The UK Bottled Water Market: Why Dasani Is Missing

Table of Contents

Intense Competition in the UK Bottled Water Market

The UK bottled water market is fiercely competitive, a battleground dominated by established brands with significant market share and deeply entrenched distribution networks. These well-established players, many boasting decades of brand loyalty, create a challenging environment for newcomers. Gaining traction requires overcoming pre-existing preferences and effectively competing on price and distribution. The competitive pressure extends beyond established national brands; the rise of private label bottled water further intensifies the struggle for market share.

- Strong Existing Brands: Highland Spring, Buxton, and Volvic, amongst others, command significant portions of the UK bottled water market, benefitting from years of successful branding and extensive distribution.

- Price Wars: The UK bottled water market experiences frequent price competition, especially within the value segment, forcing brands to constantly optimize their pricing strategies.

- Distribution Dominance: Effective distribution networks are paramount for success. Reaching consumers through supermarkets, convenience stores, and other retail channels requires substantial logistical capabilities.

- Private Label Pressure: The increasing popularity of private-label bottled water from major supermarkets puts further pressure on established and emerging brands alike. Consumers increasingly opt for cheaper alternatives offered by major retailers.

Dasani's Brand Perception and Marketing Strategies in the UK

Dasani's brand image and marketing strategies in the UK may not have resonated effectively with consumers. Unlike its success in some other international markets, the brand seems to lack a clear and distinct positioning within the UK market's nuanced preferences for specific water sources and taste profiles. A less-than-successful marketing campaign, coupled with insufficient investment in building brand awareness, might explain its limited visibility.

- Lack of Differentiation: Dasani might not have successfully differentiated itself from competitors. A lack of unique selling proposition could leave it indistinct within the crowded marketplace.

- Marketing Ineffectiveness: Potentially ineffective marketing and advertising strategies may have failed to connect with the UK target audience.

- Under-Investment: Insufficient investment in building brand awareness and consumer trust within the UK market could have hindered its growth.

- Negative Perception: While not explicitly confirmed, there might be an element of negative consumer perception or a lack of positive branding contributing to its underperformance.

