Significant XRP Buy: Whale Acquires 20 Million Tokens - What's Next?

Table of Contents

The Impact of Large XRP Transactions on Market Sentiment

A significant XRP buy of this magnitude can have a considerable impact on market sentiment and XRP price. Let's delve into the mechanics:

Increased Buying Pressure

- Supply and Demand: The fundamental principle of supply and demand dictates that increased demand, in this case, driven by a whale's purchase of 20 million XRP, puts upward pressure on the price. The available supply of XRP decreases, making the remaining tokens more valuable to those seeking to acquire them.

- Short Squeezes: Large XRP buys can also trigger short squeezes. Traders who bet against XRP (short selling) might be forced to buy back the tokens to cover their positions, further fueling the price increase.

- Historical Data: While precise historical data linking every large XRP buy to a specific price movement is difficult to isolate, anecdotal evidence and market observations suggest a correlation between significant purchases and subsequent price appreciation in the short term.

Whale Activity as a Market Indicator

Whale activity is closely watched by cryptocurrency analysts as a potential indicator of future price movements. Whales, often considered sophisticated investors, possess vast capital and their actions can be interpreted as signals:

- Sophisticated Investors: Their large-scale buying can be seen as a vote of confidence in the asset's future. This significant XRP buy could indicate a bullish outlook on XRP's prospects.

- Multiple Factors: However, it's crucial to remember that whale activity is not the sole determinant of XRP price. Other factors such as regulatory news, overall market sentiment, and technological developments also play significant roles. This specific whale's actions could be influenced by various considerations beyond a simple bullish prediction.

Analyzing the Current XRP Market Conditions

To fully understand the potential implications of this XRP buy, we must consider the current market landscape:

Ripple's Ongoing Legal Battle

Ripple's legal battle with the SEC significantly influences XRP's price and investor sentiment.

- Potential Outcomes: The lawsuit's outcome could dramatically impact XRP's future. A favorable ruling could lead to a surge in price, while an unfavorable one might cause a significant drop.

- News Impact: Any news regarding the lawsuit, whether positive or negative, immediately impacts XRP's price volatility. Positive developments often generate bullish sentiment, while negative news typically leads to selling pressure.

Overall Crypto Market Trends

The broader cryptocurrency market significantly impacts XRP's performance.

- Market Sentiment: A bullish overall crypto market generally boosts XRP's price, while a bearish market often drags it down.

- Other Cryptocurrencies: The performance of other major cryptocurrencies often correlates with XRP's price movements. A general market downturn typically affects all crypto assets, including XRP.

- Macroeconomic Factors: Global economic events and macroeconomic conditions also play a substantial role in influencing the entire cryptocurrency market, including XRP.

Predicting Future XRP Price Movement

Predicting future price movements with certainty is impossible, but we can explore potential scenarios based on the recent XRP buy:

Potential Scenarios Based on the Whale Buy

- Short-Term Pump and Consolidation: The significant XRP buy could trigger a short-term price increase, followed by a period of consolidation as the market absorbs the large purchase.

- Sustained Upward Trend: If the overall market sentiment remains bullish and positive news emerges regarding Ripple's legal case, this XRP buy could be the catalyst for a sustained upward trend.

- Limited Impact: The whale buy might have a limited impact on XRP's price if other negative factors, such as bearish market sentiment or negative news from the Ripple lawsuit, outweigh its influence.

Technical Analysis of XRP Charts (Optional)

(If including charts, discuss key support and resistance levels, moving averages, RSI, MACD, etc., referencing the charts.) Technical indicators can provide additional insights into potential future price movements but should always be considered in conjunction with fundamental analysis.

Conclusion

The recent acquisition of 20 million XRP tokens by a crypto whale is a significant event that has injected considerable energy into the XRP market. This massive XRP Buy has increased buying pressure and highlighted the importance of understanding whale activity as a significant market indicator. While predicting the future price of XRP with precision is impossible, various scenarios are plausible, ranging from a short-term price increase to a sustained upward trend, all heavily influenced by the Ripple lawsuit's progress and the broader cryptocurrency market trends. Keep an eye on the XRP market, stay tuned for updates on this massive XRP Buy, and continue to research XRP and related news. Share your thoughts and predictions in the comments below!

