The Shifting Sands Of Canadian Condo Investment

Table of Contents

Understanding Current Market Conditions in Canadian Condo Investment

The Canadian condo market is far from static; several key factors significantly impact investment decisions.

Interest Rate Impacts

Rising interest rates have dramatically altered the Canadian condo investment landscape. Increased borrowing costs directly reduce purchasing power, making it harder for both buyers and investors to secure mortgages. This decrease in affordability leads to reduced demand, potentially impacting property values and rental yields.

- Increased borrowing costs: Higher interest rates translate to larger monthly mortgage payments, making condos less accessible.

- Reduced purchasing power: With higher interest rates, buyers can afford less expensive properties or need larger down payments.

- Impact on rental yields: While rental demand may remain relatively stable, higher mortgage payments can squeeze profit margins for condo investors.

Data from the Bank of Canada shows a significant correlation between interest rate increases and a slowdown in condo sales across major Canadian cities. For example, [insert data/statistic linking interest rate hikes to condo sales slowdown in a specific city, e.g., Toronto]. This trend highlights the sensitivity of the Canadian condo market to monetary policy changes.

Supply and Demand Dynamics

The balance between condo supply and demand varies significantly across Canadian cities. While some areas experience a shortage of available units, others are grappling with increased inventory.

- Construction slowdowns: Rising construction costs and increased financing difficulties have led to slower condo construction in some regions.

- Increased inventory in certain areas: Over-saturation in specific markets results in increased competition and potentially downward pressure on prices.

- Analysis of absorption rates: Examining how quickly properties are selling provides insights into market health and demand.

For instance, [insert city example with high supply and its impact on pricing] is seeing a slower absorption rate compared to [insert city example with low supply and its impact on pricing], which has a robust market. Understanding these localized supply and demand dynamics is paramount for successful Canadian condo investment.

Government Regulations and Policies

Government policies, such as foreign buyer taxes and zoning regulations, significantly influence the Canadian condo market.

- Specific examples of recent policy changes and their consequences: [Insert examples of recent policies in specific provinces and their impact. For example, discuss the impact of foreign buyer taxes in British Columbia or Ontario].

- Analysis of their impact on investment strategies: These regulations often necessitate adjustments to investment strategies, potentially impacting the feasibility and profitability of certain projects.

[Link to relevant government websites and reports]. Staying informed about these regulatory changes is crucial for navigating the complexities of Canadian condo investment.

Identifying Promising Investment Opportunities in the Canadian Condo Market

Even with the challenges, opportunities still exist in the Canadian condo market. Smart investment requires careful consideration of location, condo type, and thorough due diligence.

Location, Location, Location

Strategic location remains a cornerstone of successful real estate investment. Factors to consider include:

- Proximity to transportation: Easy access to public transit and major roadways enhances property value and rental appeal.

- Amenities: Nearby parks, shopping centers, restaurants, and entertainment venues increase desirability.

- Employment centers: Proximity to major employment hubs ensures strong rental demand.

- Future development plans: Investing in areas with planned infrastructure improvements can yield significant long-term appreciation.

High-growth areas like [insert example of a high-growth area with supporting data] often present attractive investment opportunities, but thorough research is essential.

Analyzing Condo Types and Rental Potential

The type of condo significantly impacts its investment potential.

- Studio apartments vs. larger units: Studios cater to a different market segment than larger units, with varying rental demands and price points.

- Rental demand in different condo segments: Analyze market data to determine which condo types are in highest demand within a given area.

- Consideration of maintenance fees: Factor in condo fees when calculating potential rental yield and overall profitability.

Data on average rental yields for different condo types in various cities can help investors make informed decisions. [If possible, insert relevant data/statistics].

Due Diligence and Risk Management

Thorough due diligence is crucial before committing to any Canadian condo investment.

- Professional inspections: Identify potential structural or maintenance issues before purchasing.

- Legal review: Ensure all legal documents are in order and protect your investment.

- Understanding condo corporation bylaws: Be aware of any restrictions or limitations imposed by the condo corporation.

- Assessing potential risks: Identify and mitigate potential risks, such as fluctuating rental demand or unexpected repair costs.

