The Great Decoupling And Its Impact On Emerging Markets

Table of Contents

Economic Divergence and its Drivers

The Great Decoupling, characterized by increasing economic divergence between developed and developing nations, is fueled by several interconnected factors.

Geopolitical Tensions

Geopolitical instability significantly contributes to global economic decoupling. The escalating US-China trade war, for instance, has disrupted global supply chains and created uncertainty for businesses operating in emerging markets. Regional conflicts, such as the ongoing war in Ukraine, further exacerbate this instability.

- Examples: The imposition of tariffs on goods from China impacted various emerging markets reliant on Chinese manufacturing and trade. The war in Ukraine led to energy price shocks, disproportionately affecting emerging economies dependent on energy imports.

- Analysis: These tensions lead to trade restrictions, reduced foreign direct investment (FDI), and supply chain disruptions, hindering economic growth in emerging markets. Countries find themselves navigating complex geopolitical landscapes, forcing them to recalibrate their economic strategies.

Technological Competition

The intensifying technological rivalry between major global powers, particularly in areas like semiconductors and artificial intelligence (AI), is another key driver of the Great Decoupling. This competition shapes investment flows, technology transfer, and the development of domestic technological capabilities in emerging markets.

- Examples: The restrictions imposed on the export of advanced semiconductor technology to China impact the development of tech sectors in emerging markets reliant on these technologies. The global race to dominate AI development creates uneven access to advanced technologies for emerging economies.

- Analysis: Emerging markets face both challenges and opportunities. While access to cutting-edge technologies might be limited, this also fosters an environment for innovation and the development of indigenous technologies.

Supply Chain Restructuring

The Great Decoupling is prompting a fundamental reshaping of global supply chains, with many multinational corporations diversifying their production bases to reduce reliance on single regions. This "friend-shoring" or "near-shoring" trend has significant implications for emerging markets.

- Examples: Companies are relocating manufacturing facilities from China to Southeast Asia or other regions, leading to job creation in some emerging markets but potential job losses in others.

- Analysis: Emerging markets need to adapt to this shift by improving their infrastructure, regulatory environments, and skilled workforce to attract investment and become part of the restructured global supply chains. This requires significant investments in human capital and infrastructure.

Opportunities for Emerging Markets

Despite the challenges, the Great Decoupling also presents significant opportunities for emerging markets willing to adapt and innovate.

Regionalization and Trade Diversification

The decoupling encourages regional economic integration. Emerging markets can benefit by strengthening regional trade agreements and reducing reliance on traditional partners.

- Examples: The growth of the African Continental Free Trade Area (AfCFTA) presents opportunities for intra-African trade and economic growth. Regional trade blocs in Southeast Asia are also strengthening.

- Analysis: Diversifying trade partnerships and fostering regional economic integration can mitigate risks associated with dependence on a single major trading partner.

Attracting Foreign Direct Investment (FDI)

Emerging markets can position themselves strategically to attract FDI by improving their investment climates.

- Examples: Countries that implement regulatory reforms, improve infrastructure, and invest in human capital are more likely to attract FDI.

- Analysis: Attracting FDI in strategic sectors is crucial for technological advancement, job creation, and economic diversification, offsetting the negative impacts of the decoupling.

Technological Leap-Frogging

The decoupling could enable some emerging markets to bypass older technologies and adopt cutting-edge solutions directly.

- Examples: The rapid adoption of mobile payment systems in some African countries demonstrates the potential for technological leapfrogging.

- Analysis: This requires investment in education, digital infrastructure, and a supportive regulatory environment to facilitate the adoption and development of new technologies.

Challenges Faced by Emerging Markets

The Great Decoupling also poses significant challenges for emerging markets.

Increased Volatility and Uncertainty

The decoupling creates increased economic volatility and uncertainty, impacting trade, investment, and financial markets.

- Examples: Sharp fluctuations in commodity prices and capital flows can negatively impact macroeconomic stability in emerging markets.

- Analysis: Navigating this uncertain environment requires strong macroeconomic management, prudent fiscal policies, and robust financial regulations.

Capital Flight and Currency Fluctuations

The decoupling can lead to capital flight and currency fluctuations, potentially destabilizing emerging market economies.

- Examples: Emerging markets with weak fundamentals or perceived political risks are more susceptible to capital flight.

- Analysis: Stronger institutions, transparent governance, and sound monetary policies are crucial to mitigate these risks.

Increased Dependence on Specific Trading Partners

While diversification is key, some emerging markets may become overly reliant on specific new trading partners, creating new vulnerabilities.

- Examples: A country heavily reliant on one regional trade partner might be vulnerable if relations sour.

- Analysis: A balanced approach to diversification is crucial, avoiding over-reliance on any single partner or region.

Conclusion: Navigating the Great Decoupling in Emerging Markets

The Great Decoupling presents both substantial opportunities and formidable challenges for emerging markets. While regionalization, FDI attraction, and technological leapfrogging offer avenues for growth, increased volatility, capital flight, and dependence on specific partners pose significant risks. Understanding the complexities of the Great Decoupling and its impact on emerging markets is crucial for investors, policymakers, and businesses alike. Further research into specific emerging market economies and their responses to this global shift is vital to effectively navigate this transformative period. Adapting to the realities of the Great Decoupling and leveraging its opportunities will be key to ensuring sustainable economic growth in emerging markets in the years to come.

