The Real Safe Bet: Investing Strategies For Secure Returns

Table of Contents

Diversification: Spreading Your Risk Across Asset Classes

Diversification is a cornerstone of secure investing. It's the principle of spreading your investments across different asset classes to reduce the impact of any single investment's underperformance. Instead of putting all your eggs in one basket, you diversify to create a more resilient portfolio.

Types of Assets to Diversify Into:

-

Stocks: These represent ownership in a company.

- Blue-chip stocks: Large, established companies with a history of stable earnings and dividends (lower risk, potentially slower growth).

- Dividend stocks: Companies that regularly pay out a portion of their profits to shareholders (reliable income stream, moderate risk).

- Growth stocks: Companies with high growth potential, often in emerging industries (higher risk, potentially higher reward).

-

Bonds: These represent loans you make to a government or corporation.

- Government bonds: Issued by governments, generally considered low-risk (lower returns, high security).

- Corporate bonds: Issued by companies, offering higher potential returns but with greater risk (higher returns, moderate to high risk).

- Municipal bonds: Issued by state or local governments, often tax-advantaged (moderate risk, moderate returns).

-

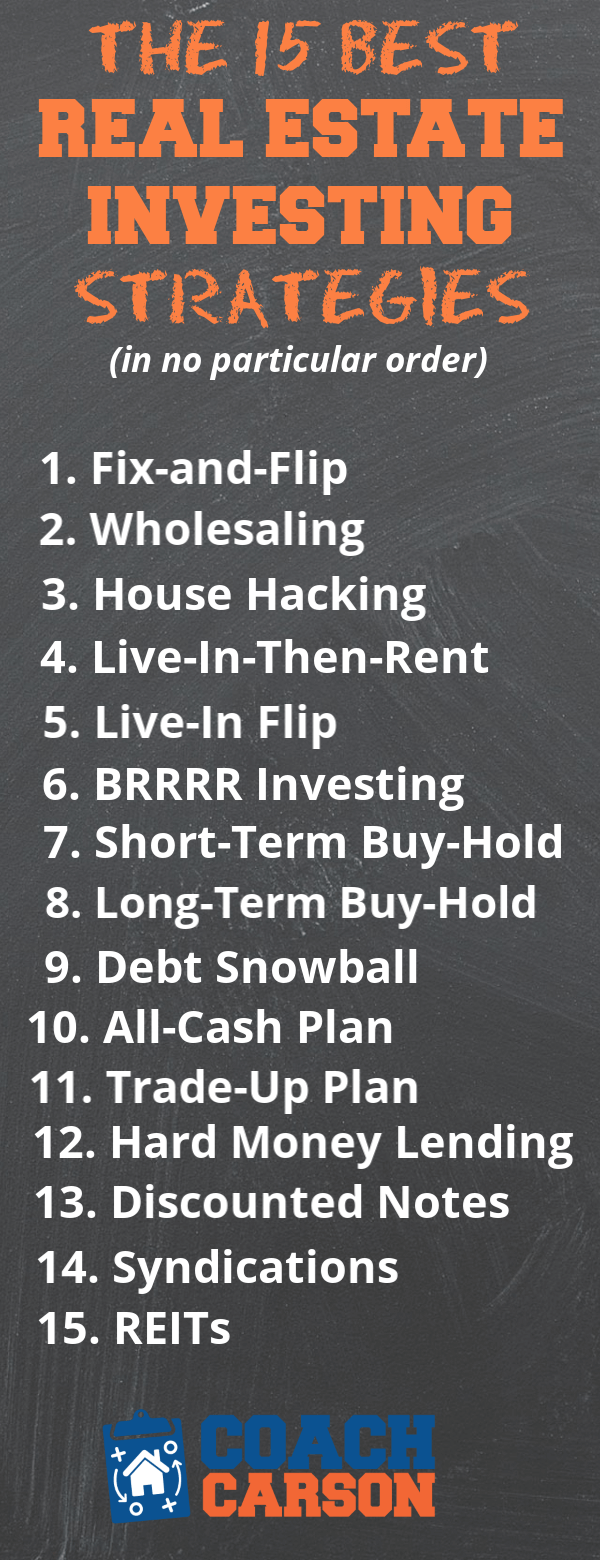

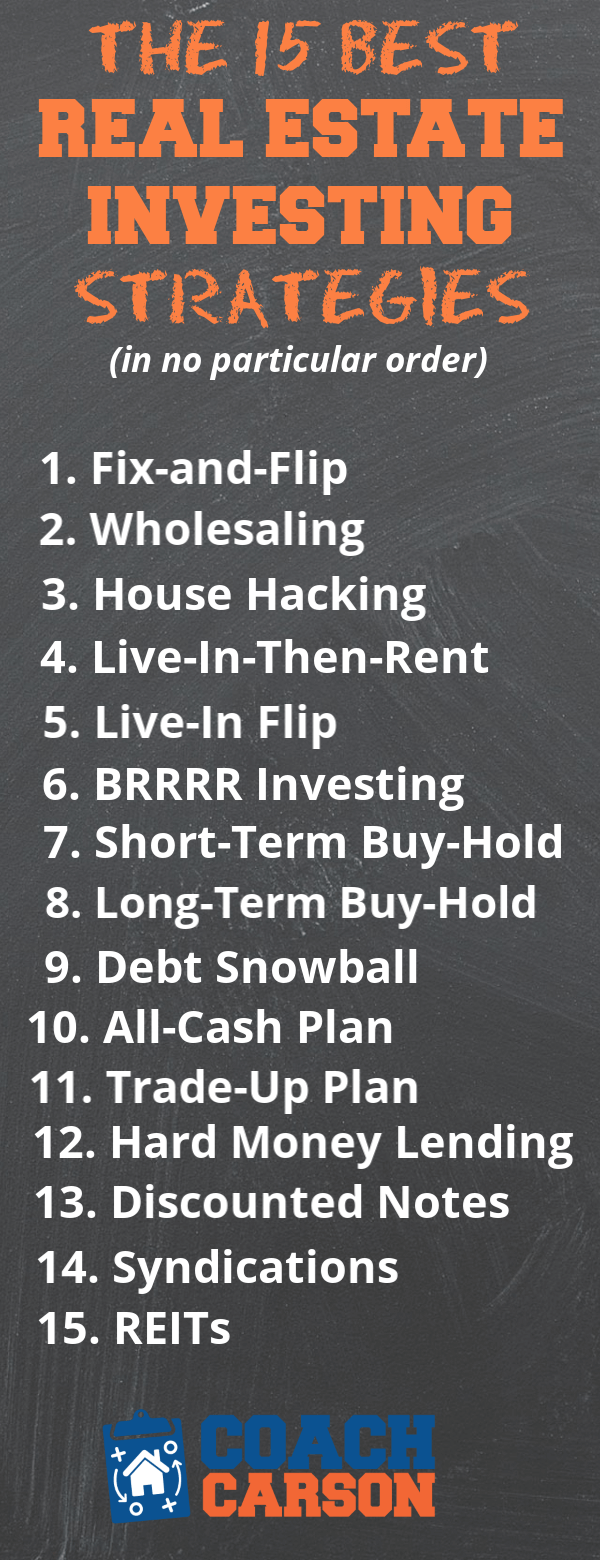

Real Estate: Investing in properties or real estate investment trusts (REITs).

- Rental properties: Generate passive income through rent, but require active management (moderate to high risk, potential for high returns).

- REITs: Publicly traded companies that own and operate income-producing real estate (moderate risk, moderate returns).

-

Commodities: Raw materials like gold, oil, and agricultural products. These can act as a hedge against inflation (high risk, potentially high returns).

-

Alternative Investments: Hedge funds and private equity offer potentially high returns but require significant capital and expertise (very high risk, potentially very high returns).

-

Benefits of Diversification:

- Reduced volatility: Losses in one asset class can be offset by gains in another.

- Protection against market downturns: A diversified portfolio is better equipped to withstand market fluctuations.

- Potential for higher long-term returns: A diversified approach can lead to better overall performance over time.

