The Impact Of Trump's Tariffs On Nicolai Tangen's Investment Decisions

Table of Contents

Understanding the Trump Tariffs and Their Global Reach

Trump's tariffs, implemented between 2018 and 2020, targeted various sectors, most notably steel and aluminum imports globally, and a wide range of Chinese goods. These actions significantly disrupted global supply chains, leading to increased costs for businesses and heightened market volatility. The uncertainty surrounding the tariffs' scope and duration further exacerbated the situation, creating a challenging environment for investors.

- Sectors most affected by tariffs: Manufacturing, technology, agriculture, and automotive industries were among the hardest hit. The ripple effects extended to numerous other sectors dependent on these industries.

- Examples of specific tariff implementations and their consequences: The 25% tariff on steel imports from several countries led to increased steel prices in the US, impacting manufacturers reliant on steel as a raw material. Similarly, tariffs on Chinese goods triggered retaliatory measures, further complicating global trade relationships.

- Rise in protectionist sentiment globally: Trump's tariffs fueled a resurgence of protectionist sentiment worldwide, with other countries implementing their own trade barriers, intensifying the global economic uncertainty.

Nicolai Tangen's Investment Philosophy and NBIM's Mandate

Nicolai Tangen, appointed CEO of NBIM in 2020, brought a distinctive investment approach. While his tenure didn't fully encompass the entire period of Trump's tariffs, his investment philosophy and NBIM's mandate provide a crucial context for understanding their response. NBIM, managing Norway's sovereign wealth fund, is mandated to generate long-term returns for the benefit of future generations. This focus on long-term value creation guides its investment strategies.

- Key investment strategies employed by NBIM: NBIM utilizes a broadly diversified investment approach, spanning equities, fixed income, real estate, and renewable energy. They emphasize a long-term perspective, avoiding short-term market speculation.

- NBIM’s approach to ESG (Environmental, Social, and Governance) investing: NBIM actively incorporates ESG factors into its investment decisions, seeking to balance financial returns with positive environmental and social impacts. This approach can influence its selection of companies, potentially mitigating risks associated with environmentally damaging practices.

- The fund's geographical diversification strategy: NBIM’s portfolio is geographically diversified, reducing exposure to risks concentrated in any single region or economy. This diversification strategy helps mitigate the impact of region-specific economic shocks, such as those caused by trade wars.

Direct Impact of Tariffs on NBIM's Portfolio

The Trump tariffs directly impacted several sectors within NBIM's portfolio. Companies in the manufacturing and technology sectors, heavily reliant on global supply chains, experienced disruptions and price fluctuations. While precise figures on NBIM's losses or gains remain undisclosed due to confidentiality, the overall market volatility undoubtedly impacted the fund's performance.

- Examples of specific companies within NBIM's portfolio affected by tariffs: Although specific company names are not publicly disclosed, it's reasonable to assume that multinational corporations within NBIM's extensive holdings across various sectors experienced varying degrees of impact.

- Analysis of NBIM's adjustments to its holdings in response to tariffs: NBIM likely adjusted its portfolio in response to market fluctuations, potentially re-allocating capital towards less volatile asset classes or sectors less affected by tariffs. This would have involved complex risk assessments and portfolio rebalancing strategies.

- Quantitative data (if available) demonstrating the financial impact: Unfortunately, detailed quantitative data on the direct financial impact of the tariffs on NBIM's portfolio is not publicly accessible. Such information is usually considered confidential.

Indirect Impacts: Economic Uncertainty and Risk Management

The broader economic consequences of Trump's tariffs, including increased inflation and reduced global growth, presented significant challenges for NBIM's risk management strategies. The uncertainty surrounding future trade policies forced NBIM to carefully assess and adjust its portfolio allocation.

- Shift in investment allocation toward less volatile asset classes: In response to heightened uncertainty, NBIM might have shifted a portion of its portfolio towards less volatile asset classes, such as government bonds, to reduce its overall risk exposure.

- Changes in hedging strategies to mitigate tariff-related risks: Sophisticated hedging strategies would have been employed to mitigate risks stemming from currency fluctuations and commodity price volatility caused by the tariffs.

