.

Stock Valuation

Evaluating Palantir's current stock valuation is crucial for determining whether it's fairly priced.

- Stock price history: Reviewing the historical price performance can give insights into market sentiment.

- Current valuation multiples (P/E ratio, P/S ratio): Compare these ratios to industry peers to ascertain if Palantir is overvalued or undervalued.

- Keyword integration: Palantir stock valuation, Palantir stock price, Palantir PE ratio, Palantir PS ratio.

Conclusion

Investing in Palantir stock involves navigating a landscape of significant potential and inherent risks. Palantir's innovative data analytics platform, strong government contracts, and expanding commercial presence offer substantial growth potential. However, its dependence on government contracts, competitive pressures, and stock valuation need careful consideration. The information presented here is for analysis purposes and is not financial advice.

Ultimately, the decision of whether to buy Palantir stock now is a personal one. After considering the information presented in this analysis, conduct your own due diligence and consult with a financial advisor before making any investment in Palantir stock or any other security. Remember to carefully evaluate your own risk tolerance and investment goals before investing in Palantir or any other stock. Thorough research is crucial before making any Palantir stock investment.

Featured Posts

-

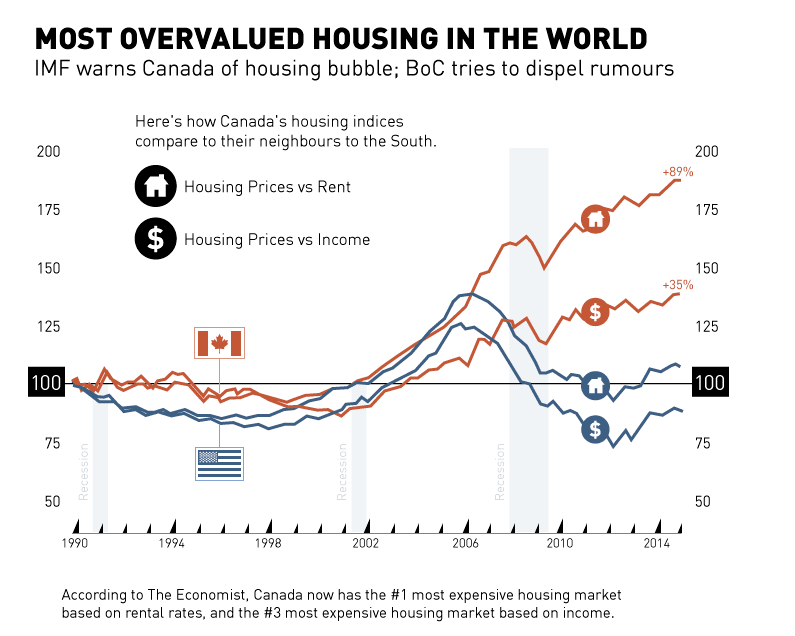

Affordable Housing In Canada The Down Payment Dilemma

May 09, 2025

Affordable Housing In Canada The Down Payment Dilemma

May 09, 2025 -

Palantirs Nato Deal A Revolution In Public Sector Ai

May 09, 2025

Palantirs Nato Deal A Revolution In Public Sector Ai

May 09, 2025 -

Barbashevs Overtime Heroics Evens Up Golden Knights Wild Series

May 09, 2025

Barbashevs Overtime Heroics Evens Up Golden Knights Wild Series

May 09, 2025 -

Changes To Uk Visa Policy Implications For Nigerians And Pakistanis

May 09, 2025

Changes To Uk Visa Policy Implications For Nigerians And Pakistanis

May 09, 2025 -

Why Did Williams Let Colapinto Go To Alpine Explained

May 09, 2025

Why Did Williams Let Colapinto Go To Alpine Explained

May 09, 2025