The Changing Face Of X: Financial Data From The Recent Debt Offering

Table of Contents

The recent debt offering from X has significantly altered the company's financial landscape. This analysis delves into the key financial data emerging from this offering, exploring its impact on X's financial structure, investor confidence, and future growth prospects. We will examine the terms of the offering, the investor response, and the potential long-term consequences for the company and the market. This in-depth look at the recent debt will provide valuable insights into the current financial health and future trajectory of X.

Key Terms of the Debt Offering

Amount Raised

X successfully raised $500 million through its recent debt offering. This involved the issuance of 50,000 bonds with a par value of $10,000 each. This amount is significantly higher than their previous offering of $300 million in 2021, reflecting X's ambitious expansion plans and increased capital needs. The larger amount raised suggests a strong belief in future growth potential and the ability to service the increased debt load.

- Specific Figures: $500 million total, 50,000 bonds issued, $10,000 par value per bond.

- Comparison to Previous Offerings: Increased by $200 million compared to the 2021 offering.

- Reasons for the Specific Amount: To fund significant capital expenditures for new production facilities and R&D initiatives.

Interest Rates and Maturity

The bonds offered a coupon rate of 4.5% per annum, a figure slightly higher than the prevailing market rate for similar corporate bonds. The bonds mature in 10 years, providing a manageable repayment schedule for X.

- Comparison to Market Rates: 4.5% coupon rate, slightly above the market average for similar risk profiles, reflecting the market's assessment of X's creditworthiness.

- Implications of the Interest Rate on Future Profitability: Increased interest expense will impact profitability in the short-term, but the long-term growth potential from the investments made outweighs the short-term cost.

- Analysis of the Maturity Structure: 10-year maturity aligns with the long-term investment projects planned, mitigating refinancing risks.

Type of Debt Instrument

X chose to issue senior unsecured bonds as the debt instrument for this offering.

- Advantages and Disadvantages of the Chosen Instrument: Senior unsecured bonds offer a relatively lower interest rate than secured debt but carry higher risk for investors. The use of unsecured bonds reflects X's confidence in its ability to service the debt.

- Rationale Behind the Selection: The company chose this type to balance cost-effectiveness with maintaining financial flexibility.

Investor Response and Market Reaction

Demand and Oversubscription

The debt offering was significantly oversubscribed, indicating strong investor confidence in X's future prospects. The offering was oversubscribed by approximately 20%, suggesting a robust demand from the investment community.

- Numbers Indicating Demand: Oversubscription rate of 20%.

- Interpretation of the Level of Investor Confidence: High demand and oversubscription strongly suggest positive investor sentiment and a belief in X's long-term growth.

Impact on Credit Ratings

Following the debt offering, X maintained its investment-grade credit rating from major credit rating agencies. This indicates that the market does not see the increased debt levels as significantly increasing X's financial risk.

- Pre- and Post-Offering Ratings: Rating remained consistent, signifying investor confidence in X's financial strength.

- Reasons for Any Changes: No change in credit rating due to meticulous financial planning and strong future projections presented.

- Implications of the Rating Change (or lack thereof): Consistent ratings support continued access to favorable financing terms in the future.

Stock Price Performance

X's stock price saw a modest increase following the announcement of the successful debt offering, suggesting a generally positive market reaction.

- Stock Price Movements Before, During, and After the Offering: Slight increase in stock price after announcement, demonstrating positive investor sentiment related to increased capital for investments.

- Correlation Between Stock Price and Investor Sentiment: Positive correlation between the successful debt offering and positive investor reaction reflected in a slightly increased stock price.

Long-Term Financial Implications

Debt Burden and Leverage

The debt offering will undoubtedly increase X's debt burden and leverage ratios. However, careful management of these metrics is crucial to ensure long-term financial health. Detailed analysis of X’s financial statements is required for precise projections, but projections based on the current debt load suggest the company will be capable of servicing its debt.

- Key Financial Ratios (Debt-to-Equity, Interest Coverage): These will be carefully monitored to ensure manageable levels of debt.

- Analysis of the Company's Ability to Service its Debt: The company has demonstrated financial strength and a strong capability to service its increased debt based on projections and previous performance.

Potential Uses of Funds

X plans to allocate the funds raised from the offering towards several key initiatives:

- Specific Projects or Investments: Expansion of production facilities, R&D for new product lines, strategic acquisitions.

- Potential Impact on Future Profitability and Growth: These investments are expected to increase profitability and generate growth in the medium to long term.

Opportunities and Risks

The increased debt level presents both opportunities and risks for X:

- Potential Benefits (e.g., Expansion, Acquisitions): The increased capital allows for strategic expansion and acquisition opportunities that enhance competitiveness.

