Stock Market Valuation Concerns: BofA's Perspective And Investor Advice

Table of Contents

BofA's Key Concerns Regarding Stock Market Valuation

Bank of America's analysts have voiced several key concerns regarding the current stock market valuation, impacting the overall stock market outlook. These concerns stem from several interconnected factors, all of which warrant careful consideration by investors.

High Price-to-Earnings Ratios (P/E):

The price-to-earnings ratio (P/E ratio) is a valuation metric that compares a company's stock price to its earnings per share. A high P/E ratio suggests investors are paying a premium for future earnings. BofA's analysis reveals that many sectors currently exhibit historically high P/E ratios, indicating a potential overvaluation. This elevated valuation, particularly in certain growth sectors, raises concerns about future market corrections. BofA’s research has highlighted specific sectors, such as technology and consumer discretionary, showing P/E ratios significantly above historical averages.

- High P/E ratios suggest investors are paying a premium for future earnings, potentially reflecting high growth expectations.

- Historically high P/E ratios can precede market corrections, leading to significant losses for investors.

- BofA's analysis pinpoints specific sectors with elevated P/E ratios, urging investors to exercise caution in these areas. For example, their research might indicate that the technology sector is overvalued based on current P/E ratios compared to historical data and projected future earnings.

Interest Rate Sensitivity:

Rising interest rates significantly impact stock valuations, especially for growth stocks. Higher interest rates increase the discount rate used in valuation models, thus lowering the present value of future earnings. Growth stocks, which rely heavily on future earnings projections, are particularly vulnerable. BofA's predictions for future interest rate hikes suggest a continued pressure on stock valuations. The Federal Reserve's monetary policy plays a crucial role here, and BofA's analysts closely monitor these actions and their potential implications for the market.

- Higher interest rates increase the discount rate used in valuation models, lowering the present values of future cash flows and impacting stock prices negatively.

- Growth stocks, reliant on high future earnings, are especially vulnerable to rising interest rates due to the increased discount rate.

- BofA's projections for interest rates and their effect on different asset classes highlight the need for a diversified portfolio and strategic asset allocation.

Geopolitical and Economic Uncertainty:

Global events, such as inflation, geopolitical conflicts (e.g., the war in Ukraine), and ongoing supply chain issues, significantly influence market valuations. BofA's assessment highlights the heightened risks associated with these uncertainties. These factors contribute to market volatility and decreased investor confidence, impacting stock market analysis and investor sentiment.

- Geopolitical risks, such as wars or trade disputes, can lead to market volatility and decreased investor confidence, impacting stock market valuation.

- Inflation erodes purchasing power and impacts corporate profitability, making accurate stock market valuation challenging.

- Supply chain disruptions negatively affect earnings growth and increase operational costs for businesses, contributing to stock market concerns.

BofA's Recommended Investment Strategies

Given these stock market valuation concerns, BofA recommends a cautious yet proactive approach to investing. Their advice centers on risk mitigation and long-term growth strategies.

Diversification:

Diversification is crucial for mitigating risk. BofA emphasizes diversifying across asset classes (stocks, bonds, real estate, etc.) and geographically across different sectors and countries. This strategy helps to reduce the impact of poor performance in any single asset class. The level of diversification should reflect your individual risk tolerance and investment goals.

- Don't put all your eggs in one basket: Spread investments across multiple asset classes and geographical regions.

- Consider diversifying geographically and across sectors to reduce your exposure to specific market risks.

- Rebalance your portfolio periodically to maintain your desired asset allocation and manage risk effectively.

Value Investing:

In a high-valuation market, value investing can be a suitable strategy. BofA might advocate for focusing on undervalued companies with strong fundamentals, as these companies may offer better risk-adjusted returns. Value stocks, with lower P/E ratios and often higher dividend yields, can provide a potential hedge against market corrections.

- Focus on undervalued companies with strong fundamentals and a history of stable earnings growth.

- Look for companies with low P/E ratios and high dividend yields, which can offer a more stable income stream.

- Conduct thorough due diligence before investing to ensure the company's valuation aligns with its intrinsic value.

Long-Term Perspective:

Maintaining a long-term investment horizon is critical for navigating market fluctuations. BofA advises investors to avoid panic selling during market downturns. Focusing on long-term financial goals helps investors stay disciplined and avoid emotional decision-making.