Consumer Preferences and Taste Profiles in the UK

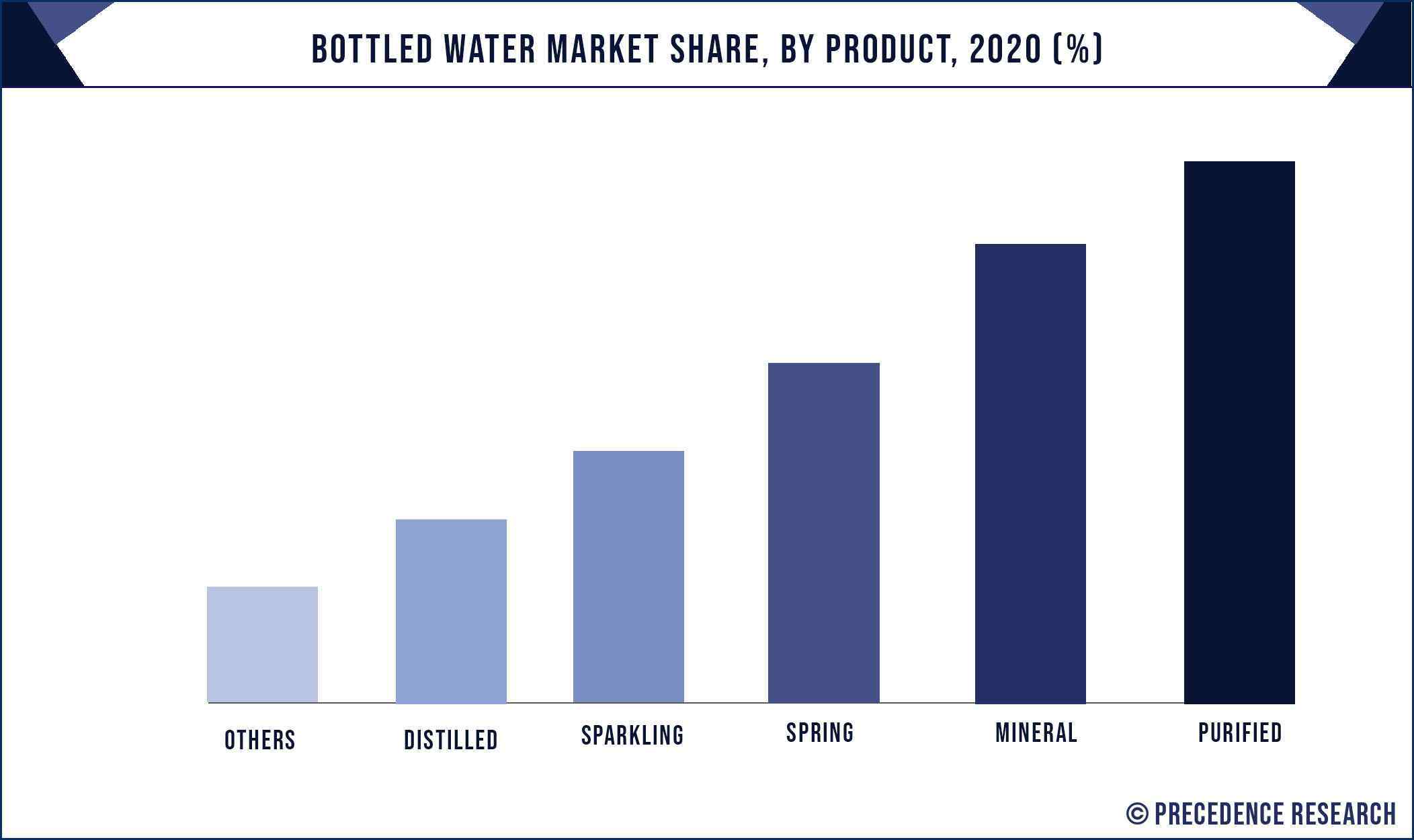

The UK bottled water market reveals strong preferences for specific water sources and taste profiles. Consumers often show a marked preference for naturally sourced mineral water from established springs, associating these sources with quality, purity, and a unique taste profile often linked to the water's geographical origin. Dasani's purified water approach, while appealing in some markets, might not fully align with these deeply rooted preferences.

- Spring Water Dominance: A significant portion of the UK bottled water market is dedicated to spring water and naturally sourced mineral water.

- Regional Preferences: Regional variations exist in preferred water types, reflecting local tastes and brand loyalties.

- Emphasis on Source & Purity: UK consumers place strong emphasis on the origin and purity of their bottled water, actively seeking information about the source and the water's mineral content.

- Sustainability Concerns: Growing concerns about sustainability and ethical sourcing are increasingly influencing consumer buying choices within the bottled water market.

The Role of Water Source and Purity Perception

The perceived purity and source of the water heavily influence purchasing decisions. The association of specific geographical locations with high-quality spring water creates a strong brand image and consumer trust. Dasani's positioning as purified water, while highlighting purity, might lack the romanticism and perceived inherent quality associated with naturally sourced mineral waters from established springs. The absence of a strong narrative around its origin might be a contributing factor to its low market penetration.

Conclusion

Dasani's limited success in the UK bottled water market is likely a result of a complex interplay of factors. Intense competition from established brands, potentially ineffective marketing strategies, and a possible mismatch between its brand positioning and the UK's deeply ingrained preferences for locally sourced and naturally mineral-rich waters all contribute to its underperformance.

Understanding the nuances of the UK bottled water market is crucial for any brand aiming to succeed. Further research into specific consumer preferences, coupled with the development of effective marketing strategies tailored to this dynamic market, could unlock significant growth opportunities. The analysis of Dasani's underperformance provides valuable lessons for brands seeking to compete effectively or gain entry into the competitive UK bottled water market.

