The Low-Key Path To Wealth: How The Stealthy Wealthy Accumulate Their Fortunes

Table of Contents

Living Below Your Means: The Cornerstone of Stealth Wealth

Living below your means is the bedrock of building quiet wealth. It's not about deprivation; it's about conscious spending and prioritizing long-term financial goals over immediate gratification. This approach is crucial for the stealthy wealthy, allowing them to amass significant savings and invest aggressively without attracting unwanted attention.

Strategic Budgeting and Expense Tracking:

Developing a detailed budget is paramount. This isn't just about tracking income and expenses; it's about understanding where your money goes and identifying areas for improvement.

- Meticulous Tracking: Utilize budgeting apps (Mint, YNAB, Personal Capital) or spreadsheets to monitor your income and expenses rigorously. Categorize spending to pinpoint areas of overspending.

- Cutting Back Strategically: Don't drastically slash your budget; instead, make incremental changes. Identify non-essential expenses (subscriptions, eating out, entertainment) and find ways to reduce them without sacrificing essential needs.

- Prioritizing Needs vs. Wants: Differentiate between necessities (housing, food, healthcare) and wants (luxury goods, entertainment). Focus spending on needs first, allowing for occasional wants only after essential expenses are covered.

Delayed Gratification and Investing for the Future:

Resisting impulse purchases is vital for long-term financial success. The stealthy wealthy understand the power of delayed gratification, preferring to invest their money rather than spending it on fleeting pleasures.

- Long-Term Financial Goals: Define clear financial goals (retirement, early retirement, property ownership). Use these goals to motivate responsible saving and investing habits.

- Consistent Investing: Invest consistently in a diversified portfolio of assets. Automate your investments to ensure regular contributions, even small amounts.

- Frugal Mindset: A frugal mindset doesn't mean deprivation. It's about making smart financial decisions and finding value in experiences rather than material possessions.

Strategic Investing: Diversification and Long-Term Vision

Strategic investing is crucial for building understated wealth. The stealthy wealthy understand the importance of diversification and a long-term perspective. They avoid get-rich-quick schemes and instead focus on building wealth steadily and securely.

Diversification Across Asset Classes:

Diversification is key to mitigating risk. Don't put all your eggs in one basket.

- Asset Allocation: Spread investments across various asset classes, including stocks, bonds, real estate, and potentially alternative investments like precious metals or private equity (after thorough research and with professional guidance).

- Index Funds and ETFs: Utilize low-cost index funds and ETFs to gain broad market exposure without the need for extensive individual stock picking.

- Cautious Alternative Investments: Consider alternative investments carefully, understanding their higher risk profiles. Only allocate a small percentage of your portfolio to these options.

Long-Term Investment Approach:

Patience is a virtue for the stealthy wealthy. They understand that building significant wealth takes time and resist the urge to react to short-term market fluctuations.

- Long-Term Growth: Focus on the long-term growth potential of your investments rather than chasing short-term gains.

- Emotional Discipline: Avoid emotional decision-making. Stick to your investment plan regardless of market volatility.

- Reinvesting Profits: Reinvest dividends and capital gains to accelerate wealth accumulation through compounding.

Building Multiple Income Streams: Expanding Financial Horizons

The stealthy wealthy rarely rely on a single income source. They actively seek opportunities to generate multiple income streams, enhancing financial security and resilience.

Passive Income Generation:

Passive income provides a safety net and accelerates wealth building.

- Rental Properties: Invest in rental properties to generate consistent cash flow.

- Dividend-Paying Stocks: Build a portfolio of dividend-paying stocks for regular income.

- Online Businesses: Explore opportunities to create and manage online businesses that generate passive income.

Skill Enhancement and Career Advancement:

Continuously improving your skills is essential for increasing your earning potential.

- Skill Upgrades: Invest in your education and professional development to enhance your marketability.

- Career Advancement: Seek promotions or explore new career paths within your field.

- Entrepreneurship: Consider starting your own business to create a potentially high-income stream.

Protecting Your Wealth: Financial Privacy and Security

Protecting your wealth is as important as accumulating it. The stealthy wealthy prioritize financial privacy and security to safeguard their hard-earned assets.

Financial Privacy Strategies:

Maintaining financial privacy is crucial for protecting your wealth and avoiding unwanted attention.

- Discretion in Spending: Avoid ostentatious displays of wealth and maintain a low profile.

- Legal Structures: Explore the use of trusts and other legal structures to protect assets and maintain privacy.

- Professional Advice: Consult with financial advisors and tax professionals to optimize your financial strategy and minimize tax liabilities.

Protecting Assets from Risk:

Safeguarding your wealth requires planning for unforeseen circumstances.

- Insurance Coverage: Maintain adequate insurance coverage (health, life, property) to protect against unexpected events.

- Asset Diversification: Diversify your assets across different asset classes and geographies to mitigate risk.

- Regular Review: Regularly review and update your financial plans to adapt to changing circumstances.

Conclusion:

The path to building substantial wealth isn't always glamorous. The stealthy wealthy demonstrate that accumulating significant assets often involves a quiet, disciplined approach focused on living below your means, strategic investing, diversifying income streams, and protecting your financial privacy. By embracing the principles outlined above, you can embark on your own low-key journey toward achieving lasting financial security. Start building your stealthy wealth today by implementing these strategies and taking control of your financial future. Embrace the principles of quiet wealth and begin your journey towards financial freedom.

