To Buy Or Not To Buy Palantir Stock: Weighing The 40% 2025 Prediction

Table of Contents

The allure of a 40% increase in Palantir stock by 2025 is undeniably tempting. But in the volatile world of stock market investments, such predictions require careful scrutiny. This article delves into the details of this Palantir stock prediction, examining the supporting arguments, inherent risks, and alternative investment strategies. We will analyze the potential for a 40% increase in Palantir stock price by 2025, helping you decide if this investment aligns with your risk tolerance and financial goals. This deep dive into the Palantir stock prediction for 2025 will equip you to make a more informed decision.

2. Main Points:

2.1. Analyzing the 40% Palantir Stock Price Prediction for 2025: Understanding the Basis

Where did this 40% Palantir stock prediction for 2025 originate? Pinpointing the source is crucial. Is it a reputable analyst's forecast, a complex financial model, or simply market speculation? Understanding the methodology behind the prediction is the first step in evaluating its credibility. For example, some predictions might be based on projected revenue growth fueled by increased government contracts or expansion into the commercial sector. Others might focus on technological advancements and Palantir's competitive advantages.

Factors contributing to this prediction include:

- Government Contracts: Palantir's substantial government contracts, particularly in defense and intelligence, significantly contribute to its revenue stream. Future contract wins and renewals will directly impact the 2025 prediction.

- Commercial Sector Growth: The increasing adoption of Palantir's data analytics platform by commercial clients across various sectors – finance, healthcare, etc. – is a key driver of potential growth.

- Technological Advancements: Palantir's ongoing investments in research and development, leading to new product features and improved capabilities, could enhance its market position and fuel stock price appreciation.

- Competitive Landscape: A strong competitive advantage, demonstrated through superior technology, customer service, or market penetration, compared to competitors like Databricks or Snowflake, will influence the accuracy of the 2025 Palantir stock prediction.

[Insert chart/graph here showcasing Palantir's historical stock performance and relevant financial data.]

2.2. Risks Associated with Investing in Palantir Stock:

While the 40% Palantir stock prediction is enticing, significant risks are involved:

- Market Volatility: The technology sector, and Palantir specifically, is susceptible to market fluctuations. Economic downturns or shifts in investor sentiment can significantly impact stock prices.

- Government Contract Dependence: Over-reliance on government contracts exposes Palantir to potential budget cuts or changes in government priorities.

- Intense Competition: The big data and analytics market is highly competitive. New entrants and established players could erode Palantir's market share.

- Financial Performance: Palantir's actual financial performance may fall short of projections, negatively impacting investor confidence and the stock price. Analyzing the company's profitability, debt levels, and cash flow is crucial.

- Slower-than-Expected Growth: Even with positive projections, achieving a 40% increase in such a short timeframe is ambitious. Any deviation from projected growth trajectories poses significant risk.

Risk mitigation strategies: Diversification is key. Don't put all your eggs in one basket. Spread your investments across different asset classes to reduce overall portfolio risk.

2.3. Palantir's Financial Performance and Future Growth Prospects:

Examining Palantir's recent financial reports (quarterly and annual) is crucial. Focus on key metrics:

- Revenue Growth: Consistent and substantial revenue growth is a positive indicator of future potential.

- Customer Acquisition Cost (CAC): A low CAC suggests efficiency in acquiring new clients.

- Customer Churn: Low churn indicates high customer satisfaction and retention.

- Earnings: Consistent profitability demonstrates the company's ability to generate sustainable income.

- Strategic Initiatives: Analyze Palantir's strategic plans, new product launches, and market expansion initiatives to assess their potential impact on future growth.

2.4. Comparing Palantir to Competitors in the Big Data Analytics Market:

Palantir operates in a fiercely competitive market. A comparative analysis against key competitors, like Databricks and Snowflake, is necessary:

- Competitive Advantages: Does Palantir possess a unique selling proposition (USP) that sets it apart? This could be superior technology, specialized expertise, or a strong customer base.

- Market Share: Analyzing Palantir's current market share and its growth trajectory compared to competitors provides valuable insights.

- Competitive Disadvantages: Understanding Palantir's weaknesses, such as higher pricing or limited scalability, is equally important.

2.5. Alternative Investment Strategies: Diversification and Risk Management

Investing solely in Palantir stock based on a single prediction is risky. Diversification is paramount:

- Diversify your portfolio: Spread investments across different asset classes (stocks, bonds, real estate) and sectors to reduce risk.

- Consider alternative investments: Explore other growth opportunities within the tech sector or other promising industries.

- Seek professional advice: Consult a qualified financial advisor before making significant investment decisions. They can help you create a personalized investment strategy aligned with your risk tolerance and financial goals.

