The Next Fed Chair: Inheriting Trump's Economic Challenges

Table of Contents

Navigating the Inflationary Landscape Inherited from the Trump Era

The Trump administration's economic policies left a significant mark on the inflationary landscape, presenting a complex challenge for the next Fed Chair. Understanding these legacies is crucial for effective monetary policy decisions.

The Impact of Trump's Tax Cuts

The 2017 tax cuts, while aiming to stimulate economic growth, also injected significant funds into the economy. This had several effects:

- Increased consumer spending: The tax cuts led to a surge in disposable income, boosting consumer spending and contributing to inflationary pressures.

- Potential for overheating: The increased spending, without corresponding increases in production capacity, risked overheating the economy and further fueling inflation.

- Long-term debt implications: The tax cuts significantly increased the national debt, creating long-term fiscal challenges and potentially impacting future monetary policy options.

- Effect on fiscal policy: The tax cuts significantly altered the nation's fiscal policy trajectory, leaving the incoming Fed Chair with a less flexible framework for managing economic fluctuations.

Trade Wars and Their Economic Ripple Effects

The Trump administration's trade policies, characterized by tariffs and trade disputes, created significant economic ripple effects.

- Tariffs: Tariffs imposed on imported goods increased prices for consumers and businesses, contributing directly to inflationary pressures.

- Trade deficits: While aiming to reduce trade deficits, the trade wars often resulted in retaliatory tariffs and disrupted established supply chains, leading to further economic uncertainty.

- Impact on manufacturing: The trade wars significantly impacted certain manufacturing sectors, leading to job losses and supply chain disruptions, further complicating the economic outlook.

- Global economic uncertainty: The trade disputes created significant uncertainty in the global economy, impacting investor confidence and potentially hindering economic growth.

Managing Inflation Expectations

Managing inflation expectations is paramount for the next Fed Chair. The legacy of Trump's policies makes this task particularly challenging.

- Credibility of the Fed: The Fed's credibility in managing inflation is crucial, and past actions and communication strategies will influence market reactions to future decisions.

- Communication strategies: Clear and consistent communication with the public and markets is essential to shape inflation expectations effectively. The Fed Chair must carefully calibrate communication to manage expectations without triggering unwanted market reactions.

- Market reaction to Fed decisions: The markets will closely scrutinize the Fed's actions, and the reaction will heavily depend on the perceived credibility of the Fed's strategy in the context of the existing inflationary environment.

Unemployment and the Labor Market Under the Shadow of Trump's Policies

The labor market inherited by the next Fed Chair is a complex mix of strengths and weaknesses, largely shaped by the preceding administration's policies.

Assessing the Strength of the Pre-Pandemic Job Market

Before the COVID-19 pandemic, the US job market experienced a period of relatively low unemployment. However, certain underlying issues remained:

- Unemployment rates: While unemployment rates were low, they didn't fully capture the complexities of underemployment and discouraged workers.

- Wage growth: Wage growth remained stagnant for many workers, particularly those in low-wage sectors.

- Participation rates: Labor force participation rates remained below pre-recession levels, suggesting potential untapped labor resources.

The Impact of Trump's Deregulation

Trump's deregulation efforts aimed to stimulate economic growth but also had implications for job creation and worker protections.

- Impact on specific industries: Deregulation impacted various sectors differently, with some experiencing job growth while others faced worker safety concerns.

- Worker safety concerns: Relaxed regulations raised concerns about worker safety and potential increases in workplace accidents.

- Long-term consequences: The long-term consequences of deregulation on job quality, worker well-being, and environmental protection remain to be fully assessed.

Addressing Labor Shortages and Skills Gaps

The next Fed Chair will face challenges in addressing labor market imbalances.

- Automation: Automation continues to transform the labor market, requiring adjustments in skills training and workforce development programs.

- Skills training: Investing in effective skills training programs is crucial to equip workers for the changing demands of the labor market.

- Immigration policies: Immigration policies play a significant role in shaping the labor supply, impacting both the availability of skilled and unskilled workers.

Long-Term Economic Sustainability: Addressing Trump's Fiscal Legacy

The next Fed Chair must grapple with the long-term economic sustainability challenges inherited from the Trump administration.

The Growing National Debt

The national debt significantly increased during the Trump administration, posing serious challenges for future economic stability.

- Interest payments: The rising national debt necessitates larger interest payments, reducing funds available for other government programs.

- Fiscal sustainability: The long-term sustainability of the nation's finances is threatened by the growing debt burden.

- Potential for future crises: Uncontrolled debt growth increases the risk of future economic crises and limits the government's ability to respond effectively to shocks.

Maintaining Fiscal Responsibility

Promoting fiscal responsibility requires close coordination between the Federal Reserve and Congress.

