Thailand Inflation Turns Negative: What This Means For The Economy

Table of Contents

Thailand is experiencing a surprising economic shift: negative inflation. This phenomenon, also known as deflation, represents a significant departure from recent trends and raises crucial questions about the country's economic health and future trajectory. This article explores the causes, consequences, and potential implications of negative Thailand inflation for businesses, consumers, and the overall economy. We will delve into the contributing factors, analyze the impact on various sectors, and examine potential solutions to address this economic challenge.

Causes of Negative Thailand Inflation

Several interconnected factors have contributed to the current negative Thailand inflation. Understanding these root causes is vital for formulating effective policy responses.

Decreased Consumer Demand

A decline in consumer spending is a significant driver of deflationary pressures. Reduced consumer confidence, coupled with a global economic slowdown and rising unemployment, has led to decreased purchasing power. This decreased demand impacts prices across various sectors, contributing to overall deflation.

- Impact of global economic slowdown: The ripple effects of global economic uncertainty have dampened consumer sentiment in Thailand, leading to reduced spending.

- Rising unemployment: Job losses and fear of job insecurity have further restricted consumer spending, impacting the demand for goods and services.

- Reduced consumer confidence: Negative news and economic uncertainty contribute to a pessimistic outlook, causing consumers to postpone purchases and save more.

Available data on the consumer price index (CPI) reflects this trend of decreased consumer spending, showing a consistent decline in prices across various consumer goods and services. Understanding these shifting spending habits is crucial for policymakers and businesses alike.

Increased Supply and Reduced Production Costs

Simultaneously, an increase in the supply of goods and a reduction in production costs have contributed to the deflationary pressures. This means more goods are available in the market at lower prices.

- Technological advancements: Improvements in technology have led to increased efficiency in production, resulting in lower costs.

- Efficient production methods: Businesses are adopting more streamlined production processes, further lowering costs.

- Global commodity price drops: Reduced prices of raw materials and commodities have decreased the overall production costs for various sectors.

These factors have led to a situation where the supply of goods exceeds the demand, further pushing prices downward. Analysis of supply chain improvements and production cost reductions across different sectors corroborates this trend.

Government Policies

Government policies, both fiscal and monetary, also play a significant role. Specific interventions can either exacerbate or mitigate deflationary pressures.

- Fiscal policy: Government spending and taxation policies directly impact aggregate demand. Tax cuts or subsidies can stimulate spending, but poorly targeted interventions can worsen the situation.

- Monetary policy: The central bank's actions influence interest rates and money supply. Low interest rates can encourage borrowing and spending, but may also lead to other economic imbalances.

Analyzing the specific impacts of various government interventions requires a careful examination of official reports and policy documents. Understanding the interplay between fiscal and monetary policies is vital in addressing Thailand inflation.

Consequences of Negative Thailand Inflation

Negative Thailand inflation has wide-ranging consequences across businesses, consumers, and the overall economy.

Impact on Businesses

Falling prices create significant challenges for businesses.

- Reduced profit margins: Lower prices mean lower revenues, squeezing profit margins and hindering business growth.

- Decreased investment: Uncertainty about future profitability can lead businesses to delay or cancel investment plans.

- Potential for business closures: Businesses unable to adapt to falling prices may face closure, leading to job losses.

Impact on Consumers

While lower prices seem beneficial, deflation can have detrimental effects.

- Delayed purchases: Consumers may postpone purchases expecting further price drops, dampening demand further.

- Potential benefits: Lower prices can increase purchasing power, particularly for essential goods.

- Potential drawbacks: Job losses due to business closures and reduced consumer confidence can outweigh the benefits of lower prices.

Impact on the Overall Economy

The broader implications of deflation can be severe.

- Impact on GDP growth: Deflation can lead to a slowdown in economic growth, as businesses defer investment and consumers postpone spending.

- Foreign investment: Deflation can deter foreign investment, as investors seek more stable and profitable markets.

- National debt: Deflation can increase the real value of national debt, making it harder for the government to manage its finances.

Potential Solutions and Future Outlook for Thailand Inflation

Addressing deflation requires a multifaceted approach.

- Monetary policy adjustments: The central bank can lower interest rates further to stimulate borrowing and spending. Quantitative easing measures may also be considered.

