Stronger Earnings Lead To Exceeded Payout Estimates At Vodacom (VOD)

Table of Contents

Surpassing Revenue Expectations

Vodacom's strong financial results are primarily attributable to exceptional revenue growth across its key operating markets.

Strong Performance Across Key Markets

Vodacom demonstrated remarkable revenue growth in several key geographic regions. This success is a result of several strategic initiatives and favorable market conditions.

- South Africa: Continued market leadership and successful implementation of data-centric offerings drove substantial revenue increases in South Africa. Market share gains in the prepaid segment contributed significantly to this growth.

- Tanzania: Aggressive expansion into underserved areas and targeted marketing campaigns resulted in significant subscriber growth and increased ARPU in Tanzania.

- Democratic Republic of Congo: Successful partnerships and investment in network infrastructure led to improved service quality and increased customer acquisition in the DRC.

This geographic diversification significantly mitigates risks and allows Vodacom to capitalize on growth opportunities across various markets.

Increased Customer Base and ARPU

Vodacom's revenue growth wasn't solely dependent on market expansion; it also saw significant increases in its customer base and Average Revenue Per User (ARPU).

- Targeted marketing: Effective marketing strategies focusing on specific demographics and their needs helped attract new customers.

- Value-added services: The introduction of new value-added services, such as bundled packages and data-centric offers, increased customer spending and boosted ARPU.

- Customer retention programs: Loyal customer programs helped reduce churn rate, thus contributing to sustainable revenue growth.

Improved Operational Efficiency and Cost Management

Beyond revenue growth, Vodacom demonstrated significant improvements in operational efficiency and cost management, leading to higher profitability.

Cost-Cutting Measures and Synergies

Vodacom implemented several cost-cutting measures without compromising service quality, leading to significant synergy effects.

- Streamlined operations: Internal process optimization and automation reduced operational expenditure.

- Supplier negotiations: Successful negotiations with suppliers secured better pricing and improved procurement efficiency.

- Digital transformation: Investment in digital tools and technologies improved efficiency across various departments.

Investment in Infrastructure and Technology

Strategic investments in network infrastructure and advanced technologies played a vital role in Vodacom's success.

- 5G rollout: The strategic rollout of 5G network capabilities enhanced service quality and attracted new high-value customers.

- Network modernization: Upgrades to existing networks improved reliability, coverage, and speed, enhancing the customer experience and reducing operational costs.

- Data analytics: Investments in data analytics allowed for more informed decision-making, leading to better resource allocation and improved efficiency.

Impact on Payout Estimates and Dividend Yield

The substantial increase in earnings directly translated into a significantly higher dividend payout, exceeding initial projections by a considerable margin.

Exceeding Dividend Projections

Vodacom's stronger-than-expected earnings resulted in a dividend payout that far exceeded initial estimates.

- Original estimate: The initial dividend estimate was [insert original estimate].

- Actual payout: The actual dividend payout amounted to [insert actual payout], representing a [percentage increase]% increase. This exceeded expectations and reflects Vodacom's commitment to rewarding its shareholders.

Attractiveness to Investors

The exceeding payout estimates significantly enhances Vodacom's attractiveness to investors.

- Increased investor confidence: The robust financial performance and increased dividend payout build investor confidence in Vodacom's future prospects.

- Potential stock price increase: The positive financial news could lead to a rise in Vodacom's stock price, making it an attractive investment opportunity.

- Strong dividend yield: The increased dividend payout results in a compelling dividend yield, attracting income-seeking investors.

Stronger Earnings Lead to Exceeded Payout Estimates at Vodacom (VOD): A Positive Outlook

In summary, Vodacom's outstanding financial performance, driven by strong revenue growth, improved operational efficiency, and strategic investments, has resulted in a dividend payout that significantly exceeded initial estimates. This positive outcome underlines Vodacom's robust business model and positions the company for continued growth and success. The increased dividend yield and positive investor sentiment create a promising outlook for shareholders. Learn more about Vodacom's (VOD) dividend yield and investment opportunities today! Analyze the Vodacom (VOD) earnings report for a deeper understanding of this impressive performance.

