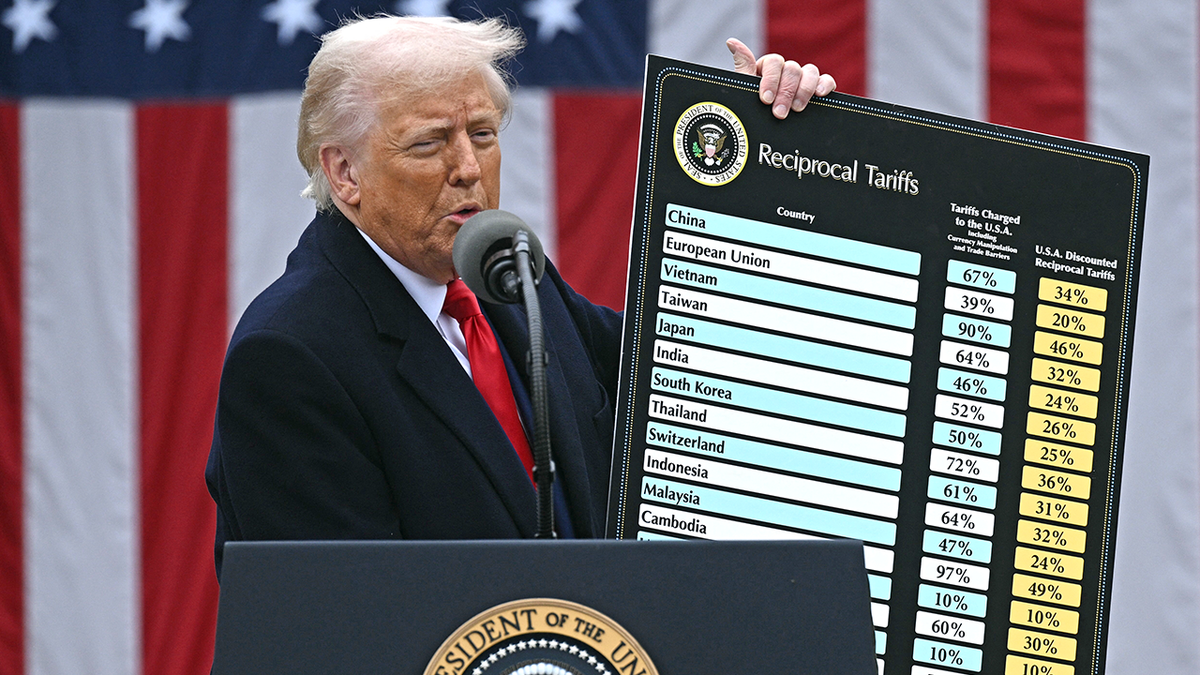

Stock Market Volatility: Amsterdam Exchange Down 2% Post-Trump Tariff Announcement

Table of Contents

The Immediate Impact of Trump's Tariff Announcement on the Amsterdam Exchange

Sharp Decline and Trading Volume

The Amsterdam Exchange's 2% drop occurred within the first hour of trading following the official announcement of the new tariffs. This marked a significant decline compared to the previous day's relatively stable performance and the preceding week's moderate growth. The magnitude of the fall, coupled with a substantial surge in trading volume, clearly indicated heightened investor anxiety and uncertainty. The increased trading activity suggests a significant number of investors were reacting swiftly to the news, either selling off assets or attempting to adjust their portfolios in response to the perceived threat.

- Timing: Immediately following the official announcement.

- Magnitude: A sharp 2% drop within the first hour of trading.

- Trading Volume: A significant increase compared to previous days.

[Insert chart or graph illustrating the 2% drop visually here]

Sector-Specific Impacts

The impact of the tariff announcement wasn't uniform across all sectors. Export-oriented industries and technology companies were particularly hard hit. This is because these sectors are more directly exposed to the ramifications of trade wars and potential retaliatory measures.

- Technology: Suffered a 2.5% drop, due to concerns about disrupted supply chains and reduced demand from the US market.

- Export-Oriented Industries (e.g., Agriculture, Manufacturing): Experienced a 3% decline on average, as tariffs directly impact their ability to compete in the US market.

The greater vulnerability of these sectors highlights the importance of understanding the specific risks associated with different asset classes when constructing an investment portfolio.

Investor Sentiment and Panic Selling

The rapid decline reflects a palpable shift in investor sentiment. Fear and uncertainty, fueled by the unpredictable nature of trade policy, triggered panic selling. Many investors opted to secure their positions by liquidating assets, further exacerbating the market downturn.

