Trump Tariffs And The Fintech IPO Freeze: Affirm Holdings (AFRM) Case Study

Table of Contents

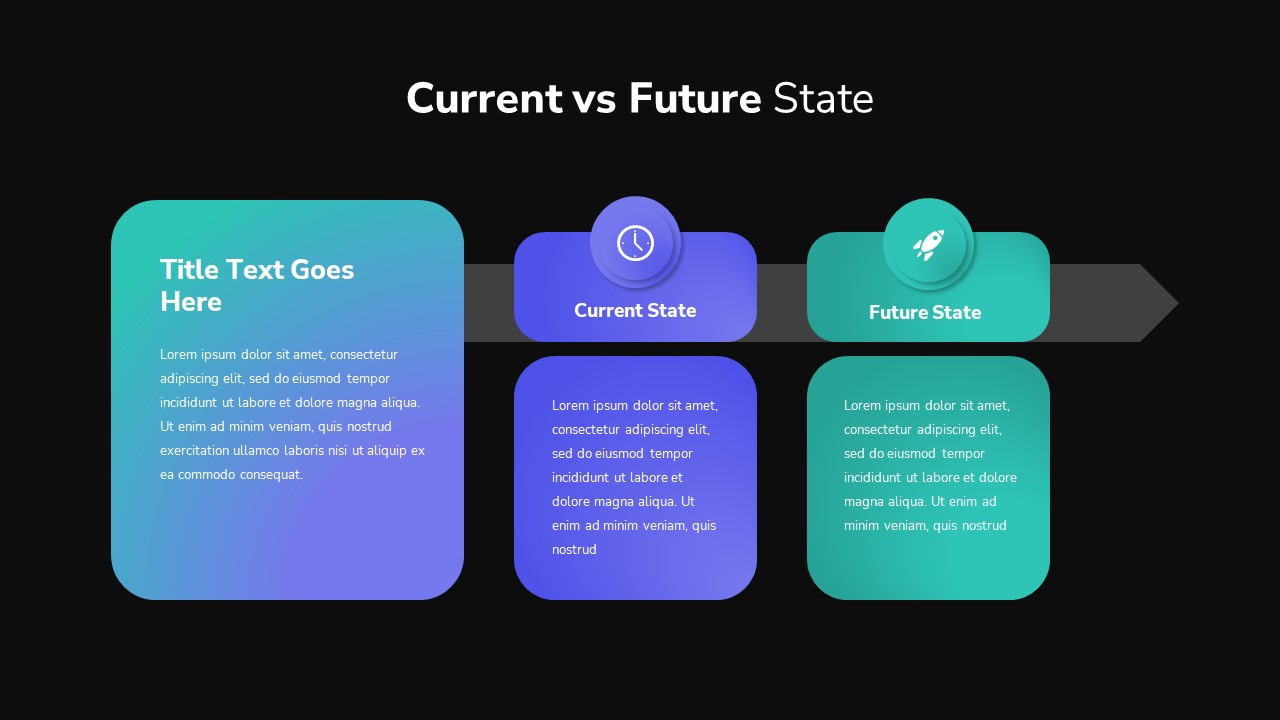

The Economic Impact of Trump Tariffs

Trump's trade policies, characterized by significant tariffs on imported goods, created a turbulent economic environment that significantly impacted businesses and investor sentiment.

Disruption of Global Supply Chains

Tariffs dramatically increased costs for businesses relying on imported goods and components. This led to:

- Increased input costs: Manufacturing costs soared as businesses faced higher prices for raw materials and intermediate goods.

- Reduced international trade: Tariffs discouraged international trade, leading to reduced market access and stifled economic growth.

- Uncertainty in supply chains: Businesses struggled with supply chain disruptions and increased lead times, making accurate financial forecasting difficult.

These disruptions rippled through the economy, creating uncertainty and reducing the overall attractiveness of riskier investments, particularly impacting companies preparing for IPOs. The added complexity and cost of navigating the new trade landscape made it harder for businesses to present a compelling investment narrative to potential investors.

Investor Sentiment and Market Volatility

The uncertainty generated by the tariffs fueled market volatility and dampened investor enthusiasm. This resulted in:

- Increased market volatility: Fluctuating stock prices reflected the heightened uncertainty and risk aversion in the market.

- Reduced investor confidence: Investors became more cautious, prioritizing safety over potentially higher returns from riskier ventures.

- Flight to safety: Investors shifted their funds towards safer investments, like government bonds, further reducing capital available for riskier IPOs, including those in the fintech sector.

