The Trade War And Crypto: A Single Cryptocurrency's Potential For Growth

Table of Contents

The Instability of Traditional Markets During Trade Wars

Trade wars significantly impact traditional markets, creating a ripple effect across stocks, bonds, and commodities. The imposition of tariffs and trade restrictions leads to increased uncertainty, impacting investor confidence and market stability.

- Increased volatility and uncertainty: Trade wars introduce unpredictable elements into the global economy, making it difficult to forecast market movements. This heightened volatility makes traditional investments riskier.

- Potential for capital flight from traditional assets: Investors often seek safer havens for their capital during times of economic uncertainty. This can lead to a significant outflow of investment from stocks and bonds.

- Investor search for alternative, safe-haven assets: The search for stability pushes investors towards assets perceived as less susceptible to trade war-related shocks.

- Examples of past trade war impacts on specific markets: The US-China trade war of 2018-2020 saw significant fluctuations in stock markets globally, as well as increased volatility in commodity prices like soybeans and aluminum.

Cryptocurrency as a Hedge Against Trade War Uncertainty

Cryptocurrencies, like Bitcoin, offer a potential hedge against the uncertainty stemming from trade wars. Their decentralized nature and independence from traditional financial systems make them attractive alternatives.

- Decentralized nature reduces reliance on government control: Unlike fiat currencies, Bitcoin's operation isn't controlled by any single government or institution, making it relatively immune to geopolitical risks and trade policy changes.

- Potential for price appreciation as investors seek alternative stores of value: During times of uncertainty, investors may flock to Bitcoin as a store of value, potentially driving up its price.

- Increased adoption due to heightened uncertainty in traditional markets: As trust in traditional markets erodes, more investors may turn to cryptocurrencies, boosting Bitcoin’s adoption rate.

- Bitcoin's advantages: Bitcoin's inherent decentralization, its established track record, and its limited supply (21 million coins) position it as a potential safe-haven asset in times of economic turmoil. This scarcity contributes to its perceived value as "digital gold."

Factors Influencing Bitcoin's Growth

Several factors could significantly influence Bitcoin's growth during periods of heightened trade tensions:

- Technological advancements in Bitcoin: Improvements in scalability and transaction speeds could enhance Bitcoin's usability and attractiveness to a wider range of users and investors. The Lightning Network, for example, addresses Bitcoin's scalability limitations.

- Regulatory developments and their impact on Bitcoin’s adoption: Clearer and more favorable regulatory frameworks in various jurisdictions could increase institutional investment and wider public adoption.

- Growing institutional investment in Bitcoin: Increased participation from institutional investors, such as hedge funds and asset management firms, can significantly impact Bitcoin's price and market capitalization.

- Increased media attention and public awareness: Positive media coverage and rising public awareness contribute to greater adoption and price appreciation.

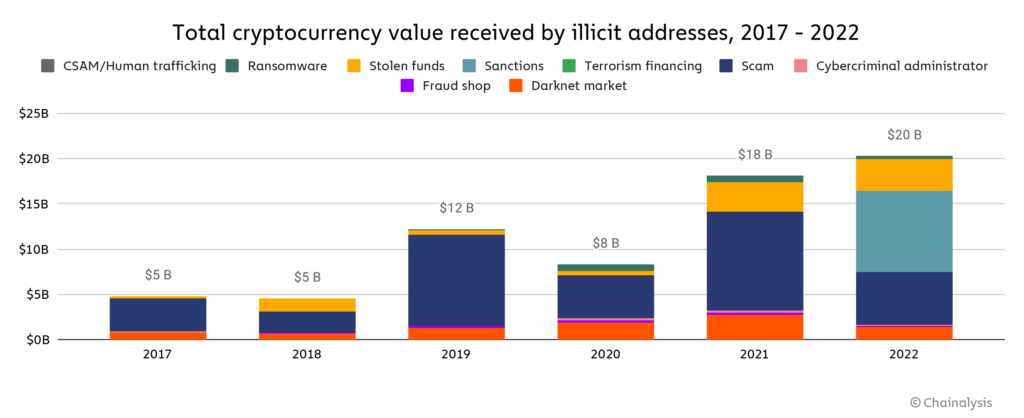

Case Study: Bitcoin and Trade War Impacts

While it's difficult to isolate the impact of trade wars solely on Bitcoin's price, historical data shows a correlation between periods of global economic uncertainty and increased Bitcoin price volatility. For instance, during the height of the 2018-2020 US-China trade war, Bitcoin experienced periods of both significant price drops and rallies, reflecting the overall market uncertainty.

Conclusion

The instability created by trade wars presents a potential opportunity for significant growth in cryptocurrencies, particularly Bitcoin. Its decentralized nature, limited supply, and potential as a store of value make it an attractive alternative to traditional assets during periods of economic uncertainty. The factors discussed above, from technological advancements to regulatory clarity, will play a vital role in shaping Bitcoin’s trajectory. Explore the potential of Bitcoin during trade wars and learn more about its benefits as a hedge against economic instability. Invest wisely in Bitcoin and navigate the complexities of trade wars with a diversified strategy that includes this digital asset.

