Taiwan Investors Retreat From US Bond ETFs: A Shift In Investment Strategy

Table of Contents

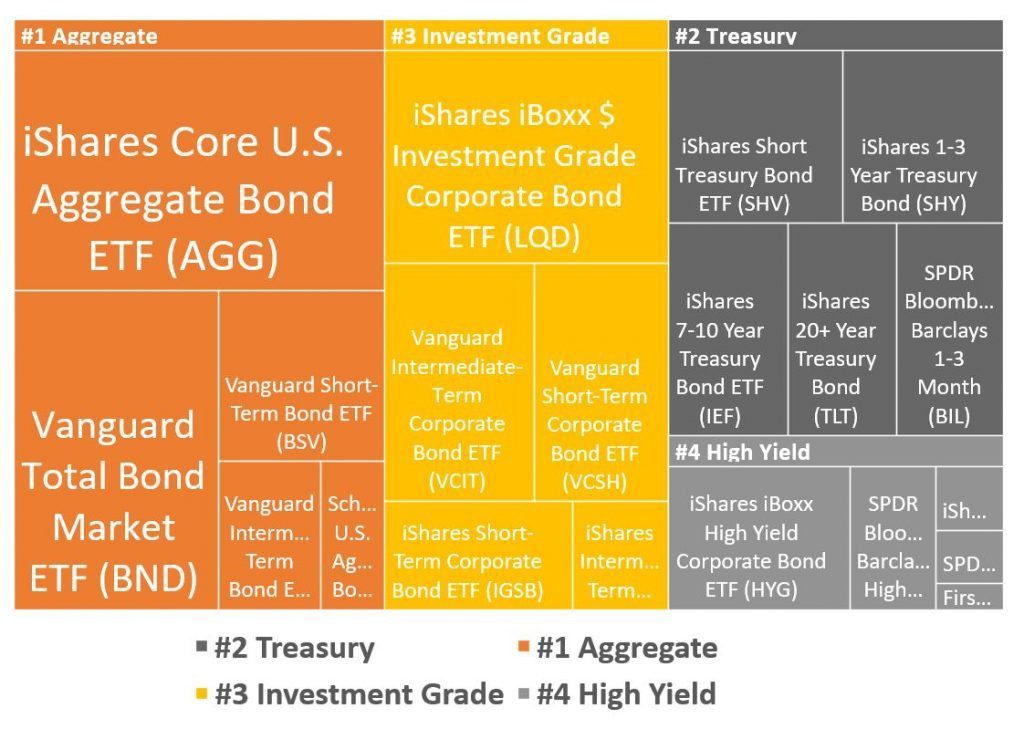

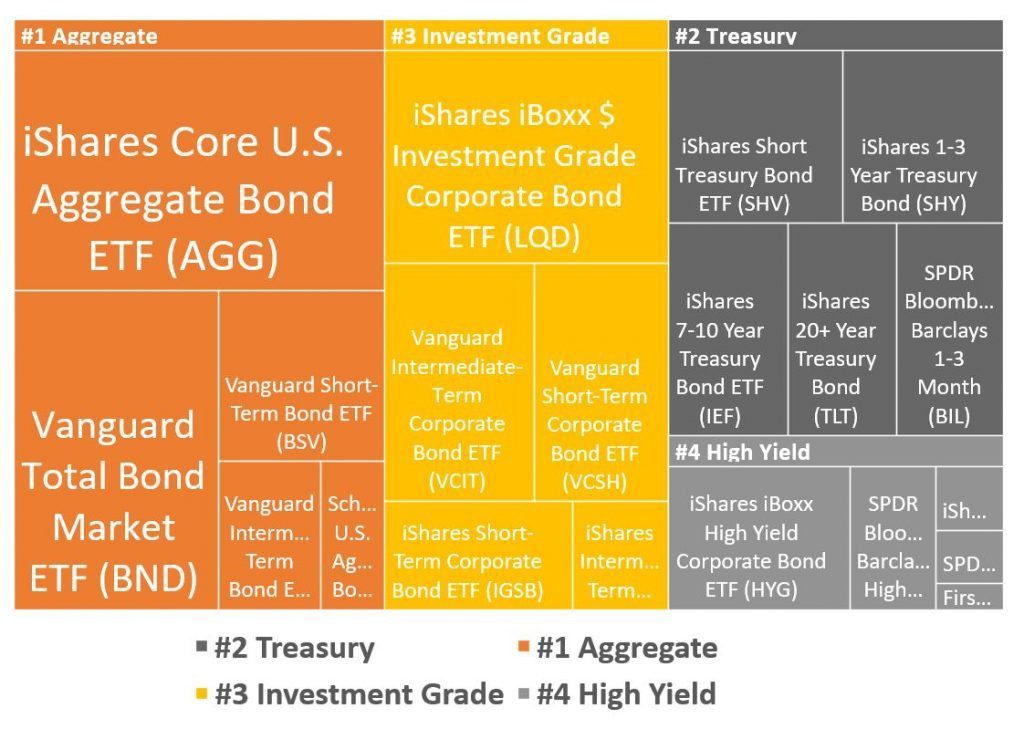

Rising Interest Rates and Their Impact on US Bond ETFs

The inverse relationship between interest rates and bond prices is a fundamental principle of finance. As the US Federal Reserve continues its campaign of raising interest rates to combat inflation, the returns on US bond ETFs have suffered. This is because higher interest rates make newly issued bonds more attractive, driving down the prices of existing bonds held within these ETFs.

