Trump's Tariff Comments Boost European Markets; LVMH Dips

Table of Contents

Positive European Market Reaction to Trump's Tariff Comments

The initial reaction to the possibility of renewed trade tensions under a potential Trump administration was, unsurprisingly, negative. Investors, already grappling with global inflation and supply chain disruptions, adopted a "risk-off" sentiment, fearing a renewed trade war could further destabilize the global economy. However, Trump's comments, while hinting at future trade actions, were interpreted by many as less aggressive than previously anticipated. This perception triggered a significant market rebound.

-

Initial Negative Sentiment: The mere suggestion of increased tariffs led to an immediate drop in investor confidence, as businesses feared increased costs and reduced export opportunities. This was especially true for export-oriented sectors within Europe.

-

Less Aggressive than Anticipated: Instead of announcing sweeping new tariffs, Trump's comments focused more on renegotiating existing trade deals, prompting a sigh of relief among investors. This perception of a less confrontational approach contributed to the subsequent market uptick.

-

Influx of Investment: The perceived reduction in immediate trade war risks led to a substantial influx of investment into European markets. Investors, previously hesitant, saw an opportunity to capitalize on potentially undervalued assets.

-

Sector-Specific Gains: Export-oriented industries within Europe, such as automotive and manufacturing, experienced the most significant gains. These sectors had been particularly vulnerable to previous trade disputes. The FTSE 100 and DAX, key European stock market indices, saw noticeable increases following the news. (Specific data on percentage increases would be inserted here, drawing from reliable financial news sources).

-

Market Indices: The FTSE 100, for example, saw a [Insert Percentage]% increase in the days following the comments, while the DAX experienced a [Insert Percentage]% rise.

LVMH's Dip Despite Broader Market Gains

Despite the broader positive movement in European markets, LVMH, the world's largest luxury goods company, experienced a dip in its stock price. This divergence underscores the unique vulnerabilities of the luxury goods sector to global economic uncertainty.

-

Sensitivity to Trade Tensions: LVMH's high reliance on international trade and consumer spending makes it particularly sensitive to trade tensions and global economic uncertainty. Increased tariffs on imported goods, for example, can significantly increase production costs.

-

Tariff Impact on Luxury Goods: Tariffs on luxury goods, which often involve high import costs, can significantly reduce consumer spending. Higher prices can discourage purchases, especially in price-sensitive markets.

-

Importance of the Chinese Market: The Chinese market is crucial for LVMH's success. Any escalation of trade tensions between the US and China could negatively impact the company's revenue streams. The uncertainty surrounding future trade policies added to investor apprehension.

-

Company Response: [Insert information about any official statement or response LVMH made regarding the news. If no specific response is available, state that "At the time of writing, LVMH has not issued a public statement regarding these market fluctuations."]

-

Stock Price Performance: LVMH's stock price experienced a [Insert Percentage]% decrease, contrasting sharply with the positive performance of broader European markets.

Analyzing the Paradox: Why the Divergent Market Reactions?

The contrasting market reactions highlight the complexities of investor behavior and the sector-specific impacts of geopolitical events. While the overall reduction in immediate trade war fears boosted European markets, LVMH's vulnerability to specific trade dynamics led to a different outcome.

-

Differing Investor Behavior: Investors assessed the risk differently for broad European markets versus a specific luxury goods company. European markets were viewed as having a higher resilience to trade policy shifts than LVMH.

-

Unique Risk Profile of Luxury Goods: The luxury goods sector faces a unique set of challenges, including price sensitivity, dependence on high-net-worth consumers, and complex international supply chains. These factors contribute to a higher risk profile than many other sectors.

-

Geopolitical Uncertainty: The lingering uncertainty surrounding future trade policy continues to shape investor sentiment. While the immediate risk perception diminished, the possibility of future changes remains a source of volatility.

-

Impact on Market Segments: Different market segments respond differently to geopolitical events. The impact of Trump’s tariff comments on technology, energy, and other key sectors needs to be analyzed individually, not just in aggregate.

-

Future Market Trends: The situation highlights the need for continued monitoring of global trade policies and their impact on individual market segments and specific businesses. The current situation suggests an ongoing period of volatility, requiring careful consideration by investors and policymakers alike.

Conclusion

Trump's recent tariff-related statements have produced a mixed reaction in the market, with European markets exhibiting growth while LVMH experienced a decline. This disparity highlights the complex interplay between global trade dynamics, investor sentiment, and sector-specific vulnerabilities. The differing responses underscore the need for nuanced analysis of market trends, considering both overarching geopolitical factors and the unique characteristics of individual companies and sectors. Understanding the nuances of Trump’s tariff comments and their influence on the stock market is crucial for informed investment decisions. Continue to follow our analysis for insightful updates on the impact of Trump’s trade policies and their impact on global markets.

