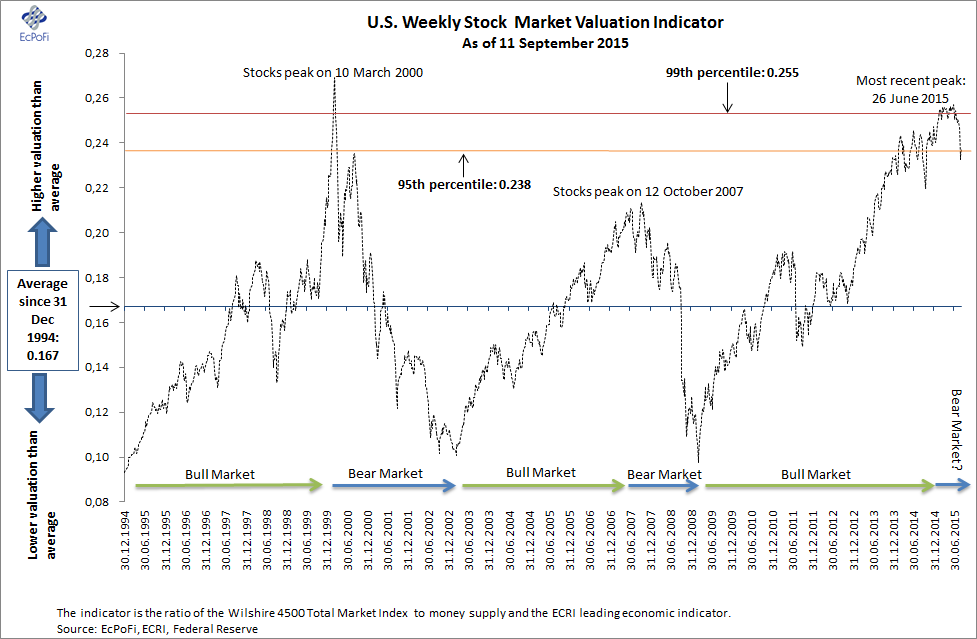

Stock Market Valuation Concerns: BofA's Reassuring Analysis

Table of Contents

BofA's Key Arguments Against Overvaluation

BofA's analysis pushes back against the narrative of widespread stock market overvaluation, presenting a more balanced view. They base their arguments on several key factors:

Earnings Growth Projections

BofA emphasizes the crucial role of future earnings growth in assessing equity valuation. Simply looking at current price-to-earnings (P/E) ratios can be misleading without considering the potential for future earnings increases.

- Projected Earnings Growth: They highlight projected earnings growth across various sectors, suggesting that this growth may offset currently high P/E ratios. Specific sectors showing strong potential are often mentioned in their reports.

- Sophisticated Forecasting Models: BofA employs sophisticated forecasting methodologies, likely including discounted cash flow (DCF) analysis and other quantitative models, to predict future earnings. These models incorporate various macroeconomic factors and company-specific data to arrive at their projections.

- Long-Term Growth Potential: The focus is not solely on short-term earnings but also on the long-term growth potential of companies and the overall market. This long-term perspective is crucial in mitigating the impact of short-term market fluctuations.

Interest Rate Impact and Valuation

Rising interest rates significantly impact market valuation. BofA's analysis carefully considers this impact.

- Interest Rate Hikes and Valuation Models: BofA's valuation models explicitly factor in projected interest rate hikes, acknowledging the inverse relationship between bond yields and equity valuations. Higher interest rates generally lead to lower equity valuations as investors shift to higher-yielding bonds.

- Historical Context: BofA's analysis likely compares current interest rates to historical levels, providing context and highlighting whether current rates are exceptionally high or within a reasonable range historically. This historical perspective helps to assess the potential impact on stock market valuation.

- Yield Curve Analysis: They likely incorporate yield curve analysis into their models, assessing the shape of the yield curve to gauge the market's expectations for future interest rate movements. An inverted yield curve is often seen as a predictor of potential recessions.