Featured Posts

-

Cemetery Corruption In Ukraine The Profiting From Fallen Soldiers

May 08, 2025

Cemetery Corruption In Ukraine The Profiting From Fallen Soldiers

May 08, 2025 -

Micro Strategy Stock Vs Bitcoin A 2025 Investment Comparison

May 08, 2025

Micro Strategy Stock Vs Bitcoin A 2025 Investment Comparison

May 08, 2025 -

Why Reliability And Trust Are Crucial In Todays Crypto News Landscape

May 08, 2025

Why Reliability And Trust Are Crucial In Todays Crypto News Landscape

May 08, 2025 -

Superman Movie New Footage Features Krypto

May 08, 2025

Superman Movie New Footage Features Krypto

May 08, 2025 -

Stephen Kings The Long Walk Mark Hamill In First Look Trailer

May 08, 2025

Stephen Kings The Long Walk Mark Hamill In First Look Trailer

May 08, 2025

Latest Posts

-

Kyle Kuzma Responds To Jayson Tatums Trending Instagram Post

May 08, 2025

Kyle Kuzma Responds To Jayson Tatums Trending Instagram Post

May 08, 2025 -

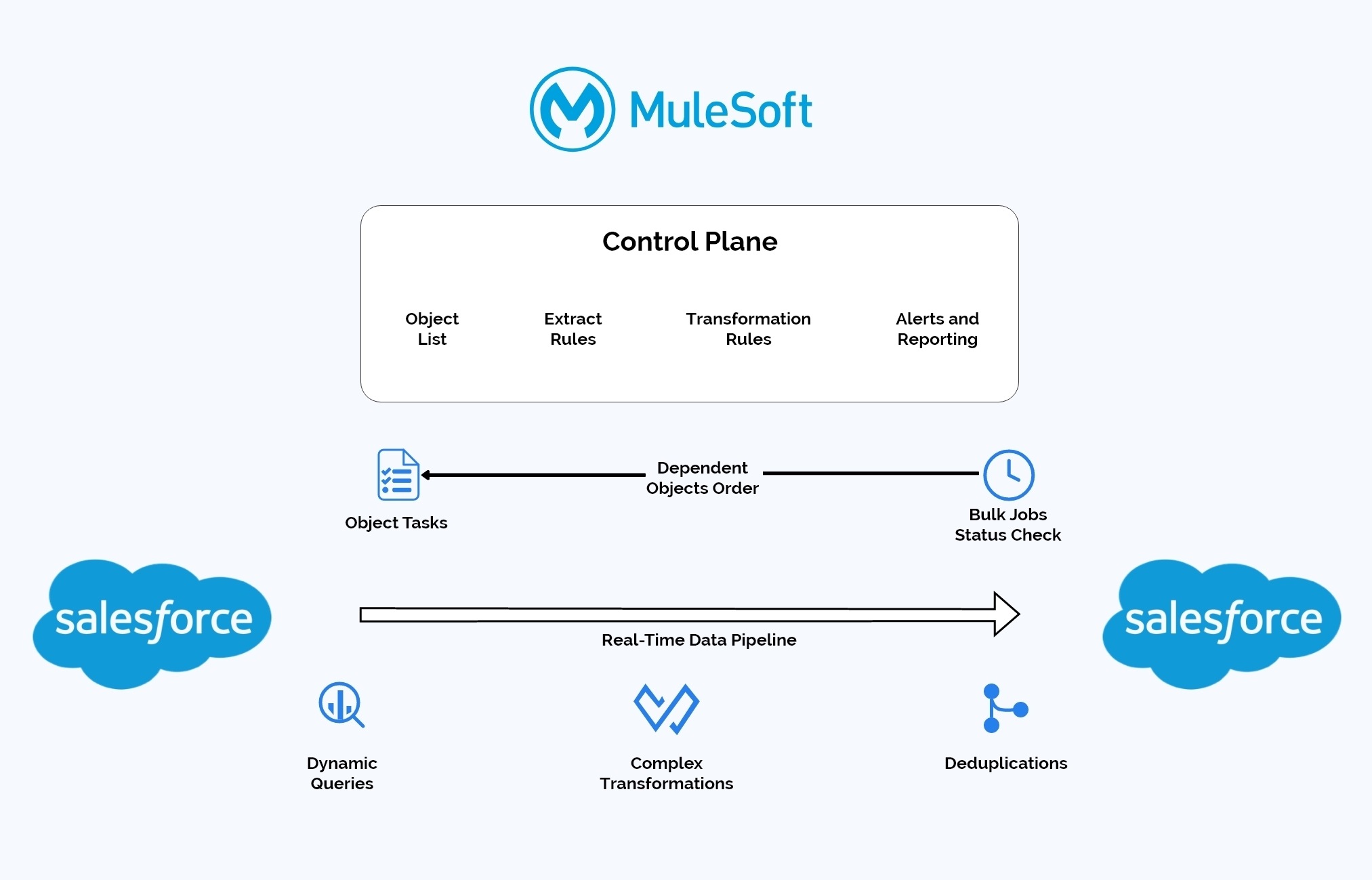

Transferred Data A Comprehensive Guide To Secure Data Migration

May 08, 2025

Transferred Data A Comprehensive Guide To Secure Data Migration

May 08, 2025 -

Kuzma Comments On Tatums Viral Instagram Photo

May 08, 2025

Kuzma Comments On Tatums Viral Instagram Photo

May 08, 2025 -

Andor Season 2 Trailer Release Date Speculation And Confirmed Details

May 08, 2025

Andor Season 2 Trailer Release Date Speculation And Confirmed Details

May 08, 2025 -

Todays Weather Partly Cloudy With A Chance Of Insert Relevant Condition

May 08, 2025

Todays Weather Partly Cloudy With A Chance Of Insert Relevant Condition

May 08, 2025