3. Conclusion: Making Informed Decisions about Palantir Stock Investment

The potential for a 40% increase in Palantir stock by 2025 is intriguing, but the associated risks are significant. This analysis highlights the importance of thorough due diligence before investing. Carefully weigh the potential rewards against the inherent uncertainties. Remember, no prediction is guaranteed. Before making any investment decisions related to the 2025 Palantir stock price prediction, conduct further research, reviewing Palantir’s financial statements, analyzing market trends, and considering your personal financial situation. Remember to consult a financial advisor before investing. Making informed decisions about Palantir stock, or any stock for that matter, requires a comprehensive understanding of the company, its market, and your own risk tolerance.

Featured Posts

-

Did Snls Harry Styles Impression Miss The Mark His Reaction Speaks Volumes

May 10, 2025

Did Snls Harry Styles Impression Miss The Mark His Reaction Speaks Volumes

May 10, 2025 -

Solve Nyt Strands Game 376 March 14 Complete Guide

May 10, 2025

Solve Nyt Strands Game 376 March 14 Complete Guide

May 10, 2025 -

Seattle Businesses Accepting Canadian Dollars For Sports Fans

May 10, 2025

Seattle Businesses Accepting Canadian Dollars For Sports Fans

May 10, 2025 -

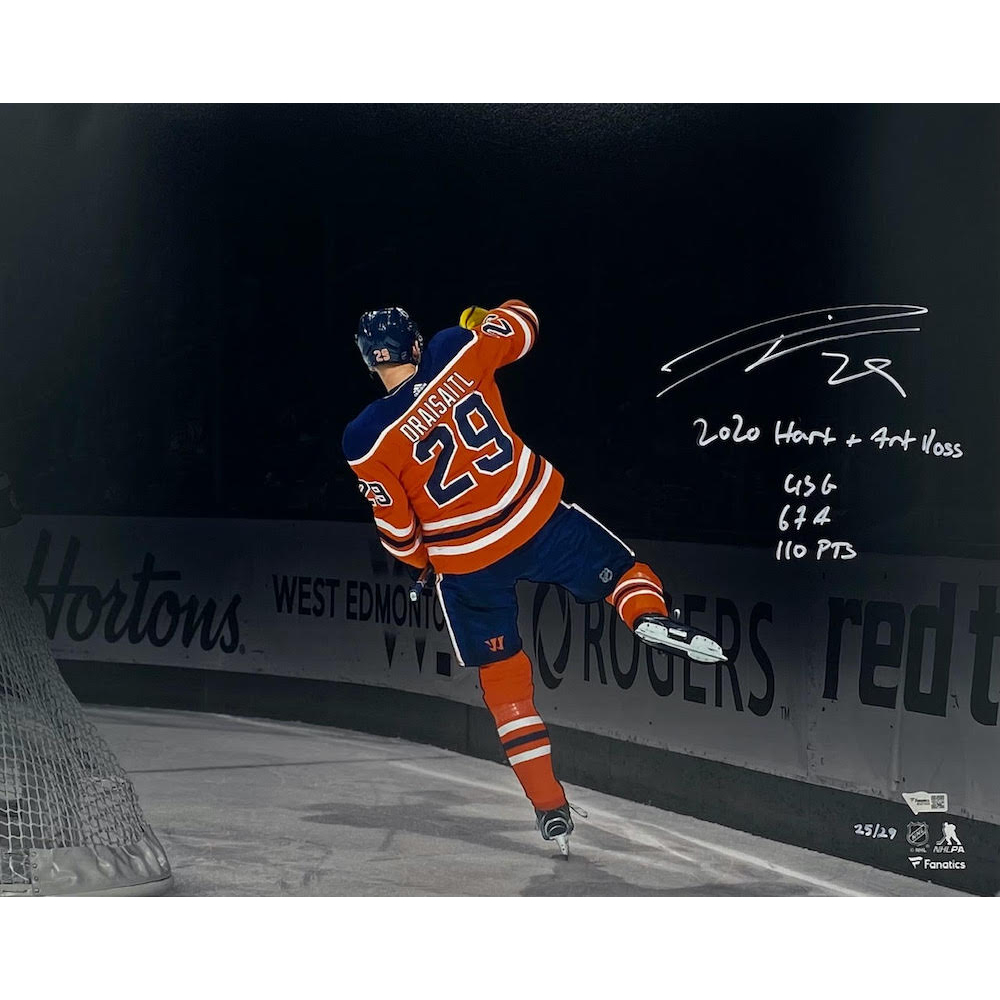

Leon Draisaitl Hart Trophy Contender And Edmonton Oilers Key Player

May 10, 2025

Leon Draisaitl Hart Trophy Contender And Edmonton Oilers Key Player

May 10, 2025 -

U S Federal Reserve Holds Steady Rate Pause Amidst Growing Economic Pressures

May 10, 2025

U S Federal Reserve Holds Steady Rate Pause Amidst Growing Economic Pressures

May 10, 2025