SSE Announces £3 Billion Spending Reduction Due To Slowing Growth

Table of Contents

Details of SSE's Spending Reduction Plan

SSE's £3 billion spending reduction represents a substantial reshaping of its investment strategy. The cuts will affect various areas, impacting both short-term and long-term projects. While specific details remain scarce, initial reports suggest significant reductions in planned investments for renewable energy projects, particularly in offshore wind farms and other large-scale renewable energy infrastructure. Network infrastructure upgrades will also experience a considerable slowdown.

- Quantifiable Impacts: Initial estimates suggest a percentage reduction ranging from 15% to 25% in several key projects, although the exact figures are yet to be officially confirmed by SSE.

- Impact on Jobs: While SSE has yet to release specific figures on job losses, industry analysts anticipate potential restructuring and workforce reductions, particularly in project management and engineering teams associated with the affected projects.

- Bullet Points:

- Cancellation of at least three smaller-scale renewable energy projects.

- Significant delays in the development of two major offshore wind farms, pushing completion dates back by at least 12 months.

- Revised investment timelines across the board, leading to a slowdown in the deployment of new energy infrastructure.

- Potential impact on future energy projects, including delays in achieving carbon emission reduction targets.

Underlying Reasons for Slowing Growth and Spending Reduction

The decision to slash £3 billion from its spending reflects a complex interplay of macroeconomic factors and shifts in the energy market. SSE's announcement underscores a broader trend impacting the entire energy sector.

- Macroeconomic Factors: Soaring inflation, rising interest rates, and increased global economic uncertainty have significantly increased the cost of capital and made financing large-scale projects considerably more challenging. This inflationary pressure directly impacts project viability and return on investment.

- Energy Market Dynamics: Reduced energy demand, potentially driven by factors like energy efficiency improvements and economic slowdowns, has also impacted the investment outlook. Increased competition among energy providers further contributes to a more cautious approach to capital expenditure.

- Regulatory Changes: Changes in government policies, including potential shifts in renewable energy subsidies and regulations, can influence the financial attractiveness of certain projects, leading to reassessments of investment priorities.

- Bullet Points:

- Inflationary pressures increasing project costs by an estimated 10-15%.

- A noticeable decrease in consumer demand for energy during the past quarter.

- Uncertainty surrounding future government support for renewable energy projects.

Impact of the Spending Reduction on SSE's Future Strategy

SSE's £3 billion spending reduction signals a significant shift in the company's strategic focus. The company is likely to prioritize short-term profitability and operational efficiency over aggressive expansion in the near future.

- Shift in Investment Priorities: Resources will be redirected toward projects with quicker returns and lower risk profiles. This could involve a greater emphasis on optimizing existing infrastructure and enhancing operational efficiency.

- Focus on Profitability: SSE's emphasis will likely be on strengthening its financial position and improving shareholder returns before investing heavily in large-scale, long-term projects.

- Potential for Future Investments: While the current spending reduction is significant, SSE hasn't completely ruled out future investments. However, any future projects will likely undergo more rigorous scrutiny and require stronger evidence of profitability.

- Bullet Points:

- Increased focus on operational efficiency and cost reduction measures.

- Potential divestment of non-core assets to generate capital and improve balance sheets.

- Exploration of new revenue streams through diversification and partnerships.

