The Grim Truth About Retail: Implications For Bank Of Canada Rates

Table of Contents

Weakening Consumer Spending and Retail Sales

The downturn in the Canadian retail sector is primarily driven by weakening consumer spending and declining retail sales. This trend has significant implications for the Bank of Canada's rate-setting decisions.

Declining Consumer Confidence

Several factors contribute to decreased consumer confidence, creating a challenging environment for retailers.

- High inflation eroding purchasing power: Soaring inflation has significantly reduced the real value of consumers' incomes, leaving less disposable income for non-essential purchases. Statistics Canada's Consumer Price Index consistently shows inflation exceeding wage growth, impacting purchasing power.

- Increased mortgage payments impacting disposable income: The Bank of Canada's previous interest rate hikes have led to substantially higher mortgage payments for many homeowners, reducing their discretionary spending. This directly impacts retail sales, especially in sectors reliant on discretionary spending.

- Anxieties about job security: Concerns about potential job losses due to economic slowdown are contributing to cautious spending habits. Uncertainty about future income streams leads consumers to prioritize essential spending over discretionary purchases.

- Global economic slowdown: The global economic landscape is marked by uncertainty, impacting consumer confidence in Canada. Geopolitical instability and concerns about recession further fuel anxieties and reduce consumer spending. According to recent Statistics Canada data, consumer confidence has fallen to [insert relevant statistic]. Retail sales figures also reflect this decline, showing a [insert percentage] decrease in [specify period].

Shifting Consumer Behavior

Consumers are adapting to economic pressures by changing their spending habits and priorities.

- Increased focus on value and discounts: Consumers are actively seeking value for their money, prioritizing discounts and promotions. Retailers are responding with increased sales and promotional activities.

- Prioritizing essential goods over non-essentials: Spending is shifting towards essential goods like groceries and utilities, while spending on discretionary items like clothing and electronics is declining. This is clearly evident in the sales data of different retail sectors.

- Utilizing budgeting apps and seeking financial advice: Consumers are increasingly turning to budgeting tools and financial advisors to manage their finances more effectively in this challenging economic climate. This reflects a broader trend of increased financial prudence. The shift in spending patterns is noticeable across various retail sectors. For instance, grocery sales have remained relatively stable while sales in the apparel sector have experienced a significant drop.

Impact on Retail Businesses and Employment

The weakening consumer spending is having a direct and substantial impact on retail businesses and employment across Canada.

Increased Business Failures and Layoffs

The combination of reduced sales and increased operating costs is leading to an increase in retail bankruptcies and job losses.

- Challenges faced by small and medium-sized retail businesses: Smaller businesses are particularly vulnerable to economic downturns due to their limited financial resources and capacity to weather prolonged periods of low sales. Many are struggling to stay afloat, leading to closures and job losses.

- Impact on employment rates in the retail sector: The retail sector is a significant employer in Canada, and job losses in this sector have broad economic implications. The unemployment rate in the retail sector is expected to [insert predicted statistic based on reliable sources].

- Potential regional disparities: The impact of the economic slowdown is not uniform across the country. Certain regions and sectors might be disproportionately affected, leading to regional disparities in unemployment and business closures. According to [source], the retail sector in [region] has experienced [statistic on job losses/business closures].

Pressure on Wages and Inflation

The struggles of the retail sector are also creating pressure on wages and inflation, further complicating the Bank of Canada's mandate.

- The impact of reduced consumer spending on business profitability: Decreased sales directly impact business profitability, limiting the ability of retailers to offer wage increases or maintain existing wage levels.

- The potential for wage stagnation or cuts: In some cases, businesses might be forced to freeze or even cut wages to reduce costs and remain viable in the current economic climate. This can further dampen consumer spending.

- The feedback loop to inflation: Wage stagnation or cuts in the retail sector can contribute to lower overall wage growth, potentially easing inflationary pressures. However, this can also lead to a vicious cycle of reduced consumer spending and further economic slowdown. This complex interplay creates a significant challenge for the Bank of Canada in managing inflation.

The Bank of Canada's Response and Future Rate Decisions

The Bank of Canada faces a difficult balancing act in responding to the challenges facing the retail sector and the broader economy.