- Impact on NBIM's long-term investment horizons: While NBIM maintains a long-term investment horizon, the increased uncertainty likely necessitated more frequent monitoring and adjustments to its investment strategy to respond to evolving market conditions.

Tangen's Response and Adaptability

While detailed public statements from Tangen regarding specific responses to the tariffs are limited, NBIM's overall actions demonstrate an adaptive approach to managing the increased uncertainty and risk. Their focus on long-term value creation, combined with a diversified portfolio and sophisticated risk management techniques, likely helped mitigate the negative impacts of the trade war.

- Examples of Tangen's responses to market volatility: His response would have involved close monitoring of market trends, working with the investment teams to assess risks, and implementing adjustments to the portfolio allocation.

- Analysis of his communication strategies to stakeholders: Tangen’s communication likely focused on transparency and confidence in NBIM's ability to navigate market volatility, reassuring stakeholders of the fund's long-term stability.

- Assessment of NBIM's overall resilience in the face of the trade war: NBIM's diverse investment strategy and risk management expertise allowed it to weather the storm of the trade war relatively well. The long-term perspective ensured the fund didn’t make rash decisions based solely on short-term market fluctuations.

Conclusion

Trump's tariffs created a period of significant economic uncertainty, directly and indirectly impacting Nicolai Tangen's investment decisions and NBIM's portfolio. The challenges included navigating market volatility, managing increased risk, and adapting investment strategies to the changing global landscape. NBIM's diversified portfolio, long-term perspective, and robust risk management capabilities were crucial in mitigating the negative consequences. The experience highlights the importance of adaptability and strategic foresight in navigating volatile global markets.

Understanding the intricacies of global trade and its impact on investment decisions is crucial for investors of all sizes. Continue to research the impact of Trump's tariffs and other geopolitical events to refine your own investment strategy and improve your risk management. Learn more about the strategies employed by leading investors like Nicolai Tangen to navigate economic uncertainty and protect your portfolio.

