Thursday's D-Wave Quantum (QBTS) Stock Plunge: Causes And Implications

Table of Contents

Potential Causes of the QBTS Stock Plunge

Several factors likely contributed to the dramatic drop in D-Wave Quantum's stock price. Analyzing these causes provides a clearer understanding of the current market sentiment and the challenges facing the company.

Disappointing Earnings Report

The most immediate cause appears to be a disappointing earnings report released earlier that week. This report likely fell significantly short of analyst expectations, triggering a sell-off amongst investors. The specifics of the report need to be detailed here. For example:

- Revenue significantly below analyst projections: The reported revenue was considerably lower than what market analysts had predicted, indicating a shortfall in sales and potentially a weakening market position.

- Increased operating losses compared to the previous quarter: Growing operational losses signal a widening gap between revenue and expenses, a major concern for investors focused on profitability.

- Lower-than-expected customer acquisition: A slower-than-anticipated rate of customer acquisition suggests difficulties in penetrating the market and securing new business, impacting future revenue streams.

These negative data points likely fueled investor anxieties and contributed significantly to the QBTS stock plunge.

Market-Wide Sell-Off

Beyond D-Wave's specific performance, broader market conditions also played a role. Thursday might have witnessed a general downturn affecting the technology sector, particularly within the Nasdaq. This context is essential:

- Overall market sentiment negatively impacted tech stocks: A general negative sentiment toward technology stocks, potentially fueled by macroeconomic concerns, could have exacerbated the decline in QBTS stock.

- Interest rate hikes or other economic news potentially spooked investors: Negative economic news, such as interest rate hikes or indications of a slowing economy, could have triggered a broader market sell-off, affecting even strong performing companies.

- Sector-specific concerns impacting investor confidence in quantum computing: Concerns specific to the quantum computing sector, such as skepticism about the technology's near-term commercial viability or increased competition, could have contributed to a more widespread sell-off within the industry.

Lack of Significant Technological Breakthroughs

The stock plunge might also reflect investor concerns regarding the pace of technological advancements at D-Wave. While the company is a pioneer in quantum annealing, a perceived lack of recent major breakthroughs could have impacted investor confidence.

- Absence of major new product announcements or partnerships: The absence of significant new product launches or strategic partnerships might signal a slowdown in innovation and limit future growth potential in the eyes of some investors.

- Competition from other quantum computing companies potentially impacting market share: Increased competition from companies pursuing different quantum computing approaches (e.g., gate-based quantum computing) could erode D-Wave's market share and raise investor anxieties about its long-term competitiveness.

- Concerns about the pace of technological advancement in the quantum computing field: The relatively nascent stage of the quantum computing industry may create inherent volatility, with investor sentiment fluctuating based on perceived progress or setbacks.

Implications of the QBTS Stock Plunge

The QBTS stock plunge carries significant implications for D-Wave, its investors, and the broader quantum computing industry.

Impact on Investor Confidence

The sharp decline has undoubtedly shaken investor confidence in both D-Wave and the quantum computing sector as a whole.

- Potential for further stock price decline in the short term: The initial plunge may be followed by further short-term price drops as investors react to the news and reassess their investment strategies.

- Impact on future fundraising efforts for D-Wave: Securing future funding rounds may become more challenging, particularly if investors remain wary of the company’s prospects.

- Reduced investor interest in the quantum computing sector: The QBTS drop may trigger a more widespread reassessment of the risk-reward profile of investing in the quantum computing sector, potentially leading to reduced interest from venture capitalists and other investors.

Future of D-Wave Quantum's Business

The plunge significantly impacts D-Wave's operational strategies and future direction.

- Potential for restructuring or cost-cutting measures: To navigate the downturn, D-Wave may need to implement restructuring measures or cost-cutting initiatives to improve profitability and conserve resources.

- Impact on D-Wave's ability to attract and retain top talent: A negative stock price and potential financial instability could make it more challenging for D-Wave to attract and retain highly skilled scientists and engineers crucial for its research and development efforts.

- Long-term viability of the company's business model: The plunge raises serious questions about the long-term viability of D-Wave's business model and its ability to achieve sustained profitability in a rapidly evolving and competitive market.

Wider Implications for the Quantum Computing Industry

The QBTS stock plunge serves as a cautionary tale for the broader quantum computing industry.

- Potential for a wider market correction in quantum computing stocks: The event could trigger a broader market correction, impacting other quantum computing companies and potentially causing a period of uncertainty.

- Impact on government funding and investment in quantum computing research: The volatility in the quantum computing market may influence government funding decisions and the overall level of investment in research and development.

- Long-term prospects for the quantum computing industry's growth: While the long-term prospects remain positive, the QBTS plunge highlights the inherent risks and challenges in this nascent industry, potentially affecting its overall rate of growth.

Conclusion

The D-Wave Quantum (QBTS) stock plunge resulted from a confluence of factors, including disappointing earnings, broader market conditions, and concerns about technological progress. The implications are significant, affecting investor confidence, D-Wave's future, and the quantum computing industry's trajectory. The D-Wave Quantum (QBTS) stock plunge serves as a stark reminder of the volatility in the quantum computing sector. Staying informed about future announcements, market trends, and the company's strategic responses is crucial for navigating this rapidly evolving landscape. Continue to monitor the D-Wave Quantum (QBTS) stock and its performance for insights into the future of this revolutionary technology.

Featured Posts

-

Understanding The D Wave Quantum Qbts Stock Dip On Monday

May 21, 2025

Understanding The D Wave Quantum Qbts Stock Dip On Monday

May 21, 2025 -

Benjamin Kaellman Maalivire Huuhkajien Apuna

May 21, 2025

Benjamin Kaellman Maalivire Huuhkajien Apuna

May 21, 2025 -

Self Guided Walking Holiday In Provence Mountains To The Sea

May 21, 2025

Self Guided Walking Holiday In Provence Mountains To The Sea

May 21, 2025 -

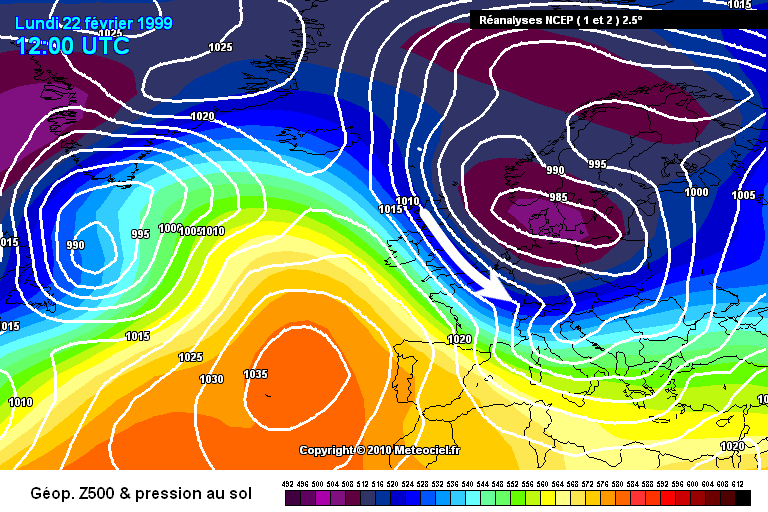

Southern French Alps Late Snowfall And Stormy Weather

May 21, 2025

Southern French Alps Late Snowfall And Stormy Weather

May 21, 2025 -

Mass Layoffs Cast Shadow On Future Of Abc News Program

May 21, 2025

Mass Layoffs Cast Shadow On Future Of Abc News Program

May 21, 2025