Amundi MSCI World Ex-US UCITS ETF Acc: Understanding Net Asset Value (NAV)

Table of Contents

What is Net Asset Value (NAV) and how is it calculated for the Amundi MSCI World ex-US UCITS ETF Acc?

Net Asset Value (NAV) represents the net value of an ETF's assets minus its liabilities, per share. For the Amundi MSCI World ex-US UCITS ETF Acc, this means calculating the total value of all the underlying securities (stocks, primarily, representing a broad range of companies outside the US) held within the ETF, then subtracting any expenses or liabilities.

The calculation considers several factors:

- Market Value of Underlying Assets: The primary component is the current market value of each stock within the ETF's portfolio. These values fluctuate constantly based on market conditions.

- Expenses and Fees: The ETF's management fees, administrative costs, and other expenses are deducted from the total asset value. These fees are crucial as they directly impact the NAV.

- Liabilities: Any outstanding liabilities the ETF holds are also subtracted from the total asset value.

Here's a step-by-step breakdown of the NAV calculation process:

- Step 1: Determine the market value of each security in the ETF portfolio.

- Step 2: Sum the market values of all securities to obtain the total asset value.

- Step 3: Deduct all expenses and liabilities from the total asset value.

- Step 4: Divide the resulting net asset value by the total number of outstanding ETF shares. This provides the NAV per share.

NAV updates are typically daily, reflecting the closing prices of the underlying assets. There might be slight discrepancies between the bid and ask price of the ETF and its NAV due to market liquidity and trading activity.

How to find the NAV of your Amundi MSCI World ex-US UCITS ETF Acc?

Finding the NAV of your Amundi MSCI World ex-US UCITS ETF Acc is straightforward. You can access this information from various sources:

- Amundi Website: The official Amundi website is the most reliable source. Look for fund factsheets or daily pricing data.

- Financial News Websites: Many financial news sources (like Bloomberg, Yahoo Finance, Google Finance) provide ETF NAV data. Search using the ETF ticker symbol.

- Brokerage Platforms: Your brokerage account will display the NAV of your holdings alongside the current market price.

Here are some tips for interpreting NAV data:

- Consistent Source: Stick to one reliable source to ensure consistent data interpretation.

- Time Zone: Be mindful of the time zone used for NAV reporting.

- Potential Delays: There might be a slight delay between market close and the official NAV update.

Using NAV to Track Performance and Make Informed Investment Decisions with the Amundi MSCI World ex-US UCITS ETF Acc

