Should You Buy XRP (Ripple) In 2024?

Table of Contents

The Ripple Lawsuit: A Critical Factor Affecting XRP's Future

The SEC vs. Ripple lawsuit is undeniably the most significant factor influencing XRP's price and future. Understanding its intricacies is crucial for any potential XRP investment.

Understanding the SEC vs. Ripple Case

The core of the dispute lies in the SEC's claim that XRP is an unregistered security. Ripple argues that XRP is a currency used for payments and remittances, not a security offering investment contracts. The potential outcomes are multifaceted:

- Summary Judgment: A judge could rule in favor of either party without a full trial, significantly impacting XRP's price. A ruling for Ripple could lead to a substantial price surge; a ruling against Ripple could cause a drastic drop.

- Settlement: Both parties could reach a settlement, potentially resulting in a less dramatic price reaction than a full judgment. The terms of any settlement would be crucial in determining the future trajectory of XRP.

- Full Trial and Verdict: This prolonged process adds further uncertainty. The final verdict would profoundly influence XRP's regulatory status and market perception.

The legal arguments are complex, involving interpretations of the Howey Test and the definition of a security.

- SEC's Arguments: The SEC claims XRP sales constituted an investment contract, promising investors a profit based on Ripple's efforts.

- Ripple's Arguments: Ripple contends XRP is a decentralized digital asset used for transactions, not an investment contract tied to Ripple's success.

Expert opinions are divided. Some analysts predict a positive outcome for Ripple, leading to a significant XRP price increase. Others remain cautious, emphasizing the inherent risks associated with regulatory uncertainty.

Ripple's Ongoing Development and Partnerships

Despite the legal challenges, Ripple continues to develop its network and secure partnerships. This ongoing activity is a crucial factor to consider when assessing the long-term viability of XRP.

- Significant Partnerships: Ripple maintains partnerships with various financial institutions globally, facilitating cross-border payments. These partnerships demonstrate the practical application of XRP's technology.

- Expanding XRP Utility: Ripple is exploring ways to expand XRP's utility beyond remittance, including integration with NFTs and DeFi platforms. This diversification could enhance XRP's value proposition.

- Technological Advancements: The XRP Ledger undergoes continuous upgrades, enhancing its speed, scalability, and security. These improvements make it more attractive for financial institutions and developers.

XRP Price Analysis and Market Predictions

Analyzing XRP's past performance and current market sentiment is essential for any informed investment decision.

Historical Price Performance of XRP

XRP's price has experienced significant volatility, influenced by various factors:

- Price Fluctuations: Charts and graphs clearly show XRP's dramatic price swings, influenced by both positive and negative news.

- Key Influencing Factors: Market sentiment, regulatory announcements, and technological advancements have all played significant roles in XRP's past price movements. For example, positive news regarding the Ripple lawsuit often triggers price increases.

Current Market Sentiment and Future Price Predictions

The current market sentiment towards XRP is largely tied to the outcome of the Ripple lawsuit.

- Analyst Predictions: Various analysts offer diverse price predictions for 2024, ranging from extremely bullish to cautiously bearish. It is essential to consider the source and methodology behind these predictions. (Note: Specific predictions and sources would be included here in a complete article.)

- Bullish Factors: A positive outcome in the Ripple lawsuit, wider adoption by financial institutions, and increased utility could drive XRP's price upwards.

- Bearish Factors: An unfavorable legal outcome, increased regulatory scrutiny, or broader cryptocurrency market downturns could negatively impact XRP's price.

Risk Assessment and Investment Strategies

Investing in XRP, like any cryptocurrency, involves substantial risks.

Risks Associated with Investing in XRP

- Regulatory Uncertainty: The ongoing lawsuit highlights the significant regulatory uncertainty surrounding XRP.

- Market Manipulation: The cryptocurrency market is susceptible to manipulation, impacting XRP's price.

- Technological Risks: As with any technology, there are inherent risks associated with the XRP Ledger's functionality and security.

Diversification is key. Don't put all your eggs in one basket. Consider diversifying your investment portfolio to mitigate risk.