Data from the period shows a marked decrease in IPO activity across various sectors, with the fintech sector being particularly vulnerable due to its reliance on technology imports and its generally higher risk profile.

Affirm Holdings (AFRM) IPO and the Challenging Market Conditions

Affirm Holdings, a buy-now-pay-later fintech company, launched its IPO amidst the peak impact of Trump's tariffs and the resulting market uncertainty.

Timing of Affirm's IPO

Affirm's IPO timing coincided with a period of considerable economic uncertainty.

- IPO date: [Insert Affirm's IPO date here]

- Market conditions at the time: Characterized by increased market volatility and reduced investor appetite for risk.

- Key economic indicators: [Include relevant economic indicators such as GDP growth, inflation rates, and market indices data around the IPO date].

While the long-term prospects for Affirm were promising, the challenging market environment undoubtedly made it a more difficult IPO to execute successfully compared to a period of economic stability.

Impact of Tariffs on Affirm's Business Model

While the direct impact of tariffs on Affirm might have been limited, indirect effects are worth considering.

- Specific areas affected (if any): The tariffs might have increased the cost of Affirm's technology infrastructure if it relied on imported components. Supply chain disruptions could have affected its operational efficiency.

- Potential strategies to mitigate the impact: Affirm may have needed to explore strategies to reduce costs elsewhere or improve its supply chain resilience.

Detailed financial analysis is needed to accurately assess the impact of tariffs on Affirm’s performance prior to and immediately after its IPO.

The Broader Fintech IPO Freeze

Affirm's experience wasn't unique. Many other fintech companies faced similar challenges during this period.

Comparative Analysis of Other Fintech IPOs

Comparing Affirm's IPO to other fintech companies that went public around the same time reveals a broader trend.

- Examples of other fintech IPOs: [List examples of other fintech companies that went public during this period].

- Their performance: Analyze their post-IPO performance, noting any similarities or differences in their experiences.

- Comparison of their challenges: Determine whether the challenges were primarily due to the tariffs or other factors.

This comparative analysis helps establish whether the difficulties experienced by Affirm were specific to the company or a reflection of a larger trend affecting the entire fintech IPO landscape.

The Role of Geopolitical Uncertainty

The geopolitical uncertainty generated by Trump's trade policies further exacerbated the negative impact on investor sentiment.

- Examples of other geopolitical events: [List other geopolitical events that coincided with the period].

- Impact on investor confidence: The confluence of trade tensions and other geopolitical factors created a climate of extreme uncertainty, depressing investor confidence across the board.

- Overall market sentiment: The overall risk-off sentiment led to a significant decrease in IPO activity, especially for companies in more volatile sectors such as fintech.

The interplay between these trade wars and market behavior highlights the critical role of global political stability in shaping investor decisions.

Conclusion: Trump Tariffs, Fintech IPOs, and the Lessons Learned from Affirm (AFRM)

The case of Affirm Holdings demonstrates the significant impact of Trump Tariffs and the Fintech IPO Freeze. The economic uncertainty created by the tariffs led to reduced investor confidence, making it challenging for fintech companies, like Affirm, to successfully launch their IPOs. This analysis highlights the sensitivity of the IPO market to macroeconomic factors and geopolitical events. The lessons learned emphasize the importance of considering the broader economic and political context when assessing investment opportunities in the fintech sector. Understanding the potential influence of events like the Trump Tariffs and the Fintech IPO Freeze is crucial for investors and businesses alike. Further research into the correlation between trade policies and financial market behavior is highly recommended to avoid repeating similar missteps in the future.

