Stock Market Volatility: Analyzing Dow Futures In Light Of China's Economic Support Package

Table of Contents

Understanding the Chinese Economic Support Package

China's recent economic slowdown has prompted a substantial intervention aimed at boosting growth and stabilizing the economy. This support package is multifaceted and carries significant implications for global markets, particularly the Dow futures.

Key Components of the Package:

The package comprises several key elements designed to stimulate various sectors of the Chinese economy:

- Increased Infrastructure Spending: Massive investment in infrastructure projects, including roads, railways, and renewable energy, is intended to create jobs and stimulate economic activity. This could potentially inject trillions of Yuan into the economy.

- Tax Cuts and Incentives for Businesses: Reductions in corporate and individual taxes, alongside targeted incentives for small and medium-sized enterprises (SMEs), aim to encourage investment and consumption. Analysts estimate this could lead to a significant boost in business confidence.

- Support for the Real Estate Sector: Measures to alleviate the ongoing crisis in the real estate market, including potential easing of lending restrictions, are designed to prevent a broader economic downturn. This sector's impact on the Chinese economy is substantial, and its stabilization is a key priority.

- Boosting Consumer Confidence: Initiatives to support consumption, such as subsidies and promotional campaigns, aim to increase domestic demand and stimulate economic growth.

These measures, while ambitious, are predicted by some economists to add X percentage points to China's GDP growth in the next year (Source needed – replace X with actual data if available). The intended goal is to bolster growth, stabilize the financial system, and restore confidence both domestically and internationally.

Market Reaction to the Announcement:

The initial market reaction to the announcement was mixed. While there was an initial surge in some Chinese stocks and related commodities, the Dow futures experienced a more nuanced response. We saw an initial upward tick, followed by some consolidation and then a period of increased volatility.

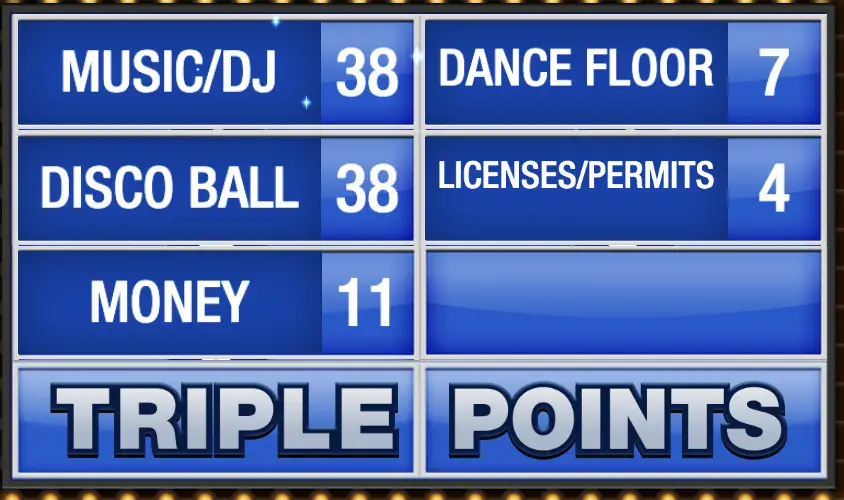

[Insert chart here illustrating market movements if available].

Analyst sentiment was generally cautiously optimistic, with many noting the potential positive long-term effects of the stimulus but also highlighting the uncertainties surrounding its implementation and effectiveness. The short-term impact, however, was largely characterized by increased market uncertainty.

Impact on Dow Futures

The Chinese economy and the US economy are deeply intertwined through global trade, supply chains, and financial markets. Consequently, significant economic events in China can have a notable impact on Dow futures.

Correlation Between Chinese Economy and Dow Futures:

The interconnected nature of the global economy means that a slowdown or significant policy shift in China can reverberate through global markets. This is especially true for sectors heavily reliant on Chinese manufacturing and exports. For example, technology companies with significant manufacturing operations in China could see their stock prices affected by changes in Chinese economic policy.

- Global Trade and Supply Chains: Disruptions in Chinese supply chains, even minor ones, can have cascading effects on global manufacturing and logistics, impacting US companies and their stock performance.

- Specific Sectors Heavily Impacted: Sectors like technology, manufacturing, and consumer goods are particularly sensitive to changes in the Chinese economy. Dow futures, reflecting the overall US market, will naturally respond to shifts in these sectors.

