The Wall Street Surge: How The Market Is Reversing Bearish Trends

Table of Contents

Inflation Cooling and Interest Rate Adjustments

The recent slowdown in inflation has been a major catalyst for the Wall Street surge. Keywords like "inflation," "interest rates," and "market reversal" are central to understanding this shift. The Federal Reserve's adjustments to interest rates, while still impacting borrowing costs, are showing signs of moderating the aggressive tightening policies of the past year. This more measured approach is crucial for market stability.

-

Declining inflation rates signal a potential end to aggressive rate hikes. The Consumer Price Index (CPI) and Producer Price Index (PPI) reports are key indicators to watch. Recent data showing a decrease in inflation suggests the Fed might be successful in taming rising prices without triggering a recession.

-

Reduced inflation expectations boost investor confidence and fuel market growth. When investors believe inflation is under control, they are more likely to invest, driving up stock prices and contributing to the overall Wall Street surge.

-

Interest rate adjustments are creating a more stable investment environment. While higher interest rates initially dampened market enthusiasm, the current trend towards less aggressive increases is fostering a more predictable investment landscape.

-

Analysis of recent CPI and PPI reports showing decreased inflation: A detailed examination of these reports reveals a gradual cooling of inflation, providing concrete evidence supporting the market's positive momentum. The consistent downward trend in these key indicators is crucial for sustaining this Wall Street surge.

Stronger-Than-Expected Corporate Earnings

Several key corporations have reported stronger-than-expected earnings, defying bearish predictions and boosting investor sentiment. This positive news, coupled with keywords like "corporate earnings," "market performance," and "stock market growth," has fueled a surge in stock prices across various sectors. This unexpected outperformance signals underlying economic strength.

-

Key examples of companies exceeding earnings expectations: Highlighting specific companies and their robust performance provides concrete examples of this positive trend. This demonstrates that the surge isn't isolated but rather a broader market phenomenon.

-

Analysis of industry trends showing positive growth trajectories: Identifying specific industries demonstrating significant growth helps investors understand where the strongest growth opportunities lie. This detailed analysis allows investors to make informed decisions based on strong market data.

-

Impact of strong earnings on investor confidence and market valuation: Strong earnings reports reassure investors, leading to increased confidence and higher valuations for many companies. This positive feedback loop helps sustain the current market upswing.

-

Discussion of future earnings projections and their potential impact on the market: Looking ahead, analysts' projections for future earnings provide valuable insights into the potential sustainability of the current Wall Street surge. Analyzing these projections helps investors assess the market's long-term outlook.

Increased Investor Confidence and Renewed Risk Appetite

As the economic outlook improves, investor confidence is steadily rising. This renewed optimism, closely linked to keywords like "investor sentiment," "market volatility," and "risk appetite," is translating into a greater willingness to take on risk, driving investments into sectors previously considered too volatile.

-

Survey data demonstrating improved investor sentiment: Citing surveys and market research data provides objective evidence of the shift in investor psychology. This quantifiable data helps validate the claim of increased investor confidence.

-

Increased trading volume indicating growing market participation: Higher trading volume suggests increased market activity, reflecting the growing participation of investors who are emboldened by the positive market trend.

-

Analysis of investment flows into previously underperforming sectors: Tracking investment flows into previously neglected areas indicates a broadening of the market's recovery. This demonstrates that the positive sentiment extends beyond a few key sectors.

-

Discussion of the psychological factors driving investor behavior: Understanding the psychology behind investor decisions provides valuable insight into the dynamics of the current market surge. This exploration of human behavior offers a deeper understanding of the forces at play.

Geopolitical Factors and Their Influence

While geopolitical events continue to pose risks, their impact on the market seems to be lessening, contributing to the overall positive trend on Wall Street. Keywords such as "geopolitical risk," "market stability," and "global economy" are crucial to consider when assessing the complete picture.