- "The market's reaction was immediate and forceful, reflecting a lack of confidence in the stability of the global trading environment," said [Quote from a financial analyst].

Underlying Causes of Increased Stock Market Volatility

Uncertainty and Geopolitical Risk

Trump's tariffs inject significant uncertainty into the global economy. Businesses struggle to plan for the future, facing fluctuating costs and unpredictable market access. The threat of retaliatory tariffs from other countries adds another layer of complexity, creating a volatile and unpredictable geopolitical landscape.

- Global Impact: Trade wars disrupt established supply chains and stifle international trade, negatively affecting global economic growth.

- Unpredictability: The fluctuating nature of trade policy makes it difficult for businesses to make informed decisions about investment and expansion.

Impact on European Businesses

European businesses, particularly those heavily reliant on US exports, are acutely vulnerable to these tariffs. Reduced market access and increased costs can lead to job losses and potentially slow economic growth across Europe.

- Example: Dutch agricultural exporters face significant challenges due to increased tariffs on their products.

- Potential Consequences: Reduced profitability, job losses, and a potential slowdown in economic activity.

The Role of Currency Fluctuations

The fluctuating value of the Euro against the dollar adds further complexity. A weakening Euro makes European exports more expensive in the US market, compounding the negative impact of the tariffs.

- Impact on Exports: A weaker Euro reduces the competitiveness of European goods in the US market.

- Impact on Imports: A weaker Euro increases the cost of US imports to Europe. This could influence consumer spending and inflation.

Strategies for Navigating Stock Market Volatility

Diversification and Risk Management

Diversification is a cornerstone of effective risk management. By spreading investments across different asset classes (stocks, bonds, real estate, commodities), investors can reduce their exposure to any single market downturn.

- Asset Classes: Diversifying into bonds, real estate, or alternative investments can help mitigate risks associated with stock market volatility.

Long-Term Investing Approach

A long-term perspective is essential when navigating market fluctuations. Short-term market swings are normal, and impulsive reactions based on fear or panic can lead to poor investment decisions.

- Avoid Panic Selling: Resist the urge to sell assets impulsively during periods of market volatility.

Seeking Professional Financial Advice

Consulting with a qualified financial advisor provides personalized guidance tailored to individual circumstances and risk tolerance. Professional expertise can help navigate the complexities of market volatility and develop effective long-term investment strategies.

- Benefits of Professional Advice: Personalized investment plans, risk management strategies, and emotional support during volatile market conditions.

Conclusion: Understanding and Managing Stock Market Volatility in Amsterdam

The 2% drop in the Amsterdam Exchange following Trump's tariff announcement underscores the importance of understanding stock market volatility. This volatility stems from several factors, including the uncertainty created by the tariffs, their direct impact on European businesses, and the influence of currency fluctuations. To effectively manage risk, investors should prioritize diversification, adopt a long-term investment approach, and consider seeking professional financial advice. Stay informed about market trends, carefully consider your investment risk tolerance, and seek professional guidance to make sound investment decisions in the face of stock market volatility. Further research into Amsterdam Exchange performance and strategies for mitigating investment risk related to market fluctuations is highly recommended.

