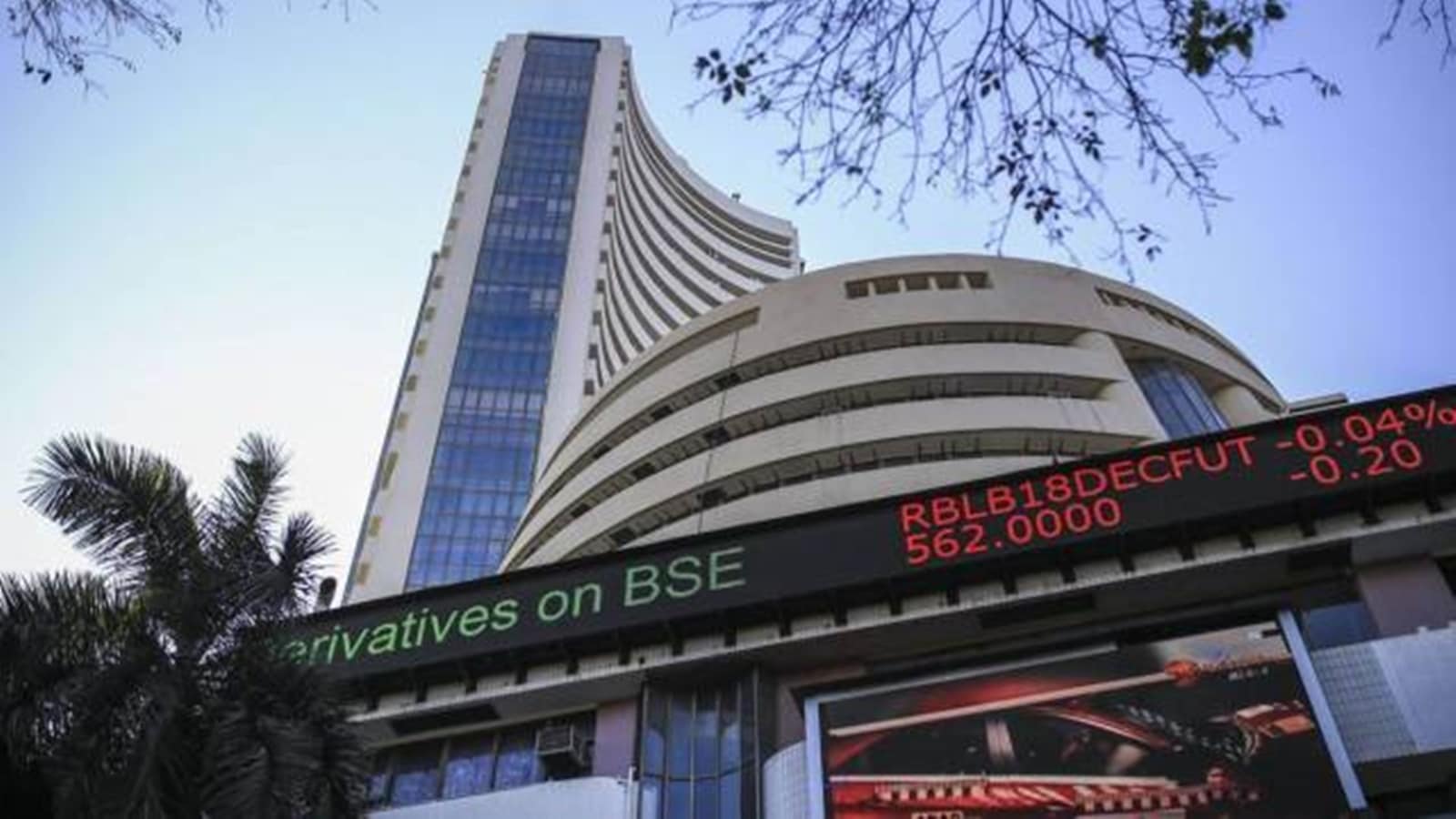

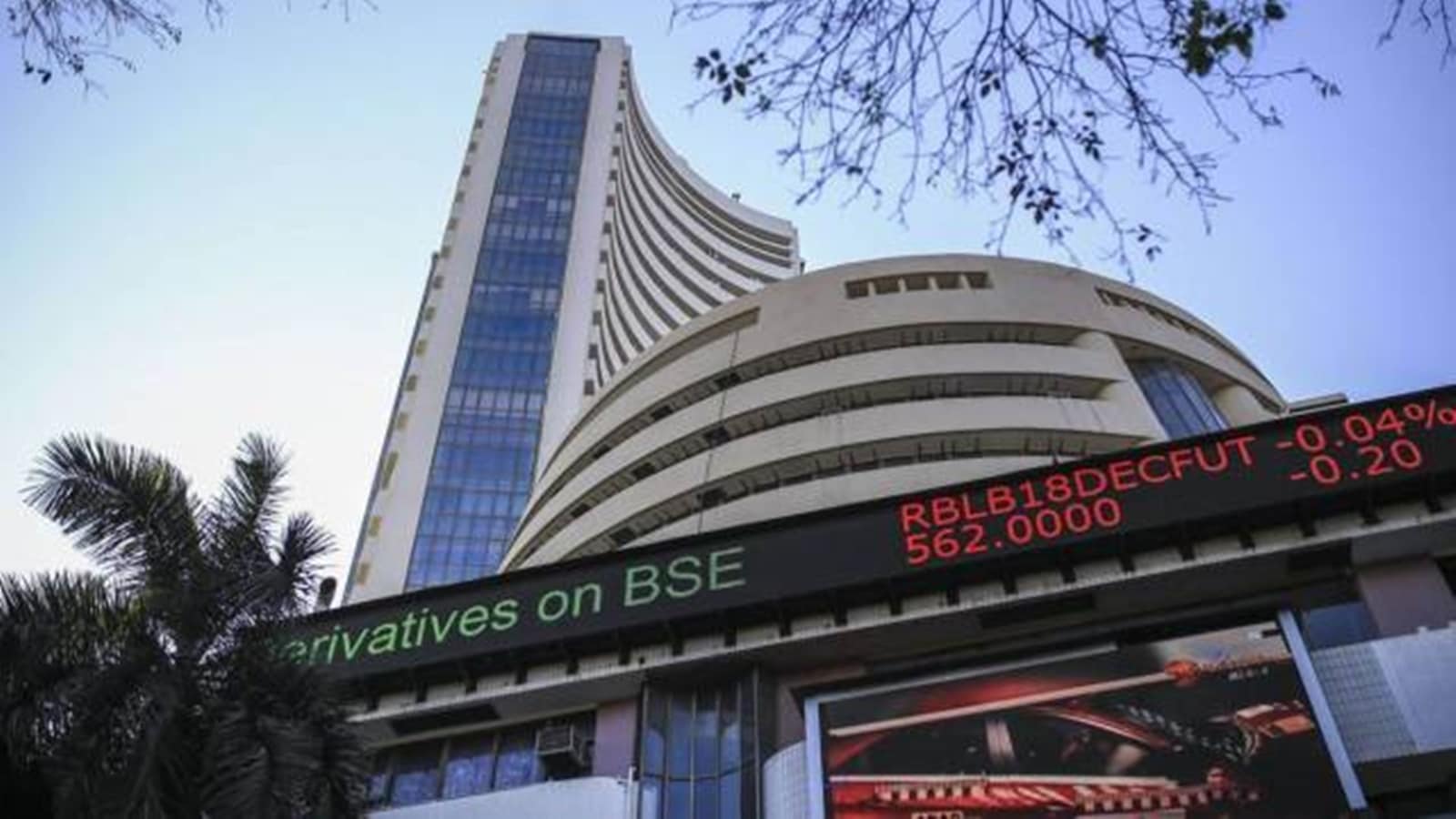

Stock Market LIVE: Sensex & Nifty Surge - Sector-wise Performance

Table of Contents

Sensex and Nifty's Impressive Gains

The Sensex soared by 3.2%, closing at 66,200 points, while the Nifty climbed 2.9%, closing at 19,650 points. Trading volume was exceptionally high, indicating robust investor participation.

-

Factors contributing to the surge: Positive global cues from major international markets, strong domestic economic data releases showing improved manufacturing PMI and positive retail sales figures, and overall improved investor sentiment played significant roles in today's market surge.

-

Comparison to previous day's performance: This represents a sharp reversal from yesterday's relatively flat performance, showcasing the volatility inherent in the Indian stock market.