-

Discussion of key geopolitical events and their potential market impact: Identifying and analyzing key geopolitical events and their potential to affect the market provides a complete picture of the current conditions.

-

Analysis of how market reactions to these events are changing: Observing how the market responds to geopolitical events helps investors understand the overall resilience of the current market surge.

-

Assessing the overall influence of geopolitical factors on the current surge: Understanding how geopolitical risks affect the market helps investors make informed decisions that account for uncertainty.

Conclusion

The Wall Street surge is a complex phenomenon driven by multiple interconnected factors, including cooling inflation, positive corporate earnings, and renewed investor confidence. While uncertainty remains, the current market trend suggests a potential shift away from bearish predictions. However, continuous monitoring of economic indicators and geopolitical developments is crucial. Stay informed and understand the nuances of the market to make well-informed investment decisions during this dynamic Wall Street surge. Learn more about navigating the current market trends and capitalizing on the Wall Street surge by [link to relevant resource/further reading].

Featured Posts

-

Treiler Materialists Ntakota Tzonson Pedro Paskal And Kris Evans Se Romantiki Komodia

May 10, 2025

Treiler Materialists Ntakota Tzonson Pedro Paskal And Kris Evans Se Romantiki Komodia

May 10, 2025 -

Stricter Uk Visa Regulations For Nigerians And Pakistanis

May 10, 2025

Stricter Uk Visa Regulations For Nigerians And Pakistanis

May 10, 2025 -

Stephen King On The Stranger Things It Connection

May 10, 2025

Stephen King On The Stranger Things It Connection

May 10, 2025 -

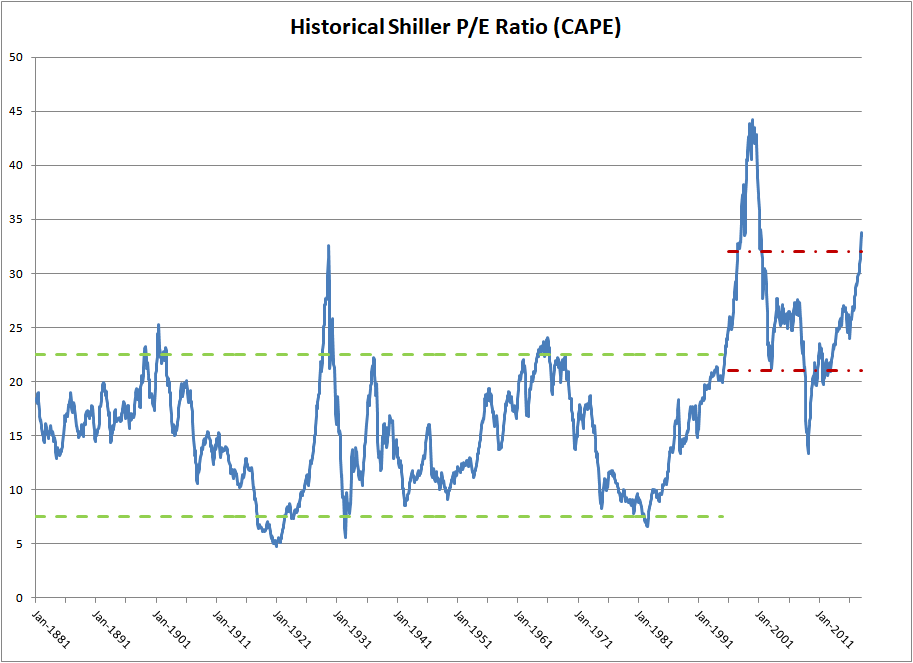

Bof A Understanding And Addressing Concerns About Stretched Stock Market Valuations

May 10, 2025

Bof A Understanding And Addressing Concerns About Stretched Stock Market Valuations

May 10, 2025 -

Analyzing Apples Ai Investments Success Or Failure

May 10, 2025

Analyzing Apples Ai Investments Success Or Failure

May 10, 2025