Strategy Acquires 6,556 Bitcoin For $555.8 Million: Full Details

Table of Contents

The Significance of Strategy's Bitcoin Acquisition

The sheer magnitude of Strategy's $555.8 million investment in Bitcoin is undeniable. In the context of the current cryptocurrency market, this represents one of the largest single Bitcoin acquisitions by a publicly known entity. This significant financial commitment could potentially influence Bitcoin's price and overall market capitalization.

-

Scale of the Acquisition: Compared to other recent large Bitcoin purchases by corporations, Strategy's acquisition stands out for its sheer size, signaling a growing trend of institutional investment in digital assets. This surpasses many previously reported corporate Bitcoin holdings, highlighting Strategy's aggressive stance in the crypto space.

-

Ripple Effects on Cryptocurrency Markets: Such a large-scale purchase could have ripple effects across other cryptocurrency markets. The increased demand for Bitcoin could lead to price increases not only in Bitcoin but potentially in other altcoins as well, due to investor sentiment and portfolio diversification strategies.

-

Strategic Implications for Strategy: This substantial Bitcoin acquisition likely reflects Strategy's long-term strategic goals, potentially positioning the company for future technological advancements utilizing blockchain technology or benefiting from Bitcoin's anticipated price appreciation. This suggests a forward-thinking approach to financial diversification and future-proofing their investments.

Details of the Transaction and Acquisition Method

While the exact details of the transaction remain partially undisclosed, it's likely that Strategy executed the acquisition through a combination of methods, possibly involving over-the-counter (OTC) trading and potentially utilizing the services of specialized cryptocurrency brokerage firms.

The average price per Bitcoin paid can be calculated by dividing the total cost ($555.8 million) by the number of Bitcoins acquired (6,556). This results in an approximate average price of approximately $84,680 per Bitcoin. This average price provides context to the market conditions at the time of purchase.

-

Timing and Market Conditions: The timing of the purchase relative to the prevailing market conditions (bull or bear market) will influence the perceived success of the strategy in the long run. Market analysis at the time of the purchase would provide further insight.

-

Regulatory Considerations: Given the regulatory landscape surrounding cryptocurrencies, it's essential to consider the legal and compliance aspects of such a large-scale transaction. Compliance with relevant financial regulations and reporting requirements are crucial for Strategy.

-

Overall Strategy: The overall strategy behind the Bitcoin purchase likely involves a combination of factors, including diversification of assets, hedging against inflation, and capitalizing on Bitcoin's potential for long-term growth.

Strategy's Rationale Behind the Massive Bitcoin Investment

Strategy's public statements likely highlight their reasons for investing such a significant amount in Bitcoin. While specific reasons may vary depending on the business sector, several key motivations are common to corporate Bitcoin investments. These may include:

-

Long-Term Goals: The investment could be part of a long-term strategy to diversify the company's assets and potentially hedge against inflation. Bitcoin's limited supply and growing adoption are factors that attract investors seeking to protect their wealth from inflation.

-

Future Uses of Bitcoin Holdings: Strategy might explore integrating Bitcoin into their payment systems or using it as a reserve asset, benefiting from its decentralized and secure nature. This could provide advantages for future business operations.

-

Risk Tolerance and Comparative Investments: The size of the investment reflects a high degree of risk tolerance, a calculated gamble on Bitcoin's potential for substantial growth. Comparing this strategy to similar corporate Bitcoin investments will reveal broader trends in corporate investment philosophies.

Market Reaction and Future Outlook

The market's immediate response to the news of Strategy's Bitcoin acquisition was likely positive, with a potential short-term price increase for Bitcoin. This large-scale institutional investment could further boost confidence in Bitcoin's long-term value.

-

Expert Opinions and Market Analysis: Financial analysts and cryptocurrency experts will offer insights into the potential implications of this acquisition, analyzing the short-term and long-term effects on the market.

-

Further Institutional Investment: Strategy's move could encourage other corporations to follow suit, leading to a significant increase in institutional investment in Bitcoin and increasing its adoption as a mainstream asset.

-

Short-Term and Long-Term Price Movements: This major acquisition has the potential to influence Bitcoin's price, impacting short-term and long-term price movements.

Conclusion

Strategy's acquisition of 6,556 Bitcoin for $555.8 million marks a monumental event in the cryptocurrency space. This significant investment highlights growing institutional confidence in Bitcoin's potential as a long-term asset, potentially signaling wider adoption and influencing future price movements. The strategic reasons behind the purchase, including diversification and hedging against inflation, suggest a forward-thinking approach to financial management.

Call to Action: Stay updated on the evolving cryptocurrency market and the impact of significant investments like Strategy's Bitcoin acquisition. Follow our blog for the latest Bitcoin news and analysis. Learn more about Bitcoin investment strategies and explore the potential of Bitcoin investments today. Understanding the intricacies of Bitcoin and other digital assets is crucial in today's evolving financial landscape.