Featured Posts

-

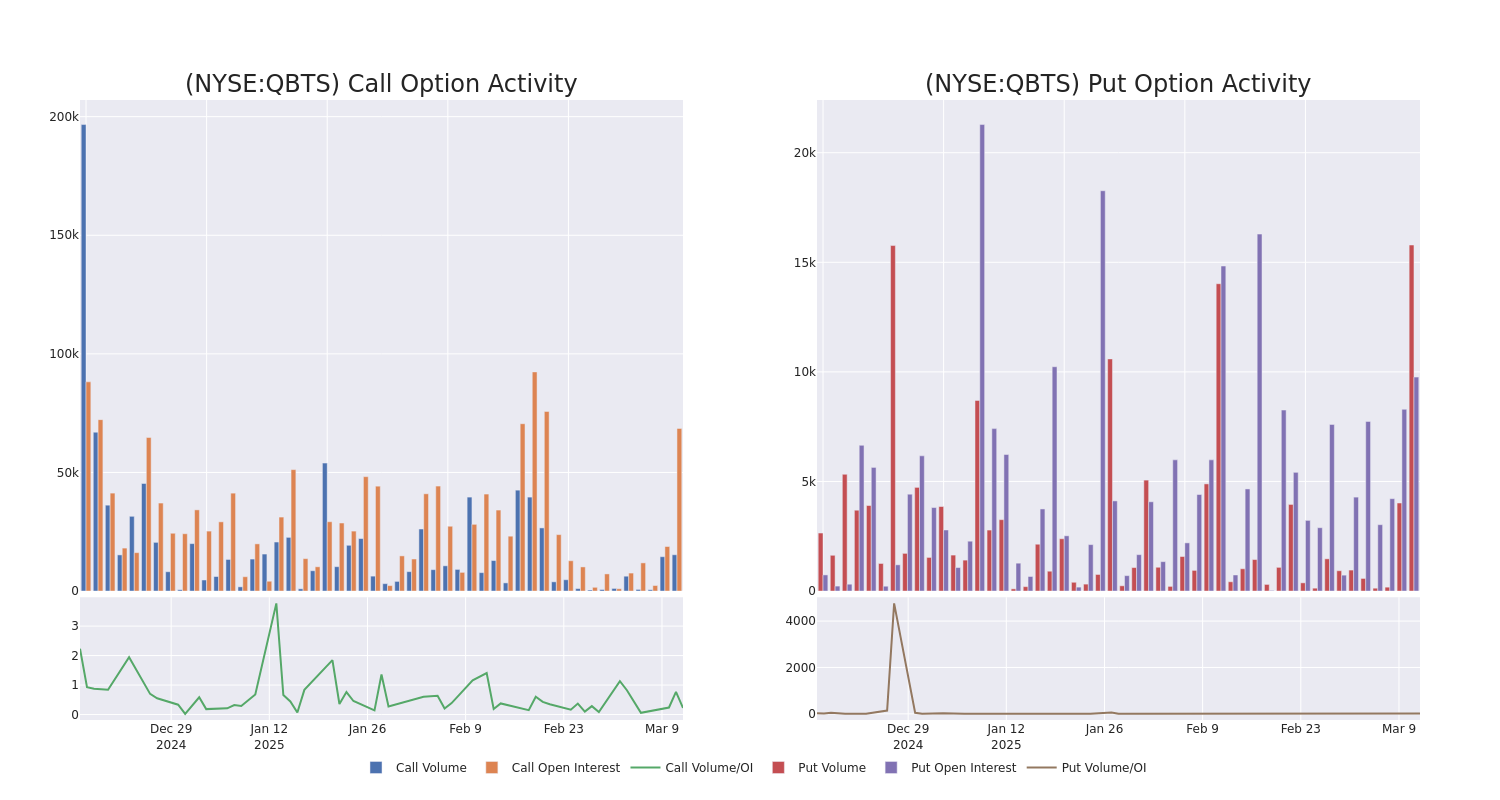

D Wave Quantum Qbts Stock Market Performance A Deep Dive Into Recent Events

May 20, 2025

D Wave Quantum Qbts Stock Market Performance A Deep Dive Into Recent Events

May 20, 2025 -

Meurtre D Aramburu La Traque Des Deux Suspects D Extreme Droite Se Poursuit

May 20, 2025

Meurtre D Aramburu La Traque Des Deux Suspects D Extreme Droite Se Poursuit

May 20, 2025 -

Ragbrai And Beyond Exploring Scott Savilles Cycling Dedication

May 20, 2025

Ragbrai And Beyond Exploring Scott Savilles Cycling Dedication

May 20, 2025 -

Analyzing Qbts Stocks Performance Ahead Of Earnings

May 20, 2025

Analyzing Qbts Stocks Performance Ahead Of Earnings

May 20, 2025 -

Cote D Ivoire La Bcr Effectue Des Descentes Inopinees Dans Les Marches D Abidjan

May 20, 2025

Cote D Ivoire La Bcr Effectue Des Descentes Inopinees Dans Les Marches D Abidjan

May 20, 2025

Latest Posts

-

Trans Australia Run Record On The Brink Of A Breakthrough

May 21, 2025

Trans Australia Run Record On The Brink Of A Breakthrough

May 21, 2025 -

Breaking The Trans Australia Run A World Record In Sight

May 21, 2025

Breaking The Trans Australia Run A World Record In Sight

May 21, 2025 -

The Pursuit Of A New Trans Australia Run Record

May 21, 2025

The Pursuit Of A New Trans Australia Run Record

May 21, 2025 -

Trans Australia Run The Race To Break The Record

May 21, 2025

Trans Australia Run The Race To Break The Record

May 21, 2025 -

Updated Trans Australia Run World Record Predictions

May 21, 2025

Updated Trans Australia Run World Record Predictions

May 21, 2025