Trump Tariffs Spur China To Issue Special Bonds

Table of Contents

The Impact of Trump Tariffs on the Chinese Economy

The Trump administration's tariffs, targeting hundreds of billions of dollars worth of Chinese goods, significantly disrupted the Chinese economy.

Disruption of Export Markets

Tariffs imposed substantial additional costs on Chinese exporters, making their goods less competitive in the US market. This led to a sharp decline in exports and a slowdown in growth for several key sectors.

- Manufacturing: Industries like electronics, textiles, and machinery experienced significant export decline.

- Agriculture: Chinese agricultural exports, such as soybeans and pork, faced substantial tariff barriers.

The impact was measurable: Data from the Chinese government showed a [Insert Statistic: Percentage or specific dollar amount] decrease in exports to the US in [Insert Year(s)], leading to [Insert Statistic: Number] job losses in affected sectors. GDP growth also experienced a noticeable slowdown during this period.

Increased Domestic Investment Needs

Facing decreased export revenue and slower economic growth, the Chinese government prioritized stimulating domestic investment to counter the negative effects of the tariffs. This involved a significant push to boost domestic consumption and infrastructure development.

- Government initiatives included increased spending on infrastructure projects and tax cuts to encourage private investment.

- Substantial investment in technological innovation and upgrading domestic industries was also prioritized.

The government's response involved increased spending on infrastructure projects, as evidenced by a [Insert Statistic: Percentage increase or specific dollar amount] increase in government investment during [Insert Year(s)].

The Role of Special Bonds in Economic Stimulus

To fund these ambitious domestic investment projects, the Chinese government significantly increased the issuance of special bonds. These bonds, often issued by local governments, provided crucial funding for infrastructure development and other stimulus initiatives.

- Local government special bonds were a primary tool for financing infrastructure projects.

- Infrastructure bonds specifically targeted projects crucial for boosting economic activity.

The total value of special bonds issued in response to the trade war reached [Insert Statistic: Total amount issued in USD or CNY] during [Insert timeframe].

Characteristics of China's Special Bonds Issued in Response to Tariffs

The special bonds issued in response to the Trump tariffs possessed specific characteristics designed to attract investment and achieve the government's economic objectives.

Targeted Infrastructure Projects

Funds raised from these special bonds were primarily allocated to infrastructure projects designed to stimulate economic activity and improve long-term competitiveness.

- Transportation infrastructure (high-speed rail, roads, ports) received considerable investment.

- Energy infrastructure (renewable energy projects, power grids) also benefited significantly.

- Investment in 5G technology and other digital infrastructure projects was accelerated.

For example, [Insert specific example: Name of a project and the amount of funding it received].

Maturity and Interest Rates

These special bonds typically had longer maturities and offered slightly higher interest rates compared to standard government bonds to incentivize investment.

- Maturities ranged from [Insert range] years, providing long-term funding for infrastructure projects.

- Interest rates were slightly higher than regular government bonds, reflecting the higher perceived risk associated with these projects.

The average maturity date was [Insert statistic] and the average interest rate spread was approximately [Insert statistic] basis points above comparable government bonds.

Investor Appeal and Risk Assessment

Despite the slightly higher risk compared to standard government bonds, these special bonds attracted considerable investor interest due to several factors.

- The creditworthiness of the Chinese government remained strong, mitigating some risk.

- The relatively high interest rates compared to other low-risk investment options made them attractive.

Yields on these special bonds ranged from [Insert range], offering investors a relatively attractive return compared to other low-risk investment alternatives during the period.

Long-Term Implications of China's Response to Trump Tariffs

China's strategic response to the Trump tariffs through increased special bond issuance has long-term implications for its economy and the global financial system.

Shift in Economic Strategy

The increased reliance on debt-financed growth raises concerns about the potential for increased government debt levels in the long run. This could potentially limit China's flexibility in responding to future economic challenges.

- Potential for long-term debt sustainability issues, and the implications for future economic growth.

- The need for structural reforms alongside debt-financed stimulus is crucial for sustained economic health.

Impact on Global Markets

The substantial issuance of special bonds by China influenced global bond yields and had ripple effects on other emerging economies.

- Increased demand for funding could potentially put upward pressure on global bond yields.

- The Chinese government’s strategies influenced investment flows and capital allocation globally.

Geopolitical Considerations

The trade war and China's response significantly impacted US-China relations and had broader implications for global economic governance.

- The trade conflict highlighted the growing economic rivalry and strategic competition between the two countries.

- The experience underscored the interconnectedness of global economies and the potential for trade disputes to have far-reaching consequences.

Conclusion: Understanding the Link Between Trump Tariffs and Chinese Special Bonds

This article has demonstrated a clear link between the Trump-era tariffs and the surge in issuance of special bonds in China. The tariffs significantly impacted the Chinese economy, prompting a strategic response involving increased domestic investment funded by special bond issuance. While this approach provided a short-term stimulus, the long-term implications, including potential debt sustainability issues and global market effects, warrant careful consideration. Understanding the complexities of this relationship is crucial for navigating the intricacies of international trade and the interconnectedness of global economies. Learn more about the impact of Trump tariffs and the strategic use of special bonds by China to gain a deeper understanding of this pivotal period in global economic history.