Featured Posts

-

Felony Stalking And Vandalism Charges Filed Against Man Who Crashed Into Jennifer Anistons Property

May 09, 2025

Felony Stalking And Vandalism Charges Filed Against Man Who Crashed Into Jennifer Anistons Property

May 09, 2025 -

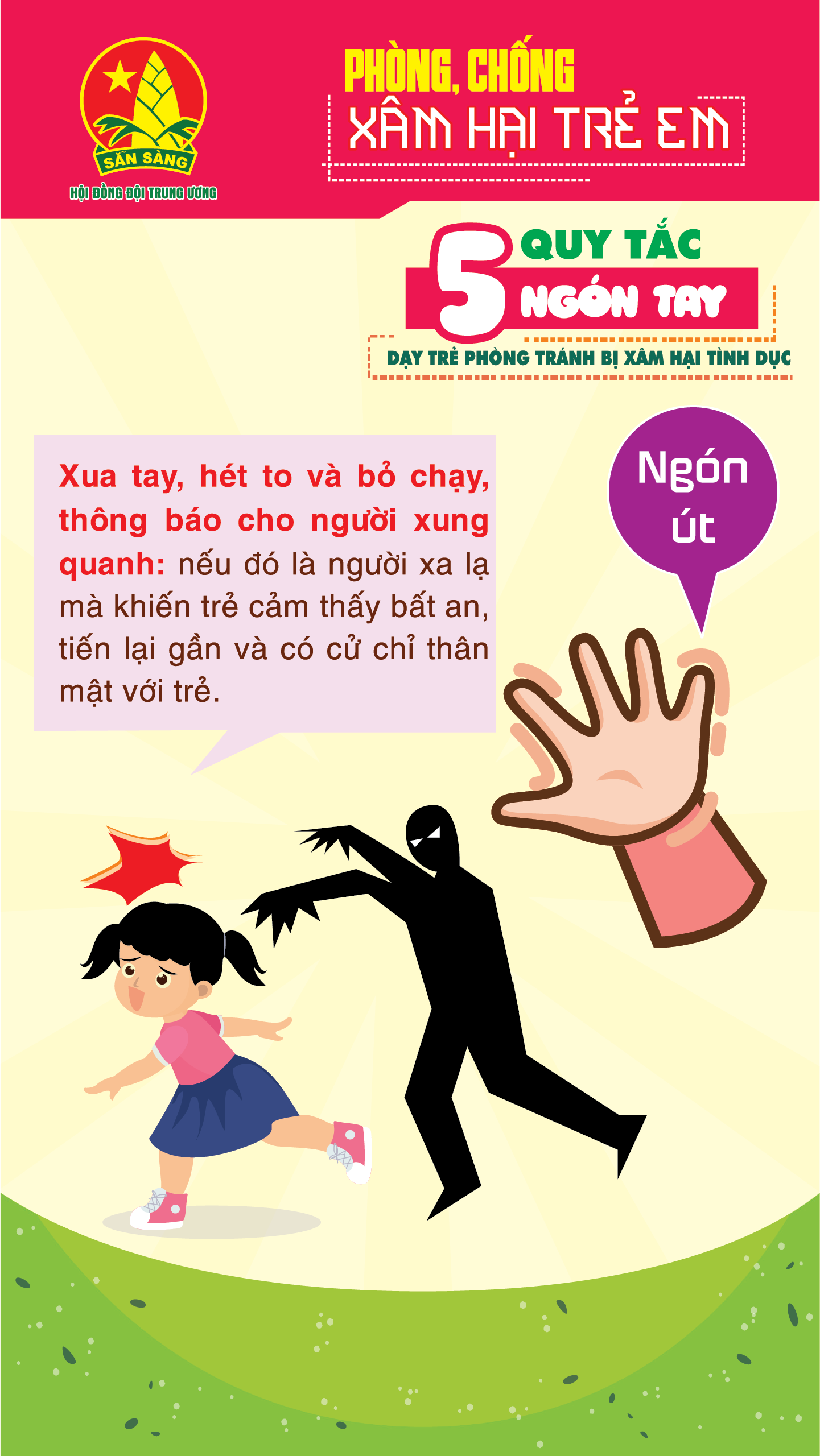

De Cao Trach Nhiem Cham Dut Bao Hanh Tre Em Tai Cac Co So Giu Tre Tu Nhan

May 09, 2025

De Cao Trach Nhiem Cham Dut Bao Hanh Tre Em Tai Cac Co So Giu Tre Tu Nhan

May 09, 2025 -

Nyt Strands Hints And Answers Sunday February 23 Game 357

May 09, 2025

Nyt Strands Hints And Answers Sunday February 23 Game 357

May 09, 2025 -

Cryptocurrencys Resilience A Winning Strategy Amidst Trade Wars

May 09, 2025

Cryptocurrencys Resilience A Winning Strategy Amidst Trade Wars

May 09, 2025 -

Zelenskiy Odin Na 9 Maya Otsutstvie Podderzhki Soyuznikov

May 09, 2025

Zelenskiy Odin Na 9 Maya Otsutstvie Podderzhki Soyuznikov

May 09, 2025