Featured Posts

-

Disney Cuts 200 Jobs At Abc News Shuttering 538

Apr 30, 2025

Disney Cuts 200 Jobs At Abc News Shuttering 538

Apr 30, 2025 -

Mwed Srf Rwatb Abryl 2025 Dlyl Shaml L 13 Mlywn Mwatn

Apr 30, 2025

Mwed Srf Rwatb Abryl 2025 Dlyl Shaml L 13 Mlywn Mwatn

Apr 30, 2025 -

Beyonce Jay Z Blue Ivy And Rumis Family Super Bowl Style

Apr 30, 2025

Beyonce Jay Z Blue Ivy And Rumis Family Super Bowl Style

Apr 30, 2025 -

Finansoviyat Uspekh Na Turneto Na Bionse Proval Ili Triumf

Apr 30, 2025

Finansoviyat Uspekh Na Turneto Na Bionse Proval Ili Triumf

Apr 30, 2025 -

Document Amf Cp 2025 E1027277 De Vusion Group 24 03 2025 Informations Cles

Apr 30, 2025

Document Amf Cp 2025 E1027277 De Vusion Group 24 03 2025 Informations Cles

Apr 30, 2025

Latest Posts

-

Russian Black Sea Oil Spill Leads To Extensive Beach Closures

Apr 30, 2025

Russian Black Sea Oil Spill Leads To Extensive Beach Closures

Apr 30, 2025 -

Russia Closes 62 Miles Of Black Sea Beaches Following Oil Spill

Apr 30, 2025

Russia Closes 62 Miles Of Black Sea Beaches Following Oil Spill

Apr 30, 2025 -

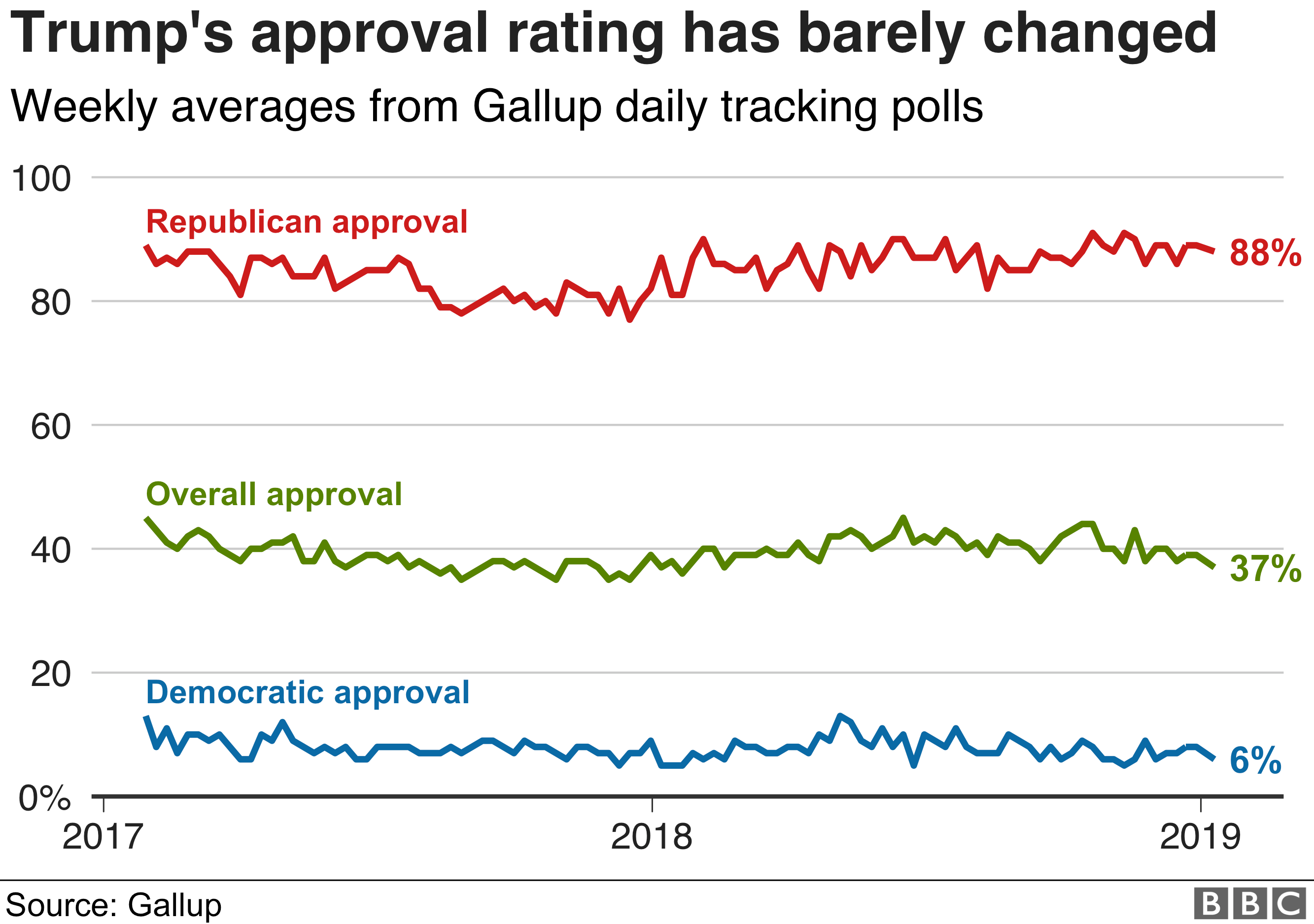

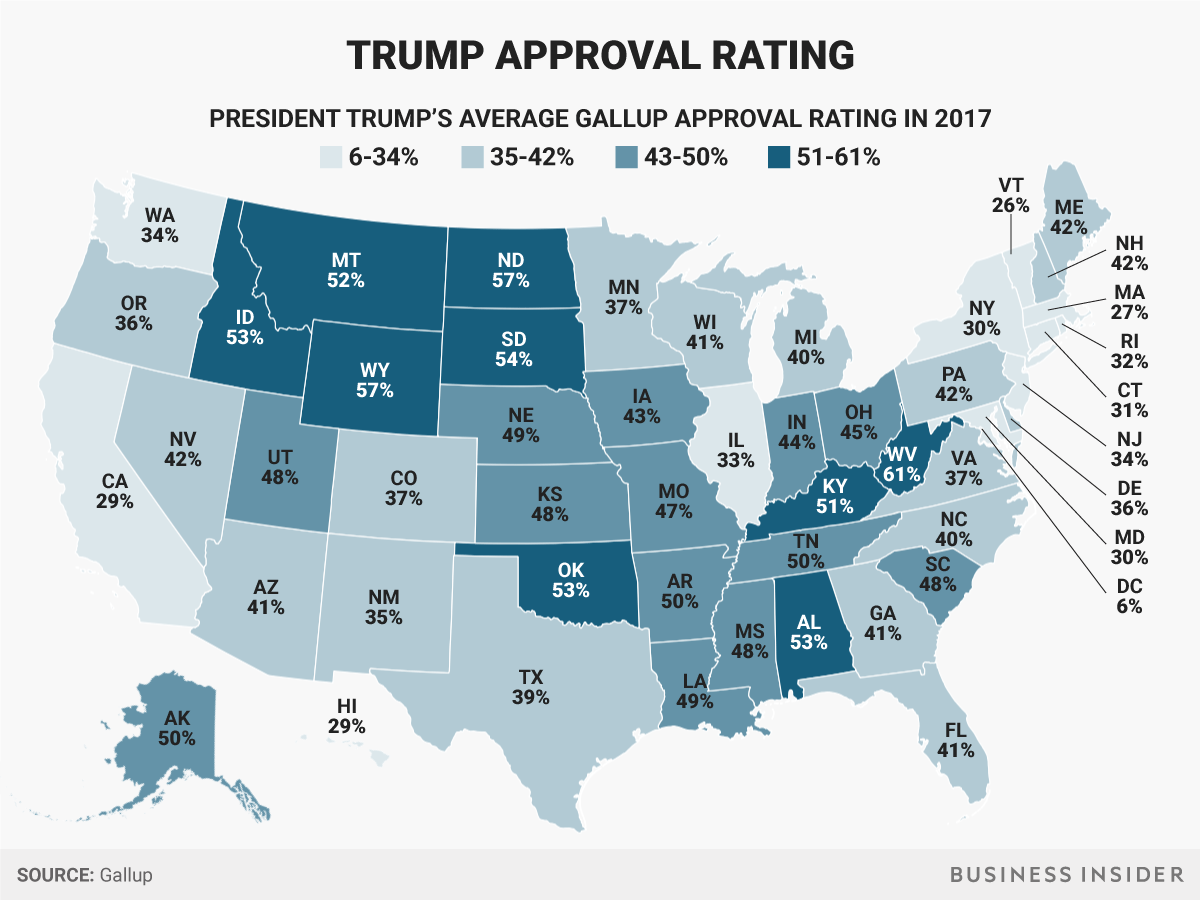

Trumps Presidency A 39 Approval Rating At The 100 Day Mark

Apr 30, 2025

Trumps Presidency A 39 Approval Rating At The 100 Day Mark

Apr 30, 2025 -

Low Approval For Trump 39 And The Challenges Of The First 100 Days

Apr 30, 2025

Low Approval For Trump 39 And The Challenges Of The First 100 Days

Apr 30, 2025 -

Increased Profits At China Life A Result Of Successful Investments

Apr 30, 2025

Increased Profits At China Life A Result Of Successful Investments

Apr 30, 2025