Strategies for Investing in XRP

Several investment strategies can be applied:

- Long-Term Holding: A long-term strategy requires patience and involves holding XRP through market fluctuations, anticipating long-term growth.

- Short-Term Trading: This involves buying and selling XRP based on short-term price movements. It's a riskier strategy requiring significant market knowledge.

- Dollar-Cost Averaging (DCA): This strategy mitigates risk by investing a fixed amount of money at regular intervals, regardless of price fluctuations.

Thorough research is essential before investing. Only invest what you can afford to lose.

Conclusion: Should You Invest in XRP in 2024? A Final Verdict

Whether you should invest in XRP in 2024 depends heavily on your risk tolerance and investment goals. The Ripple lawsuit significantly influences XRP's future, and market volatility remains a crucial consideration. While Ripple's ongoing development and potential partnerships present opportunities, the regulatory uncertainty and inherent risks of cryptocurrency investments cannot be ignored.

Before making any decisions on whether to buy XRP, conduct thorough research and consider consulting with a financial advisor. Understanding the risks associated with XRP investment is crucial before adding it to your portfolio. Remember to carefully analyze XRP price prediction models alongside the ongoing Ripple lawsuit and broader cryptocurrency market trends to inform your XRP investment strategy.

Featured Posts

-

Bila Je Prva Ljubav Zdravka Colica Kad Sam Se Vratio Ti Si Se Udala Zasto

May 02, 2025

Bila Je Prva Ljubav Zdravka Colica Kad Sam Se Vratio Ti Si Se Udala Zasto

May 02, 2025 -

Fortnite Lawless Update Server Status And Downtime Information

May 02, 2025

Fortnite Lawless Update Server Status And Downtime Information

May 02, 2025 -

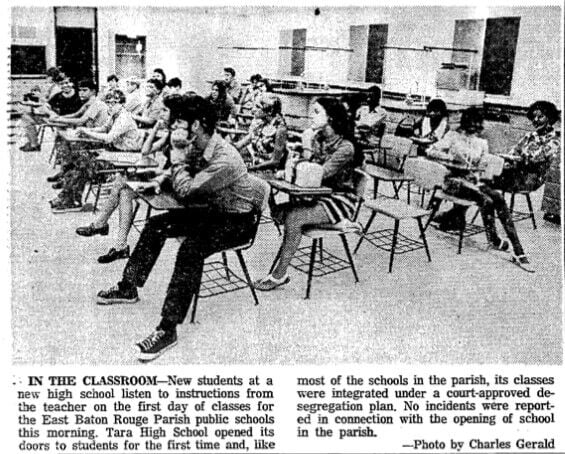

School Desegregation Order Terminated A New Era For Education

May 02, 2025

School Desegregation Order Terminated A New Era For Education

May 02, 2025 -

Riot Platforms Riot Stock Price Factors Contributing To The Drop

May 02, 2025

Riot Platforms Riot Stock Price Factors Contributing To The Drop

May 02, 2025 -

Vehicle Subsystem Issue Results In Blue Origin Launch Cancellation

May 02, 2025

Vehicle Subsystem Issue Results In Blue Origin Launch Cancellation

May 02, 2025

Latest Posts

-

Unreleased 2008 Disney Game Surfaces On Ps Plus Premium

May 03, 2025

Unreleased 2008 Disney Game Surfaces On Ps Plus Premium

May 03, 2025 -

Register For The Sony Play Station Beta Program Full Requirements Explained

May 03, 2025

Register For The Sony Play Station Beta Program Full Requirements Explained

May 03, 2025 -

Leaked 2008 Disney Ps Plus Premium Game Details And Speculation

May 03, 2025

Leaked 2008 Disney Ps Plus Premium Game Details And Speculation

May 03, 2025 -

Sony Opens Play Station Beta Check Your Eligibility And Sign Up Now

May 03, 2025

Sony Opens Play Station Beta Check Your Eligibility And Sign Up Now

May 03, 2025 -

Join The Sony Play Station Beta Program Requirements And How To Apply

May 03, 2025

Join The Sony Play Station Beta Program Requirements And How To Apply

May 03, 2025