Seeking professional advice from real estate agents, lawyers, and financial advisors is strongly recommended.

Future Trends Shaping Canadian Condo Investment

Several emerging trends will shape the Canadian condo market in the years to come.

The Impact of Technology

Technology is revolutionizing real estate, influencing transactions and property management.

- Proptech innovations: New technologies streamline property searching, purchasing, and management.

- Online property platforms: These platforms offer increased transparency and accessibility for buyers and investors.

- Smart home features: Smart home technologies enhance rental appeal and potential rental yields.

Understanding and adopting these technological advancements is vital for competitive Canadian condo investment.

Sustainability and Green Initiatives

The demand for sustainable and energy-efficient condos is growing rapidly.

- Green building certifications: Condos with green building certifications attract environmentally conscious buyers and tenants.

- Impact on property values and rental rates: Green features often command higher prices and rental rates.

- Government incentives for green buildings: Government incentives can make green condo investments even more attractive.

[Insert statistics on growing preference for sustainable properties]. Investing in green condos aligns with growing environmental concerns and can offer significant long-term advantages.

Demographic Shifts and Changing Housing Needs

Demographic changes will significantly influence condo demand.

- Demand for specific condo types catering to various age groups and lifestyles: Different age groups and lifestyles have distinct housing needs.

- Impact on rental demand and occupancy rates: Understanding these shifts is critical for predicting future rental demand.

[Include projections and forecasts about future demographic trends]. Adapting investment strategies to accommodate these shifts is essential for sustained success.

Conclusion

The Canadian condo investment landscape is undeniably complex, shaped by fluctuating interest rates, shifting supply and demand, and evolving government regulations. However, by understanding current market conditions, identifying promising investment opportunities, and anticipating future trends, investors can navigate these shifting sands successfully. Careful analysis, thorough due diligence, and a proactive approach are key to maximizing returns in this dynamic market.

Call to Action: Ready to make informed decisions in the dynamic world of Canadian condo investment? Begin your research today, and explore the potential for lucrative returns in this ever-evolving market. Learn more about navigating the complexities of Canadian condo investment with further research and expert advice.

Featured Posts

-

Manalapan Floridas Next Palm Beach The Super Rich Influx

Apr 25, 2025

Manalapan Floridas Next Palm Beach The Super Rich Influx

Apr 25, 2025 -

How Indias Wealthy Are Investing In Overseas Markets

Apr 25, 2025

How Indias Wealthy Are Investing In Overseas Markets

Apr 25, 2025 -

Dope Thief Trailer Brian Tyree Henry And Wagner Moura In Ridley Scotts Pulse Pounding New Show

Apr 25, 2025

Dope Thief Trailer Brian Tyree Henry And Wagner Moura In Ridley Scotts Pulse Pounding New Show