Valuation Metrics Beyond P/E Ratios

BofA advocates for a holistic approach to market valuation, going beyond the commonly used P/E ratio.

- Multi-Metric Approach: They utilize a wider array of valuation metrics, including Price-to-Sales (P/S), Price-to-Book (P/B), and Enterprise Value to EBITDA (EV/EBITDA). This multi-faceted approach provides a more comprehensive picture of a company's value.

- Limitations of P/E Ratios: The analysis highlights the limitations of relying solely on P/E ratios, emphasizing that they can be influenced by accounting practices and don't always capture the complete financial picture.

- Contextualizing Valuation Metrics: The importance of contextualizing these metrics is stressed, comparing them across sectors and over time to arrive at more accurate conclusions about stock market valuation.

Addressing Recessionary Fears and Market Volatility

BofA's analysis directly addresses the prevalent recession concerns impacting investor sentiment and stock market valuation.

BofA's Recessionary Outlook

BofA provides a nuanced outlook on the possibility and severity of a potential recession.

- Probability Assessment: Their analysis likely assesses the probability of a recession, considering various economic indicators such as inflation, unemployment rates, and consumer spending.

- Economic Indicators: Specific economic indicators tracked by BofA are often mentioned in their reports, providing transparency and supporting their recessionary outlook.

- Mitigating Factors: The analysis may also highlight potential mitigating factors that could lessen the impact of a recession on the stock market, such as government intervention or resilient consumer spending.

Strategies for Navigating Market Uncertainty

BofA offers practical investment strategies to navigate the current market uncertainty.

- Diversification: The importance of diversification is emphasized, suggesting a balanced portfolio across different asset classes and sectors to mitigate risk.

- Defensive Stocks: During periods of uncertainty, they may recommend favoring defensive stocks—companies less susceptible to economic downturns—as part of a broader investment strategy.

- Long-Term Perspective: Maintaining a long-term investment horizon is recommended, emphasizing that short-term market fluctuations should not dictate long-term investment decisions.

Conclusion

BofA's analysis offers a counterpoint to the widespread concerns about stock market valuation. By considering future earnings growth, addressing the impact of interest rates, and employing a multi-faceted valuation approach, BofA presents a more reassuring outlook. While acknowledging the risks associated with market volatility and potential recessionary pressures, their analysis suggests that current valuations may not be as overextended as some fear. However, investors should carefully consider their own risk tolerance and investment timelines. Understanding BofA's reasoning, and conducting your own thorough research, is crucial for making informed decisions regarding your stock market investments and managing your concerns around current market valuation. For a deeper dive into BofA's research and other valuable perspectives on stock market valuation, be sure to consult reputable financial resources and consider seeking professional financial advice.