Featured Posts

-

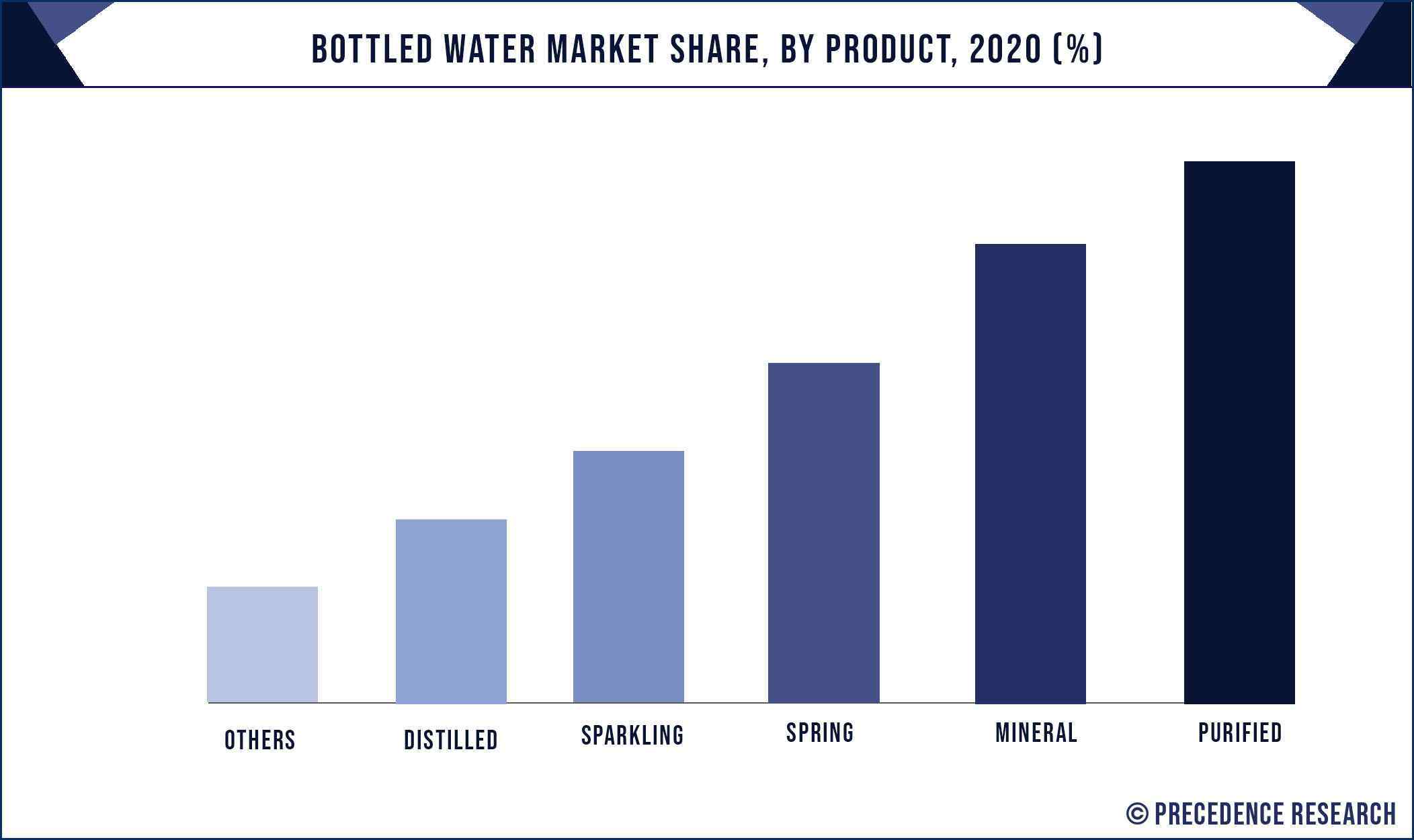

Profitable Picks Nba And Nhl Round 2 Playoffs

May 15, 2025

Profitable Picks Nba And Nhl Round 2 Playoffs

May 15, 2025 -

Pulaski Water System Issues Boil Water Order Through Saturday

May 15, 2025

Pulaski Water System Issues Boil Water Order Through Saturday

May 15, 2025 -

Urgent Action Needed Excessive Pfas Detected In Blue Mountains Water Supply

