Strong PMI Data Supports Dow Jones' Continued, Cautious Upward Trend

Table of Contents

Robust PMI Figures Indicate Economic Strength

The Purchasing Managers' Index (PMI) is a key economic indicator reflecting the prevailing direction of economic trends. It's a composite index calculated from surveys of purchasing managers in the manufacturing and services sectors. A PMI reading above 50 generally indicates expansion, while a reading below 50 suggests contraction. Recent PMI figures paint a largely positive picture. The August PMI reading for manufacturing came in at 52.5, exceeding expectations and suggesting continued growth in the sector. The services sector also showed robust growth, indicating a healthy overall economy.

- Strong PMI growth in key sectors: The technology and healthcare sectors showed particularly strong PMI growth, contributing significantly to the overall positive trend. This signals strong demand and investment in these key areas.

- Positive impact on consumer confidence: Strong PMI data generally boosts consumer confidence, leading to increased spending and further economic growth. This positive feedback loop reinforces the upward trend.

- Implications for future investment and economic growth: The robust PMI figures suggest a healthy economic outlook, encouraging further investment and supporting continued economic expansion in the coming months. This positive sentiment is directly reflected in the stock market.

Dow Jones' Cautious Upward Trajectory: A Detailed Look

The Dow Jones Industrial Average has shown a cautious upward trajectory in recent months, reflecting the mixed signals from the economy. While the index has climbed steadily, it hasn't experienced the dramatic surges seen in previous periods of rapid growth. This cautious optimism is a reflection of the underlying economic realities.

- Factors contributing to the cautious upward movement: Inflation concerns, persistent interest rate hikes by the Federal Reserve, and geopolitical uncertainties are all contributing to the measured pace of the Dow's ascent. Investors remain wary despite the positive PMI data.

- Key sectors driving the Dow's growth: While the technology and healthcare sectors are showing strength, other sectors, such as energy and consumer staples, are also contributing to the Dow's overall upward movement.

- Investor sentiment and market volatility: Investor sentiment remains mixed, with some expressing concerns about future economic prospects. This is reflected in the continued market volatility, even as the Dow continues its slow climb.

Correlation Between PMI and Dow Jones Performance

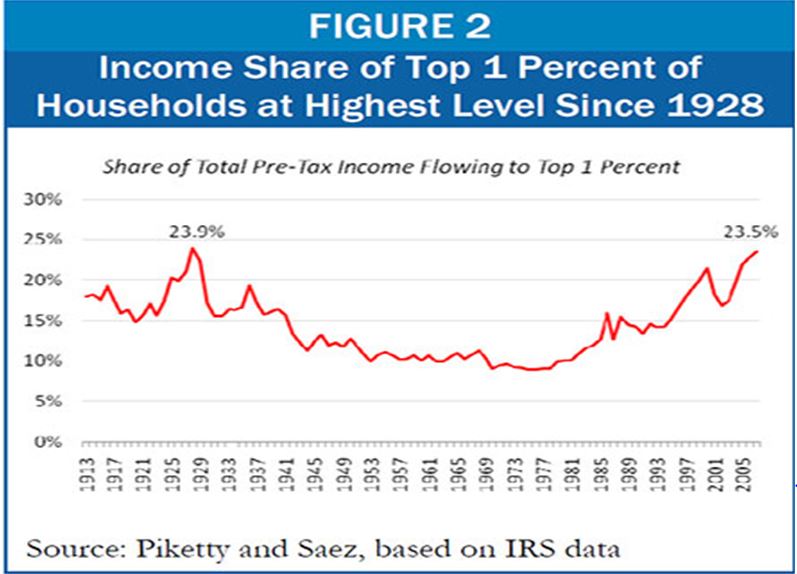

Historically, there's a strong correlation between PMI data and the performance of the Dow Jones. Strong PMI readings often precede positive movements in the Dow, reflecting a causal link between robust economic indicators and increased investor confidence.

