South Africa's Coalition Faces Tax Hike Defeat

Table of Contents

The Proposed Tax Hike: Details and Rationale

The proposed tax increases aimed to bolster South Africa's ailing finances. The government's plan included significant increases across various tax brackets: income tax, Value-Added Tax (VAT), and corporate tax were all targeted. The stated rationale behind these South African tax increase proposals centered on three key pillars: funding crucial social programs, reducing the burgeoning budget deficit, and providing financial fuel for much-needed infrastructure development.

- Specific percentage increases: The proposed income tax increase ranged from 2% to 5%, depending on the income bracket. VAT was slated for a 1% increase, pushing it to 16%. Corporate tax was earmarked for a 2% rise.

- Projected revenue generation: The government projected that these South African tax reforms would generate an additional ZAR 150 billion (approximately USD 8.5 billion) annually.

- Targeted sectors/income brackets: Higher-income earners would have faced the most significant increases in income tax, while the VAT increase would have impacted all consumers. Corporate tax increases would primarily affect large businesses.

These proposed tax hikes in South Africa were framed as necessary measures to address the country's economic challenges, but faced considerable opposition.

Opposition and Key Players in the Defeat

The opposition to the proposed South Africa tax increase was fierce and multifaceted. Key opposition parties, including the Democratic Alliance (DA) and the Economic Freedom Fighters (EFF), launched vigorous campaigns against the hikes. Their arguments focused on the potential negative impact on the already struggling economy and concerns about the fairness and equity of the proposed tax increases. Internal divisions within the ruling coalition itself also played a crucial role. Several coalition partners expressed reservations about the scale and scope of the proposed tax hikes, ultimately weakening the government's position.

- Key opposition leaders and their statements: The DA leader voiced concerns about the impact on businesses and job creation, while the EFF leader argued that the tax increases disproportionately burdened the poor.

- Specific arguments used by the opposition: The opposition highlighted the potential for increased inflation, reduced consumer spending, and a negative impact on foreign investment.

- Public protests and campaigns: Several protests and social media campaigns were launched, effectively mobilizing public opinion against the proposed South African tax reform.

Economic and Political Consequences of the Defeat

The failure to implement the proposed tax hikes has significant short-term and long-term economic consequences for South Africa. The government will now face a larger budget deficit, potentially impacting its ability to fund essential social programs and infrastructure projects. This situation may lead to reduced government spending and delays in critical projects.

- Impact on investor confidence: The defeat may damage investor confidence, potentially leading to capital flight and a weakening of the Rand.

- Possible rating downgrades: Credit rating agencies might downgrade South Africa's sovereign credit rating, increasing borrowing costs for the government.

- Revised plans for budget deficits: The government will need to find alternative ways to address the budget deficit, which might involve further austerity measures or cuts to public services.

- Effect on the country's credit rating: A lower credit rating will make it more expensive for the government to borrow money, potentially hindering economic growth.

Public Reaction and Social Media Sentiment

The public reaction to the defeat of the tax hike was mixed. While some celebrated the outcome, viewing the proposed increases as unfair or economically damaging, others expressed concern about the potential consequences for essential services. Social media became a battleground for debate, with hashtags like #NoTaxHikes and #SouthAfricaEconomy trending for days. While precise polling data is still emerging, initial indications suggest a fairly even split in public opinion.

Conclusion

The defeat of the proposed tax hike in South Africa marks a significant turning point. A combination of strong opposition, internal coalition divisions, and public concerns contributed to the outcome. The potential economic and political consequences are considerable, ranging from increased budget deficits and potential credit rating downgrades to a further erosion of public trust in the ruling coalition. The government now faces the challenging task of finding alternative solutions to address the country's fiscal challenges. Stay informed on the evolving political and economic landscape in South Africa as the government navigates the aftermath of this significant defeat. Follow our updates for further analysis on the future of South Africa tax policy and the impact of this South Africa tax hike defeat on the nation.

Featured Posts

-

Aquarela Na Maquiagem Tutorial E Inspiracoes Para Um Look Delicado

Apr 25, 2025

Aquarela Na Maquiagem Tutorial E Inspiracoes Para Um Look Delicado

Apr 25, 2025 -

Bayerns Six Point Bundesliga Lead A Hard Fought Win Against St Pauli

Apr 25, 2025

Bayerns Six Point Bundesliga Lead A Hard Fought Win Against St Pauli

Apr 25, 2025 -

Crude Oil Market Update Key Developments On April 24

Apr 25, 2025

Crude Oil Market Update Key Developments On April 24

Apr 25, 2025 -

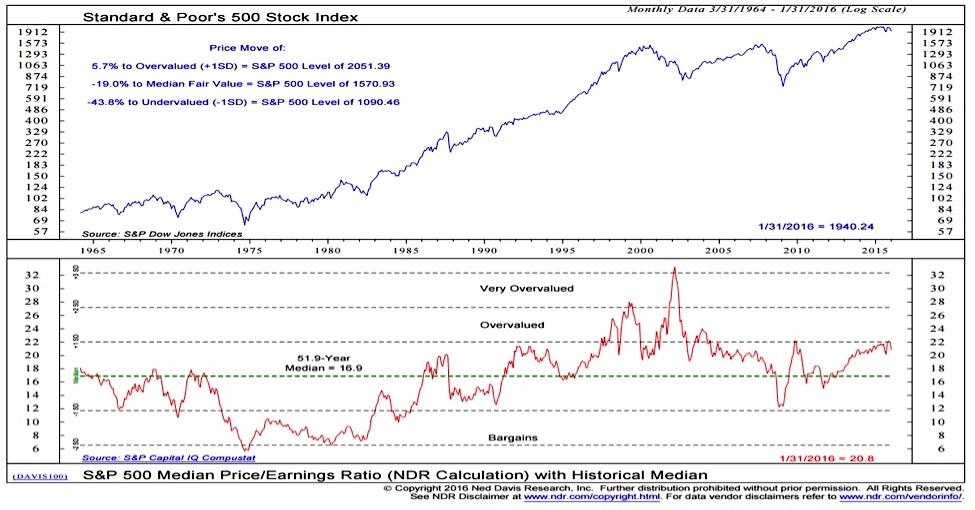

The Bof A Perspective Why Current Stock Market Valuations Are Not A Cause For Alarm

Apr 25, 2025

The Bof A Perspective Why Current Stock Market Valuations Are Not A Cause For Alarm

Apr 25, 2025 -

Price Gouging Allegations Surface After La Fires A Real Estate Perspective

Apr 25, 2025

Price Gouging Allegations Surface After La Fires A Real Estate Perspective

Apr 25, 2025

Latest Posts

-

France Vs England Six Nations Dalys Late Show Delivers Victory For England

May 01, 2025

France Vs England Six Nations Dalys Late Show Delivers Victory For England

May 01, 2025 -

Dalys Match Winning Performance England Triumphs Over France In Six Nations

May 01, 2025

Dalys Match Winning Performance England Triumphs Over France In Six Nations

May 01, 2025 -

Six Nations Showdown Englands Daly Secures Thrilling Win Over France

May 01, 2025

Six Nations Showdown Englands Daly Secures Thrilling Win Over France

May 01, 2025 -

England Edges France In Six Nations Thriller Dalys Late Game Heroics Decide

May 01, 2025

England Edges France In Six Nations Thriller Dalys Late Game Heroics Decide

May 01, 2025 -

78 73 Victory For No 10 Texas Tech Over Kansas

May 01, 2025

78 73 Victory For No 10 Texas Tech Over Kansas

May 01, 2025