- Avoid emotional decision-making driven by short-term market volatility.

- Focus on your long-term financial goals and maintain a disciplined investment strategy.

- Stay informed about market trends but resist the urge to make drastic changes based on short-term news.

Conclusion

BofA's concerns regarding stock market valuation are significant and highlight the need for a cautious yet strategic approach to investing. High P/E ratios, interest rate sensitivity, and geopolitical uncertainties all contribute to a complex market environment. By diversifying investments, considering value investing, and maintaining a long-term perspective, investors can mitigate risks and potentially benefit from long-term growth. Remember to conduct thorough research and consider consulting with a financial advisor before making any investment decisions. Stay informed about stock market valuation concerns and adapt your investment strategy accordingly. Understanding BofA's perspective and employing sound investment practices will help you navigate the complexities of the market and achieve your financial goals. Learn more about managing your portfolio amidst stock market valuation concerns.

Featured Posts

-

New Twins For Amber Heard Is Elon Musk The Father

May 30, 2025

New Twins For Amber Heard Is Elon Musk The Father

May 30, 2025 -

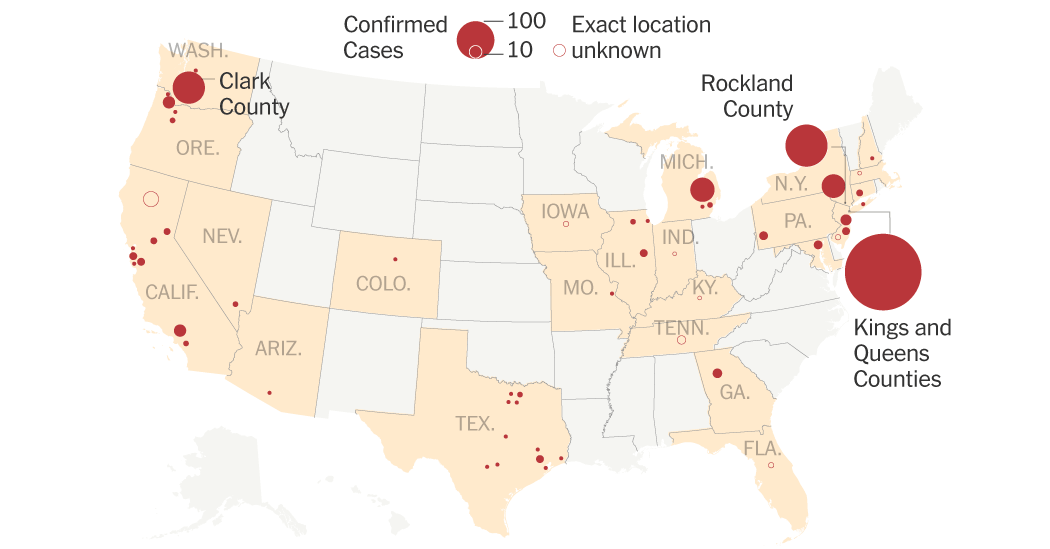

Understanding The U S Measles Outbreak Data And Locations

