Sustainable Growth: Funding Strategies For SMEs

Table of Contents

Exploring Traditional Funding Options for Sustainable Growth

Traditional funding options remain a cornerstone for many SMEs seeking sustainable business growth. While these methods may not always explicitly prioritize sustainability, tailoring your application to highlight your commitment to ESG (Environmental, Social, and Governance) factors can significantly increase your chances of securing funding.

Bank Loans and Lines of Credit

Bank loans and lines of credit offer a relatively straightforward path to funding. However, securing approval often requires a robust financial history and strong collateral.

- Lower interest rates (potentially): Green loans and initiatives from many banks offer preferential interest rates to businesses demonstrating a commitment to sustainable practices.

- Stricter eligibility criteria: Banks typically demand detailed financial projections, strong credit scores, and often require collateral to mitigate risk.

- Need for collateral: This can include assets like property, equipment, or inventory.

- Detailed financial projections required: A comprehensive business plan showcasing financial forecasts and a clear path to profitability is crucial.

Many banks are now actively promoting green loans and initiatives specifically designed to support sustainable businesses. Researching these programs is essential for SMEs focused on sustainable practices.

Venture Capital and Angel Investors

Venture capital and angel investors are attractive options for high-growth, innovative SMEs, especially those with a strong sustainability focus. These investors often look for significant potential returns and are increasingly drawn to businesses operating within the sustainable business sector.

- High potential returns for investors: Investors are willing to take on more risk for the potential of high returns.

- Equity dilution: Securing funding through venture capital will require relinquishing a portion of your company's ownership.

- Potential for mentorship and expertise: Experienced investors can provide valuable guidance and support beyond financial capital.

Impact investors are particularly interested in sustainable businesses, recognizing both the financial and societal benefits. Highlighting your company's social and environmental impact in your pitch can significantly increase your appeal to these investors.

Government Grants and Subsidies

Governments worldwide offer various grants and subsidies aimed at supporting sustainable business practices. These programs often come with specific eligibility criteria and a competitive application process.

- Competitive application process: Be prepared to submit a thorough and compelling application.

- Limited funding availability: Funding is often allocated on a first-come, first-served basis or through a competitive selection process.

- Specific eligibility criteria: Ensure your business meets all requirements before applying.

Exploring government resources and programs relevant to your country and industry is crucial. Many government websites provide detailed information on available grants and subsidies for sustainable SMEs. Actively researching these opportunities is key to securing funding for sustainable growth.

Innovative Funding Strategies for Sustainable SMEs

Beyond traditional routes, several innovative funding strategies cater specifically to the needs of sustainable businesses.

Crowdfunding (Rewards-based, Equity, Debt)

Crowdfunding platforms offer a direct route to funding, engaging directly with customers and building brand awareness simultaneously.

- Direct engagement with customers: Connect with your target audience and build a community around your brand.

- Building brand awareness: Crowdfunding campaigns can generate significant publicity for your business.

- Faster funding compared to traditional routes: Crowdfunding can accelerate the funding process compared to securing bank loans or venture capital.

- Potential for lower returns: Compared to venture capital, the returns may be lower, but crowdfunding can be a powerful tool for launching a sustainable business.

The transparency and community-building aspects of crowdfunding are particularly appealing to consumers increasingly concerned about ethical and sustainable business practices.

Green Bonds and Social Impact Bonds

Green bonds and social impact bonds are specifically designed to finance projects with positive environmental and social outcomes.

- Access to capital for environmentally friendly projects: These bonds attract investors specifically interested in supporting sustainable initiatives.

- Attracting socially responsible investors: Demonstrate your commitment to sustainability and appeal to a growing pool of impact investors.

Understanding the nuances between green bonds (focused on environmental projects) and social impact bonds (focused on broader social outcomes) is crucial for determining which financing instrument best suits your sustainable business.

Sustainable Supply Chain Financing

Optimizing your supply chain by collaborating with suppliers who share your commitment to sustainability can significantly improve your cash flow.

- Improved payment terms: Negotiate better payment terms with your suppliers.

- Reduced risk: Collaborating with responsible suppliers reduces potential supply chain disruptions and reputational risks.

- Strengthened supplier relationships: Building strong, sustainable relationships with suppliers can lead to long-term benefits.

By focusing on sustainable supply chain management, you not only enhance your environmental and social impact but also improve your financial health.

Developing a Compelling Funding Proposal for Sustainable Growth

A well-crafted funding proposal is crucial for securing the funding needed for sustainable business growth.

Highlighting Sustainability Initiatives

Clearly showcasing your company’s commitment to ESG factors is paramount.

- Quantifiable metrics: Use data and numbers to demonstrate your sustainability achievements.