- Coordination with Congress: Effective monetary policy requires cooperation with Congress on fiscal matters to achieve macroeconomic stability.

- Impact of monetary policy on fiscal policy: Monetary policy decisions can significantly impact fiscal policy outcomes, necessitating careful coordination and communication.

Global Economic Uncertainty

The global economic landscape presents further challenges for the US economy.

- Geopolitical risks: Geopolitical risks, including trade wars and international conflicts, can significantly impact the US economy.

- Global trade imbalances: Global trade imbalances and currency fluctuations create further uncertainties for the US economy.

- International cooperation: Effective management of global economic challenges requires international cooperation and coordination among central banks.

Conclusion

The next Fed Chair faces a daunting task: navigating the complex economic legacy of the Trump administration. From managing lingering inflationary pressures and addressing unemployment challenges to ensuring long-term fiscal sustainability, the challenges are multifaceted and demand skillful navigation. The incoming Fed Chair must develop a comprehensive monetary policy strategy that addresses these issues effectively. Understanding the intricacies of Trump's economic policies and their lasting impacts is crucial for anyone seeking to understand the future direction of the US economy. Therefore, continued analysis and discussion of the Fed Chair and Trump's Economic Legacy are essential for informed policymaking. We need ongoing conversations about how the next Fed Chair will confront these economic challenges and ensure the long-term health of the US economy.

Featured Posts

-

An Interview With Karli Kane Hendrickson In The Easy Chair

Apr 26, 2025

An Interview With Karli Kane Hendrickson In The Easy Chair

Apr 26, 2025 -

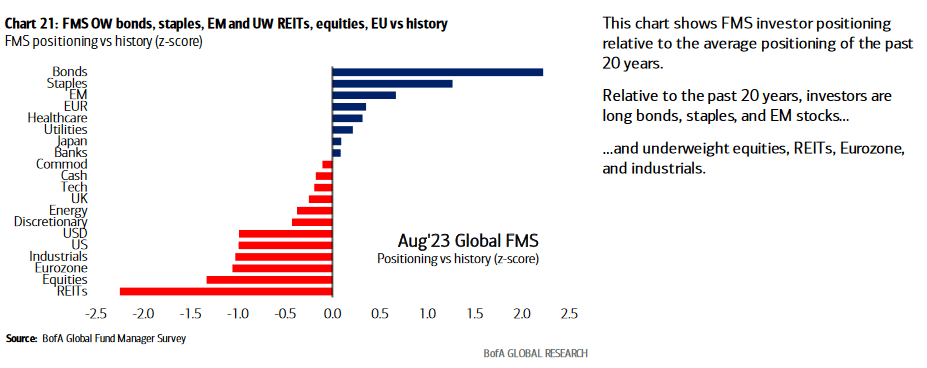

Should Investors Worry About Current Stock Market Valuations Bof As Analysis

Apr 26, 2025

Should Investors Worry About Current Stock Market Valuations Bof As Analysis

Apr 26, 2025 -

My Nintendo Switch 2 Preorder The Old Fashioned Way Game Stop

Apr 26, 2025

My Nintendo Switch 2 Preorder The Old Fashioned Way Game Stop

Apr 26, 2025 -

Why Deion Sanders Is Happy Shedeur Didnt Inherit His Speed

Apr 26, 2025

Why Deion Sanders Is Happy Shedeur Didnt Inherit His Speed

Apr 26, 2025 -

Construction Begins Damen Icdas Tugboat Partnership In Turkey

Apr 26, 2025

Construction Begins Damen Icdas Tugboat Partnership In Turkey

Apr 26, 2025

Latest Posts

-

German Politics Crumbachs Resignation And Its Implications For The Spd

Apr 27, 2025

German Politics Crumbachs Resignation And Its Implications For The Spd

Apr 27, 2025 -

Bsw Leader Crumbachs Resignation Impact On The Spd Coalition

Apr 27, 2025

Bsw Leader Crumbachs Resignation Impact On The Spd Coalition

Apr 27, 2025 -

Concerns Raised Over Hhss Appointment Of Anti Vaccine Activist To Study Debunked Autism Vaccine Theories

Apr 27, 2025

Concerns Raised Over Hhss Appointment Of Anti Vaccine Activist To Study Debunked Autism Vaccine Theories

Apr 27, 2025 -

Hhs Under Fire For Selecting Anti Vaccine Advocate To Investigate Autism Vaccine Link

Apr 27, 2025

Hhs Under Fire For Selecting Anti Vaccine Advocate To Investigate Autism Vaccine Link

Apr 27, 2025 -

Hhss Controversial Choice Anti Vaccine Advocate To Examine Debunked Autism Vaccine Claims

Apr 27, 2025

Hhss Controversial Choice Anti Vaccine Advocate To Examine Debunked Autism Vaccine Claims

Apr 27, 2025