Featured Posts

-

Escape To The Country Finding Your Dream Home For Under 1 Million

May 25, 2025

Escape To The Country Finding Your Dream Home For Under 1 Million

May 25, 2025 -

Uomini Piu Ricchi Del Mondo 2025 Musk Supera Zuckerberg E Bezos Classifica Forbes

May 25, 2025

Uomini Piu Ricchi Del Mondo 2025 Musk Supera Zuckerberg E Bezos Classifica Forbes

May 25, 2025 -

Gear Essentials For Ferrari Owners A Complete Guide

May 25, 2025

Gear Essentials For Ferrari Owners A Complete Guide

May 25, 2025 -

10 Rokiv Peremog Yevrobachennya Scho Stalosya Z Triumfatorami

May 25, 2025

10 Rokiv Peremog Yevrobachennya Scho Stalosya Z Triumfatorami

May 25, 2025 -

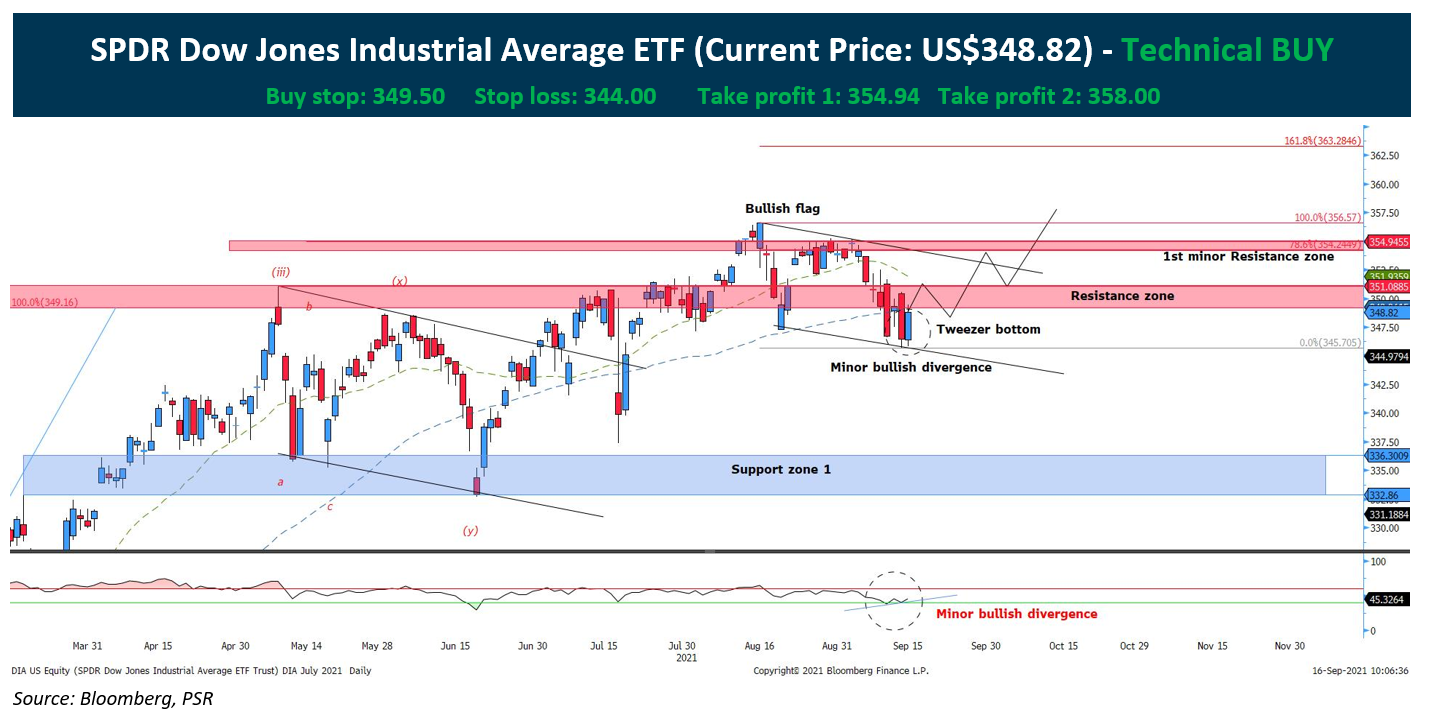

Investment In Amundi Dow Jones Industrial Average Ucits Etf Focus On Net Asset Value Nav

May 25, 2025

Investment In Amundi Dow Jones Industrial Average Ucits Etf Focus On Net Asset Value Nav

May 25, 2025

Latest Posts

-

Is Apple Stock A Buy After Strong Q2 Earnings

May 25, 2025

Is Apple Stock A Buy After Strong Q2 Earnings

May 25, 2025 -

Apple Stock Analysis Of Q2 Results And Future Predictions

May 25, 2025

Apple Stock Analysis Of Q2 Results And Future Predictions

May 25, 2025 -

Apple Stock Q2 Earnings I Phone Sales And Investor Outlook

May 25, 2025

Apple Stock Q2 Earnings I Phone Sales And Investor Outlook

May 25, 2025 -

Apple Stock Performance Exceeding Q2 Expectations

May 25, 2025

Apple Stock Performance Exceeding Q2 Expectations

May 25, 2025 -

Apple Stock Soars I Phone Sales Drive Strong Q2 Results

May 25, 2025

Apple Stock Soars I Phone Sales Drive Strong Q2 Results

May 25, 2025