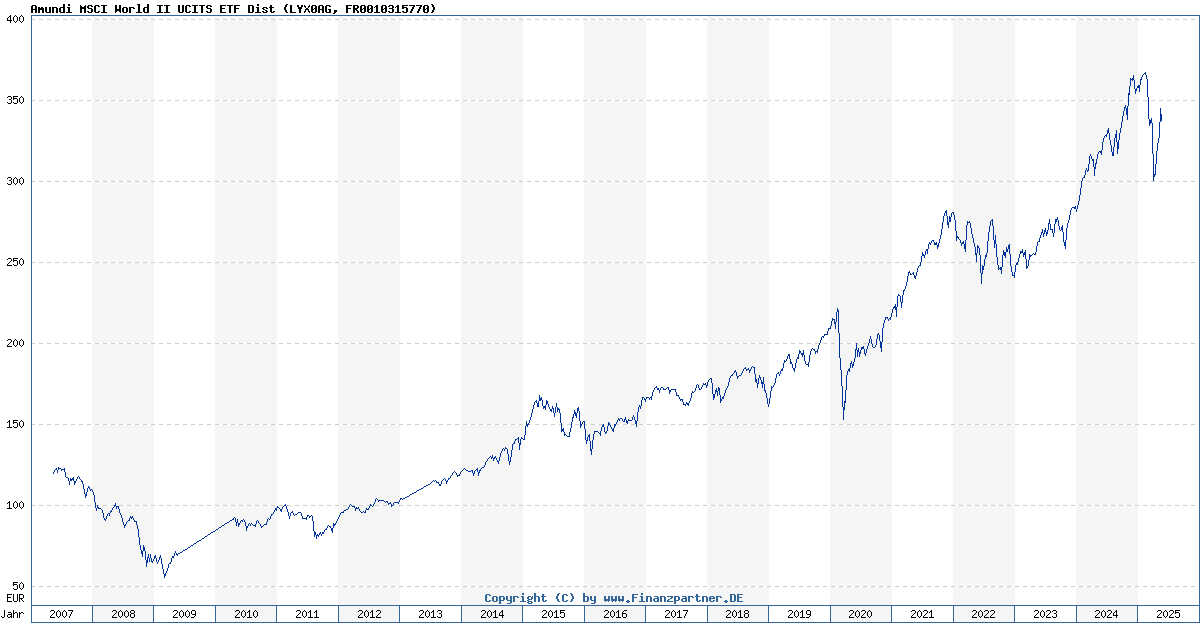

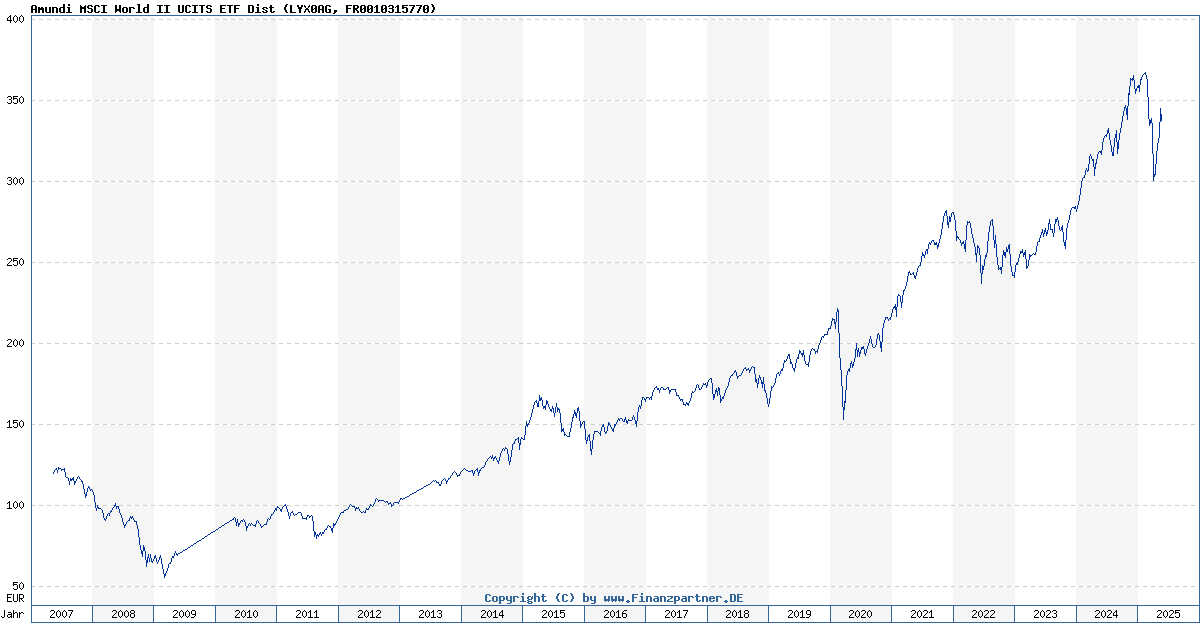

Monitoring your Amundi MSCI World ex-US UCITS ETF Acc's NAV is essential for tracking investment returns. By comparing the NAV over time, you can assess growth or decline in your investment. For instance, a consistently rising NAV suggests positive performance.

- Performance Analysis: Regularly compare the NAV against your initial investment to calculate your returns.

- Market Trends: Understand how NAV changes in relation to broader market trends. A drop in NAV might reflect a market correction, not necessarily poor ETF performance.

- Buy/Sell Decisions: While not the sole determinant, NAV can inform your buy/sell decisions. Consider a lower NAV as a potential buying opportunity (depending on market analysis), and a significantly higher NAV as a potential selling point, considering capital gains and your investment goals.

Understanding factors influencing the NAV of the Amundi MSCI World ex-US UCITS ETF Acc

Several factors influence the NAV of the Amundi MSCI World ex-US UCITS ETF Acc:

- Market Fluctuations: Changes in the stock market directly impact the NAV. A rising market generally leads to a higher NAV, and vice-versa.

- Currency Exchange Rates: As the ETF invests in non-US companies, currency exchange rate fluctuations can influence the NAV (if your account is in a different currency).

- Dividends and Capital Gains Distributions: Dividend payments and capital gains distributions from underlying holdings can slightly affect the NAV, usually through a reduction in the NAV followed by a distribution payment.

Here are some specific factors to consider:

- External Factors: Global economic events, geopolitical instability, and sector-specific news all play a role in influencing the NAV.

- Internal Factors: Changes in the ETF's underlying holdings, adjustments to the management fees, and any extraordinary expenses can also affect the NAV.

- Interaction of Factors: These factors often interact, making it important to consider their combined effect on the NAV.

Conclusion: Mastering Net Asset Value for Your Amundi MSCI World ex-US UCITS ETF Acc Investment

Understanding the Net Asset Value of your Amundi MSCI World ex-US UCITS ETF Acc is crucial for successful investing. Regularly checking your NAV, alongside broader market analysis, empowers you to make informed decisions about buying, selling, or holding your investment. Use this knowledge to optimize your investment strategy and achieve your financial goals. For more detailed information, consult the Amundi website or your financial advisor.

