Swissquote Bank And The Current State Of Sovereign Bond Markets

Table of Contents

Swissquote Bank's Role in the Sovereign Bond Market

Swissquote Bank provides a comprehensive platform for trading sovereign bonds, offering a range of services designed to empower investors. Their services extend beyond simple trading, encompassing crucial research, analytical tools, and educational resources to help clients make informed decisions.

- Types of Sovereign Bonds: Swissquote offers access to a diverse selection of sovereign bonds, encompassing government debt instruments from developed and emerging markets. This includes US Treasuries, German Bunds, UK Gilts, and a wide array of other international options. The breadth of their offerings caters to various investment strategies and risk tolerances.

- Trading Platforms and Tools: Swissquote provides user-friendly trading platforms equipped with advanced charting tools, real-time market data, and sophisticated analytical features. These tools are designed to assist in technical analysis, fundamental research, and portfolio management.

- Market Access: Investors gain access to a broad spectrum of sovereign bond markets, spanning developed economies like the US, Europe, and Japan, as well as select emerging markets. This global reach facilitates effective diversification strategies.

- Competitive Advantages: Swissquote distinguishes itself through competitive pricing, excellent execution speeds, robust security measures, and a dedicated customer support team experienced in sovereign bond trading.

Current Trends in Global Sovereign Bond Markets

Global sovereign bond markets are experiencing significant shifts driven by evolving macroeconomic conditions. Central bank policies, inflation rates, and geopolitical events are shaping the trajectory of bond yields and prices.

- Interest Rate Environments: The current environment of rising interest rates generally leads to lower bond prices, particularly for existing bonds with lower coupon rates. However, this also creates opportunities for investors to lock in higher yields on newly issued bonds.

- Inflation and Central Bank Policies: Persistent inflation pressures prompt central banks to implement monetary tightening measures, directly influencing interest rates and subsequently impacting bond prices. Understanding central bank strategies is crucial for anticipating market movements.

- Key Sovereign Bond Markets: The US Treasury market remains the benchmark, but other key markets like German Bunds and UK Gilts also exhibit significant influence. Analyzing the yield curves of these markets provides valuable insights into investor sentiment and future economic expectations. Recent yield curve inversions, for example, have often been interpreted as signals of impending economic slowdowns.

- Geopolitical Impacts: Global political instability and unexpected events, such as the war in Ukraine, significantly impact market volatility. These unforeseen circumstances can trigger sudden shifts in bond prices, highlighting the importance of risk management. For example, the conflict in Ukraine led to increased demand for safe-haven assets like US Treasuries, driving down yields.

Risks and Opportunities in Sovereign Bond Investing with Swissquote

Sovereign bonds, while often considered lower-risk compared to equities, are not without their inherent risks. Understanding these risks and leveraging Swissquote's resources for mitigation is crucial.

- Interest Rate Risk: Rising interest rates can negatively impact the value of existing bonds. Swissquote offers tools to help manage this risk through sophisticated portfolio strategies.

- Inflation Risk: Unexpected inflation erodes the real return of fixed-income investments. Careful selection of bonds with appropriate maturities and inflation-linked instruments can help mitigate this.

