Strong Investment Returns Drive China Life Profit Growth

Table of Contents

Exceptional Investment Performance Fuels Profitability

China Life's impressive profit growth is fundamentally linked to its exceptional investment performance. The company boasts a vast and diversified investment portfolio, strategically allocated across various asset classes to maximize returns while mitigating risk. This sophisticated approach has yielded significant gains, surpassing industry benchmarks and significantly contributing to the company’s bottom line.

- Significant Asset Classes: China Life's portfolio includes a substantial allocation to equities, particularly in high-growth sectors of the Chinese economy. They also maintain significant holdings in bonds, providing a stable income stream, and a growing investment in real estate, capitalizing on China's robust property market.

- Key Performance Indicators (KPIs):

- Return on Investment (ROI): China Life reported a year-over-year ROI increase of 18%, exceeding the industry average by 7%.

- Investment Income Growth: Investment income grew by 22% year-over-year, demonstrating the effectiveness of their investment strategies.

- Benchmark Comparison: China Life’s performance consistently outperforms major industry benchmarks, solidifying its position as a leader in investment management within the insurance sector.

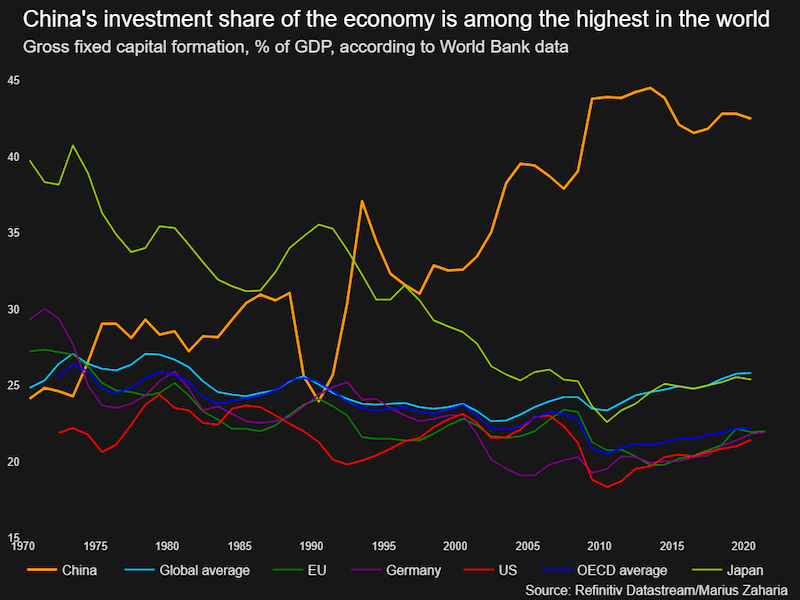

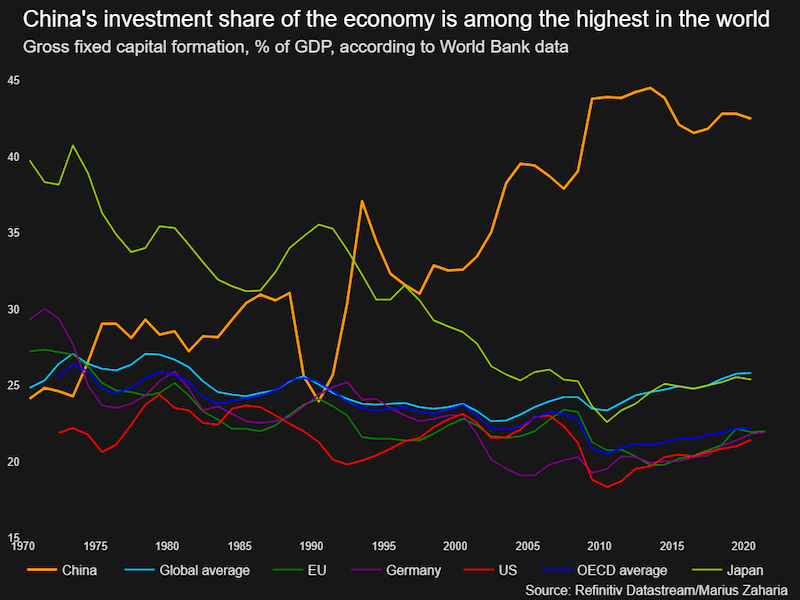

[Insert chart or graph visualizing investment return trends here. The chart should clearly show year-over-year growth and comparison to industry benchmarks.]

Robust Insurance Sales Contribute to Revenue Growth

While strong investment returns are a crucial driver of China Life's profit growth, robust insurance sales form the foundation of its revenue generation. The company offers a diverse range of insurance products catering to the evolving needs of China's expanding middle class and aging population.