Featured Posts

-

Sigue El Celta Vs Sevilla La Liga Espanola En Vivo

May 14, 2025

Sigue El Celta Vs Sevilla La Liga Espanola En Vivo

May 14, 2025 -

The Impact Of Tariffs On Ipo Activity Current State And Future Outlook

May 14, 2025

The Impact Of Tariffs On Ipo Activity Current State And Future Outlook

May 14, 2025 -

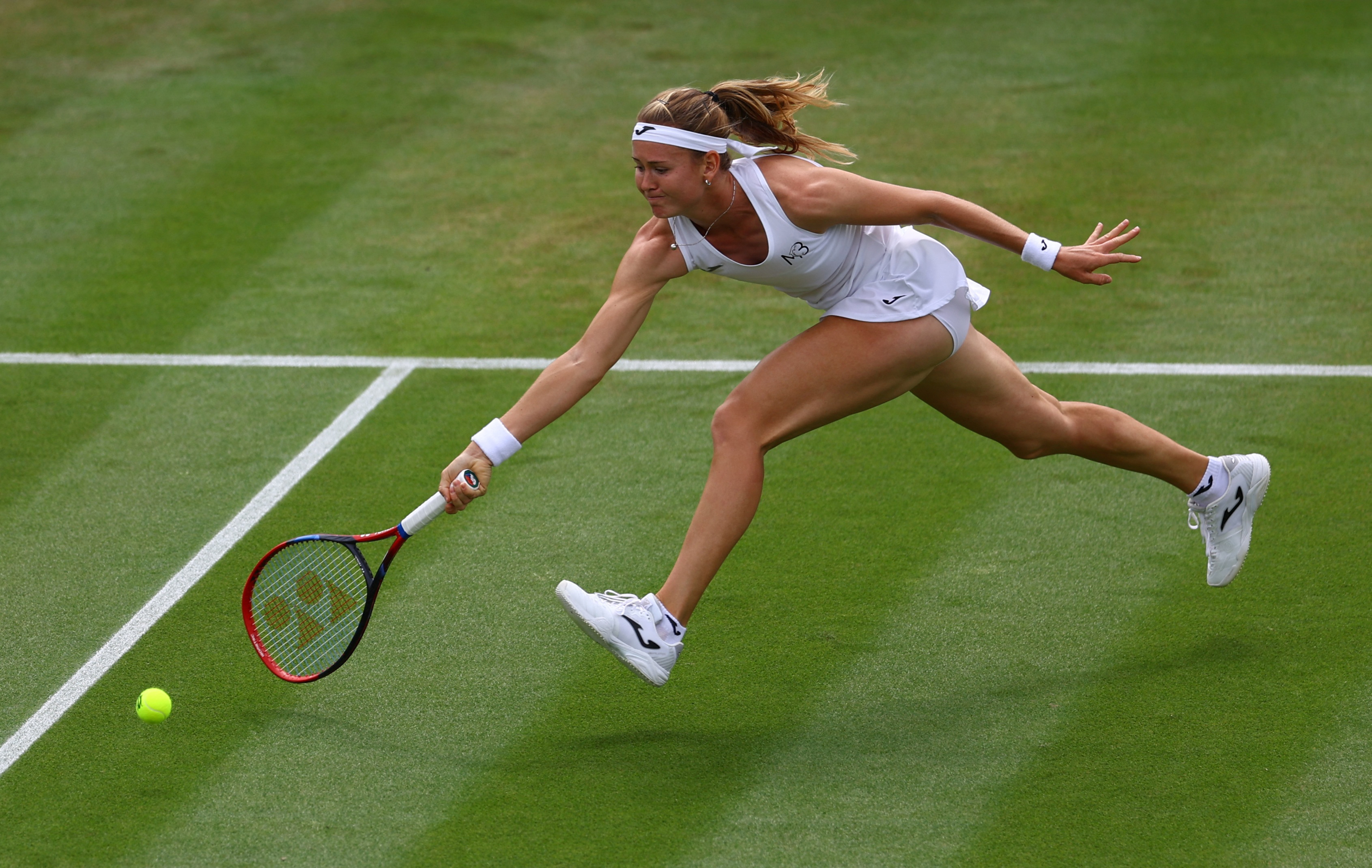

Wta Roundup No 3 Seed Stearns Falls In Austin

May 14, 2025

Wta Roundup No 3 Seed Stearns Falls In Austin

May 14, 2025 -

Klarnas Upcoming 1 Billion Ipo A Closer Look

May 14, 2025

Klarnas Upcoming 1 Billion Ipo A Closer Look

May 14, 2025 -

Gauff And Stearns Power Into Rome Quarterfinals

May 14, 2025

Gauff And Stearns Power Into Rome Quarterfinals

May 14, 2025

Latest Posts

-

Escape The Week Netflixs Latest Charming Film

May 14, 2025

Escape The Week Netflixs Latest Charming Film

May 14, 2025 -

Netflixs New Release A Charming Film For A Cozy Weekend

May 14, 2025

Netflixs New Release A Charming Film For A Cozy Weekend

May 14, 2025 -

Find Your Perfect Weekend Movie Netflixs Charming New Release

May 14, 2025

Find Your Perfect Weekend Movie Netflixs Charming New Release

May 14, 2025 -

The Judd Sisters A Docuseries Exploring Family History And Relationships

May 14, 2025

The Judd Sisters A Docuseries Exploring Family History And Relationships

May 14, 2025 -

A Charming Netflix Film To Warm Your Heart This Weekend

May 14, 2025

A Charming Netflix Film To Warm Your Heart This Weekend

May 14, 2025