Should Investors Worry About Current Stock Market Valuations? BofA's Analysis

Table of Contents

BofA's Key Findings on Current Market Valuations

BofA's analysis paints a picture of a market with elevated valuations across several sectors. Let's break down their key findings:

Elevated Valuations Across Sectors

BofA's assessment indicates that overall market valuation levels are high. Their analysis considers various metrics to reach this conclusion.

-

Specific Sectors Deemed Overvalued: BofA's report ( cite source here if available, e.g., "BofA Global Research, October 26, 2023 report" ) pointed to sectors like technology, consumer discretionary, and certain areas within the healthcare industry as exhibiting potentially unsustainable valuations based on current metrics. Specific examples of overvalued companies or indices should be included here if available from BofA's report.

-

Metrics Used to Determine Valuation Levels: The analysis likely employed several key valuation metrics, including:

- Price-to-Earnings (P/E) ratios: Comparing a company's stock price to its earnings per share. High P/E ratios generally suggest higher valuations.

- Price-to-Sales (P/S) ratios: Comparing a company's stock price to its revenue. Similar to P/E ratios, high P/S ratios can signal overvaluation.

- Other relevant valuation metrics: Include any other valuation metrics used by BofA (e.g., PEG ratio, Price-to-Book ratio) with brief explanations.

-

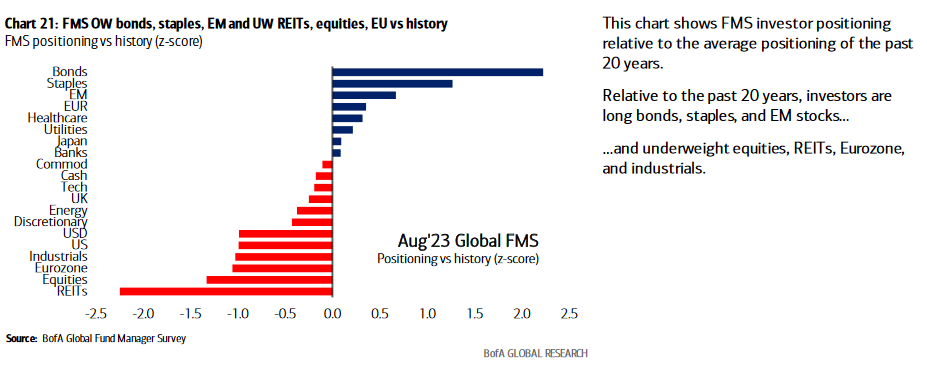

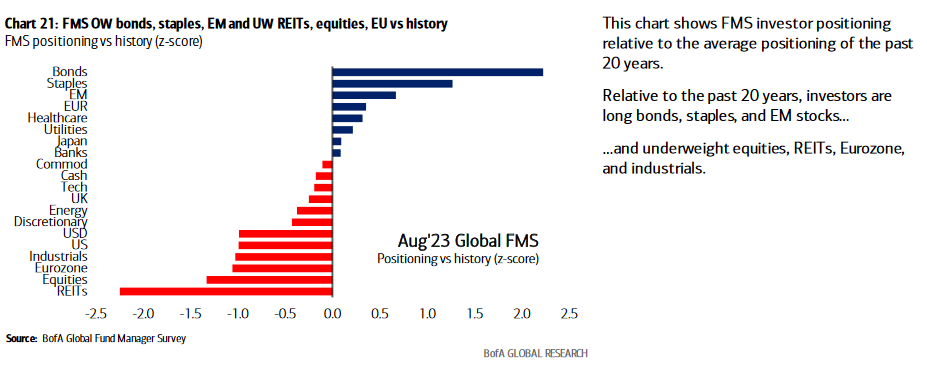

Data and Charts: If available, incorporate relevant charts and data from BofA's report to visually represent their findings on stock market valuations. Properly cite the source.

Impact of Interest Rates on Market Valuations

BofA's analysis likely highlights the significant influence of rising interest rates on stock valuations.

-

How Rising Interest Rates Affect Profitability and Sentiment: Higher interest rates increase borrowing costs for companies, potentially impacting profitability and reducing investor confidence, thereby impacting market valuation.

-

Potential for Further Rate Increases: The analysis likely addresses the Federal Reserve's potential future actions regarding interest rate hikes. This uncertainty further contributes to market volatility and affects investment decisions.

-

BofA's Predictions/Scenarios: Include BofA's predictions or various scenarios they've modeled regarding future interest rates and their potential impact on stock market valuations.

The Role of Inflation in Shaping Market Valuations

Inflation plays a crucial role in shaping investor expectations and company earnings, thus influencing market valuation. BofA's analysis likely addressed:

-

Inflation's Impact on Corporate Earnings and Investor Expectations: High inflation erodes purchasing power and can squeeze corporate profit margins, potentially leading to lower stock prices.