This decline in performance is clearly evident in recent data. For instance, [Insert data or link to data showing performance decline of relevant US Bond ETFs]. The impact is multifaceted:

- Impact on yield curves: Rising interest rates steepen the yield curve, affecting the overall attractiveness of longer-term bonds within the ETFs.

- Effect on capital appreciation: The price erosion of existing bonds leads to reduced capital appreciation for investors.

- Comparison of US bond yields vs. other markets: The relative attractiveness of US bond yields compared to those in other global markets has diminished, prompting investors to seek better returns elsewhere.

Geopolitical Risks and Their Influence on Investment Decisions

The escalating geopolitical tensions between the US and China, coupled with other global uncertainties, have significantly influenced Taiwanese investors' risk appetite. The perceived increased risk associated with US assets has prompted a reassessment of investment strategies. Taiwanese investors, mindful of their proximity to geopolitical flashpoints, are increasingly prioritizing risk mitigation.

This cautious approach is reflected in several ways:

- Specific geopolitical events impacting investor confidence: [Mention specific events, e.g., trade wars, political instability] have contributed to a climate of uncertainty.

- Analysis of the flight-to-safety phenomenon: We're seeing a shift away from riskier assets, with investors seeking havens in more stable markets.

- Alternative investment destinations considered by Taiwanese investors: Many are turning to more geographically diversified portfolios, exploring opportunities in emerging markets and other asset classes perceived as less volatile.

Shifting Investment Strategies and Portfolio Diversification

The retreat from US bond ETFs reflects a broader shift in the investment preferences of Taiwanese investors. There's a growing interest in diversifying away from traditional fixed-income assets. This diversification is driven by a desire to reduce overall portfolio risk and capitalize on opportunities in other asset classes:

- Examples of alternative investment strategies: Increased interest in emerging markets, private equity, and even real estate is observable.

- Data showcasing the shift in asset allocation: [Insert data or link to data illustrating this shift].

- The role of financial advisors in guiding investment decisions: Financial advisors are playing a crucial role in educating investors on the benefits of diversification and helping them navigate this changing landscape.

The Future Outlook for Taiwanese Investment in US Bond ETFs

Predicting future investment trends is inherently challenging. However, based on current economic conditions, several scenarios are possible. A continuation of rising interest rates in the US might further suppress demand for US bond ETFs from Taiwanese investors. However, a stabilization of interest rates or a shift in geopolitical dynamics could potentially lead to a resurgence in interest.

The long-term implications are significant:

- Potential scenarios for future interest rate movements: [Offer a range of possible scenarios].

- Forecasts on geopolitical stability: [Discuss possible developments in US-China relations].

- Impact on the overall global financial market: The decisions of Taiwanese investors, along with other significant players, will continue to shape the global financial landscape.

Conclusion: Understanding the Taiwan Investor Retreat From US Bond ETFs

The decline in Taiwanese investment in US bond ETFs is a multi-faceted phenomenon driven by rising interest rates, escalating geopolitical risks, and a fundamental shift towards greater portfolio diversification. The importance of mitigating risk through a diverse investment strategy cannot be overstated. The future of Taiwanese investment in this sector remains uncertain, dependent on both domestic and global economic factors. It's crucial for investors to carefully evaluate their current strategies and explore a range of options to safeguard their portfolios. We strongly encourage further research into alternative investment opportunities to mitigate risks associated with Taiwan investors, US bond ETFs and similar investment choices, ensuring a more robust and resilient financial future.