Featured Posts

-

Dazi E Mercati Finanziari Analisi Dell Impatto Della Crisi Ue

May 25, 2025

Dazi E Mercati Finanziari Analisi Dell Impatto Della Crisi Ue

May 25, 2025 -

Tik Tok Tourist Boom Amsterdam Residents File Lawsuit Over Snack Bar Crowds

May 25, 2025

Tik Tok Tourist Boom Amsterdam Residents File Lawsuit Over Snack Bar Crowds

May 25, 2025 -

Amundi Msci World Ex Us Ucits Etf Acc Understanding Net Asset Value Nav

May 25, 2025

Amundi Msci World Ex Us Ucits Etf Acc Understanding Net Asset Value Nav

May 25, 2025 -

From Grace To Disaster 17 Celebrities Whose Reputations Imploded

May 25, 2025

From Grace To Disaster 17 Celebrities Whose Reputations Imploded

May 25, 2025 -

Malaysia Ex Pm Najibs Alleged Role In 2002 French Submarine Bribery Scandal

May 25, 2025

Malaysia Ex Pm Najibs Alleged Role In 2002 French Submarine Bribery Scandal

May 25, 2025

Latest Posts

-

The Sutton Hoo Ship Burial Evidence Of Sixth Century Cremation Practices

May 25, 2025

The Sutton Hoo Ship Burial Evidence Of Sixth Century Cremation Practices

May 25, 2025 -

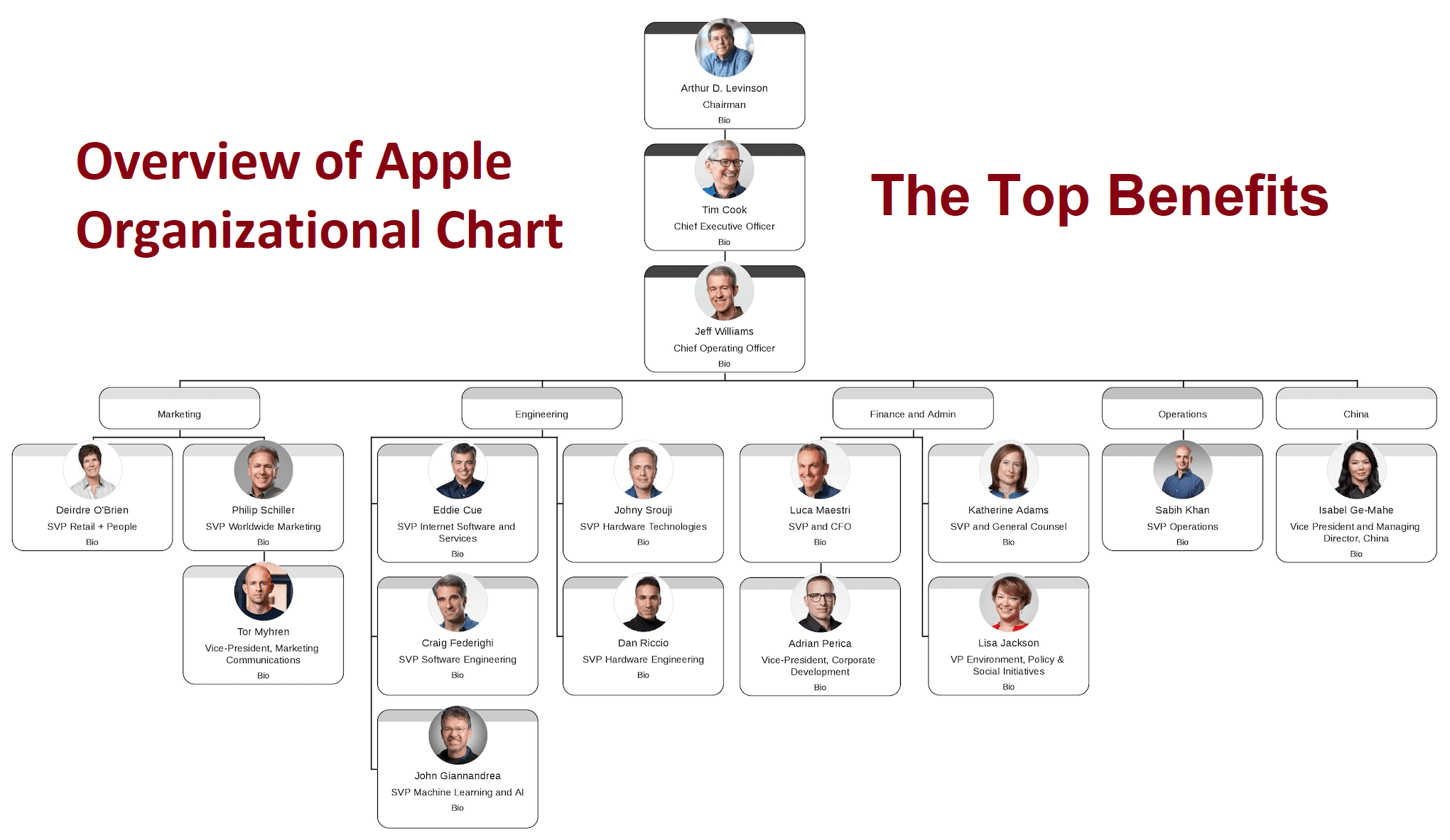

Is 2023 Apple Ceo Tim Cooks Worst Year Yet

May 25, 2025

Is 2023 Apple Ceo Tim Cooks Worst Year Yet

May 25, 2025 -

Sutton Hoos Mysterious Sixth Century Vessel A Burial Urn For Cremated Remains

May 25, 2025

Sutton Hoos Mysterious Sixth Century Vessel A Burial Urn For Cremated Remains

May 25, 2025 -

Tim Cooks Challenging 2023 Apples Struggles

May 25, 2025

Tim Cooks Challenging 2023 Apples Struggles

May 25, 2025 -

Apple Ceo Tim Cook A Difficult Year

May 25, 2025

Apple Ceo Tim Cook A Difficult Year

May 25, 2025