-

BofA's Inflation Forecast and Consequences: Include BofA's inflation forecasts and their projected consequences for stock market valuations.

-

Strategies to Mitigate Inflation Risks: Mention strategies investors might use to protect against inflation's impact, such as investing in inflation-protected securities or assets that tend to perform well during inflationary periods.

Alternative Perspectives and Counterarguments

While BofA's analysis presents a cautious outlook, it's crucial to consider alternative viewpoints.

-

Arguments Suggesting Current Valuations Are Justified: Some might argue that current high valuations are justified by strong corporate earnings growth, technological innovation, or other positive economic factors.

-

Factors Supporting Continued Market Growth: Arguments supporting continued market growth despite high valuations might cite factors like ongoing technological advancements, strong consumer spending, or government stimulus measures.

-

Other Financial Institutions' Analyses: If available, mention analyses from other financial institutions like Goldman Sachs or Morgan Stanley and compare their findings to BofA's. Highlight any discrepancies or points of agreement.

Practical Implications for Investors: How to Navigate Current Market Conditions

Based on BofA's analysis and the broader market context, investors should consider the following:

Diversification Strategies

Diversification remains a crucial risk-management tool.

-

Asset Classes for Diversification: Recommend a diversified portfolio, including stocks, bonds, real estate, and other alternative investments.

-

Adjusting Portfolio Allocation: Investors should adjust their portfolio allocation based on their risk tolerance and BofA's insights on stock market valuations. This may include reducing exposure to overvalued sectors or increasing exposure to more defensive asset classes.

Long-Term vs. Short-Term Investment Horizons

Investment time horizons significantly impact how investors should react.

-

Strategies for Long-Term Investors: Long-term investors may choose to ride out market fluctuations, focusing on long-term growth potential.

-

Strategies for Short-Term Traders: Short-term traders may need to be more reactive to market shifts and adjust their positions frequently.

Seeking Professional Financial Advice

Given the complexities of the current market, seeking professional financial guidance is highly recommended.

- Importance of Professional Guidance: A financial advisor can help develop a personalized investment strategy aligned with an investor's financial goals, risk tolerance, and time horizon, taking into account the current stock market valuations.

Conclusion: Understanding Stock Market Valuations – The BofA Perspective and Your Next Steps

BofA's analysis highlights elevated stock market valuations in several sectors, influenced by factors like interest rates and inflation. However, alternative perspectives exist, and the optimal investment strategy depends on individual circumstances and risk tolerance. Understanding market valuation and conducting thorough stock market analysis is paramount. To make informed decisions, carefully consider BofA's findings alongside other viewpoints. Research further, consult with a qualified financial professional, and develop a sound investment strategy that aligns with your goals. Continue learning about stock market valuations to navigate the market effectively.

Featured Posts

-

Todays Nyt Spelling Bee Puzzle 337 February 3rd Complete Guide

Apr 26, 2025

Todays Nyt Spelling Bee Puzzle 337 February 3rd Complete Guide

Apr 26, 2025 -

The Hunt For Lady Olive And The German Submarine A Historical Thriller

Apr 26, 2025

The Hunt For Lady Olive And The German Submarine A Historical Thriller

Apr 26, 2025 -

Wwii Warship Holds A Century Old Automotive Surprise

Apr 26, 2025

Wwii Warship Holds A Century Old Automotive Surprise

Apr 26, 2025 -

Potential Dam Hazards A Safety Review For Ajaxs 125th Anniversary Event

Apr 26, 2025

Potential Dam Hazards A Safety Review For Ajaxs 125th Anniversary Event

Apr 26, 2025 -

Nintendo Switch 2 Preorder My Game Stop Line Experience

Apr 26, 2025

Nintendo Switch 2 Preorder My Game Stop Line Experience

Apr 26, 2025

Latest Posts

-

Amphibien Und Reptilien In Thueringen Ein Umfassender Atlas

Apr 27, 2025

Amphibien Und Reptilien In Thueringen Ein Umfassender Atlas

Apr 27, 2025 -

Entdeckung Der Herpetofauna Thueringens Der Neue Amphibien Und Reptilienatlas

Apr 27, 2025

Entdeckung Der Herpetofauna Thueringens Der Neue Amphibien Und Reptilienatlas

Apr 27, 2025 -

Thueringens Amphibien Und Reptilien Der Neue Atlas

Apr 27, 2025

Thueringens Amphibien Und Reptilien Der Neue Atlas

Apr 27, 2025 -

Thueringen Amphibien Und Reptilienatlas Erscheinen Des Umfassenden Werks

Apr 27, 2025

Thueringen Amphibien Und Reptilienatlas Erscheinen Des Umfassenden Werks

Apr 27, 2025 -

German Politics Crumbachs Resignation And Its Implications For The Spd

Apr 27, 2025

German Politics Crumbachs Resignation And Its Implications For The Spd

Apr 27, 2025