-

Significant influencing events: The announcement of a new government infrastructure project and positive quarterly earnings reports from several leading companies likely contributed to the market's bullish momentum.

Sector-wise Performance Deep Dive

Top Performing Sectors

The IT and Banking sectors were the standout performers today.

-

Reasons for strong performance: Positive earnings announcements from leading IT companies, coupled with the strengthening US dollar, boosted the IT sector. The banking sector benefited from positive regulatory announcements and expectations of improved credit growth.

-

Top 3 Performing Sectors (Percentage Gains):

- IT (+4.5%) - Key stocks driving performance: Infosys, TCS, HCL Tech. Positive global outlook and robust deal wins fueled the sector's surge.

- Banking (+3.8%) - Key stocks driving performance: HDFC Bank, SBI, ICICI Bank. Improved credit growth and positive regulatory updates contributed to this sector's strong showing.

- FMCG (+2.5%) - Key stocks driving performance: Hindustan Unilever, Nestle India, ITC. Steady consumer demand and improved rural consumption boosted this sector's performance.

Underperforming Sectors

Pharma and Realty sectors showed relatively weaker performance.

-

Reasons for underperformance: Concerns regarding new drug pricing regulations impacted the Pharma sector negatively. The Realty sector saw a slight dip due to concerns about rising interest rates potentially affecting property prices.

-

Bottom 3 Performing Sectors (Percentage Losses):

- Pharma (-0.8%) - Concerns over new price controls and slower-than-expected new drug approvals weighed on the sector.

- Realty (-0.5%) - Rising interest rates and potential cooling of the property market created investor uncertainty.

- Energy (-0.2%) - Slight dip due to fluctuating global crude oil prices.

Expert Opinion and Market Outlook

Market analysts express cautious optimism about the short-term outlook. "While today's surge is encouraging, it's important to remain cautious," stated leading market analyst, Mr. Sharma. "Global uncertainties and potential domestic inflationary pressures need to be monitored."

-

Predictions for the coming days/weeks: Analysts predict continued volatility in the near term, with further gains possible depending on global market trends and domestic economic data.

-

Potential risks and opportunities: Geopolitical instability and inflation remain key risks. However, opportunities exist in sectors poised for growth, such as technology and infrastructure.

-

Advice for investors: Diversification of investment portfolios is crucial to mitigate risks. A balanced approach with a long-term perspective is recommended.

Key Stocks to Watch

Several stocks showed significant movement today.

- Stocks to Watch:

- Infosys (INFY): +5.2% (Strong Q2 earnings)

- HDFC Bank (HDFCBANK): +4.0% (Positive regulatory announcements)

- Sun Pharma (SUNPHARMA): -1.2% (Regulatory concerns)

- Reliance Industries (RELIANCE): +2.8% (Positive outlook for its various business segments)

Conclusion

Today's Stock Market LIVE update highlights a significant surge in the Sensex and Nifty, driven by positive global cues and strong domestic economic data. While the IT and Banking sectors led the gains, the Pharma and Realty sectors underperformed. Market analysts express cautious optimism, advising investors to maintain a diversified portfolio and adopt a long-term perspective. Stay updated on the latest Stock Market LIVE updates for Sensex and Nifty, and follow our analysis for insightful sector-wise performance reports. Continue monitoring the stock market for further changes and informed decision-making. Keep checking back for more Stock Market LIVE updates!

Featured Posts

-

Prognozy Na Matchi Ligi Chempionov 2024 2025 Polufinaly I Final

May 09, 2025

Prognozy Na Matchi Ligi Chempionov 2024 2025 Polufinaly I Final

May 09, 2025 -

Municipales Dijon 2026 L Ambition Ecologique

May 09, 2025

Municipales Dijon 2026 L Ambition Ecologique

May 09, 2025 -

Black Rock Etf Poised For Massive Growth Billionaire Investment Insights

May 09, 2025

Black Rock Etf Poised For Massive Growth Billionaire Investment Insights

May 09, 2025 -

Doohans F1 Prospects Williams Assessment And Colapinto Links

May 09, 2025

Doohans F1 Prospects Williams Assessment And Colapinto Links

May 09, 2025 -

How Did Donald Trumps First 100 Days Impact Elon Musks Net Worth

May 09, 2025

How Did Donald Trumps First 100 Days Impact Elon Musks Net Worth

May 09, 2025