Featured Posts

-

Thunder Vs Trail Blazers Game March 7th Time Tv Channel And Streaming

May 08, 2025

Thunder Vs Trail Blazers Game March 7th Time Tv Channel And Streaming

May 08, 2025 -

Counting Crows Snl Appearance A Defining Moment In Their Career

May 08, 2025

Counting Crows Snl Appearance A Defining Moment In Their Career

May 08, 2025 -

Nantes Psg Yi Evinden Puanla Geri Goenderdi 0 0

May 08, 2025

Nantes Psg Yi Evinden Puanla Geri Goenderdi 0 0

May 08, 2025 -

Xrp And Ripple Recent Developments And Market Analysis

May 08, 2025

Xrp And Ripple Recent Developments And Market Analysis

May 08, 2025 -

Is 2 700 The Next Ethereum Price Target Wyckoff Accumulation Suggests So

May 08, 2025

Is 2 700 The Next Ethereum Price Target Wyckoff Accumulation Suggests So

May 08, 2025

Latest Posts

-

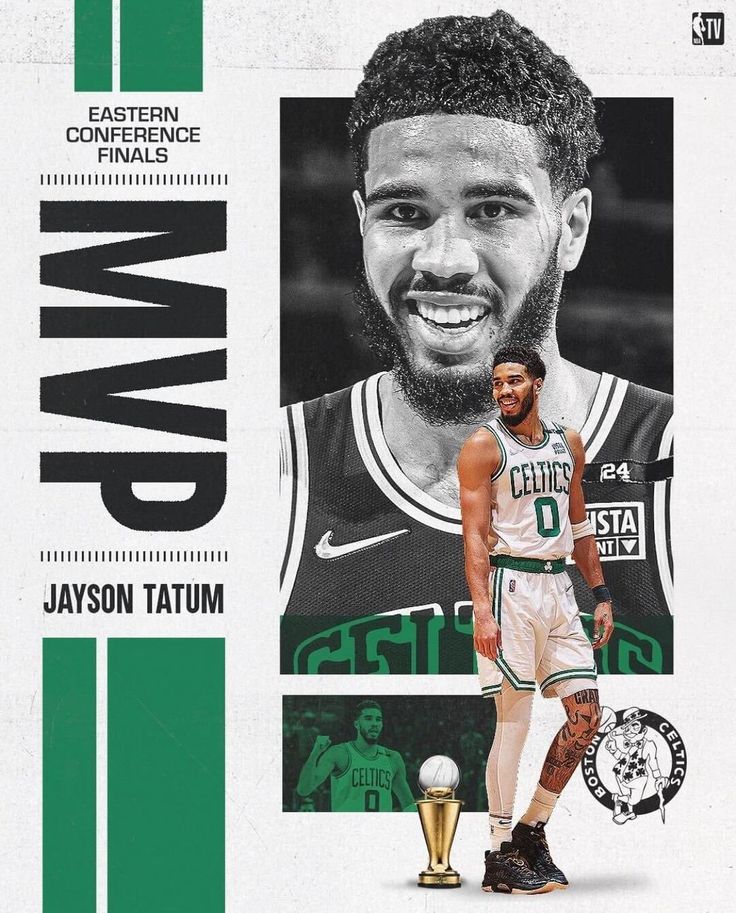