Featured Posts

-

Texas Longhorns Spring Football Sarkisian Provides Injury Update

May 08, 2025

Texas Longhorns Spring Football Sarkisian Provides Injury Update

May 08, 2025 -

Taiwans Strengthening Currency Pressures For Economic Restructuring

May 08, 2025

Taiwans Strengthening Currency Pressures For Economic Restructuring

May 08, 2025 -

Psg Nice Macini Canli Olarak Nereden Izleyebilirsiniz

May 08, 2025

Psg Nice Macini Canli Olarak Nereden Izleyebilirsiniz

May 08, 2025 -

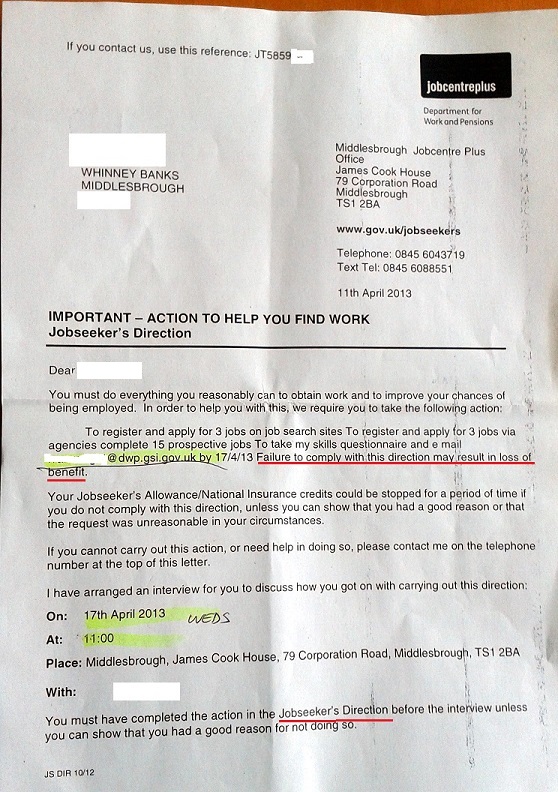

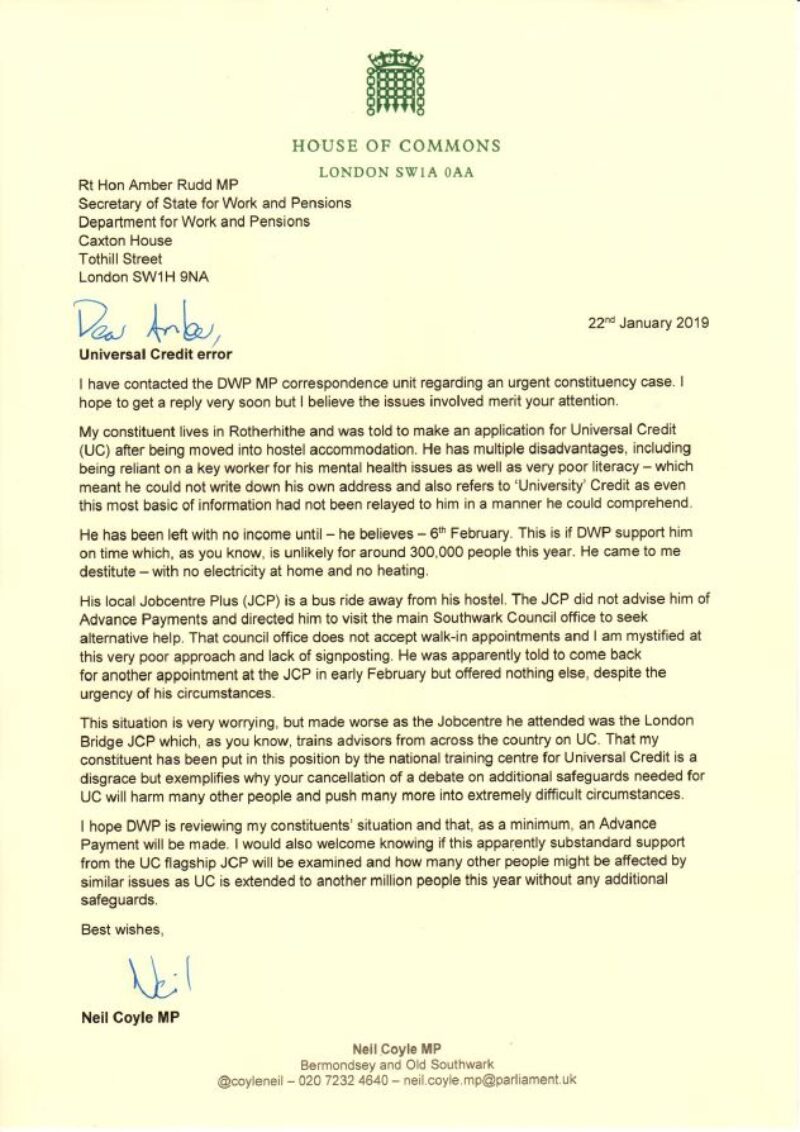

Uk Households Receive Dwp Letters Benefits Under Threat

May 08, 2025

Uk Households Receive Dwp Letters Benefits Under Threat

May 08, 2025 -

Raphaels Decommitment A Blow To Nc State Football Recruiting

May 08, 2025

Raphaels Decommitment A Blow To Nc State Football Recruiting

May 08, 2025

Latest Posts

-

Universal Credit Overhaul Dwp Alters Claim Verification Process

May 08, 2025

Universal Credit Overhaul Dwp Alters Claim Verification Process

May 08, 2025 -

Dwp Announces Major Universal Credit Claim Verification Changes

May 08, 2025

Dwp Announces Major Universal Credit Claim Verification Changes

May 08, 2025 -

Are You Due A Universal Credit Refund Dwps 5 Billion Payment Plan

May 08, 2025

Are You Due A Universal Credit Refund Dwps 5 Billion Payment Plan

May 08, 2025 -

Dwp Letter Missing Potential 6 828 Benefit Loss

May 08, 2025

Dwp Letter Missing Potential 6 828 Benefit Loss

May 08, 2025 -

Universal Credit Refund Dwp Details On April And May Payments

May 08, 2025

Universal Credit Refund Dwp Details On April And May Payments

May 08, 2025