The Connection Between Federal Debt And Your Mortgage Payments

Table of Contents

How Federal Debt Influences Interest Rates

The relationship between government borrowing and interest rates is significant. When the government needs to borrow money to finance its spending (often increasing the national debt), it issues Treasury bonds. This increased demand for funds in the market competes with other borrowers, including banks that provide mortgages. The Federal Reserve (the Fed), the central bank of the U.S., plays a crucial role in managing interest rates through monetary policy. However, high levels of federal debt can put upward pressure on interest rates regardless of the Fed's actions.

- Increased government borrowing leads to higher demand for funds. This increased demand pushes up the price of borrowing money, resulting in higher interest rates across the board.

- Higher demand pushes interest rates upwards. This affects not only government borrowing costs but also rates for businesses and consumers.

- Rising interest rates directly impact mortgage rates. Mortgage lenders base their rates on broader market interest rates, including Treasury yields.

- Treasury yields significantly affect mortgage rates. When Treasury yields rise, mortgage rates tend to follow suit, making mortgages more expensive.

The Impact of Inflation on Mortgage Payments

Federal debt contributes to inflation in several ways. Excessive government spending, often financed by borrowing, can increase demand for goods and services without a corresponding increase in supply, pushing prices higher. This inflation erodes the purchasing power of your money, impacting the real cost of your mortgage payments.

- Government spending financed by debt can fuel inflation. This is especially true when the economy is already operating near its capacity.

- Inflation erodes the value of money, impacting mortgage payments. Even if your monthly payment stays the same, its purchasing power decreases with inflation.

- Higher inflation often leads to higher interest rates to combat it. The Fed often raises interest rates to cool down an overheating economy and curb inflation, further impacting mortgage rates.

- Inflation affects the real cost of your mortgage. While your nominal payment might be fixed, the actual cost of your mortgage in terms of goods and services you can purchase decreases as inflation rises.