Lakers Kuzma On Celtics Tatums Viral Instagram Update

May 08, 2025

Lakers Kuzma On Celtics Tatums Viral Instagram Update

May 08, 2025 -

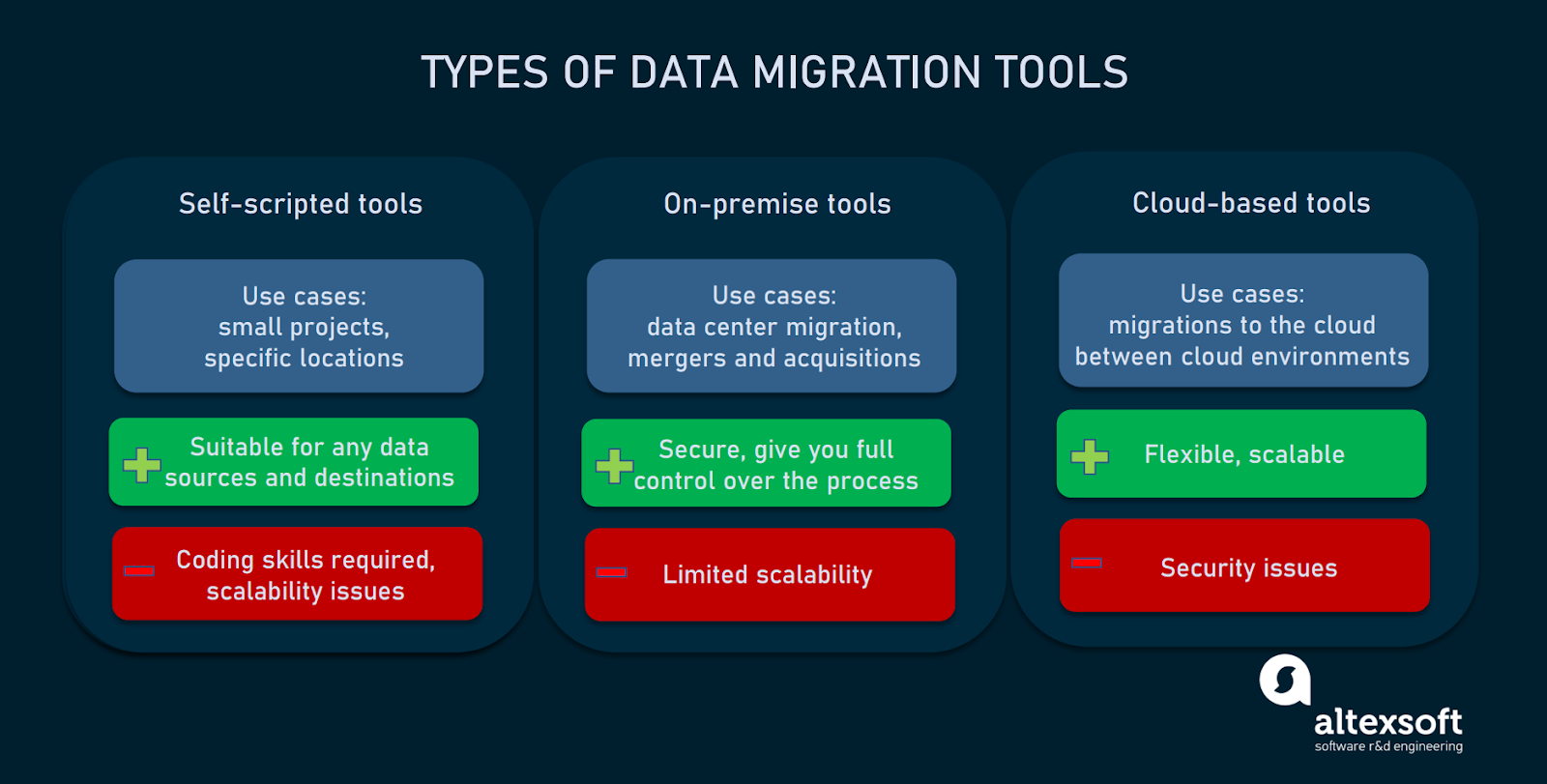

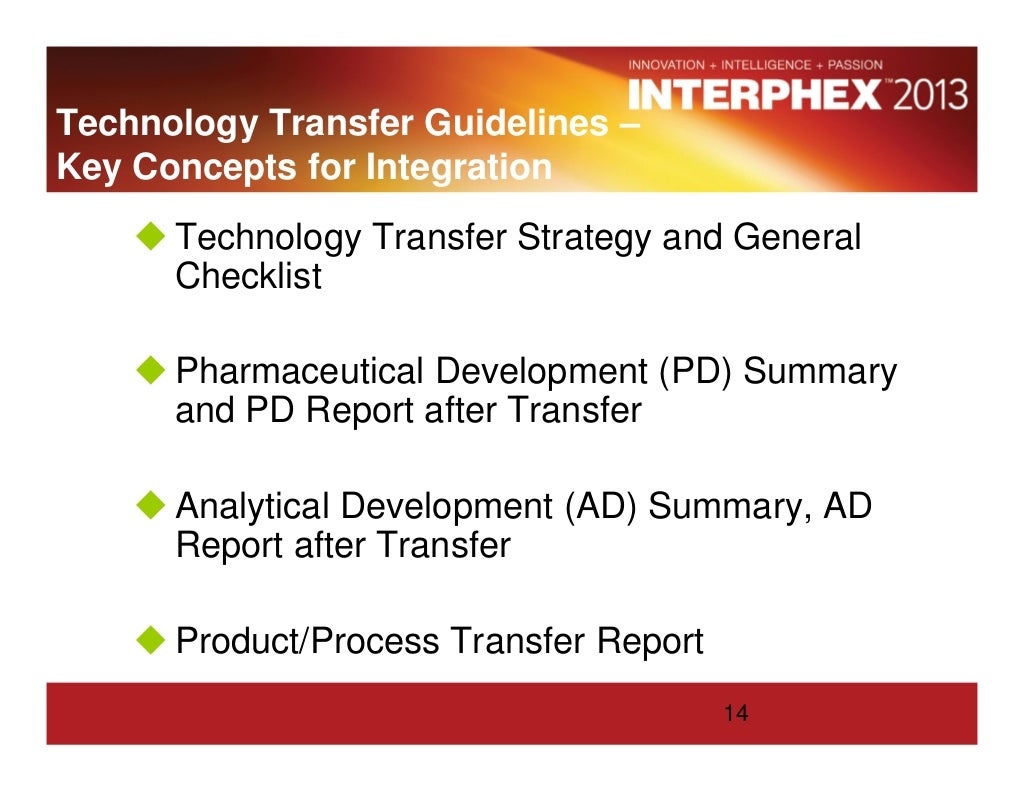

Efficient Data Transfer Methods And Technologies For Seamless Migration

May 08, 2025

Efficient Data Transfer Methods And Technologies For Seamless Migration

May 08, 2025 -

Kuzma Weighs In Viral Instagram Post By Jayson Tatum

May 08, 2025

Kuzma Weighs In Viral Instagram Post By Jayson Tatum

May 08, 2025 -

Understanding Data Transfer Best Practices And Challenges

May 08, 2025

Understanding Data Transfer Best Practices And Challenges

May 08, 2025 -

Kyle Kuzma Responds To Jayson Tatums Trending Instagram Post

May 08, 2025

Kyle Kuzma Responds To Jayson Tatums Trending Instagram Post

May 08, 2025