- Clear communication of your sustainability goals: Articulate your vision for a sustainable future and how your business contributes to it.

- Alignment with investor values: Demonstrate how your sustainability efforts align with the values of potential investors.

Including a comprehensive sustainability report and integrating sustainability metrics into your financial forecasts are crucial steps in crafting a convincing proposal.

Creating a Strong Financial Forecast

Accurate financial projections are essential for demonstrating long-term financial viability and return on investment.

- Detailed revenue projections: Provide realistic and well-supported revenue forecasts.

- Cost analysis: Include a detailed breakdown of your operational expenses.

- Clearly stated funding needs: Specify exactly how much funding you require and how it will be used to support sustainable growth.

Demonstrate a clear understanding of your market, your competitive advantages, and a robust and sustainable revenue model.

Building a Credible Team

Highlighting the expertise and experience of your management team is crucial in building investor confidence.

- Relevant experience: Showcase the experience of your team members in both business management and sustainability.

- Strong track record: Demonstrate a history of success in achieving both business and sustainability goals.

- Commitment to sustainability: Clearly communicate your team’s dedication to sustainable practices.

A strong team with a proven track record of both business acumen and a commitment to sustainability significantly enhances your credibility and appeal to potential investors.

Conclusion

Securing funding for sustainable growth requires a strategic approach. This article explored a range of traditional and innovative funding strategies, from bank loans and venture capital to crowdfunding and green bonds. Remember that a well-crafted funding proposal, highlighting your company's commitment to both financial success and sustainability, is crucial for attracting investors. By carefully considering these options and developing a compelling narrative around your sustainability initiatives, you can significantly improve your chances of securing the necessary resources to build a thriving and responsible business. Secure funding for sustainable growth today and invest in your sustainable growth future. [Link to relevant resources or contact form]

Featured Posts

-

Cliffs Pavilion Cinderella Pantomime Rylan Clark To Star

May 19, 2025

Cliffs Pavilion Cinderella Pantomime Rylan Clark To Star

May 19, 2025 -

Ukraines Defense Against Russias Largest Drone Attack

May 19, 2025

Ukraines Defense Against Russias Largest Drone Attack

May 19, 2025 -

Le Salami Au Chocolat Un Classique Du Dessert Francais Revisite Par Sweet France

May 19, 2025

Le Salami Au Chocolat Un Classique Du Dessert Francais Revisite Par Sweet France

May 19, 2025 -

Securing A Place In The Sun Due Diligence And Legal Considerations

May 19, 2025

Securing A Place In The Sun Due Diligence And Legal Considerations

May 19, 2025 -

Is This The Loneliest Generation An Interview With Dr John Delony

May 19, 2025

Is This The Loneliest Generation An Interview With Dr John Delony

May 19, 2025

Latest Posts

-

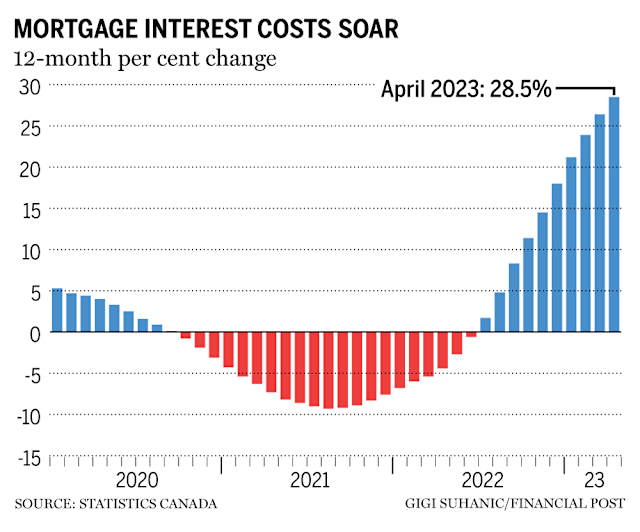

How Increased Federal Debt Could Increase Mortgage Costs

May 19, 2025

How Increased Federal Debt Could Increase Mortgage Costs

May 19, 2025 -

Trumps Aerospace Deals A Critical Examination Of Substance Vs Spectacle

May 19, 2025

Trumps Aerospace Deals A Critical Examination Of Substance Vs Spectacle

May 19, 2025 -

China Tariffs To Remain At 30 Analyst Predictions For 2025

May 19, 2025

China Tariffs To Remain At 30 Analyst Predictions For 2025

May 19, 2025 -

Federal Debts Impact On The Housing Market And Mortgage Rates

May 19, 2025

Federal Debts Impact On The Housing Market And Mortgage Rates

May 19, 2025 -

Trumps 30 China Tariffs Extended Until Late 2025

May 19, 2025

Trumps 30 China Tariffs Extended Until Late 2025

May 19, 2025