Analyst Reactions and Market Response to SSE's Announcement

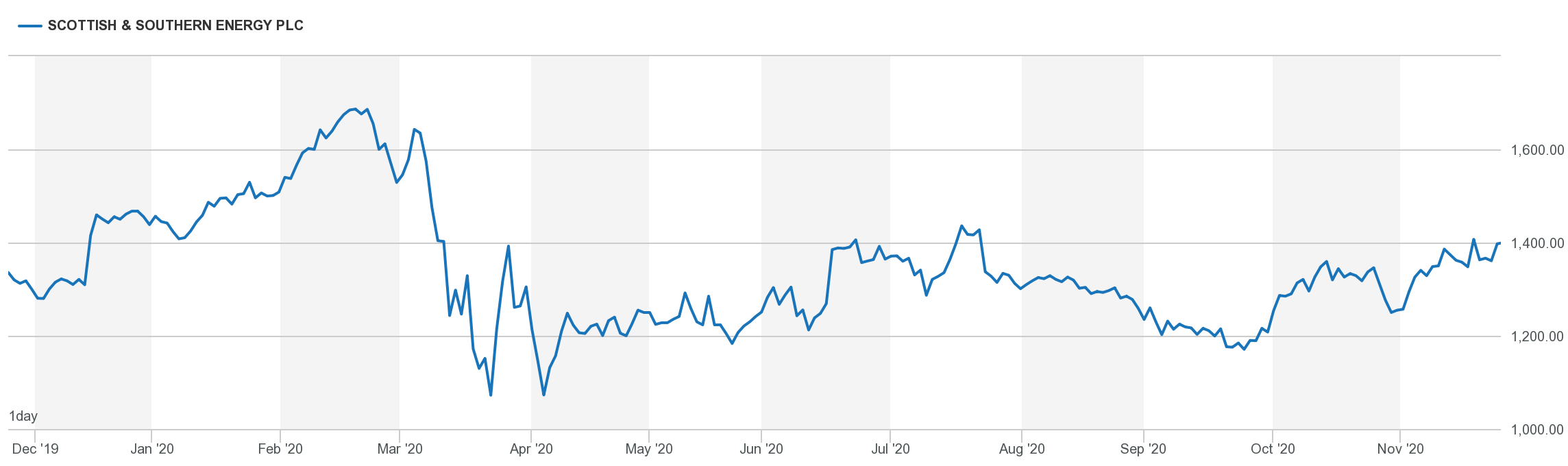

The market responded to SSE's announcement with a mixture of caution and anticipation. SSE's share price experienced a temporary dip following the news, reflecting investor concerns about the company's future growth prospects.

- Stock Market Performance: Following the announcement, SSE's share price initially fell by approximately 2%, but quickly rebounded as investors digested the news and considered the company’s focus on improved profitability.

- Expert Opinions: Several financial analysts have expressed cautious optimism, suggesting that the spending reduction is a necessary strategic move given the current economic climate. The consensus points toward the potential for improved short-term profitability, although long-term growth prospects might be affected.

- Competitor Analysis: The impact on competitors is likely to be varied. Some may see an opportunity to increase market share, while others may follow suit by re-evaluating their own investment plans.

- Bullet Points:

- Share price fluctuations stabilized after an initial dip, suggesting a measured market reaction.

- Most analysts maintained a "hold" rating on SSE shares, reflecting uncertainty about the long-term impact.

- The announcement could trigger a wave of similar spending reductions across the broader energy sector.

Conclusion: SSE's £3 Billion Spending Cut – What's Next?

SSE's decision to reduce its capital expenditure by £3 billion is a significant development driven by slowing growth and challenging macroeconomic conditions. The impact on SSE's future strategy, including its investment priorities and potential job losses, remains to be seen. The ripple effect across the wider energy sector is also noteworthy, indicating a period of uncertainty and adjustment. This £3 billion spending reduction reflects a broader industry trend and highlights the complex challenges facing energy companies as they navigate the current economic climate. Stay updated on SSE’s response to slowing growth and the impact of this significant spending reduction on the company's long-term strategy and the wider energy market. Follow the impact of this £3 billion spending reduction and learn more about the future of SSE's investment strategy.

Featured Posts

-

Itineraires Cyclistes En Loire Atlantique Nantes Le Vignoble Et L Estuaire

May 22, 2025

Itineraires Cyclistes En Loire Atlantique Nantes Le Vignoble Et L Estuaire

May 22, 2025 -

Get Ready For A Looney Tunes And Cartoon Network Crossover In 2025

May 22, 2025

Get Ready For A Looney Tunes And Cartoon Network Crossover In 2025

May 22, 2025 -

Wisconsin Gas Prices Increase Average Now 2 98 Per Gallon

May 22, 2025

Wisconsin Gas Prices Increase Average Now 2 98 Per Gallon

May 22, 2025 -

Chronic Wasting Disease Cwd Detected In Jackson Hole Elk Feedground

May 22, 2025

Chronic Wasting Disease Cwd Detected In Jackson Hole Elk Feedground

May 22, 2025 -

Women And Finances 3 Costly Errors To Avoid

May 22, 2025

Women And Finances 3 Costly Errors To Avoid

May 22, 2025