Featured Posts

-

Nyt Mini Crossword Today Hints And Answers For March 3 2025

May 19, 2025

Nyt Mini Crossword Today Hints And Answers For March 3 2025

May 19, 2025 -

Jennifer Lawrence And Cooke Maroney Couple Makes Public Appearance After Second Child Rumors

May 19, 2025

Jennifer Lawrence And Cooke Maroney Couple Makes Public Appearance After Second Child Rumors

May 19, 2025 -

U S Allies Await Tariff Relief Despite China Trade Truce

May 19, 2025

U S Allies Await Tariff Relief Despite China Trade Truce

May 19, 2025 -

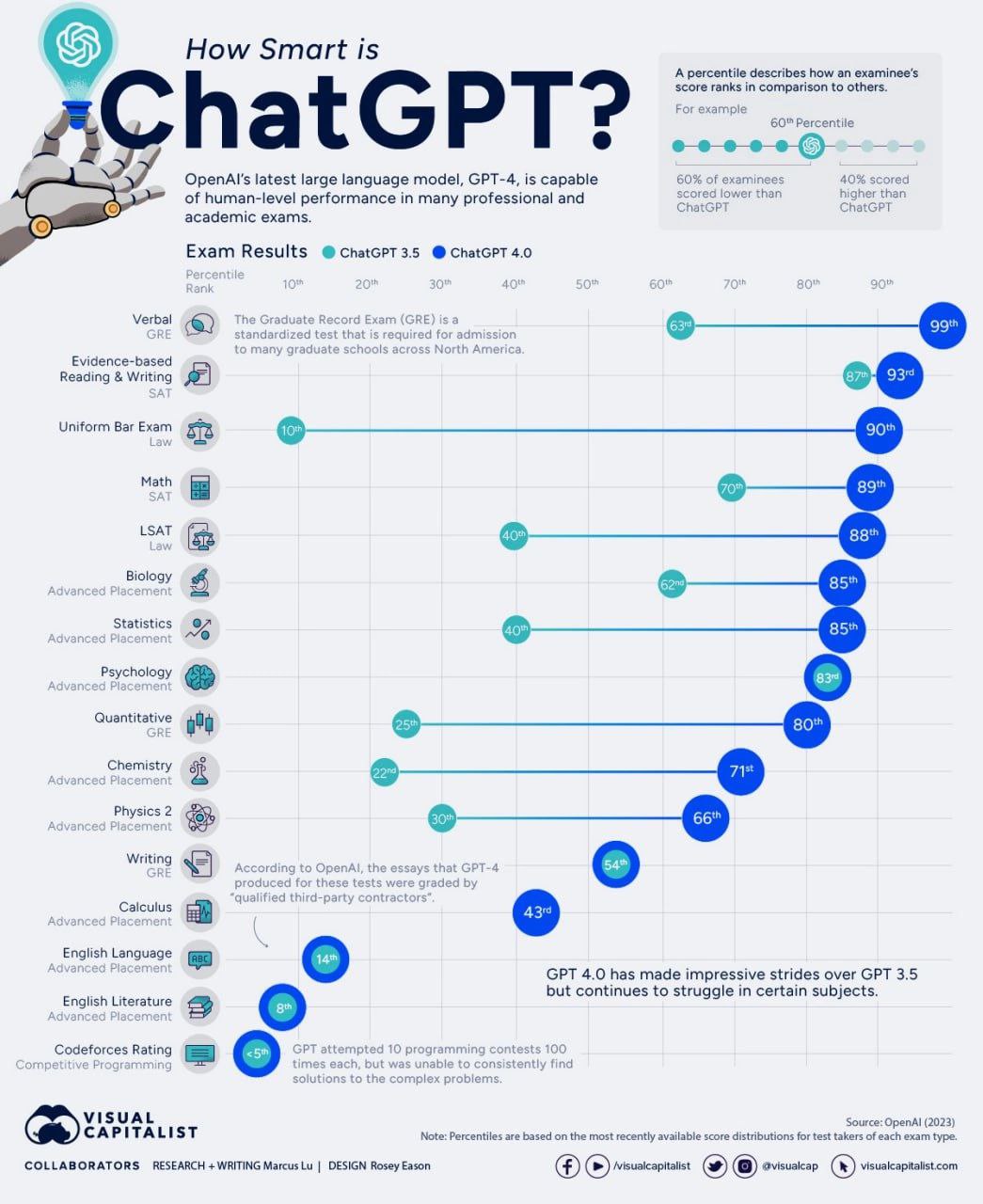

Dissecting The Chatter 5 Rumors About Chat Gpts Release Features And Price

May 19, 2025

Dissecting The Chatter 5 Rumors About Chat Gpts Release Features And Price

May 19, 2025 -

Ko Predstavlja Hrvatsku Na Eurosongu 2024 Marko Bosnjak

May 19, 2025

Ko Predstavlja Hrvatsku Na Eurosongu 2024 Marko Bosnjak

May 19, 2025