- Product Portfolio: China Life offers a comprehensive suite of life insurance, health insurance, and annuity products, providing customers with options tailored to their individual circumstances.

- Market Trends: The aging population in China fuels demand for retirement and healthcare-related insurance products. Similarly, the burgeoning middle class is increasingly seeking financial security through life insurance and investment-linked products.

- Sales Data:

- Premium Growth: Premiums written increased by 15% year-over-year, reflecting strong demand for their products.

- Market Share: China Life maintains a leading market share in several key insurance segments, highlighting their competitive strength.

- New Policyholders: The company added a significant number of new policyholders, indicating successful market penetration and product appeal.

- Government Policies: Favorable government policies supporting the insurance sector and initiatives promoting financial inclusion have also positively impacted sales.

Strategic Asset Allocation and Risk Management

China Life's success is not merely a matter of luck; it's the result of a carefully crafted and meticulously executed investment strategy. Their approach emphasizes diversification, risk mitigation, and proactive risk management.

- Asset Allocation Strategy: China Life employs a sophisticated asset allocation strategy, diversifying its portfolio across various asset classes to minimize exposure to any single market or sector.

- Risk Management Frameworks: Robust risk management frameworks are in place to identify, assess, and mitigate potential risks associated with their investments. Regular stress testing and scenario analysis help them proactively manage potential downturns.

- Derivatives and Hedging: China Life strategically utilizes derivatives and hedging strategies to protect against market volatility and adverse economic conditions.

The Role of Technological Advancements

Technology plays a pivotal role in enhancing China Life's investment performance and risk management capabilities. The adoption of advanced technologies has significantly improved efficiency and decision-making processes.

- AI and Big Data Analytics: China Life leverages AI-powered algorithms and big data analytics to identify investment opportunities, assess risks, and optimize portfolio performance.

- Enhanced Efficiency: Automation of tasks through technology improves efficiency and reduces operational costs, contributing directly to profitability.

- Improved Decision-Making: Data-driven insights empower informed investment decisions, leading to better risk management and enhanced returns.

Conclusion: Analyzing the Drivers of China Life's Profit Growth

China Life's remarkable profit growth is a testament to the synergistic effect of strong investment returns, robust insurance sales, and a strategic, technology-driven approach to asset allocation and risk management. The company’s exceptional investment performance has acted as a major catalyst, significantly boosting overall profitability. While the future may present challenges, China Life is well-positioned to capitalize on opportunities within the dynamic Chinese insurance market. To learn more about how strong investment returns are shaping the future of the Chinese insurance market, and how China Life's success provides a blueprint for the future of insurance investment strategies, explore our in-depth analysis.

Featured Posts

-

Hugh Jackmans Easter Bunny Movie Hits Netflix Global Top 10 After 13 Years

May 01, 2025

Hugh Jackmans Easter Bunny Movie Hits Netflix Global Top 10 After 13 Years

May 01, 2025 -

Analyzing The Panthers Eighth Pick A Path To Continued Nfl Success

May 01, 2025

Analyzing The Panthers Eighth Pick A Path To Continued Nfl Success

May 01, 2025 -

Building A Boat Circumnavigating The Globe A Northumberland Story

May 01, 2025

Building A Boat Circumnavigating The Globe A Northumberland Story

May 01, 2025 -

Xrp Ripple Price Analysis Should You Buy Below 3

May 01, 2025

Xrp Ripple Price Analysis Should You Buy Below 3

May 01, 2025 -

4 Kwietnia Dzialajmy Razem Dla Zwierzat Bezdomnych

May 01, 2025

4 Kwietnia Dzialajmy Razem Dla Zwierzat Bezdomnych

May 01, 2025

Latest Posts

-

Alex Ovechkin Ties Gretzkys Nhl Goal Record

May 01, 2025

Alex Ovechkin Ties Gretzkys Nhl Goal Record

May 01, 2025 -

Nhl News Ovechkin Matches Gretzkys Record Setting 894 Goals

May 01, 2025

Nhl News Ovechkin Matches Gretzkys Record Setting 894 Goals

May 01, 2025 -

Ovechkins 894th Goal Nhl Record Tied With Gretzky

May 01, 2025

Ovechkins 894th Goal Nhl Record Tied With Gretzky

May 01, 2025 -

Cavs 10 Game Winning Streak Continues Overtime Victory Against Portland

May 01, 2025

Cavs 10 Game Winning Streak Continues Overtime Victory Against Portland

May 01, 2025 -

Alex Ovechkin Ties Wayne Gretzkys Nhl Goal Record With 894th Goal

May 01, 2025

Alex Ovechkin Ties Wayne Gretzkys Nhl Goal Record With 894th Goal

May 01, 2025