Federal Debt and the Housing Market

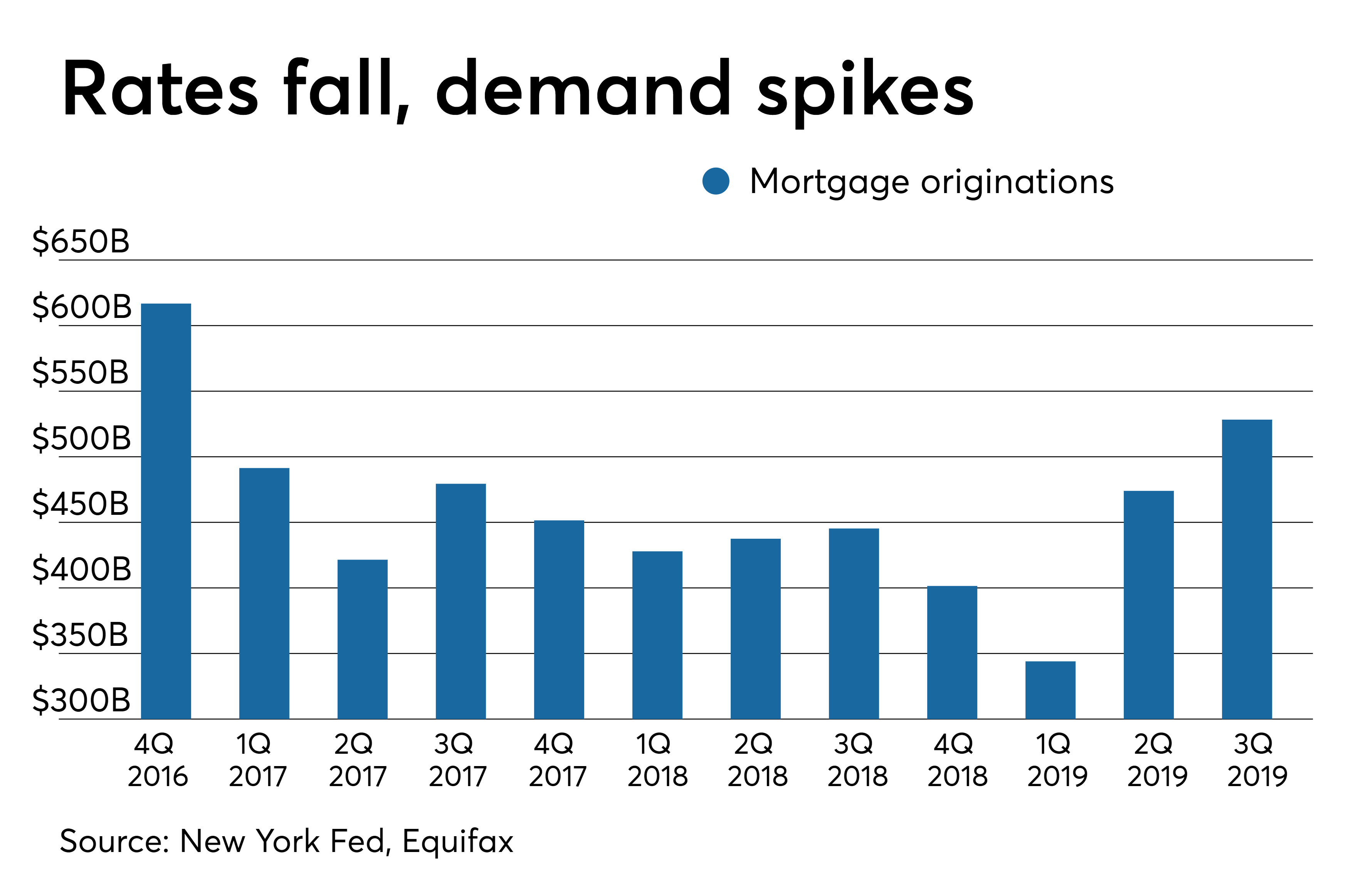

The overall impact of high federal debt on the housing market's stability is significant. Increased interest rates, a direct consequence of rising federal debt, make mortgages less affordable. This reduced affordability can lead to decreased demand for housing, potentially impacting home values and slowing down market growth.

- Higher mortgage rates reduce affordability. This makes it harder for prospective homebuyers to qualify for loans and reduces the number of buyers in the market.

- Reduced demand can lead to price adjustments in the housing market. A decrease in buyer demand can cause a slowdown or even a correction in housing prices.

- Potential impact on home values. Depending on the severity of the situation, the value of existing homes can be negatively impacted.

- A healthy economy is crucial for housing market stability. High levels of federal debt can create economic uncertainty, negatively impacting the housing market’s health and stability.

Strategies for Homeowners During Times of High Federal Debt

High federal debt and its effect on mortgage payments can be concerning. However, homeowners can take proactive steps to manage their situation.

- Refinancing options to lower interest rates. If interest rates have fallen since you took out your mortgage, refinancing could lower your monthly payments.

- Budgeting strategies to manage increased payments. Careful budgeting and expense tracking can help you manage higher mortgage payments.

- Exploring options for mortgage assistance programs (if available). Government or non-profit organizations may offer assistance programs to help homeowners facing financial difficulties.

- Importance of financial planning and monitoring interest rates. Regularly review your financial plan and keep an eye on interest rate trends to make informed decisions.

Conclusion

The connection between federal debt and your mortgage payments is undeniable. Rising federal debt often leads to higher interest rates and inflation, directly impacting the affordability and cost of homeownership. Understanding this relationship is crucial for responsible financial planning. Stay informed about federal debt levels, interest rate changes, and their impact on mortgage payments. Proactive financial planning, including monitoring interest rates and exploring refinancing options, can help mitigate the potential negative effects of high federal debt on your mortgage payments and overall financial well-being. Understanding the relationship between federal debt and your mortgage payments is vital for responsible homeownership.

Featured Posts

-

The Impact Of National Debt On Mortgage Interest Rates And Availability

May 19, 2025

The Impact Of National Debt On Mortgage Interest Rates And Availability

May 19, 2025 -

China Pakistan Satellite Collaboration Analysis Of Indian Defense Groups Statement

May 19, 2025

China Pakistan Satellite Collaboration Analysis Of Indian Defense Groups Statement

May 19, 2025 -

Record Drone Attack On Ukraine Russias Escalation

May 19, 2025

Record Drone Attack On Ukraine Russias Escalation

May 19, 2025 -

Analyzing Jordan Bardellas Electoral Strategy

May 19, 2025

Analyzing Jordan Bardellas Electoral Strategy

May 19, 2025 -

Mayor Presencia Policial En El Cne Para Resguardar La Integridad Electoral

May 19, 2025

Mayor Presencia Policial En El Cne Para Resguardar La Integridad Electoral

May 19, 2025