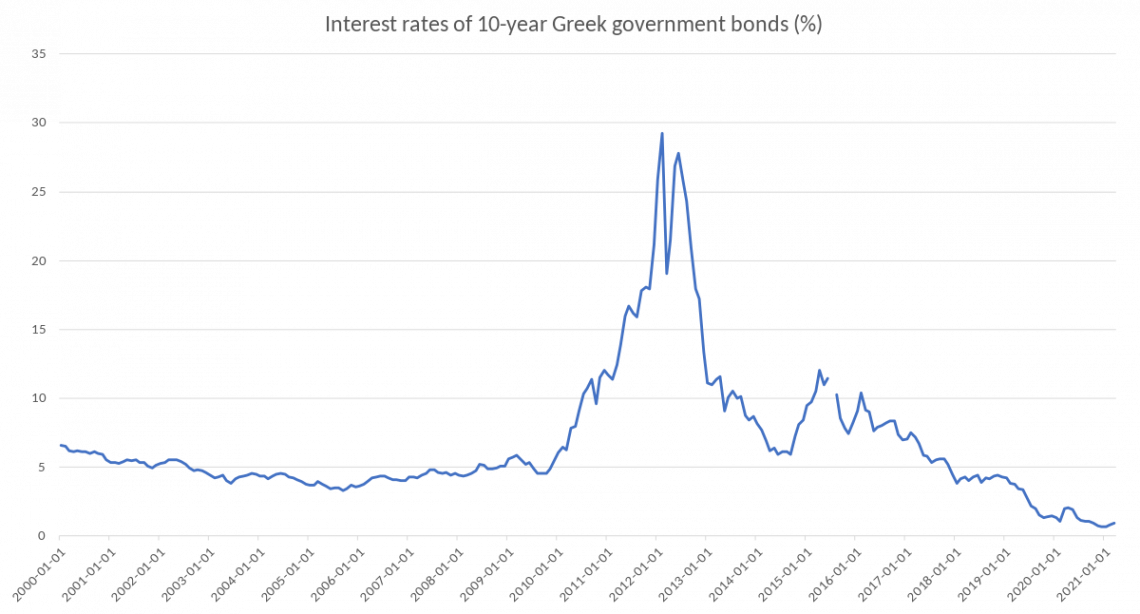

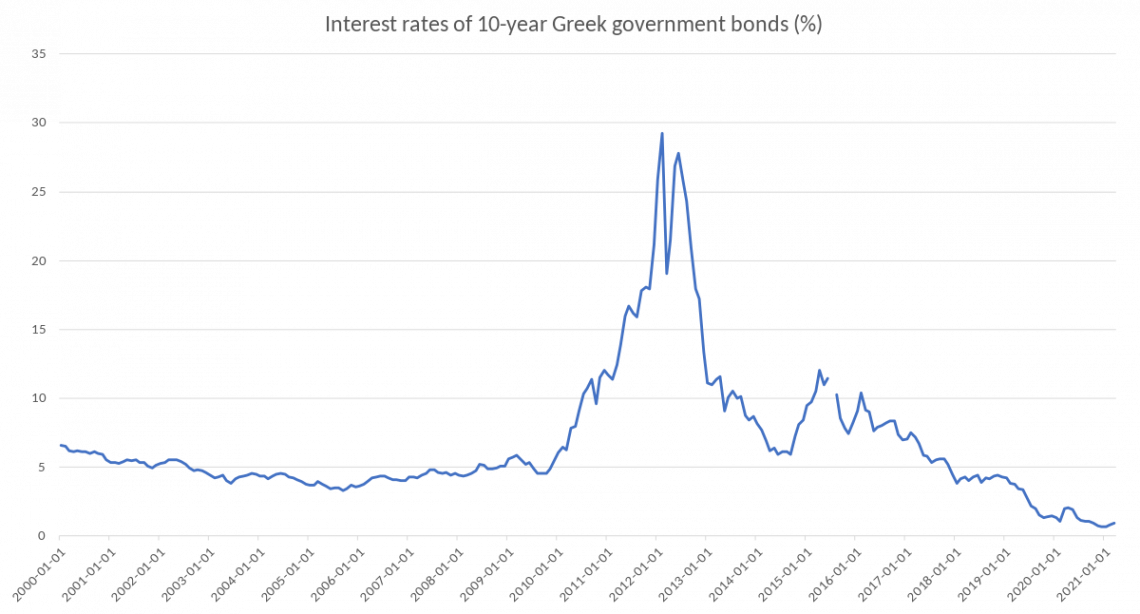

- Credit Risk: Although sovereign bonds are generally considered less risky than corporate bonds, there's still a possibility of default, especially in emerging markets. Swissquote’s research can help investors assess country-specific risks.

- Geopolitical Risk: Global events can significantly impact bond markets. Diversification across different countries and regions is a key strategy to lessen geopolitical risk.

- Opportunities: Despite the risks, the current market presents opportunities for discerning investors. Swissquote's research and analytical tools can help identify sovereign bonds offering attractive yields and diversification benefits. For instance, bonds from countries with stable economies and low inflation might offer comparatively high returns.

Diversification Strategies using Swissquote's Sovereign Bond Offerings

Swissquote's platform facilitates the creation of diversified sovereign bond portfolios, crucial for mitigating risks and optimizing returns.

- Geographic Diversification: Spreading investments across various countries minimizes the impact of single-country risks. Swissquote's broad selection enables investors to construct portfolios encompassing bonds from developed and emerging economies.

- Maturity Diversification: Diversifying across different bond maturities (short-term, medium-term, long-term) helps manage interest rate risk. Swissquote's platform enables granular control over portfolio duration.

- Portfolio Construction: Swissquote's tools and resources assist investors in constructing diversified portfolios aligned with their risk tolerance and investment objectives.

Conclusion

The current sovereign bond market is characterized by volatility and uncertainty, but also presents opportunities for skilled investors. Swissquote Bank provides a robust platform for navigating this complex landscape, offering access to diverse instruments, advanced analytical tools, and resources for managing risk. Understanding the risks associated with sovereign bond investments, including interest rate risk, inflation risk, credit risk, and geopolitical risk, is paramount. However, by employing effective diversification strategies and leveraging Swissquote's resources, investors can potentially achieve their financial goals. To explore the possibilities of Swissquote sovereign bond investments and trading sovereign bonds with Swissquote, visit the Swissquote website or contact a representative to learn more about Swissquote's sovereign bond platform and how it can benefit your investment strategy.