Balancing Economic Growth and Inflation

The Bank of Canada's mandate is to maintain price stability while supporting sustainable economic growth. The current situation requires a careful balancing act.

- Analysis of current interest rate levels: The current interest rate levels reflect the Bank of Canada's attempt to control inflation while minimizing the negative impact on economic growth.

- Potential future rate adjustments based on economic indicators: Future rate adjustments will depend on a range of economic indicators, including inflation, employment, consumer spending, and retail sales. The Bank will closely monitor these factors to inform its decisions.

- Consideration of the impact on different segments of the population: The Bank must consider the impact of its interest rate decisions on different segments of the population, particularly vulnerable groups affected by higher borrowing costs.

Predicting Future Trends

Predicting future economic activity and interest rate decisions is inherently challenging.

- The role of data analysis and economic modeling in the Bank of Canada's decision-making process: The Bank relies heavily on sophisticated data analysis and economic modeling to forecast future trends and inform its rate-setting decisions.

- The potential impact of unforeseen events (e.g., global economic shocks): Unforeseen events, such as global economic shocks or geopolitical instability, can significantly alter the economic outlook and influence the Bank's decisions.

- Discussion of different economic scenarios and their implications for interest rates: The Bank considers various economic scenarios and their potential implications for interest rates to ensure its policy is adaptable to changing circumstances.

Conclusion

The struggling Canadian retail sector is a critical factor influencing the Bank of Canada's decisions on interest rates. Weakening consumer spending, rising business failures, and employment pressures create a complex economic environment. The Bank must carefully consider these factors when setting monetary policy, balancing the need to control inflation with the desire to support economic growth. Understanding the “grim truth about retail” is crucial to comprehending the future trajectory of Bank of Canada rates. Stay informed about the latest economic data and analyses to better understand the implications for your financial planning and business strategies related to Bank of Canada rates and their impact on the Canadian economy.