Featured Posts

-

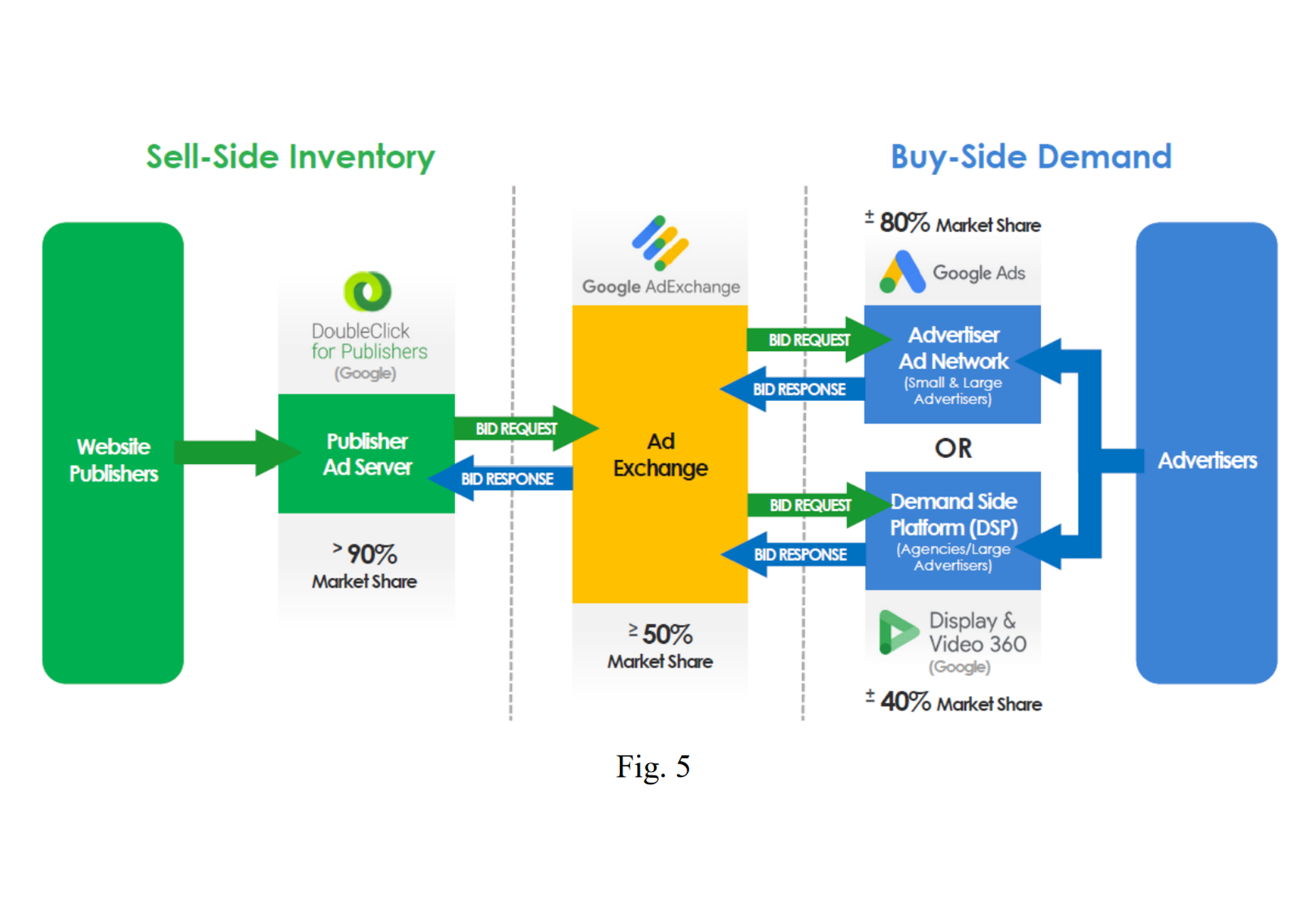

U S Antitrust Suit Could Force Google To Divest Ad Business

May 05, 2025

U S Antitrust Suit Could Force Google To Divest Ad Business

May 05, 2025 -

Sheins London Ipo A Victim Of Us Trade Tensions

May 05, 2025

Sheins London Ipo A Victim Of Us Trade Tensions

May 05, 2025 -

Blake Lively Anna Kendrick A 3 Word Reaction That Went Viral

May 05, 2025

Blake Lively Anna Kendrick A 3 Word Reaction That Went Viral

May 05, 2025 -

Kolkata Weather Alert Me T Department Predicts Thunderstorms

May 05, 2025

Kolkata Weather Alert Me T Department Predicts Thunderstorms

May 05, 2025 -

How Anna Kendrick And Rebel Wilson Became Friends A Pitch Perfect Story

May 05, 2025

How Anna Kendrick And Rebel Wilson Became Friends A Pitch Perfect Story

May 05, 2025

Latest Posts

-

Emma Stone And Margaret Qualley Oscars Feud Rumors Explained

May 05, 2025

Emma Stone And Margaret Qualley Oscars Feud Rumors Explained

May 05, 2025 -

Murder Charges Filed Against Stepfather Accused Of Torturing And Starving 16 Year Old Stepson

May 05, 2025

Murder Charges Filed Against Stepfather Accused Of Torturing And Starving 16 Year Old Stepson

May 05, 2025 -

Emma Stone At The Oscars 2025 Sequin Louis Vuitton And Old Hollywood Glamour

May 05, 2025

Emma Stone At The Oscars 2025 Sequin Louis Vuitton And Old Hollywood Glamour

May 05, 2025 -

16 Year Old Stepsons Death Stepfather Arrested Accused Of Murder Torture And Starvation

May 05, 2025

16 Year Old Stepsons Death Stepfather Arrested Accused Of Murder Torture And Starvation

May 05, 2025 -

Emma Stones Show Stopping Oscars 2025 Dress Louis Vuitton Sequin And Retro Hairstyle

May 05, 2025

Emma Stones Show Stopping Oscars 2025 Dress Louis Vuitton Sequin And Retro Hairstyle

May 05, 2025