Featured Posts

-

Glastonbury Festival Unannounced Us Band Fuels Fan Excitement

May 25, 2025

Glastonbury Festival Unannounced Us Band Fuels Fan Excitement

May 25, 2025 -

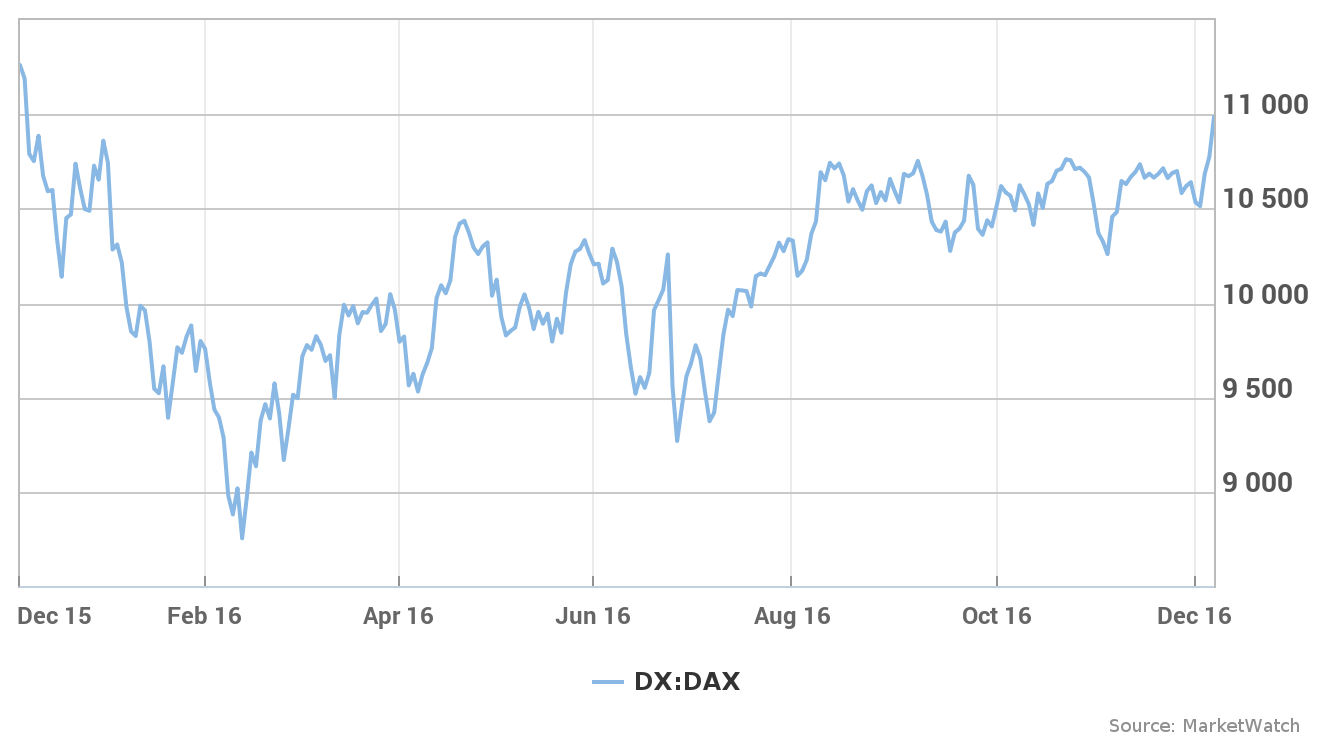

Avrupa Borsalari Duesueste Stoxx Europe 600 Ve Dax 40 Endekslerinde Gerileme 16 Nisan 2025

May 25, 2025

Avrupa Borsalari Duesueste Stoxx Europe 600 Ve Dax 40 Endekslerinde Gerileme 16 Nisan 2025