Featured Posts

-

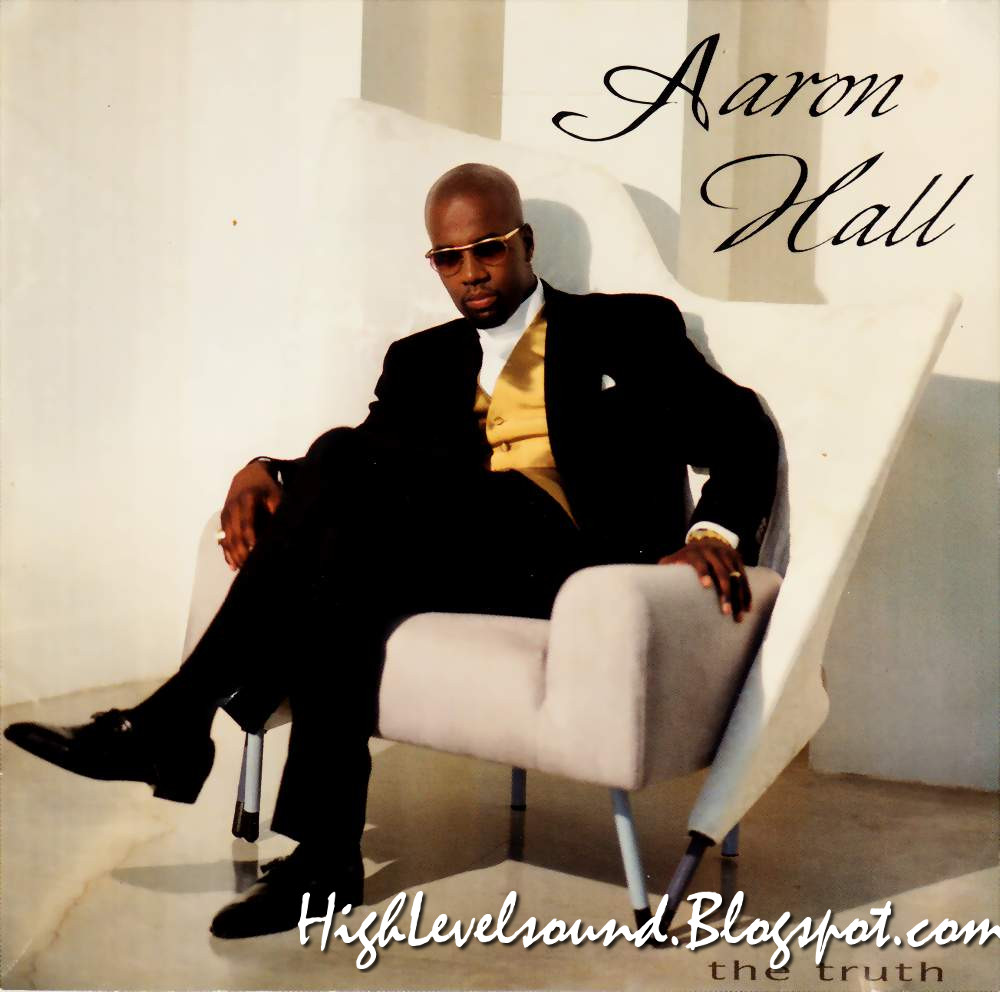

Willie Nelsons New Album Oh What A Beautiful World

Apr 29, 2025

Willie Nelsons New Album Oh What A Beautiful World

Apr 29, 2025 -

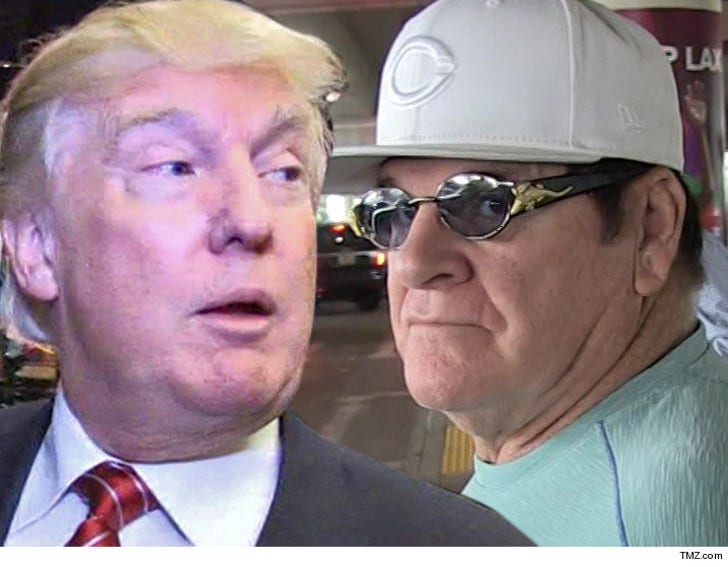

The Pete Rose Pardon Understanding Trumps Latest Announcement

Apr 29, 2025

The Pete Rose Pardon Understanding Trumps Latest Announcement

Apr 29, 2025 -

Nyt Strands April 3 2025 Complete Solutions And Spangram

Apr 29, 2025

Nyt Strands April 3 2025 Complete Solutions And Spangram

Apr 29, 2025 -

Trump To Pardon Pete Rose After Death Fact Or Fiction

Apr 29, 2025

Trump To Pardon Pete Rose After Death Fact Or Fiction

Apr 29, 2025 -

Djokovics Monte Carlo Masters 2025 Campaign Ends In Straight Sets Loss To Tabilo

Apr 29, 2025

Djokovics Monte Carlo Masters 2025 Campaign Ends In Straight Sets Loss To Tabilo

Apr 29, 2025

Latest Posts

-

Concern Grows For Missing British Paralympian In Las Vegas Last Contact Over A Week Ago

Apr 29, 2025

Concern Grows For Missing British Paralympian In Las Vegas Last Contact Over A Week Ago

Apr 29, 2025 -

Concern Grows For British Paralympian Missing In Las Vegas

Apr 29, 2025

Concern Grows For British Paralympian Missing In Las Vegas

Apr 29, 2025 -

Las Vegas Police Search For Missing British Paralympian A Week Of Uncertainty

Apr 29, 2025

Las Vegas Police Search For Missing British Paralympian A Week Of Uncertainty

Apr 29, 2025 -

Urgent Appeal British Paralympian Missing For Over A Week In Las Vegas

Apr 29, 2025

Urgent Appeal British Paralympian Missing For Over A Week In Las Vegas

Apr 29, 2025 -

Las Vegas Police Seek Information On Missing British Paralympian

Apr 29, 2025

Las Vegas Police Seek Information On Missing British Paralympian

Apr 29, 2025