- Past instances of strong PMI correlating with positive Dow Jones performance: Numerous instances throughout the past decade demonstrate a clear correlation between strong PMI figures and subsequent positive performance of the Dow Jones. Periods of strong economic expansion, as reflected by PMI, have consistently translated into higher stock prices.

- Limitations in interpreting the correlation: It's crucial to remember that correlation doesn't equal causation. While strong PMI data often suggests positive market movement, other factors can influence the Dow's performance.

- (Insert chart or graph here illustrating the correlation between PMI and Dow Jones performance, if data is available.)

Geopolitical and Macroeconomic Factors Influencing the Trend

Several geopolitical and macroeconomic factors influence both PMI readings and the Dow Jones' trajectory. These external forces create uncertainty and can significantly impact the market's direction.

- Global inflation and its impact: Persistent inflation remains a significant concern, impacting consumer spending and potentially slowing economic growth. This uncertainty is reflected in the cautious upward trend of the Dow.

- Influence of geopolitical events: Geopolitical events, such as ongoing conflicts and trade tensions, contribute to market volatility and can negatively impact investor confidence.

- Role of central bank policies: Central bank policies, particularly interest rate adjustments, have a substantial effect on both economic activity and market sentiment. The current monetary policy tightening has contributed to the cautious approach seen in the Dow's rise.

Conclusion: Strong PMI Data and the Future of the Dow Jones

In summary, the strong correlation between robust PMI data and the Dow Jones' cautious upward trend is undeniable. PMI data serves as a valuable indicator of economic health, influencing investor sentiment and market performance. While the current economic climate presents a mixed outlook, positive PMI readings suggest continued underlying strength. The future trajectory of the Dow will depend significantly on continued robust PMI figures and how effectively macroeconomic and geopolitical challenges are navigated.

Stay updated on the latest PMI releases to make informed decisions about your Dow Jones investments. Understanding the relationship between strong PMI data and the Dow Jones' continued, cautious upward trend is crucial for successful market navigation.

Featured Posts

-

Porsche 356 Dari Zuffenhausen Jerman Menuju Legenda

May 25, 2025

Porsche 356 Dari Zuffenhausen Jerman Menuju Legenda

May 25, 2025 -

Analiz Svadebnykh Tseremoniy Na Kharkovschine 600 Brakov

May 25, 2025

Analiz Svadebnykh Tseremoniy Na Kharkovschine 600 Brakov

May 25, 2025 -

Will The Wall Street Recovery Undermine The Daxs Recent Gains

May 25, 2025

Will The Wall Street Recovery Undermine The Daxs Recent Gains

May 25, 2025 -

Gazeta Trud I Publikatsiya Gryozy Lyubvi Ili Ilicha

May 25, 2025

Gazeta Trud I Publikatsiya Gryozy Lyubvi Ili Ilicha

May 25, 2025 -

Net Asset Value Nav Of Amundi Msci World Catholic Principles Ucits Etf Acc What You Need To Know

May 25, 2025

Net Asset Value Nav Of Amundi Msci World Catholic Principles Ucits Etf Acc What You Need To Know

May 25, 2025

Latest Posts

-

Ces Unveiled Europe Les Technologies De Demain A Amsterdam

May 25, 2025

Ces Unveiled Europe Les Technologies De Demain A Amsterdam

May 25, 2025 -

Decouvrez Les Innovations Au Ces Unveiled Europe A Amsterdam

May 25, 2025

Decouvrez Les Innovations Au Ces Unveiled Europe A Amsterdam

May 25, 2025 -

Nouveautes Technologiques Au Ces Unveiled Europe A Amsterdam

May 25, 2025

Nouveautes Technologiques Au Ces Unveiled Europe A Amsterdam

May 25, 2025 -

L Avenir Du Francais Perspectives Selon Mathieu Avanzi

May 25, 2025

L Avenir Du Francais Perspectives Selon Mathieu Avanzi

May 25, 2025 -

La Langue Francaise Depasser Les Cliches Avec Mathieu Avanzi

May 25, 2025

La Langue Francaise Depasser Les Cliches Avec Mathieu Avanzi

May 25, 2025