May 30, 2025

Understanding The U S Measles Outbreak Data And Locations

May 30, 2025 -

Province Expands Advanced Care Paramedic Services In Rural And Northern Manitoba

May 30, 2025

Province Expands Advanced Care Paramedic Services In Rural And Northern Manitoba

May 30, 2025 -

Rising Inflation And Unemployment Fuel Economic Uncertainty

May 30, 2025

Rising Inflation And Unemployment Fuel Economic Uncertainty

May 30, 2025 -

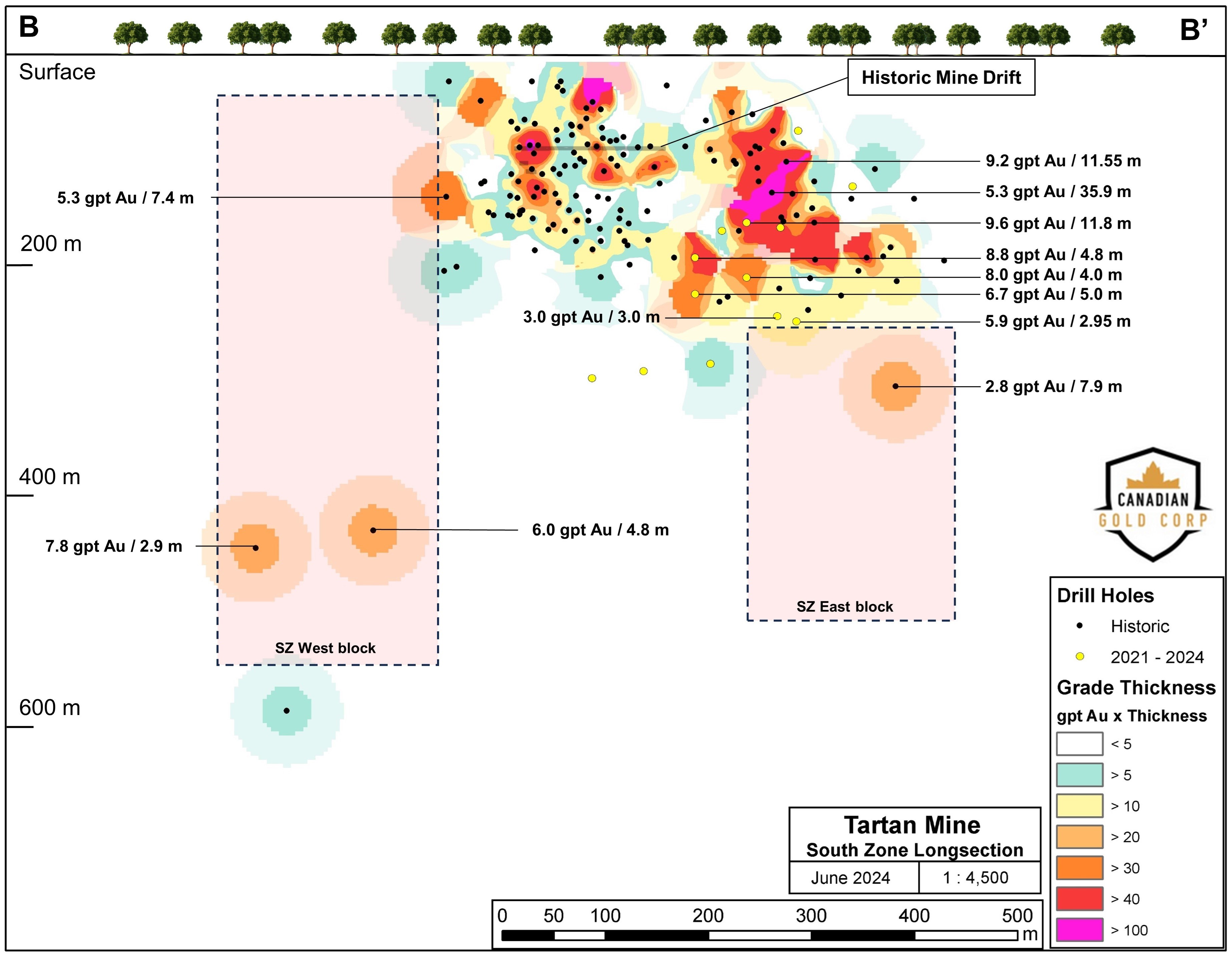

Canadian Gold Corps Tartan Mine Ni 43 101 Update And Preliminary Economic Assessment Funded

May 30, 2025

Canadian Gold Corps Tartan Mine Ni 43 101 Update And Preliminary Economic Assessment Funded

May 30, 2025

Latest Posts

-

Upset Alert Griekspoor Defeats Top Seeded Zverev In Indian Wells

May 31, 2025

Upset Alert Griekspoor Defeats Top Seeded Zverev In Indian Wells

May 31, 2025 -

Staying Safe During The Rise Of Covid 19 Variant Lp 8 1

May 31, 2025

Staying Safe During The Rise Of Covid 19 Variant Lp 8 1

May 31, 2025 -

Alexander Zverev Loses To Tallon Griekspoor At Indian Wells

May 31, 2025

Alexander Zverev Loses To Tallon Griekspoor At Indian Wells

May 31, 2025 -

Covid 19 Case Increase Is A New Variant To Blame Who Investigation

May 31, 2025

Covid 19 Case Increase Is A New Variant To Blame Who Investigation

May 31, 2025 -

Covid 19 Variant Lp 8 1 Impact And Response

May 31, 2025

Covid 19 Variant Lp 8 1 Impact And Response

May 31, 2025