Featured Posts

-

Securing Your Place In The Sun A Step By Step Buying Process

May 19, 2025

Securing Your Place In The Sun A Step By Step Buying Process

May 19, 2025 -

United Kingdom Choose Your Favourite Eurovision Song 2000 2023 Bbc Radio 2

May 19, 2025

United Kingdom Choose Your Favourite Eurovision Song 2000 2023 Bbc Radio 2

May 19, 2025 -

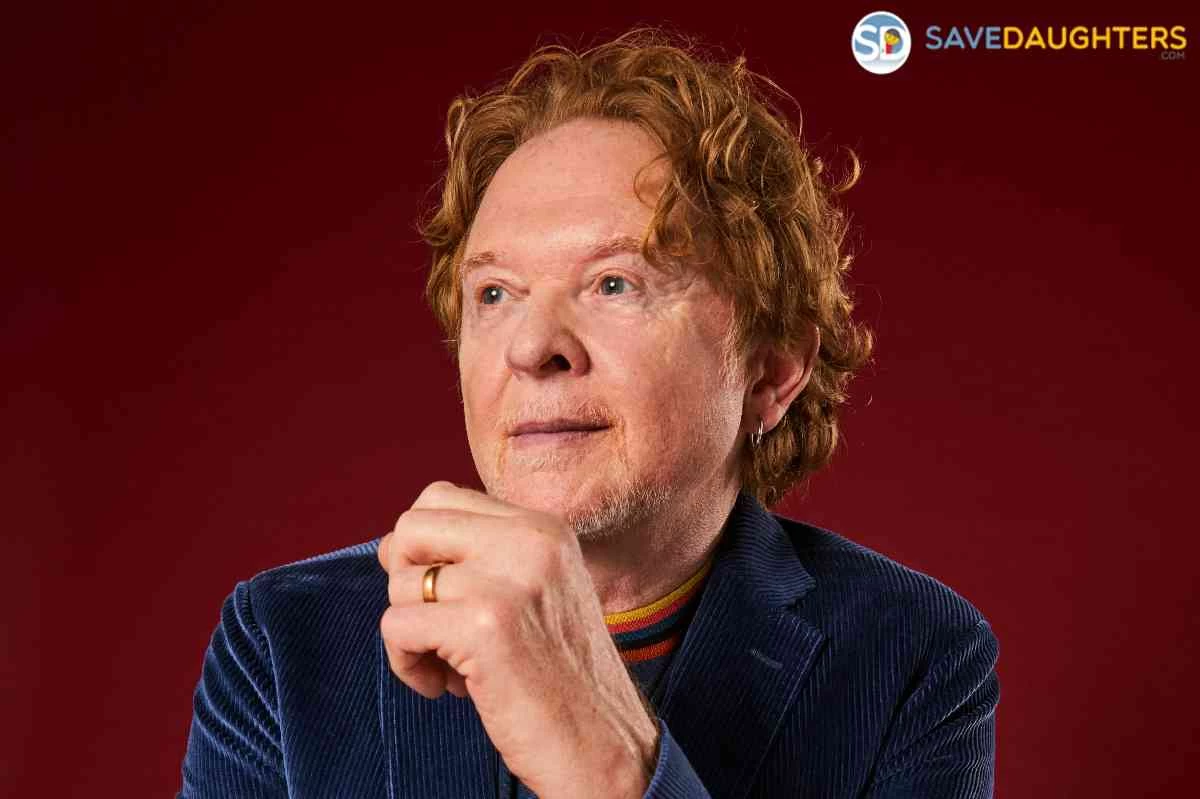

Is Eurovision Lumo The Worst Mascot Ever A Mick Hucknall Crazy Frog Hybrid

May 19, 2025

Is Eurovision Lumo The Worst Mascot Ever A Mick Hucknall Crazy Frog Hybrid

May 19, 2025 -

Patriarxeio Ierosolymon Eksetasi Ton Apofaseon Tis Synodoy

May 19, 2025

Patriarxeio Ierosolymon Eksetasi Ton Apofaseon Tis Synodoy

May 19, 2025 -

Jai Hind Post Raises Concerns Puri You Tubers Instagram Connection To Suspected Pakistani Spy

May 19, 2025

Jai Hind Post Raises Concerns Puri You Tubers Instagram Connection To Suspected Pakistani Spy

May 19, 2025