- Fiscal stimulus packages: Government spending on infrastructure projects or social programs can boost aggregate demand.

- Infrastructure investments: Investing in infrastructure can create jobs and stimulate economic activity.

Expert opinions on the future trajectory of Thailand inflation vary. However, proactive government intervention and close monitoring of economic indicators are essential for managing the risks associated with deflation and fostering economic recovery.

Conclusion

Negative Thailand inflation presents a complex economic challenge. While lower prices may offer short-term benefits for consumers, the longer-term implications for businesses and the overall economy require careful consideration and proactive policy responses. The causes are multifaceted, involving decreased consumer demand, increased supply, and the impact of government policies. Understanding these dynamics is crucial for navigating this economic shift effectively.

Call to Action: Stay informed about the evolving situation of Thailand inflation by regularly consulting reputable economic news sources and government reports. Understanding the intricacies of Thailand inflation is key to making informed economic decisions. Monitoring Thailand inflation trends and understanding the government's responses will help businesses and consumers adapt and thrive amidst these economic changes.

Featured Posts

-

Ripple Xrp Analysis Potential For 3 40 Price Increase

May 07, 2025

Ripple Xrp Analysis Potential For 3 40 Price Increase

May 07, 2025 -

Warriors Vs Rockets How Important Is Home Court Advantage

May 07, 2025

Warriors Vs Rockets How Important Is Home Court Advantage

May 07, 2025 -

The Trump Presidency And The American Film Industry A Look At Restored Production

May 07, 2025

The Trump Presidency And The American Film Industry A Look At Restored Production

May 07, 2025 -

Go Ahead Eagles Cup Final How De Busser Secured Victory

May 07, 2025

Go Ahead Eagles Cup Final How De Busser Secured Victory

May 07, 2025 -

Watch Warriors Vs Trail Blazers Live Game Time Tv Broadcast And Streaming Details April 11th

May 07, 2025

Watch Warriors Vs Trail Blazers Live Game Time Tv Broadcast And Streaming Details April 11th

May 07, 2025

Latest Posts

-

The Anthony Edwards Baby Mama Controversy Understanding The Online Chaos

May 07, 2025

The Anthony Edwards Baby Mama Controversy Understanding The Online Chaos

May 07, 2025 -

Popcorn Prank Mitchells Game Night Prediction For Cavs Rookie

May 07, 2025

Popcorn Prank Mitchells Game Night Prediction For Cavs Rookie

May 07, 2025 -

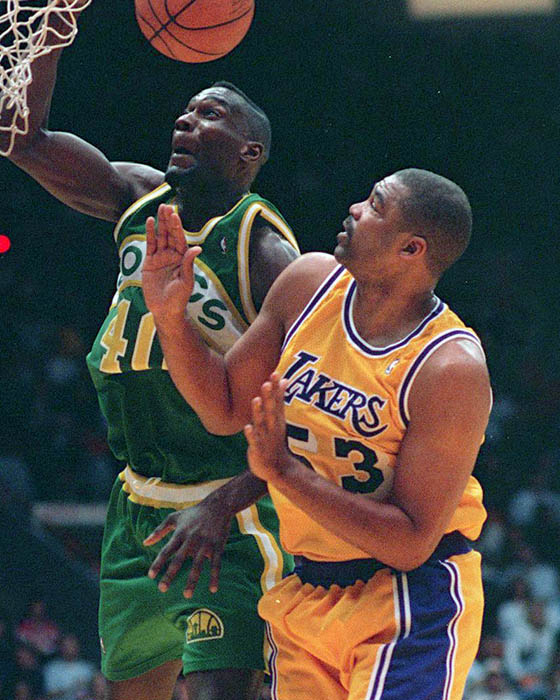

Anthony Edwards And Lakers Center In On Court Altercation

May 07, 2025

Anthony Edwards And Lakers Center In On Court Altercation

May 07, 2025 -

Anthony Edwards Baby Mama Drama A Deep Dive Into The Online Frenzy

May 07, 2025

Anthony Edwards Baby Mama Drama A Deep Dive Into The Online Frenzy

May 07, 2025 -

Anthony Edwards Shoving Match With Lakers Center What Happened

May 07, 2025

Anthony Edwards Shoving Match With Lakers Center What Happened

May 07, 2025