Apr 25, 2025 -

Road Conditions In Okc Icy Roads Cause Multiple Crashes Watch

Apr 25, 2025

Road Conditions In Okc Icy Roads Cause Multiple Crashes Watch

Apr 25, 2025 -

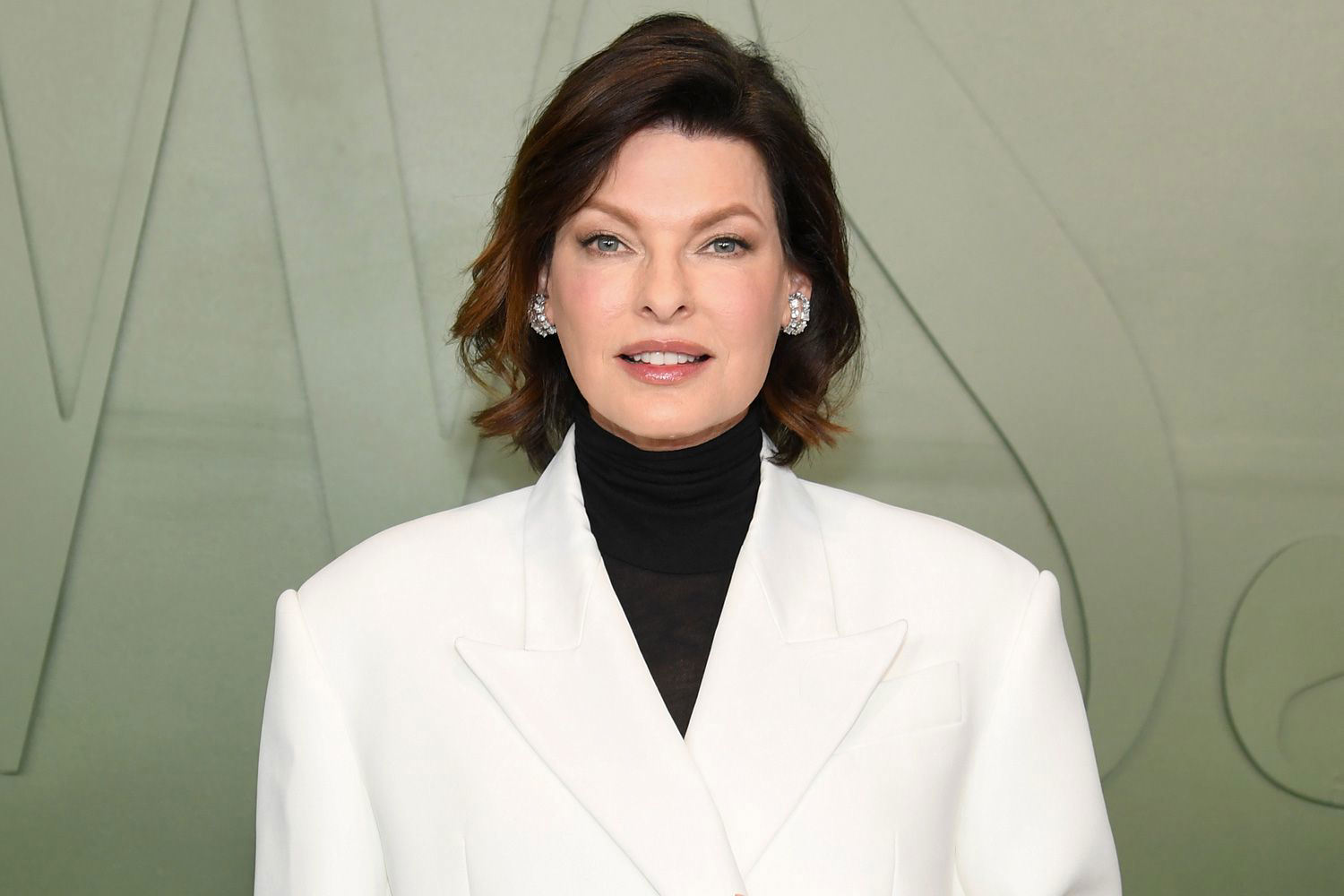

Linda Evangelista At 59 Revealing Her Honest Feelings On Showing Mastectomy Scars To Friends

Apr 25, 2025

Linda Evangelista At 59 Revealing Her Honest Feelings On Showing Mastectomy Scars To Friends

Apr 25, 2025

Latest Posts

-

Eurovision 2025 Live Stream Australia Date Time And Viewing Options

Apr 30, 2025

Eurovision 2025 Live Stream Australia Date Time And Viewing Options

Apr 30, 2025 -

Germanys Political Landscape Klingbeils Bid For Vice Chancellor And Finance Minister

Apr 30, 2025

Germanys Political Landscape Klingbeils Bid For Vice Chancellor And Finance Minister

Apr 30, 2025 -

When And Where To Watch The Eurovision Song Contest 2025 In Australia

Apr 30, 2025

When And Where To Watch The Eurovision Song Contest 2025 In Australia

Apr 30, 2025 -

The Implications Of Lars Klingbeils Potential Appointment As German Finance Minister

Apr 30, 2025

The Implications Of Lars Klingbeils Potential Appointment As German Finance Minister

Apr 30, 2025 -

Spds Coalition Challenges Addressing Youth Anger In Germany

Apr 30, 2025

Spds Coalition Challenges Addressing Youth Anger In Germany

Apr 30, 2025