May 25, 2025 -

Porsche Now

May 25, 2025

Porsche Now

May 25, 2025 -

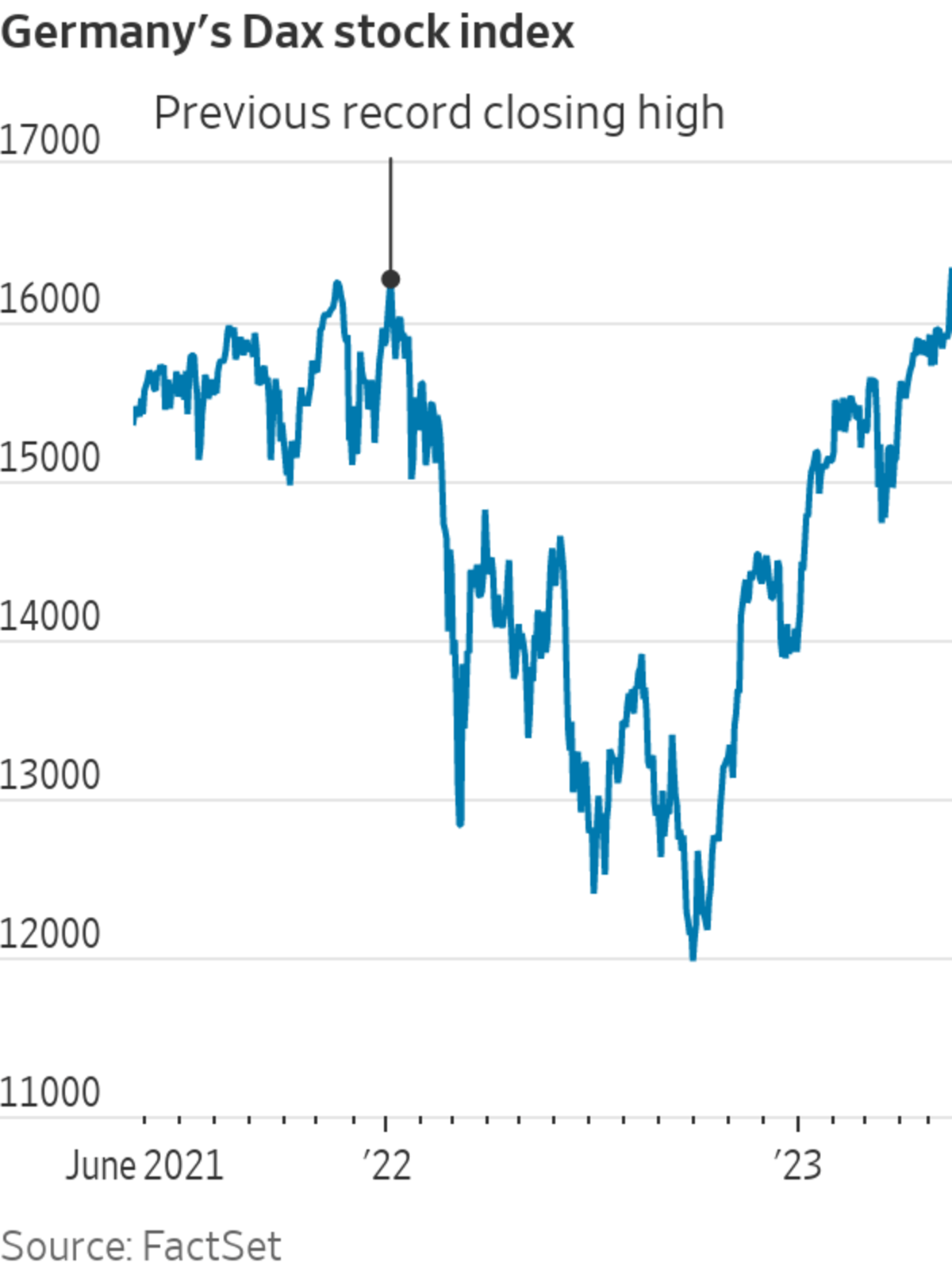

Germanys Dax Soars Could Wall Streets Recovery Cast A Shadow

May 25, 2025

Germanys Dax Soars Could Wall Streets Recovery Cast A Shadow

May 25, 2025 -

The Truth About Lauryn Goodmans Move To Italy Following Kyle Walkers Transfer

May 25, 2025

The Truth About Lauryn Goodmans Move To Italy Following Kyle Walkers Transfer

May 25, 2025

Latest Posts

-

Strong Pmi Data Supports Dow Jones Continued Cautious Upward Trend

May 25, 2025

Strong Pmi Data Supports Dow Jones Continued Cautious Upward Trend

May 25, 2025 -

Dow Jones Climbs On Positive Pmi Report A Cautious Ascent

May 25, 2025

Dow Jones Climbs On Positive Pmi Report A Cautious Ascent

May 25, 2025 -

Dow Jones Index Cautious Climb Continues After Strong Pmi Data

May 25, 2025

Dow Jones Index Cautious Climb Continues After Strong Pmi Data

May 25, 2025 -

18 Brazilians Face Charges In Massachusetts Gun Trafficking Ring

May 25, 2025

18 Brazilians Face Charges In Massachusetts Gun Trafficking Ring

May 25, 2025 -

The Importance Of Net Asset Value Nav In The Amundi Dow Jones Industrial Average Ucits Etf

May 25, 2025

The Importance Of Net Asset Value Nav In The Amundi Dow Jones Industrial Average Ucits Etf

May 25, 2025