Your asset allocation – the percentage of your portfolio invested in each asset class – should be tailored to your risk tolerance and investment goals. A younger investor with a longer time horizon might tolerate more risk, while an older investor nearing retirement might prioritize capital preservation.

Index Funds and ETFs: Low-Cost, Passive Investing for Steady Growth

Index funds and exchange-traded funds (ETFs) offer a simple, cost-effective way to achieve diversified exposure to the market. They track a specific market index, like the S&P 500, providing broad diversification with minimal management fees.

Advantages of Index Funds and ETFs:

- Low expense ratios: They typically have much lower fees than actively managed funds.

- Built-in diversification: They instantly provide exposure to a wide range of companies.

- Historically strong performance: They often match or slightly exceed the market average over the long term.

Index Funds vs. ETFs: Both offer similar benefits, but ETFs trade like stocks throughout the day, offering greater flexibility, while index funds are typically only bought or sold at the end of the trading day.

Choosing index funds or ETFs that track well-established and diverse market indexes, such as the S&P 500, the Nasdaq Composite, or total stock market indexes, is crucial for achieving broad market exposure and minimizing risk.

Value Investing: Finding Undervalued Assets for Long-Term Gains

Value investing focuses on identifying companies trading below their intrinsic value – essentially, finding undervalued gems. This long-term strategy involves thorough research and a patient approach.

Key Principles of Value Investing:

- Thorough fundamental analysis: Carefully examine a company's financial statements, competitive landscape, and management team.

- Patience and long-term perspective: Value investing requires holding onto undervalued assets until the market recognizes their true worth.

- Margin of safety: Buying assets significantly below their estimated intrinsic value provides a buffer against potential errors in analysis.

Metrics like Price-to-Earnings ratio (P/E), Price-to-Book ratio (P/B), and dividend yield are commonly used in value investing to identify undervalued opportunities. Remember, thorough due diligence and research are paramount before investing in any undervalued company.

Dollar-Cost Averaging: Reducing Risk Through Consistent Investment

Dollar-cost averaging (DCA) is a strategy where you invest a fixed amount of money at regular intervals, regardless of market fluctuations. This approach mitigates the risk of investing a lump sum at a market peak.

Benefits of Dollar-Cost Averaging:

- Reduces the impact of market volatility: By investing consistently, you avoid the risk of buying high and selling low.

- Allows for consistent investment: You can stick to your investment plan without worrying about market timing.

- Eliminates the need for market timing: You don't have to try to predict market tops and bottoms.

For example, investing $500 per month consistently will buy more shares when prices are low and fewer shares when prices are high, averaging out your cost per share over time.

Conclusion

Building a secure investment portfolio requires a multifaceted approach. By combining diversification across various asset classes, utilizing low-cost index funds and ETFs, employing value investing principles, and implementing dollar-cost averaging, you can significantly enhance your chances of achieving strong, long-term returns while mitigating risk. Remember to carefully plan your investment strategy, considering your individual risk tolerance and financial goals. Start exploring Investing Strategies for Secure Returns that best suit your circumstances. Conduct thorough research or seek guidance from a qualified financial advisor before making any investment decisions. Remember, a well-defined plan is your best bet for achieving financial security.

Featured Posts

-

Unexpected Turn White House Replaces Surgeon General Nominee With Maha Influencer

May 09, 2025

Unexpected Turn White House Replaces Surgeon General Nominee With Maha Influencer

May 09, 2025 -

A Candid Look At Judge Jeanine Pirros Life At Fox News

May 09, 2025

A Candid Look At Judge Jeanine Pirros Life At Fox News

May 09, 2025 -

Where To Invest A Geographic Analysis Of New Business Hotspots

May 09, 2025

Where To Invest A Geographic Analysis Of New Business Hotspots

May 09, 2025 -

Weight Watchers Bankruptcy A Consequence Of The Weight Loss Drug Market

May 09, 2025

Weight Watchers Bankruptcy A Consequence Of The Weight Loss Drug Market

May 09, 2025 -

Federal Charges Filed Millions Stolen Through Executive Office365 Compromise

May 09, 2025

Federal Charges Filed Millions Stolen Through Executive Office365 Compromise

May 09, 2025