- Potential Downsides (e.g., Higher Interest Payments, Financial Distress): Higher interest payments will reduce short-term profitability, and it will be crucial for the company to execute its investment plans successfully to avoid financial distress.

Conclusion

X's recent debt offering represents a significant shift in the company's financial structure. While the increased debt burden introduces some risks, the successful oversubscription and maintenance of the investment-grade credit rating demonstrate substantial investor confidence. The strategic allocation of the funds towards growth initiatives holds the potential for significant long-term gains, although careful management of the debt load will be crucial for long-term success. The key takeaways are an increase in available capital for investments, an increase in debt burden requiring careful management, and strong positive investor sentiment based on X’s projected growth plans. Staying informed about the evolving financial landscape of X and the impact of this significant debt offering is crucial for any investor. Continue to monitor our updates for further analysis and insights on the changing face of X and future debt offerings in the market.

Featured Posts

-

U S Iran Nuclear Talks Stalemate On Key Issues

Apr 28, 2025

U S Iran Nuclear Talks Stalemate On Key Issues

Apr 28, 2025 -

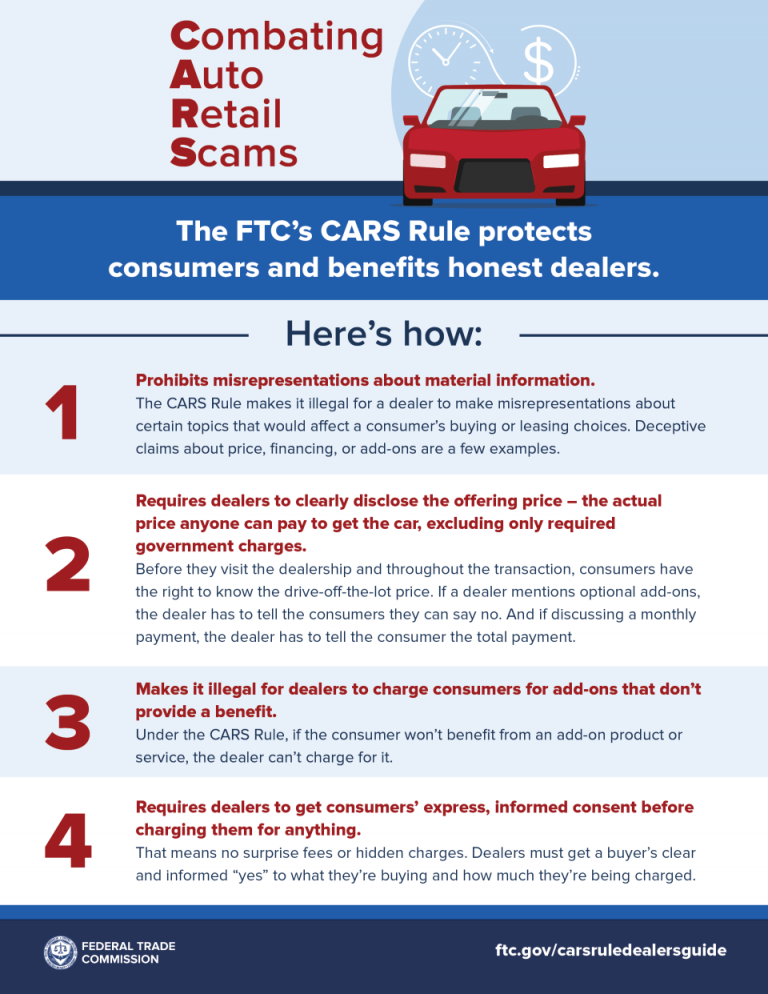

Auto Dealers Push Back Against Mandatory Ev Quotas

Apr 28, 2025

Auto Dealers Push Back Against Mandatory Ev Quotas

Apr 28, 2025 -

Individual Investors And Market Swings Opportunities And Risks

Apr 28, 2025

Individual Investors And Market Swings Opportunities And Risks

Apr 28, 2025 -

Ftc Appeals Microsoft Activision Merger Ruling

Apr 28, 2025

Ftc Appeals Microsoft Activision Merger Ruling

Apr 28, 2025 -

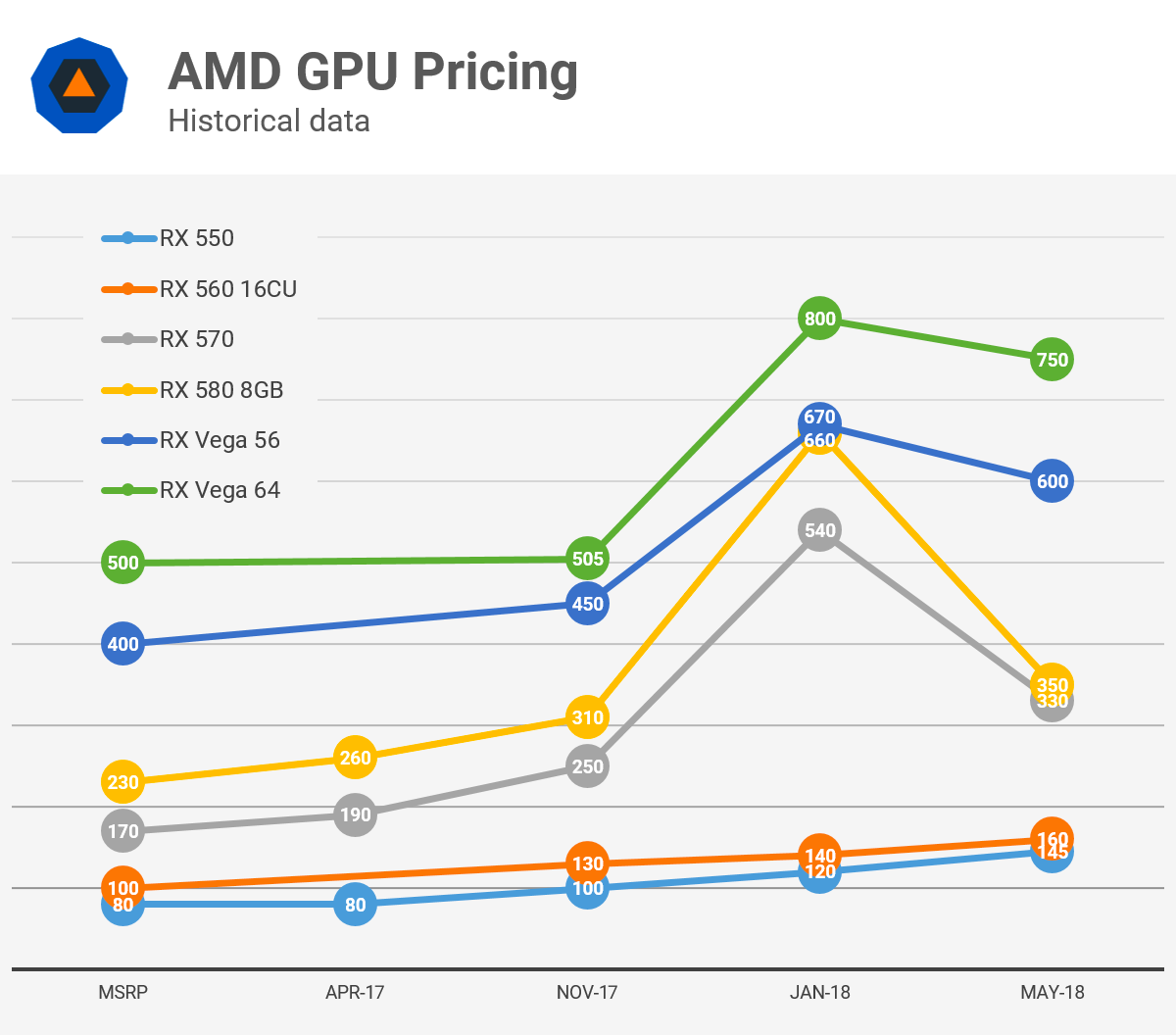

Gpu Market Update Understanding The Price Surge

Apr 28, 2025

Gpu Market Update Understanding The Price Surge

Apr 28, 2025

Latest Posts

-

Boston Red Sox Injury Update Crawford Bello Abreu And Rafaela Status

Apr 28, 2025

Boston Red Sox Injury Update Crawford Bello Abreu And Rafaela Status

Apr 28, 2025 -

Red Sox Injury News Latest On Crawford Bello Abreu And Rafaela

Apr 28, 2025

Red Sox Injury News Latest On Crawford Bello Abreu And Rafaela

Apr 28, 2025 -

Red Sox Injury Report Crawford Bello Abreu And Rafaela Updates

Apr 28, 2025

Red Sox Injury Report Crawford Bello Abreu And Rafaela Updates

Apr 28, 2025 -

Red Sox Breakout Season Predicting The Next Star

Apr 28, 2025

Red Sox Breakout Season Predicting The Next Star

Apr 28, 2025 -

Under The Radar Red Sox Player Poised For Breakout Season

Apr 28, 2025

Under The Radar Red Sox Player Poised For Breakout Season

Apr 28, 2025