SSE Announces £3 Billion Reduction In Spending Plan Due To Growth Slowdown

Table of Contents

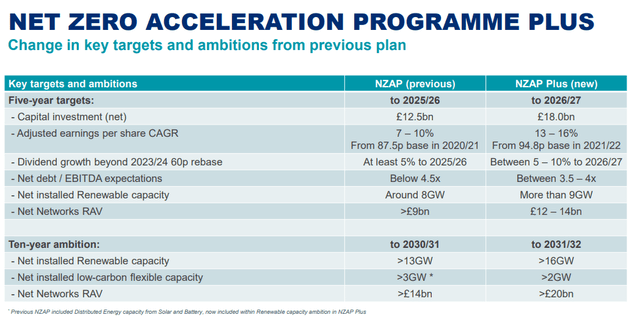

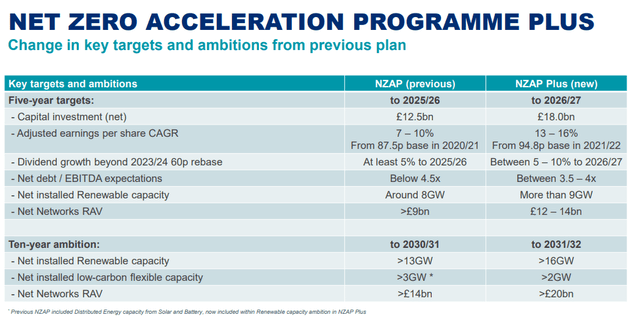

Reasons Behind the £3 Billion Spending Reduction

SSE's decision to slash its capital expenditure by £3 billion is a multifaceted issue stemming from a confluence of economic headwinds and internal strategic adjustments.

Economic Headwinds and Inflation

The UK, like much of the world, is grappling with persistent inflation and rising interest rates. These economic headwinds have significantly impacted SSE's investment decisions. The Bank of England has implemented several interest rate hikes in an attempt to curb inflation, which currently sits at [insert current UK inflation rate]%. This increase in borrowing costs makes financing large-scale energy projects considerably more expensive.

- Increased borrowing costs: Securing loans for massive infrastructure projects, such as new renewable energy facilities, has become significantly more expensive, making many projects less financially viable.

- Reduced consumer spending: High inflation is squeezing household budgets, leading to reduced energy demand and impacting SSE's revenue forecasts.

- Uncertainty in the energy market: Geopolitical instability and fluctuating energy prices add further uncertainty to the long-term projections necessary for making substantial investments.

Slower-Than-Expected Growth in Renewable Energy

Despite the UK's ambitious renewable energy targets, SSE, like other companies in the sector, has encountered challenges in the rollout of new projects.

- Delays in offshore wind farm construction: Supply chain disruptions and difficulties in securing necessary components have resulted in significant delays in the construction of offshore wind farms.

- Increased costs of materials and labor: The price of steel, concrete, and other essential materials has skyrocketed, alongside labor costs, significantly increasing the overall cost of projects.

- Difficulty securing necessary planning permissions: The planning process for large-scale renewable energy projects can be lengthy and complex, leading to further delays and increased costs.

Review of Investment Portfolio and Prioritization

In response to the challenging economic environment and slower-than-expected growth, SSE is undertaking a comprehensive review of its investment portfolio. This involves a prioritization of projects based on profitability and strategic alignment with the company's long-term goals.

- Focus on core businesses and most profitable ventures: SSE is concentrating its resources on its most profitable and strategically important businesses.

- Deferral or cancellation of less profitable projects: Projects deemed less financially viable or strategically less important are being deferred or cancelled entirely.

- Strategic reallocation of resources: The £3 billion reduction allows SSE to reallocate its resources to projects with a higher likelihood of success and better returns.

Impact of the Spending Cuts on the Energy Sector

The £3 billion spending reduction by SSE has significant implications for both the company itself and the wider energy sector.

Implications for Renewable Energy Development

SSE's decision to cut spending could have a ripple effect on the UK's renewable energy targets.

- Potential delays in reaching net-zero targets: Reduced investment in renewable energy projects could slow down the UK's progress towards its net-zero emissions goals.

- Reduced competition in the renewable energy market: Fewer large-scale projects could lead to less competition and potentially higher energy prices in the long run.

- Impact on jobs and employment in the renewable energy sector: Delays and cancellations of projects could result in job losses within the renewable energy sector.

Effect on SSE's Future Growth and Profitability

The short-term and long-term consequences of the spending cuts for SSE are complex and multifaceted.

- Reduced earnings in the short term: The immediate impact will likely be a reduction in earnings as fewer projects are undertaken.

- Potential long-term benefits from a more focused investment strategy: By concentrating on more profitable ventures, SSE could improve its long-term financial performance.

- Impact on investor confidence and credit rating: The spending cuts could impact investor confidence and potentially affect SSE's credit rating.

Conclusion

SSE's decision to cut its spending plan by £3 billion reflects the challenging economic climate and slower-than-anticipated growth in the energy sector. This significant reduction highlights the complexities facing energy companies as they navigate inflation, supply chain issues, and the transition to renewable energy. The impact on the broader energy landscape and SSE's future trajectory remains to be seen.

Call to Action: Stay informed about the evolving situation with SSE and its impact on the UK energy market. Follow our updates on further developments concerning SSE's spending plans and the broader implications of this £3 billion investment reduction. Learn more about the changing dynamics of the energy sector and how SSE’s actions affect future energy prices and renewable energy investment.

Featured Posts

-

Atletico Madrid Barcelona Maci Canli Izle Fanatik Gazetesi Nden Canli Yayin

May 25, 2025

Atletico Madrid Barcelona Maci Canli Izle Fanatik Gazetesi Nden Canli Yayin

May 25, 2025 -

The Kyle Walker Peters To Leeds Transfer Saga A Detailed Look

May 25, 2025

The Kyle Walker Peters To Leeds Transfer Saga A Detailed Look

May 25, 2025 -

Porsche Now

May 25, 2025

Porsche Now

May 25, 2025 -

Monacos Robuchon Restaurants A Look At Francis Sultanas Interior Design

May 25, 2025

Monacos Robuchon Restaurants A Look At Francis Sultanas Interior Design

May 25, 2025 -

Trumps Tariff Comments Boost European Markets Lvmh Dips

May 25, 2025

Trumps Tariff Comments Boost European Markets Lvmh Dips

May 25, 2025

Latest Posts

-

Milioni I Vile Penzionerski Zivot Iz Snova

May 25, 2025

Milioni I Vile Penzionerski Zivot Iz Snova

May 25, 2025 -

Novaya Fotosessiya Naomi Kempbell Smelye I Otkrovennye Snimki

May 25, 2025

Novaya Fotosessiya Naomi Kempbell Smelye I Otkrovennye Snimki

May 25, 2025 -

Zavidna Penzija Kako Penzioneri Zive U Luksuzu

May 25, 2025

Zavidna Penzija Kako Penzioneri Zive U Luksuzu

May 25, 2025 -

Naomi Kempbell Otkrovennye Obrazy V Novoy Fotosessii Dlya Glyantsa

May 25, 2025

Naomi Kempbell Otkrovennye Obrazy V Novoy Fotosessii Dlya Glyantsa

May 25, 2025 -

Penzionerski Raj Luksuzan Zivot I Bogatstvo U

May 25, 2025

Penzionerski Raj Luksuzan Zivot I Bogatstvo U

May 25, 2025