Featured Posts

-

Full List Celebrities Affected By The La Palisades Wildfires

Apr 25, 2025

Full List Celebrities Affected By The La Palisades Wildfires

Apr 25, 2025 -

Eu China Relations Sanctions On Meps Reportedly Set To End

Apr 25, 2025

Eu China Relations Sanctions On Meps Reportedly Set To End

Apr 25, 2025 -

Addressing High Stock Market Valuations A Bof A Investors Guide

Apr 25, 2025

Addressing High Stock Market Valuations A Bof A Investors Guide

Apr 25, 2025 -

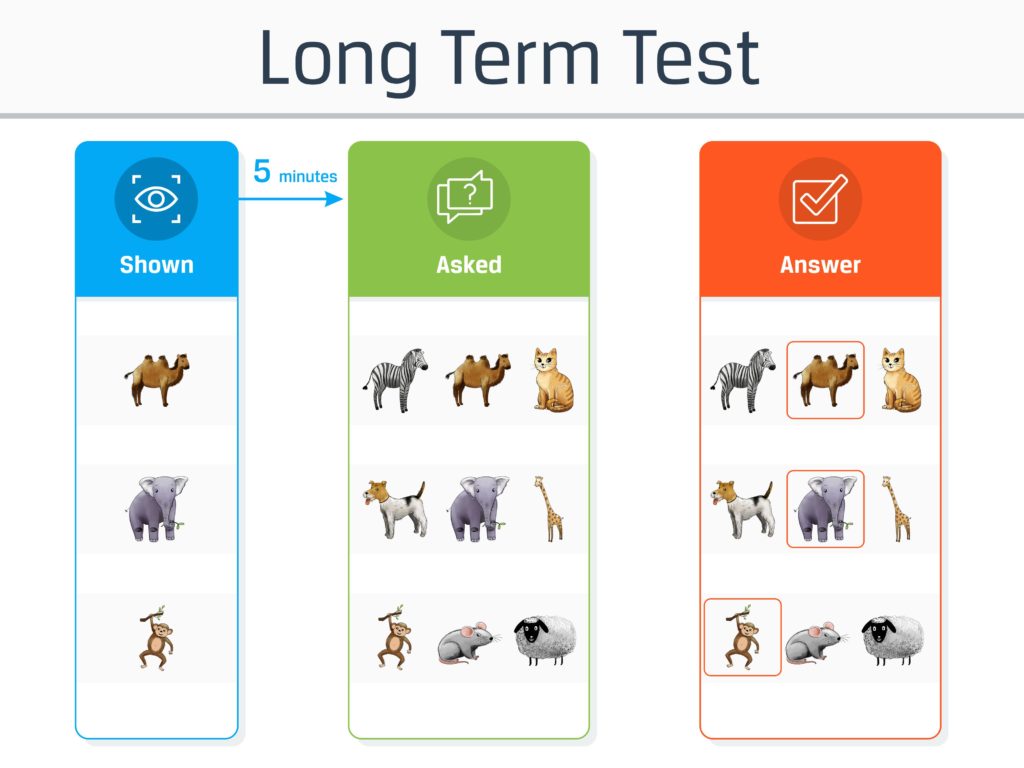

Test Your Memory Faces From April 1999

Apr 25, 2025

Test Your Memory Faces From April 1999

Apr 25, 2025 -

Voyna V Ukraine Buduschee Mirnogo Soglasheniya I Rol Trampa

Apr 25, 2025

Voyna V Ukraine Buduschee Mirnogo Soglasheniya I Rol Trampa

Apr 25, 2025

Latest Posts