May 15, 2025

Urgent Action Needed Excessive Pfas Detected In Blue Mountains Water Supply

May 15, 2025 -

Analysis Of Androids Updated Visual Design

May 15, 2025

Analysis Of Androids Updated Visual Design

May 15, 2025 -

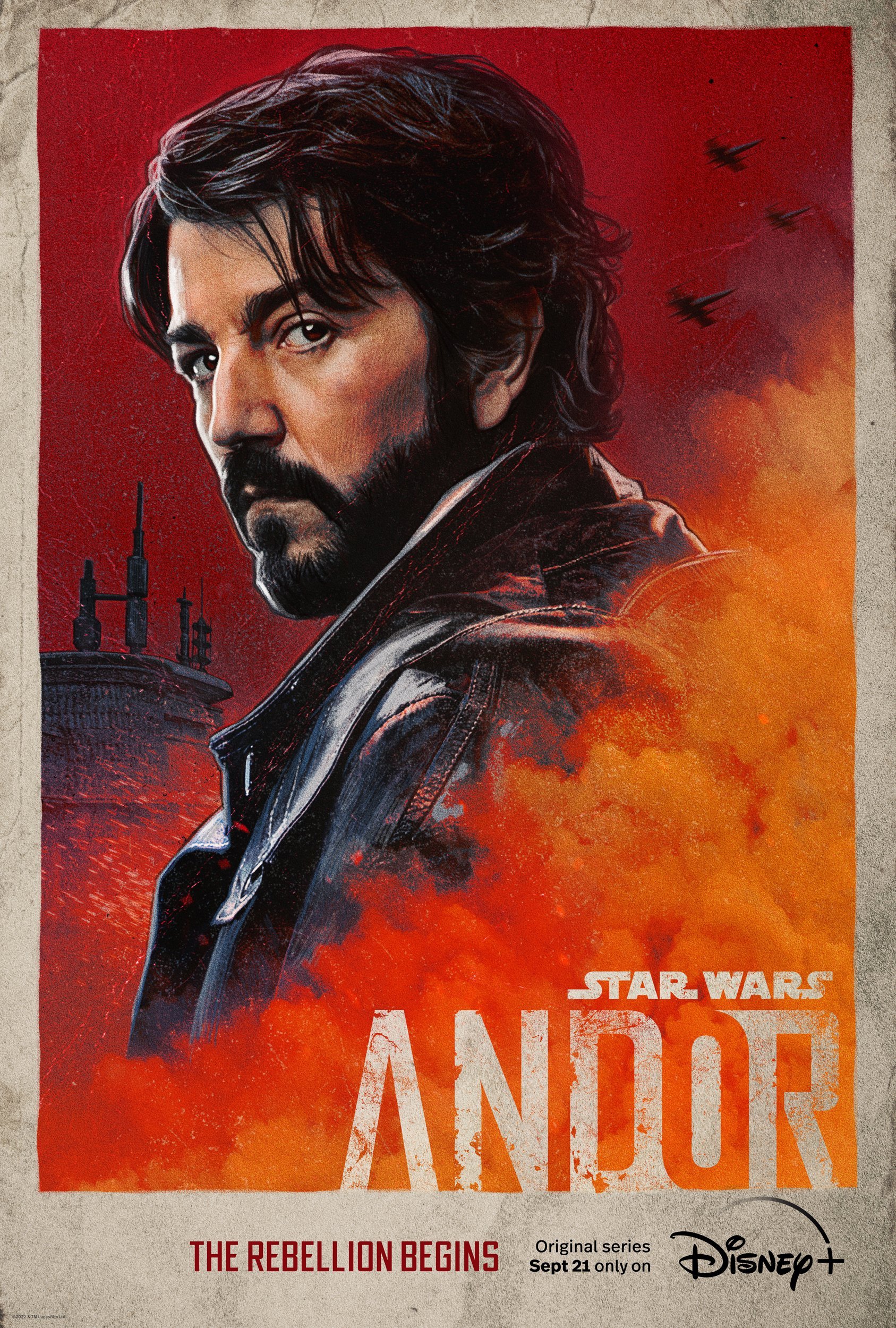

Andor A First Look At The Major Event 31 Years In The Making

May 15, 2025

Andor A First Look At The Major Event 31 Years In The Making

May 15, 2025