Tesla's Defensive Strategy: Addressing Shareholder Litigation After Musk's Compensation

Table of Contents

The Nature of the Shareholder Lawsuits

The core arguments in the lawsuits against Tesla related to Musk's compensation center around accusations of mismanagement and a disregard for shareholder interests. Plaintiffs argue that the board of directors failed to adequately protect shareholder value when approving the massive compensation package for Elon Musk.

-

Allegations of breach of fiduciary duty: Lawsuits allege that Tesla's board members breached their fiduciary duty by approving a compensation package that is demonstrably excessive and not aligned with shareholder interests. This is a critical legal claim, as fiduciary duty requires directors to act in the best interests of the company and its shareholders.

-

Claims of inadequate process and lack of shareholder approval: Plaintiffs contend that the process used to approve Musk's compensation lacked transparency and proper shareholder input. The argument revolves around the assertion that shareholders were not given a fair opportunity to voice their concerns or vote on the matter. This relates directly to issues of corporate governance and best practices.

-

Arguments focusing on the excessive value of the compensation package compared to performance metrics: A central argument is that the value of the compensation package is wildly disproportionate to Tesla's performance relative to comparable companies and industry benchmarks. Plaintiffs will likely present expert testimony to support this claim.

-

Potential legal precedents cited by plaintiffs: Lawsuits will likely cite past cases involving excessive executive compensation and breaches of fiduciary duty to bolster their arguments. These precedents provide legal frameworks for the current claims against Tesla. Finding similar cases with unfavorable outcomes for the defendant will strengthen the plaintiffs' position.

Tesla's Legal Defenses

Tesla is likely employing a multi-pronged legal strategy to defend against these shareholder lawsuits. Their defense will likely focus on demonstrating the fairness and legality of the compensation package.

-

Arguments emphasizing board approval and adherence to corporate governance procedures: Tesla's defense will hinge on demonstrating that the compensation committee and the board of directors followed proper procedures and acted within their legal authority when approving the package. They will aim to showcase robust due diligence.

-

Justification of the compensation package based on Musk's contributions to Tesla's success: Tesla will likely argue that Musk's contributions to the company's growth and innovation justify the compensation, even if it appears exceptionally high. They’ll focus on quantifiable contributions to market share and innovation.

-

Reliance on expert testimony to support the valuation of the compensation: To counter claims of excessiveness, Tesla will likely present expert testimony from financial professionals who will argue that the compensation package is consistent with industry norms, or at least that the valuation methodologies used were appropriate.

-

Potential use of contractual clauses and indemnification agreements: Tesla may rely on contractual clauses within Musk's employment agreement and potentially indemnification agreements to protect the company and its directors from liability.

The Role of Independent Board Members

The role of Tesla's independent board members in approving Musk's compensation package is under intense scrutiny. Their actions will be closely examined by the courts.

-

Scrutiny of the board's due diligence process: The diligence exercised by the independent directors in evaluating the compensation package will be a key factor. Lawsuits will examine the process, including the information considered and the advice received.

-

Potential conflicts of interest and their legal implications: Any potential conflicts of interest among independent directors will be carefully examined. Even perceived conflicts can weaken their legal position.

-

The board's responsibility in protecting shareholder interests: Central to the litigation will be the question of whether the board adequately discharged its duty to protect shareholder interests when approving the compensation.

-

Potential legal ramifications for individual board members: Individual board members could face personal liability if the court finds they acted negligently or breached their fiduciary duty. This is a significant incentive for robust defense.

Potential Outcomes and Long-Term Implications

The shareholder litigation against Tesla carries significant potential outcomes, influencing Tesla's future and the broader tech industry.

-

Potential settlements and their financial implications: Tesla may choose to settle the lawsuits to avoid the costs and risks of a trial. Settlements can be costly, potentially impacting earnings and shareholder value.

-

Likelihood of a trial and the associated costs and risks: A trial could be lengthy and expensive, exposing Tesla to potentially greater financial losses and reputational damage.

-

Impact on Tesla's stock price and investor confidence: The outcome of the litigation will likely affect Tesla's stock price and investor confidence. Negative outcomes could lead to a decline in both.

-

Long-term effects on Tesla's corporate governance and reputation: The litigation will likely prompt changes to Tesla's corporate governance practices to enhance transparency and shareholder protection, impacting future compensation decisions and investor relations.

-

Implications for executive compensation practices in the tech industry: The outcome could set a precedent for executive compensation practices in the tech industry, influencing future negotiations and board decisions related to executive pay.

Conclusion

This analysis of Tesla's defensive strategy in addressing the shareholder litigation stemming from Elon Musk's compensation reveals a complex legal battle with significant implications. The outcomes will not only affect Tesla's financial standing but will also shape future corporate governance practices within the industry. Understanding the intricacies of this case—from the allegations of breach of fiduciary duty to Tesla’s legal defenses and the potential ramifications for the company’s leadership—is crucial for investors and stakeholders alike. Staying informed about developments in this ongoing shareholder litigation is vital to navigate the evolving landscape of Tesla's corporate governance.

Featured Posts

-

Worldwide Reddit Outage Users Report Problems

May 18, 2025

Worldwide Reddit Outage Users Report Problems

May 18, 2025 -

Steun Voor Uitbreiding Nederlandse Defensie Industrie Neemt Toe Te Midden Van Groeiende Internationale Spanningen

May 18, 2025

Steun Voor Uitbreiding Nederlandse Defensie Industrie Neemt Toe Te Midden Van Groeiende Internationale Spanningen

May 18, 2025 -

Confortos Path To Success Can He Mirror Hernandezs Impact On The Dodgers

May 18, 2025

Confortos Path To Success Can He Mirror Hernandezs Impact On The Dodgers

May 18, 2025 -

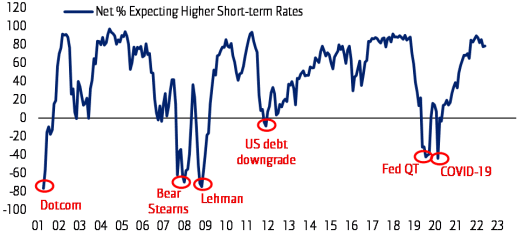

Stock Market Valuations Bof A Assures Investors

May 18, 2025

Stock Market Valuations Bof A Assures Investors

May 18, 2025 -

Angels 1 0 Victory Fueled By Sorianos Dominant Performance

May 18, 2025

Angels 1 0 Victory Fueled By Sorianos Dominant Performance

May 18, 2025

Latest Posts

-

Former Child Star Amanda Bynes Joins Only Fans For 50 Month

May 18, 2025

Former Child Star Amanda Bynes Joins Only Fans For 50 Month

May 18, 2025 -

Amanda Bynes Launches Only Fans A New Chapter At 50 Per Month

May 18, 2025

Amanda Bynes Launches Only Fans A New Chapter At 50 Per Month

May 18, 2025 -

Amanda Bynes A Classmates Perspective On Past Incidents

May 18, 2025

Amanda Bynes A Classmates Perspective On Past Incidents

May 18, 2025 -

Classmate Shares Account Of Amanda Bynes Past At School

May 18, 2025

Classmate Shares Account Of Amanda Bynes Past At School

May 18, 2025 -

Amanda Bynes Rachel Green And Drake Bell Unpacking The Comparison

May 18, 2025

Amanda Bynes Rachel Green And Drake Bell Unpacking The Comparison

May 18, 2025