Analyzing Volatility in Dow Futures Contracts:

Following the announcement of the economic support package, volatility in Dow futures contracts increased significantly. This is reflected in a rise in the VIX (Volatility Index), a key indicator of market uncertainty.

- Use of Volatility Indicators: The VIX provides a measure of market expectations of near-term volatility. A rising VIX suggests investors anticipate increased price swings.

- Implications of Increased Volatility: Higher volatility creates both opportunities and risks for investors in Dow futures. Sharp price swings can lead to significant gains or losses, depending on the trading strategy employed.

Strategies for Navigating Market Volatility

Increased volatility presents challenges, but it also presents opportunities for savvy investors. Effective risk management is paramount during such periods.

Risk Management Techniques for Dow Futures Trading:

Successfully navigating volatile markets requires a disciplined approach to risk management:

- Hedging Strategies: Hedging involves using financial instruments to offset potential losses in other positions. This can be particularly valuable during periods of increased uncertainty.

- Diversification: Spreading investments across different asset classes and sectors reduces the overall risk exposure. Don't put all your eggs in one basket.

- Stop-Loss Orders: Setting stop-loss orders automatically limits potential losses by selling a position if the price falls below a predetermined level.

Investment Opportunities in Light of the News:

While volatility creates uncertainty, it can also unveil opportunities.

- Sectors to Watch: Sectors that might benefit from China's stimulus include infrastructure, renewable energy, and potentially consumer goods if the stimulus boosts consumer spending. Sectors dependent on Chinese manufacturing might see initial downward pressure, creating potential buying opportunities for long-term investors after a thorough analysis.

- Importance of Research and Due Diligence: Thorough research and due diligence are crucial before making any investment decisions. Understanding the potential risks and rewards associated with each investment is essential.

Conclusion

China's economic support package has undeniably created a period of increased stock market volatility, significantly impacting Dow futures. The interconnected nature of global economies means events in China directly affect US markets. Understanding the correlation between the Chinese economy and Dow futures, coupled with effective risk management strategies, is critical for navigating this dynamic environment. Investors should carefully analyze the implications of this package, diversify their portfolios, and implement robust risk management techniques.

Call to Action: Conduct thorough research, develop a comprehensive investment strategy that accounts for stock market volatility, and stay informed on future developments concerning China's economic policies and their impact on Dow futures and global markets. Understanding Dow futures movements in relation to global economic shifts is crucial for making effective investment decisions.

Featured Posts

-

Mission Impossible Dead Reckoning Part Two Unveiling The Plane Stunt Bts Footage

Apr 26, 2025

Mission Impossible Dead Reckoning Part Two Unveiling The Plane Stunt Bts Footage

Apr 26, 2025 -

The Portnoy Newsom Feud What You Need To Know

Apr 26, 2025

The Portnoy Newsom Feud What You Need To Know

Apr 26, 2025 -

Royal Netherlands Navy Bolsters Marine Security With Fugro Damen Partnership

Apr 26, 2025

Royal Netherlands Navy Bolsters Marine Security With Fugro Damen Partnership

Apr 26, 2025 -

18 Projets De Menuiserie Canadiens Francais Recompenses Aux Cecobois 2025

Apr 26, 2025

18 Projets De Menuiserie Canadiens Francais Recompenses Aux Cecobois 2025

Apr 26, 2025 -

Will George Santos Go To Prison His Pre Sentencing Tirade

Apr 26, 2025

Will George Santos Go To Prison His Pre Sentencing Tirade

Apr 26, 2025

Latest Posts

-

The Interplay Between German Politics Bundestag Elections And Dax Fluctuations

Apr 27, 2025

The Interplay Between German Politics Bundestag Elections And Dax Fluctuations

Apr 27, 2025 -

Dax Performance The Influence Of German Politics And Economic Data

Apr 27, 2025

Dax Performance The Influence Of German Politics And Economic Data

Apr 27, 2025 -

How Bundestag Elections And Key Business Figures Impact The Dax

Apr 27, 2025

How Bundestag Elections And Key Business Figures Impact The Dax

Apr 27, 2025 -

Dax Bundestag Elections And Economic Indicators A Comprehensive Analysis

Apr 27, 2025

Dax Bundestag Elections And Economic Indicators A Comprehensive Analysis

Apr 27, 2025 -

Renewable Energy Growth Pne Group Welcomes Two New Wind Farms

Apr 27, 2025

Renewable Energy Growth Pne Group Welcomes Two New Wind Farms

Apr 27, 2025