-

Understanding The 9 Key Differences Between Target And Standalone Starbucks

May 01, 2025

Understanding The 9 Key Differences Between Target And Standalone Starbucks

May 01, 2025 -

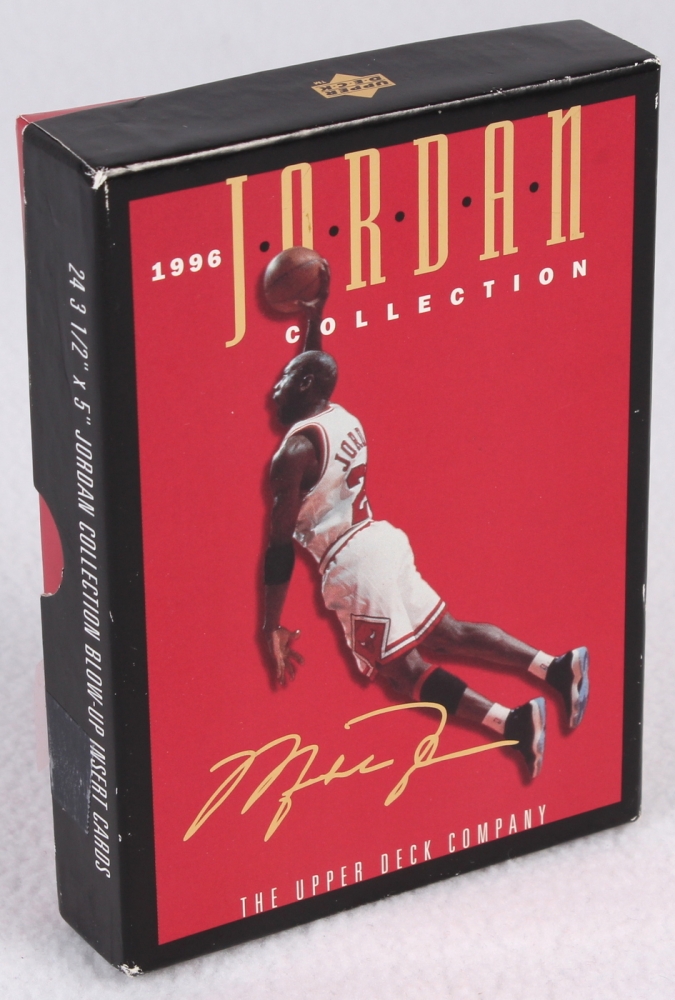

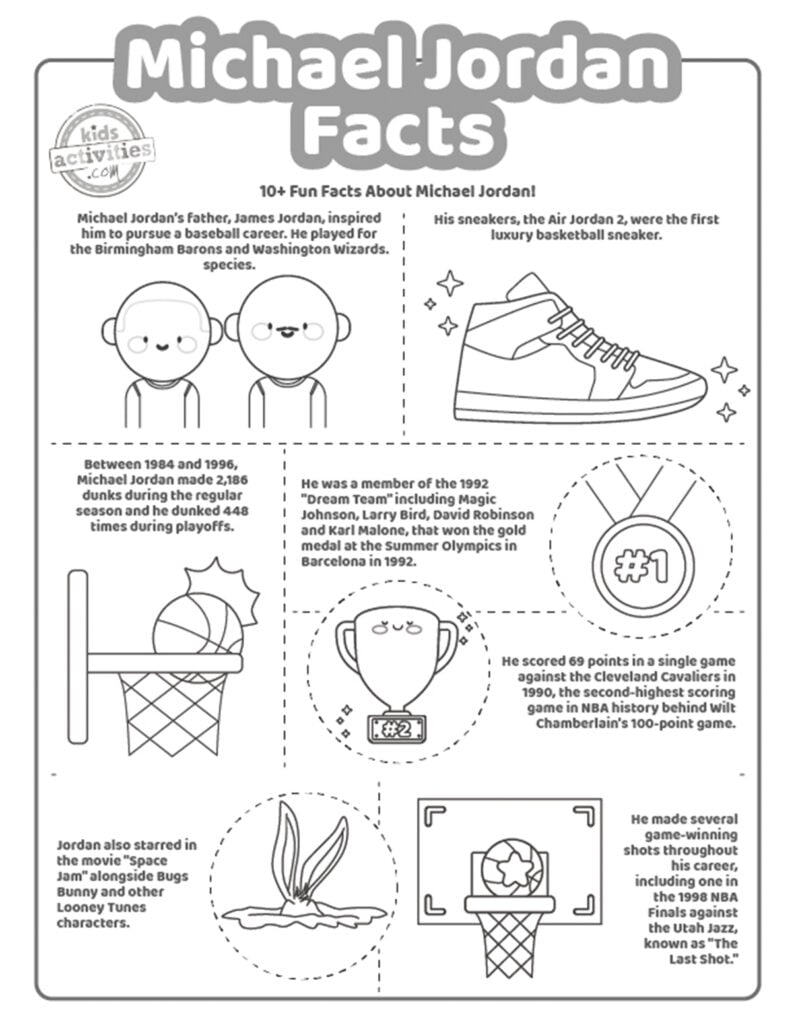

Unveiling Michael Jordan A Collection Of Fast Facts

May 01, 2025

Unveiling Michael Jordan A Collection Of Fast Facts

May 01, 2025 -

The Ultimate Michael Jordan Fast Facts Guide

May 01, 2025

The Ultimate Michael Jordan Fast Facts Guide

May 01, 2025 -

Gia Tieu Hom Nay Phan Tich Thi Truong Va Tac Dong Den Nong Dan

May 01, 2025

Gia Tieu Hom Nay Phan Tich Thi Truong Va Tac Dong Den Nong Dan

May 01, 2025 -

Gia Tieu Leo Thang Nong Dan Huong Loi

May 01, 2025

Gia Tieu Leo Thang Nong Dan Huong Loi

May 01, 2025