Featured Posts

-

Understanding Amanda Bynes Journey Through Public Scrutiny

May 18, 2025

Understanding Amanda Bynes Journey Through Public Scrutiny

May 18, 2025 -

House Gop Tax Bill In Jeopardy Conservative Demands Halt Progress

May 18, 2025

House Gop Tax Bill In Jeopardy Conservative Demands Halt Progress

May 18, 2025 -

Confortos Path To Following Hernandezs Dodgers Impact

May 18, 2025

Confortos Path To Following Hernandezs Dodgers Impact

May 18, 2025 -

Maneskins Damiano David Debut Solo Album Funny Little Fears Announced

May 18, 2025

Maneskins Damiano David Debut Solo Album Funny Little Fears Announced

May 18, 2025 -

Cassie And Alex Fines Red Carpet Appearance Pregnant Cassies Debut

May 18, 2025

Cassie And Alex Fines Red Carpet Appearance Pregnant Cassies Debut

May 18, 2025

Latest Posts

-

Southwest Washingtons Economic Outlook Navigating Tariff Challenges

May 18, 2025

Southwest Washingtons Economic Outlook Navigating Tariff Challenges

May 18, 2025 -

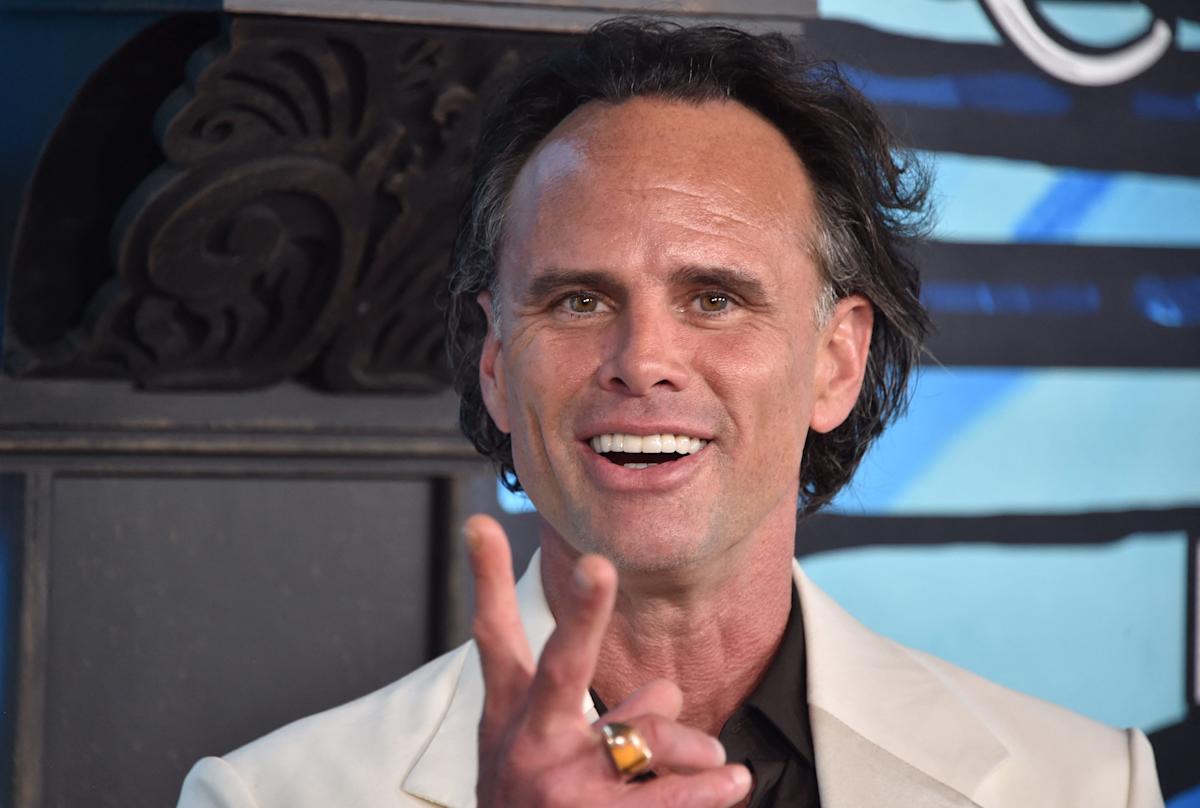

White Lotus Fan Theories Walton Goggins Snl Monologue

May 18, 2025

White Lotus Fan Theories Walton Goggins Snl Monologue

May 18, 2025 -

Snls Jack Black Episode Ego Nwodims Crowd Work And Other Memorable Moments

May 18, 2025

Snls Jack Black Episode Ego Nwodims Crowd Work And Other Memorable Moments

May 18, 2025 -

Webby Awards 2024 Taylor Swift Kendrick Lamar And Simone Biles Among The Winners

May 18, 2025

Webby Awards 2024 Taylor Swift Kendrick Lamar And Simone Biles Among The Winners

May 18, 2025 -

See Spencer Brown Live Audio Sf Concert May 2nd 2025

May 18, 2025

See Spencer Brown Live Audio Sf Concert May 2nd 2025

May 18, 2025